Is PROFIT CINDA LIMITED safe?

Business

License

Is Profit Cinda Limited A Scam?

Introduction

Profit Cinda Limited positions itself as a player in the forex market, offering trading opportunities in various financial instruments, including forex, commodities, and cryptocurrencies. However, as the financial landscape becomes increasingly complex, traders must exercise caution when evaluating forex brokers. The potential for scams and fraudulent activities is high, and understanding the credibility of a broker is crucial for protecting ones investments. This article investigates the legitimacy of Profit Cinda Limited using a structured assessment framework that includes regulatory compliance, company background, trading conditions, customer safety, and user feedback.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its trustworthiness. Profit Cinda Limited claims to operate under a regulatory framework but lacks the necessary licenses from recognized financial authorities. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Profit Cinda Limited has not provided any credible evidence of regulation, raising significant concerns about its operational legitimacy. Unregulated brokers are often associated with higher risks, including potential fraud and the inability to recover funds in case of disputes. The absence of a regulatory body overseeing Profit Cinda Limited means that traders have limited recourse if issues arise, making it imperative to question whether Profit Cinda Limited is safe for investment.

Company Background Investigation

Profit Cinda Limited appears to be a relatively new entity in the forex market, with scant information available regarding its history and ownership structure. The company's website lacks transparency, failing to disclose essential details such as its physical address, management team, and corporate structure. This lack of clarity raises red flags about its operational integrity.

Furthermore, the management teams qualifications and professional backgrounds are not publicly available, which is a significant disadvantage for potential investors seeking to understand who is behind the broker. Transparency is a hallmark of reputable firms, and the absence of such information further complicates the question of whether Profit Cinda Limited is safe for traders.

Trading Conditions Analysis

An essential aspect of evaluating any forex broker is its trading conditions, including fees, spreads, and overall cost structure. Profit Cinda Limited has not clearly articulated its fee structure, which can be a warning sign. Below is a comparison of its trading costs:

| Fee Type | Profit Cinda Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1-2 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The lack of specified fees and spreads is concerning, as it indicates a potential for hidden costs that could erode traders' profits. Furthermore, the absence of standard commission structures may suggest that the broker does not operate transparently, thus raising further doubts about whether Profit Cinda Limited is safe to trade with.

Customer Funds Safety

The safety of customer funds is paramount in the forex trading environment. Profit Cinda Limited does not provide information regarding its fund segregation practices, investor protection measures, or negative balance protection policies. These are critical components that can safeguard traders' investments. The absence of such protections means that traders may be at risk of losing their entire investment without any legal recourse.

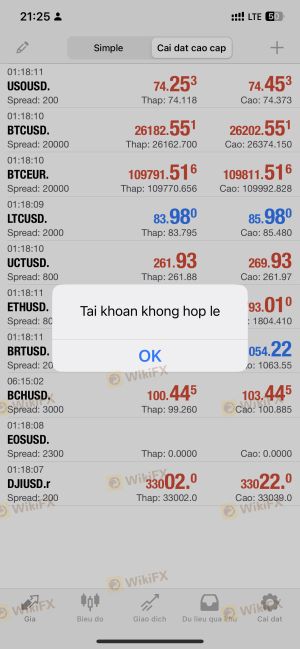

Historically, unregulated brokers like Profit Cinda Limited have been involved in various disputes concerning fund safety, with clients often reporting issues related to fund withdrawals and account freezes. This lack of security measures raises serious questions about the overall safety of funds held with Profit Cinda Limited, leading to the conclusion that Profit Cinda Limited is not safe for potential investors.

Customer Experience and Complaints

Understanding customer feedback is vital for assessing a broker's reliability. Numerous negative reviews and complaints have surfaced regarding Profit Cinda Limited, with clients frequently citing issues related to withdrawal difficulties and poor customer service. Below is a summary of common complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Freezing | High | Poor |

| Lack of Communication | Medium | Poor |

Typical case studies reveal that clients have struggled to withdraw their funds, with some alleging that their accounts were frozen without explanation. Such complaints highlight a pattern of behavior that is alarming and indicative of broader issues within the company. Therefore, it is reasonable to conclude that Profit Cinda Limited is not safe for traders seeking a reliable trading environment.

Platform and Trade Execution

The trading platform provided by Profit Cinda Limited is another area of concern. While the broker claims to offer a sophisticated trading platform, user experiences suggest that the platform may not perform reliably. Issues such as order execution delays, slippage, and potential manipulation have been reported by users, raising questions about the integrity of the trading environment.

Given that the trading platform is the primary interface through which traders interact with the market, any deficiencies in performance can severely impact trading outcomes. Therefore, traders must consider whether Profit Cinda Limited is safe based on the platform's reliability and execution quality.

Risk Assessment

Using Profit Cinda Limited for trading entails various risks. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk of fraud. |

| Fund Safety Risk | High | Lack of investor protection measures. |

| Customer Service Risk | Medium | Poor response to customer complaints. |

Given these risks, it is crucial for potential clients to exercise extreme caution. To mitigate these risks, traders should conduct thorough research, consider using regulated brokers, and avoid investing more than they can afford to lose.

Conclusion and Recommendations

In conclusion, the investigation into Profit Cinda Limited reveals several red flags that suggest it may not be a trustworthy broker. The lack of regulation, transparency, and negative customer experiences collectively indicate that Profit Cinda Limited is not safe for traders. For those considering forex trading, it is advisable to seek out regulated brokers with established reputations and robust customer protection measures.

Alternatives to consider include well-regulated brokers such as Forex.com, IG, or OANDA, which provide transparent trading conditions and a secure trading environment. Ultimately, protecting one's investments should be the top priority, and choosing a reliable broker is a critical component of that strategy.

Is PROFIT CINDA LIMITED a scam, or is it legit?

The latest exposure and evaluation content of PROFIT CINDA LIMITED brokers.

PROFIT CINDA LIMITED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PROFIT CINDA LIMITED latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.