Is AOGES safe?

Pros

Cons

Is Aoges Safe or a Scam?

Introduction

Aoges is a forex broker that has entered the competitive landscape of the foreign exchange market, aiming to cater to both novice and experienced traders. As the forex market continues to grow, it becomes increasingly crucial for traders to thoroughly evaluate brokers before committing their capital. The potential for scams and unreliable practices has led to a heightened awareness among traders regarding the legitimacy of the brokers they choose. This article aims to provide a comprehensive analysis of Aoges, examining its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk assessment. Our evaluation will be based on a thorough review of available information, including regulatory databases, user reviews, and other credible sources.

Regulation and Legitimacy

The regulatory environment is a vital factor in determining whether a broker like Aoges is safe or a potential scam. Regulation ensures that brokers adhere to strict standards, offering a layer of protection for traders' funds. Aoges' regulatory status is particularly concerning, as it lacks oversight from any major financial authority. The absence of regulation raises significant red flags regarding the safety and security of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The lack of regulation means that Aoges is not subject to the stringent compliance measures that regulated brokers must follow. This raises questions about the quality of services they provide and whether they have a history of compliance with industry standards. In the absence of a regulatory framework, traders are left vulnerable to potential misconduct, making it imperative to approach Aoges with caution.

Company Background Investigation

Aoges was established with the intent to provide a platform for forex trading, but its company history raises concerns about its reliability. The company appears to have a relatively short operational history, which can be a warning sign in the forex industry, where established brokers tend to have a better track record. The ownership structure of Aoges is also opaque, with limited information available about its founders and management team. This lack of transparency can be indicative of a broker that may not have the best interests of its clients at heart.

The absence of detailed information about the management team further complicates the situation. A reputable broker typically provides information about its leaders, including their professional backgrounds and experience in the financial sector. Aoges, however, does not seem to have this level of transparency, which is a critical factor for traders considering whether Aoges is safe or a scam.

Trading Conditions Analysis

When evaluating whether Aoges is safe, it is essential to consider its trading conditions and fee structures. Aoges claims to offer competitive trading conditions, but without sufficient transparency regarding its fees, it is challenging to ascertain the true cost of trading with this broker.

| Fee Type | Aoges | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 3.0% |

The lack of clear information on spreads, commissions, and overnight interest rates can lead to unexpected costs, which traders must be wary of. If Aoges employs hidden fees or charges that are not disclosed upfront, it could significantly affect a trader's profitability. This ambiguity in trading conditions is a common tactic used by unregulated brokers, further supporting the notion that traders should approach Aoges with skepticism.

Customer Funds Security

Another critical aspect of assessing whether Aoges is safe involves examining the measures in place for customer funds security. A reputable broker typically employs robust security protocols, including fund segregation, investor protection schemes, and negative balance protection policies. However, Aoges does not provide clear information about its security measures, leaving traders uncertain about the safety of their deposits.

The absence of fund segregation means that Aoges could potentially use client funds for its operations, which is a significant risk for traders. Additionally, without any investor protection schemes, clients may find it challenging to recover their funds in the event of a dispute or broker insolvency. Historical issues surrounding fund safety, if any, have not been disclosed, which further complicates the trustworthiness of Aoges.

Customer Experience and Complaints

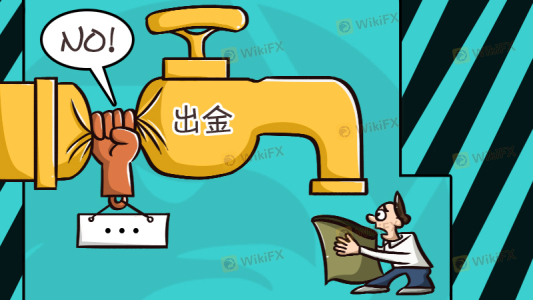

User feedback is an essential component in determining whether Aoges is safe or a scam. An analysis of customer reviews reveals a mixed bag of experiences, with some users reporting satisfactory service while others have raised serious complaints. Common complaints include issues with withdrawals, unresponsive customer service, and lack of transparency regarding fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service | Medium | Inconsistent |

| Fee Transparency | High | Poor |

Several users have reported difficulties in withdrawing their funds, which is a significant red flag. A broker that does not allow smooth withdrawals is often viewed as untrustworthy, and this issue can be indicative of deeper systemic problems within the company. The inconsistency in customer service responses also raises concerns about the broker's commitment to client satisfaction.

Platform and Trade Execution

The trading platform is another critical factor in evaluating whether Aoges is safe. A reliable trading platform should offer stability, user-friendly interfaces, and efficient order execution. However, there have been reports of slippage and rejected orders, which can significantly affect trading performance.

Traders should be cautious if they notice frequent execution issues, as this could indicate a lack of proper infrastructure or even manipulative practices. If Aoges' platform is prone to glitches or delays, it may hinder traders' ability to execute their strategies effectively, leading to potential losses.

Risk Assessment

Using Aoges as a trading platform presents several risks that traders need to consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation, potential for fraud |

| Financial Risk | Medium | Lack of transparency in fees |

| Operational Risk | High | Issues with platform stability |

| Customer Service Risk | Medium | Inconsistent responses to complaints |

Given the high regulatory risk associated with Aoges, traders should be particularly vigilant. The lack of oversight and transparency can lead to significant potential losses. It is advisable for traders to implement risk management strategies, such as limiting the amount of capital invested in Aoges and diversifying their trading portfolio.

Conclusion and Recommendations

In conclusion, after a thorough investigation, it is clear that Aoges raises several red flags that suggest it may not be a safe broker. The absence of regulation, lack of transparency regarding fees and trading conditions, and reported issues with customer service and withdrawals all point to a broker that traders should approach with caution.

For those considering trading with Aoges, it is recommended to conduct further research and potentially seek alternative brokers that are regulated and have a proven track record of reliability. Some reputable alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which provide greater assurance regarding the safety of your funds and overall trading experience. Ultimately, it is crucial for traders to prioritize their security and due diligence when selecting a broker in the forex market.

Is AOGES a scam, or is it legit?

The latest exposure and evaluation content of AOGES brokers.

AOGES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AOGES latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.