Is Optionfx trade safe?

Business

License

Is OptionFX Trade A Scam?

Introduction

OptionFX Trade is a relatively new player in the forex market, established in 2019 and based in Seychelles. The broker positions itself as a platform offering a wide array of trading instruments, including forex pairs, commodities, and cryptocurrencies. However, with the rise of online trading, the need for traders to carefully evaluate the credibility of forex brokers has never been more crucial. The forex market is rife with unregulated entities that can potentially jeopardize traders' investments. This article aims to provide a comprehensive analysis of OptionFX Trade, assessing its legitimacy and safety for traders. The evaluation will be based on a combination of regulatory status, company background, trading conditions, customer feedback, and risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety and reliability. Unfortunately, OptionFX Trade operates without any valid regulatory oversight. This lack of regulation raises serious concerns about the protection of customer funds and the overall legitimacy of the broker.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of a regulatory framework means that traders using OptionFX Trade do not have the same protections that regulated brokers provide. Regulated brokers are required to adhere to strict guidelines, including maintaining segregated accounts for client funds, which ensures that traders' money is not misused. Without such oversight, traders are at a higher risk of encountering fraudulent activities or losing their investments without any recourse.

Company Background Investigation

OptionFX Trade is operated by a company registered in the Marshall Islands, known for its lenient regulations regarding financial services. This raises questions about the broker's transparency and accountability. The company's ownership structure is not clearly disclosed, and there is little information available regarding its management team. This lack of transparency is concerning, as it makes it difficult for potential clients to understand who is behind the broker and what their qualifications are.

The history of the company is equally vague, with no substantial track record to indicate its reliability. While it is stated that the broker was founded in 2019, the absence of detailed information about its operational history and ownership raises red flags for potential investors. A broker's transparency is crucial for building trust, and the lack of such information from OptionFX Trade makes it difficult for traders to feel secure in their investments.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is vital. OptionFX Trade claims to offer competitive trading conditions, but the actual fee structure raises some eyebrows.

| Fee Type | OptionFX Trade | Industry Average |

|---|---|---|

| Spread on Major Pairs | 3 pips | 1-1.5 pips |

| Commission Model | None specified | Varies |

| Overnight Interest Range | Not specified | 2-5% |

The spreads offered by OptionFX Trade are significantly higher than the industry average, which can eat into traders' profits. Additionally, the broker charges withdrawal fees, which is uncommon among reputable brokers. The lack of clarity surrounding overnight interest rates and commission structures further complicates the situation, making it difficult for traders to understand the true costs of trading with this broker.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. Unfortunately, OptionFX Trade does not provide adequate measures to protect customer funds. There is no indication of segregated accounts, which means that client funds may be mixed with the broker's operational funds. This poses a significant risk, as clients may not be able to recover their funds in the event of the broker's insolvency.

Moreover, the absence of investor protection schemes further exacerbates the risks associated with trading on this platform. Traders should be especially cautious, as any historical issues related to fund security could indicate a pattern of negligence or malpractice.

Customer Experience and Complaints

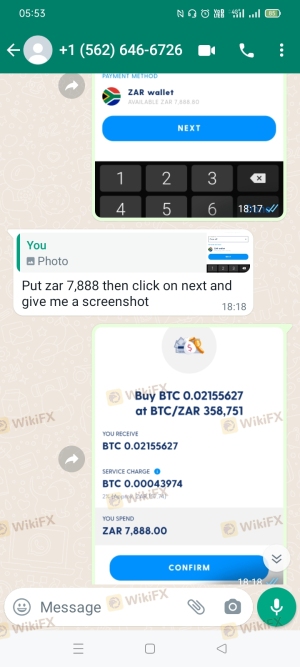

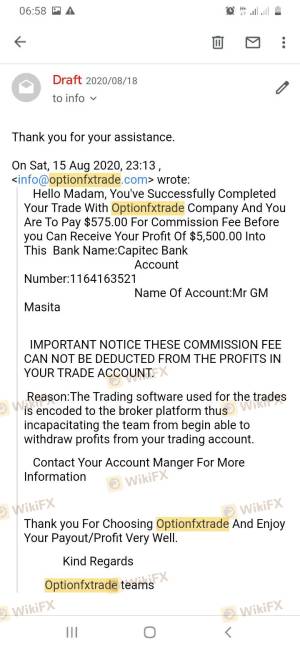

Customer feedback is a valuable resource when assessing a broker's reliability. Reviews of OptionFX Trade reveal a troubling pattern of complaints. Many users have reported difficulties in withdrawing their funds, with some stating that their accounts were closed without warning.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Misleading Promotions | Medium | Inconsistent |

| Account Closure | High | Unresponsive |

Several reviews describe experiences where clients were pressured to deposit more funds under the guise of promising returns, only to find themselves unable to withdraw their initial investments. Such practices are characteristic of scams, and they highlight the importance of exercising caution when dealing with unregulated brokers like OptionFX Trade.

Platform and Trade Execution

The trading platform offered by OptionFX Trade is web-based, which may appeal to some traders. However, the absence of a demo account limits potential clients' ability to test the platform before committing funds. Additionally, user experiences regarding order execution have been mixed, with reports of slippage and rejected orders.

A reliable trading platform should provide a seamless experience, but any signs of manipulation or poor execution quality can be detrimental to traders' success. Traders need to be wary of platforms that do not offer transparency in their trading conditions.

Risk Assessment

Trading with OptionFX Trade presents several risks that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | Lack of segregated accounts. |

| Withdrawal Risk | High | Numerous complaints about fund access. |

| Execution Risk | Medium | Reports of slippage and rejected orders. |

Given the high-risk categories associated with this broker, it is advisable for traders to proceed with caution. They should consider utilizing risk mitigation strategies, such as trading with smaller amounts or seeking out regulated alternatives.

Conclusion and Recommendations

In conclusion, the evidence suggests that OptionFX Trade raises significant concerns regarding its legitimacy and safety for traders. The lack of regulation, transparency, and numerous customer complaints indicate that this broker may not be a safe option for trading. Traders are advised to exercise extreme caution and consider alternative brokers that offer solid regulatory oversight and a proven track record of reliability.

For those looking for safer trading environments, it would be prudent to explore options with reputable regulatory bodies such as the FCA, CySEC, or ASIC. These regulators ensure that brokers adhere to strict guidelines, providing a higher level of protection for traders' funds and interests.

Is Optionfx trade a scam, or is it legit?

The latest exposure and evaluation content of Optionfx trade brokers.

Optionfx trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Optionfx trade latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.