Is PROFIT Market safe?

Pros

Cons

Is Profit Market Safe or Scam?

Introduction

Profit Market is a broker that has recently gained attention in the foreign exchange (forex) market, particularly for its offerings in cryptocurrency trading. As trading platforms proliferate, it becomes crucial for traders to carefully evaluate each broker's legitimacy and reliability. The forex market is rife with potential scams, and traders risk losing their investments if they do not conduct thorough due diligence. This article aims to explore whether Profit Market is a safe platform for trading or if it poses significant risks to its users. Our investigation is based on a comprehensive review of various online sources, user feedback, and regulatory information to deliver an objective assessment.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety. Regulated brokers are subject to strict oversight and must adhere to established standards, which provide a layer of protection for traders. In the case of Profit Market, there is a conspicuous lack of regulatory oversight. The broker does not mention any regulatory licenses on its website, raising immediate red flags regarding its legitimacy.

Below is a summary of the regulatory information we could gather:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of a regulatory framework implies that Profit Market operates without the necessary checks and balances that protect traders. This lack of regulation is a significant concern, as it suggests that the broker may not be operating legally or ethically. Moreover, without a regulatory body to oversee its operations, traders have little recourse in case of disputes or issues related to fund withdrawals. Therefore, the question of Is Profit Market safe? is met with skepticism due to its unregulated status.

Company Background Investigation

Profit Market's history and ownership structure are equally vital in understanding its credibility. Unfortunately, there is scant information available regarding the company's origins, ownership, or management team. While the broker claims to operate from locations in Hong Kong and the UK, there is no verifiable information to substantiate these claims.

The lack of transparency surrounding the company's ownership raises concerns about accountability. A reputable broker will typically provide details about its founders and management team, including their professional backgrounds and expertise in the financial sector. However, Profit Market fails to disclose this essential information, further diminishing its credibility.

In summary, the opaque nature of Profit Market's company background casts doubt on its reliability, making it difficult for potential investors to trust the platform. This lack of transparency is a critical factor when assessing Is Profit Market safe?

Trading Conditions Analysis

When evaluating a broker, the trading conditions it offers are of paramount importance. Profit Market presents itself as a competitive trading platform, but a closer inspection reveals potential issues. The broker claims to offer low spreads and minimal fees, which can be enticing for traders. However, many users have reported hidden fees and unfavorable trading conditions that contradict the broker's marketing claims.

Heres a comparison of the core trading costs associated with Profit Market:

| Cost Type | Profit Market | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity regarding commission structures and overnight interest rates raises further questions about Profit Market's trading conditions. Additionally, many users have reported difficulties in withdrawing their funds, which is a common complaint among unregulated brokers. Such issues can significantly impact a trader's experience and raise concerns about the broker's reliability. Therefore, the question of Is Profit Market safe? remains unresolved as traders navigate these unclear trading conditions.

Client Funds Safety

The safety of client funds is another critical aspect that must be considered when evaluating a broker. Profit Market's website does not provide comprehensive information about its fund protection measures. The absence of clearly defined policies regarding fund segregation, investor protection, and negative balance protection is alarming.

In regulated environments, brokers are typically required to keep client funds in segregated accounts, ensuring that traders' money is protected even if the broker faces financial difficulties. However, Profit Market does not seem to adhere to these standards, leaving client funds vulnerable.

Additionally, there have been reports of clients facing challenges in accessing their funds, with many users expressing frustration over withdrawal delays and excessive fees. This history of financial disputes raises serious concerns about the safety of client funds. Therefore, it is reasonable to question Is Profit Market safe? given the lack of transparency and the potential risks associated with fund security.

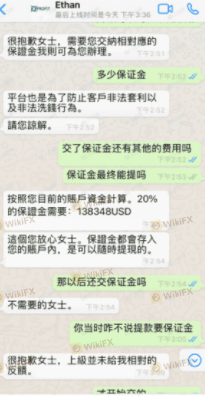

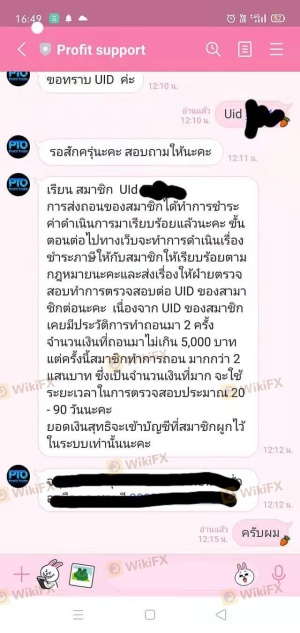

Customer Experience and Complaints

Analyzing customer feedback provides invaluable insights into a broker's reliability. Profit Market has garnered numerous complaints from users, primarily focused on withdrawal issues and poor customer service. Many clients have reported being unable to withdraw their funds, with some alleging that the broker employs tactics to delay or deny withdrawal requests.

Here is a summary of the primary complaint types related to Profit Market:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Poor |

| Transparency Concerns | High | None |

For instance, one user reported depositing €4,000 but faced challenges when attempting to withdraw their funds, ultimately leading to their account being blocked. Such experiences highlight the significant risks associated with trading on Profit Market and raise serious questions about its integrity. Therefore, the question Is Profit Market safe? is met with skepticism based on the overwhelming negative feedback from users.

Platform and Execution

The trading platform's performance and execution quality are essential factors for traders. Profit Market claims to offer a user-friendly platform, but many users have reported issues with execution speed and order slippage. Poor execution can lead to significant financial losses, especially in a volatile market like forex.

Moreover, there are concerns regarding the potential for manipulation on the platform, which is a common issue among unregulated brokers. Traders have reported instances of orders being rejected or executed at unfavorable prices, further exacerbating their frustrations.

Given these concerns, it is crucial to assess whether Is Profit Market safe? The evidence suggests that the platform may not provide the reliability and performance that traders expect, raising further doubts about its legitimacy.

Risk Assessment

Using Profit Market comes with a range of risks that potential investors should consider. The lack of regulation, transparency issues, and negative user experiences contribute to an overall high-risk profile for this broker.

Heres a summary of the key risk areas associated with Profit Market:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Withdrawal issues reported |

| Transparency Risk | High | Lack of information on ownership |

| Execution Risk | Medium | Poor order execution reported |

To mitigate these risks, it is advisable for traders to conduct thorough research and consider alternative brokers that are properly regulated and have a solid reputation.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the safety and reliability of Profit Market. The lack of regulation, transparency issues, and negative customer experiences strongly suggest that traders should exercise caution. While some may be tempted by the broker's marketing claims, the associated risks far outweigh the potential benefits.

For traders seeking a reliable and safe trading environment, it is recommended to consider regulated alternatives with a proven track record. Brokers such as IG Group, OANDA, and Forex.com offer robust regulatory oversight and a commitment to client safety. Ultimately, the question of Is Profit Market safe? leans heavily towards a negative assessment, and potential investors should be wary of engaging with this platform.

Is PROFIT Market a scam, or is it legit?

The latest exposure and evaluation content of PROFIT Market brokers.

PROFIT Market Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PROFIT Market latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.