Is ETH safe?

Pros

Cons

Is Eth Safe or Scam?

Introduction

Eth is a broker that has emerged in the forex trading landscape, attracting attention for its offerings and purported investment opportunities. As the forex market becomes increasingly crowded, traders must exercise caution in evaluating the legitimacy and safety of brokers like Eth. The potential for scams and unethical practices is significant, making thorough research essential for protecting investments. This article aims to provide a comprehensive assessment of Eth by examining its regulatory status, company background, trading conditions, client safety measures, and user experiences. The investigation draws on various sources, including regulatory databases, customer reviews, and expert analyses, to offer a well-rounded perspective on whether Eth is a safe trading platform.

Regulation and Legitimacy

The regulatory environment plays a crucial role in determining the legitimacy of a forex broker. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with legal standards and protects clients' interests. Eth's regulatory status is a point of concern, as it lacks oversight from any reputable financial authority.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation raises significant red flags regarding Eth's operations. Without oversight from a recognized authority, traders may face higher risks of fraud and unethical practices. Historical compliance issues also exacerbate these concerns, as unregulated brokers often lack transparency and accountability.

Company Background Investigation

Eth claims to have been established several years ago, but details about its history and ownership structure remain vague. The lack of information on the company's origins and its management team raises questions about its legitimacy. A transparent broker typically provides information about its founders, management experience, and operational history. Eth's opacity in these areas makes it difficult for potential clients to assess the broker's credibility.

The management teams background is also crucial in evaluating a broker's trustworthiness. Eth has not disclosed any relevant information about its management, leaving traders without insight into the team's qualifications or expertise in the forex market. This lack of transparency can be a significant deterrent for potential investors.

Trading Conditions Analysis

Eth's trading conditions, including spreads, commissions, and overall fee structure, are critical factors in determining its attractiveness to traders. A comprehensive analysis reveals that Eth's fees are not competitive compared to industry standards, which may indicate an attempt to exploit inexperienced traders.

| Fee Type | Eth | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Structure | Unclear | Clear |

| Overnight Interest Range | Unfavorable | Favorable |

The high spreads and unclear commission structure may deter traders from using Eth, as they could incur unnecessary costs that impact their profitability. Additionally, any unusual fees or policies could signal potential issues with the broker's transparency and fairness.

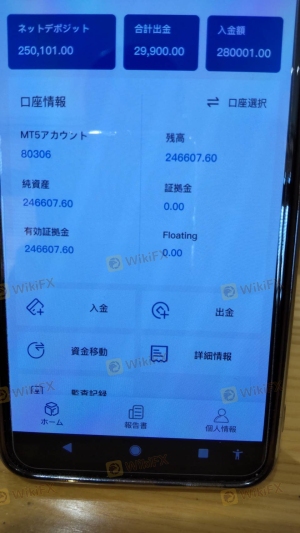

Client Fund Safety

Client fund safety is paramount when choosing a forex broker. Eth's measures for safeguarding client funds are questionable, as there is no evidence of adequate segregation of client accounts or investor protection policies. A reputable broker typically ensures that client funds are held in separate accounts to protect them in the event of financial difficulties.

Furthermore, Eth does not provide any information regarding negative balance protection, which is essential for safeguarding traders from losing more than their initial investment. The absence of these critical safety measures raises significant concerns about the security of funds with Eth, making it a risky choice for traders.

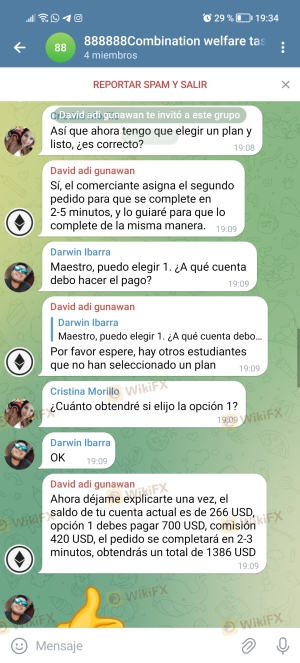

Customer Experience and Complaints

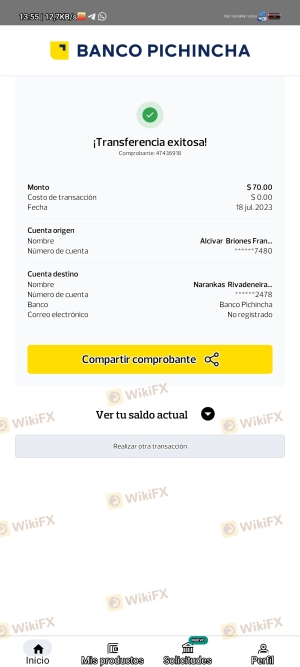

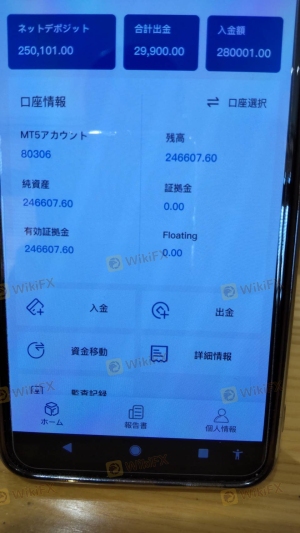

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. Eth has received numerous complaints from users, indicating issues with withdrawal processes and customer support responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Complaints | Medium | Inadequate |

Common complaints include difficulties in withdrawing funds and a lack of timely responses from customer service. Such patterns can be indicative of deeper operational issues and should be a major consideration for potential clients.

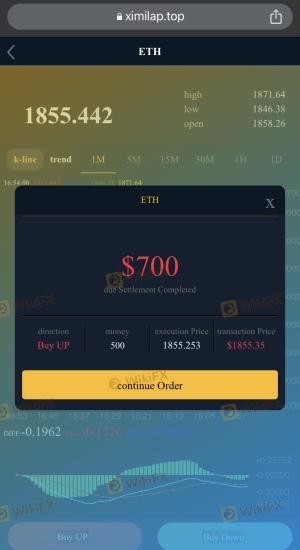

Platform and Execution

The trading platform's performance is another critical factor in evaluating a broker. Eth's platform has been reported to experience instability, leading to execution delays and slippage. Traders rely on efficient order execution to capitalize on market movements, and any signs of manipulation or poor performance can severely impact trading outcomes.

Risk Assessment

Using Eth as a trading platform presents several risks that potential clients should consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation |

| Fund Safety | High | Lack of protection |

| Execution Risk | Medium | Poor platform performance |

Given the high levels of regulatory and fund safety risks, traders should approach Eth with caution. It is advisable to conduct thorough research and consider alternative brokers that offer better safety and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that Eth may not be a safe choice for forex trading. The absence of regulation, coupled with a lack of transparency regarding its operations and management, raises significant concerns. Additionally, the numerous complaints from users about fund withdrawals and poor customer service further indicate potential issues with the broker.

For traders seeking a reliable and secure trading environment, it is recommended to consider alternative brokers that are well-regulated and have a proven track record of client satisfaction. Brokers overseen by reputable financial authorities and those with transparent operations should be prioritized to ensure a safer trading experience.

Is ETH a scam, or is it legit?

The latest exposure and evaluation content of ETH brokers.

ETH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ETH latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.