Is Pacoxr safe?

Business

License

Is Pacoxr Safe or a Scam?

Introduction

Pacoxr is a relatively new player in the forex market, positioning itself as a broker that offers various trading instruments, including forex, CFDs, and commodities. As the online trading landscape continues to evolve, traders must be vigilant in assessing the legitimacy and safety of brokers like Pacoxr. The potential for scams in the forex industry is significant, with many brokers lacking proper regulation or transparency. This article aims to provide a comprehensive evaluation of Pacoxr, using a structured approach that includes an analysis of its regulatory status, company background, trading conditions, client fund safety, customer feedback, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory status of a broker is crucial for traders as it often indicates the level of protection they can expect. In the case of Pacoxr, it has been reported that the broker operates without any valid regulatory oversight. This lack of regulation raises significant concerns regarding the safety of client funds and the overall legitimacy of the trading platform.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a regulatory body means that Pacoxr does not adhere to the standards set by recognized financial authorities. Legitimate brokers are typically registered with well-known regulators such as the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC). These regulatory bodies enforce strict compliance measures to protect traders from fraud and malpractice. Given that Pacoxr is unregulated, traders should exercise extreme caution when considering this broker, as they may have limited recourse in the event of disputes or financial loss.

Company Background Investigation

An in-depth look into the companys history and ownership structure reveals that Pacoxr lacks transparency. There is limited information available about its founding members, operational history, and location. This anonymity is a red flag, as reputable brokers often provide detailed information about their management teams and corporate structure.

The management team‘s experience is also a critical factor; however, there is little to no information available about the qualifications or backgrounds of those running Pacoxr. This opacity can lead to concerns about the broker’s intentions and ability to operate ethically. Furthermore, the lack of a physical address or contact information raises questions about the company's legitimacy. Without clear disclosure of operational details, traders may find themselves in a precarious situation, especially if issues arise.

Trading Conditions Analysis

Pacoxr offers various trading accounts, each with different minimum deposit requirements and features. However, the overall fee structure and trading conditions have raised eyebrows among industry experts.

| Fee Type | Pacoxr | Industry Average |

|---|---|---|

| Spread for Major Pairs | 3.0 pips | 1.0 pips |

| Commission Model | None disclosed | Varies by broker |

| Overnight Interest Range | Not disclosed | Typically 0.5% to 2% |

The spreads offered by Pacoxr are significantly higher than the industry average, which could erode potential profits for traders. Additionally, the lack of transparency regarding commissions and overnight interest rates is concerning. Traders should be wary of brokers that do not clearly outline their fee structures, as hidden costs can lead to unexpected losses.

Client Fund Safety

When it comes to the safety of client funds, Pacoxr's lack of regulatory oversight is a significant concern. Regulated brokers are required to keep client funds in segregated accounts, ensuring that traders' money is protected in the event of insolvency. Unfortunately, Pacoxr does not provide any information regarding its fund safety measures, including whether it employs such practices.

Furthermore, there is no indication that Pacoxr participates in any investor compensation schemes, which are designed to protect clients in case of broker failure. This absence of protective measures places traders at a higher risk of losing their investments without any means of recovery. Historical data shows that unregulated brokers often face allegations of misappropriating client funds, further emphasizing the need for caution when dealing with Pacoxr.

Customer Experience and Complaints

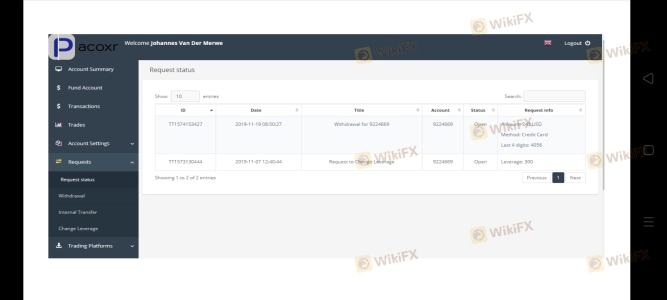

Customer feedback is an essential component in evaluating a broker's reliability. Reviews and testimonials regarding Pacoxr indicate a pattern of complaints related to fund withdrawals and customer service responsiveness. Many users have reported difficulties in accessing their funds after requesting withdrawals, which is a common red flag associated with scam brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Minimal |

Several users have shared experiences of being unable to retrieve their funds after depositing money into their accounts. This lack of responsiveness indicates a troubling trend that could signal deeper issues within the organization. One typical case involves a user who deposited funds but faced repeated delays and unreturned emails when attempting to withdraw their money. Such incidents highlight the potential risks associated with trading through an unregulated broker like Pacoxr.

Platform and Trade Execution

The performance of a trading platform is vital for ensuring a smooth trading experience. Pacoxr claims to offer a user-friendly trading environment with access to popular trading tools. However, users have reported issues with platform stability and order execution quality.

Concerns regarding slippage and order rejections have also been raised, which can lead to unfavorable trading outcomes. Traders expect their orders to be executed at the desired price, but reports of significant slippage have emerged from users of Pacoxr, suggesting that the broker may not provide the level of service expected from a reputable trading platform.

Risk Assessment

Using Pacoxr as a trading platform presents several risks that potential clients should consider. The absence of regulation, coupled with complaints about withdrawal issues and platform performance, creates a precarious trading environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight increases potential for fraud. |

| Fund Safety Risk | High | Lack of fund segregation and protection. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

Traders are advised to exercise caution and consider alternative options that offer better regulatory protection and customer service. Ensuring a clear understanding of the risks involved and implementing strategies to mitigate these risks is essential for anyone considering trading with Pacoxr.

Conclusion and Recommendations

In conclusion, the evidence suggests that Pacoxr is not a safe trading platform. The lack of regulatory oversight, combined with numerous complaints regarding fund withdrawals and customer service, raises significant red flags. Traders should be particularly wary of engaging with this broker, as the potential for loss is high.

For traders seeking reliable alternatives, it is advisable to consider brokers that are well-regulated and have a proven track record of positive customer experiences. Reputable brokers typically provide transparent fee structures, robust fund safety measures, and responsive customer support.

In summary, is Pacoxr safe? The overwhelming consensus is that it is advisable to avoid this broker and seek safer, more transparent trading options.

Is Pacoxr a scam, or is it legit?

The latest exposure and evaluation content of Pacoxr brokers.

Pacoxr Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Pacoxr latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.