Is Reliable Trade safe?

Business

License

Is Reliable Trade A Scam?

Introduction

Reliable Trade is a relatively new player in the forex market, positioning itself as a broker that offers various trading opportunities for both novice and experienced traders. With the allure of competitive spreads and a user-friendly platform, it has attracted attention. However, in an industry rife with scams and unregulated entities, it is crucial for traders to conduct thorough evaluations before committing their funds. The forex market is notorious for its volatility and the potential for fraud, making it imperative to assess the legitimacy of brokers like Reliable Trade. This article aims to provide a comprehensive investigation into the safety and reliability of Reliable Trade, utilizing various sources and structured criteria to evaluate its trustworthiness.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety. Reliable Trade claims to operate under several regulatory frameworks; however, it lacks oversight from top-tier financial authorities. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulation from recognized entities such as the SEC (U.S. Securities and Exchange Commission) or FCA (Financial Conduct Authority) raises significant concerns regarding the broker's operational transparency and adherence to industry standards. Regulatory bodies enforce strict compliance measures to protect traders, and without such oversight, the risk of encountering fraudulent practices increases. Reliable Trade's lack of a verified regulatory status suggests that it may not meet the rigorous standards expected of reputable brokers, leading to questions about the safety of traders' investments.

Company Background Investigation

Founded in 2020, Reliable Trade presents itself as a U.S.-based broker. However, details about its ownership structure and management team remain vague. This lack of transparency is concerning, as a reputable brokerage typically provides comprehensive information about its management and operational history. The absence of identifiable key personnel and their professional backgrounds further complicates the assessment of the broker's credibility.

Moreover, Reliable Trade's website does not furnish sufficient insights into its corporate governance or operational practices, which are essential for establishing trust. A broker's transparency in disclosing its history, ownership, and management team is crucial for building confidence among potential clients. The lack of such information about Reliable Trade suggests that it may not prioritize transparency, which is a red flag for potential investors.

Trading Conditions Analysis

When evaluating a broker, understanding its fee structure and trading conditions is vital. Reliable Trade offers various account types, but scrutiny of its overall fee model reveals potential issues. The following table outlines key trading costs associated with Reliable Trade:

| Fee Type | Reliable Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | No commission | $0 - $10 per trade |

| Overnight Interest Range | 0.5% | 0.2% |

The spreads offered by Reliable Trade are notably higher than the industry average, which can significantly impact profitability for traders, especially those engaging in high-frequency trading. Additionally, while the absence of commissions may seem appealing, the higher spreads could mean that traders pay more in the long run. Furthermore, the overnight interest rate is also comparatively higher, which can adversely affect traders holding positions overnight. Such discrepancies warrant careful consideration, as they could indicate a less favorable trading environment for users.

Client Funds Security

The security of client funds is paramount when assessing a broker's reliability. Reliable Trade claims to implement various measures to safeguard client deposits, but the specifics of these measures remain unclear. A comprehensive analysis of its fund safety protocols reveals several concerns.

Firstly, the broker does not provide explicit details regarding the segregation of client funds, which is a critical practice among regulated brokers. Client funds should be held in separate accounts from the broker's operational funds to ensure that they are not misused. Additionally, information regarding investor protection mechanisms and negative balance protection policies is also lacking.

Without these assurances, traders may find themselves at heightened risk of losing their investments in the event of the broker's insolvency or operational failures. The absence of historical data regarding fund security issues or disputes further complicates the evaluation of Reliable Trade's safety measures. In light of these factors, potential clients should approach this broker with caution, as the lack of transparency regarding fund security raises significant red flags.

Customer Experience and Complaints

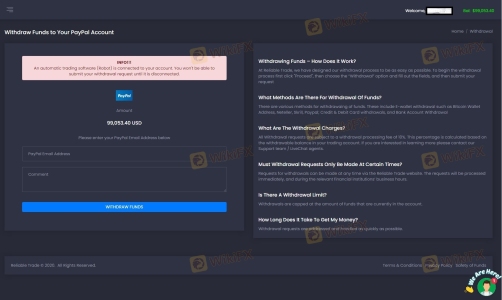

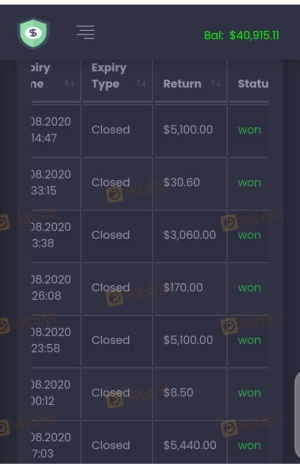

Analyzing customer feedback is essential for gauging a broker's reliability. A review of user experiences with Reliable Trade reveals a mix of positive and negative comments. Common complaints include withdrawal issues, lack of responsive customer support, and difficulties in obtaining timely information about account management.

The following table summarizes the primary types of complaints received about Reliable Trade:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Unresponsive |

| Account Management | High | Poor communication |

Several users have reported that their withdrawal requests were delayed or denied without clear explanations, which is a significant concern for any trader. The lack of responsive customer support exacerbates these issues, as traders may find it challenging to resolve problems effectively. Such complaints indicate a pattern of operational deficiencies that could jeopardize clients' funds and overall trading experience.

Platform and Execution

The trading platform is a crucial component of any broker's offering. Reliable Trade utilizes a proprietary platform that claims to offer a user-friendly interface and advanced trading features. However, user reviews indicate mixed experiences regarding platform performance and execution quality.

Traders have reported instances of slippage and order rejections, which can severely impact trading outcomes. The reliability of a platform is vital for executing trades efficiently, and any signs of manipulation or performance issues could signal deeper operational problems.

In summary, while Reliable Trade presents itself as a viable trading option, the concerns surrounding its platform performance and execution quality warrant careful scrutiny.

Risk Assessment

Assessing the overall risk of using Reliable Trade is essential for potential traders. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation from top-tier authorities. |

| Financial Transparency | High | Lack of information regarding ownership and management. |

| Fund Security | High | Unclear measures for client fund protection. |

| Customer Support | Medium | Reports of poor responsiveness and withdrawal issues. |

Given these factors, the overall risk of trading with Reliable Trade is high. Traders should consider these risks seriously and take appropriate measures to mitigate them.

Conclusion and Recommendations

In conclusion, the investigation into Reliable Trade raises several concerns about its legitimacy and safety as a forex broker. The lack of regulatory oversight, transparency issues, and negative customer feedback suggest that traders should exercise caution. While the broker may offer appealing trading conditions, the potential risks associated with fund security and customer support cannot be overlooked.

For traders seeking a safer investment environment, it is advisable to consider alternative brokers that are regulated by recognized authorities and have a proven track record of customer satisfaction. Brokers like IG, OANDA, and Forex.com are examples of more established options that provide a higher level of security and regulatory compliance.

In summary, is Reliable Trade safe? The evidence suggests that it may not be the most trustworthy choice for traders looking to safeguard their investments.

Is Reliable Trade a scam, or is it legit?

The latest exposure and evaluation content of Reliable Trade brokers.

Reliable Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Reliable Trade latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.