OneTrade 2025 Review: Everything You Need to Know

Executive Summary

OneTrade stands as a regulated forex broker that emphasizes transparent institutional-grade pricing and cost control. It makes trading suitable for both novice and experienced traders. This comprehensive onetrade review examines a broker that provides access to over 90 tradeable instruments across multiple asset classes, including forex, CFDs, and social trading opportunities through the widely recognized MetaTrader 4 platform.

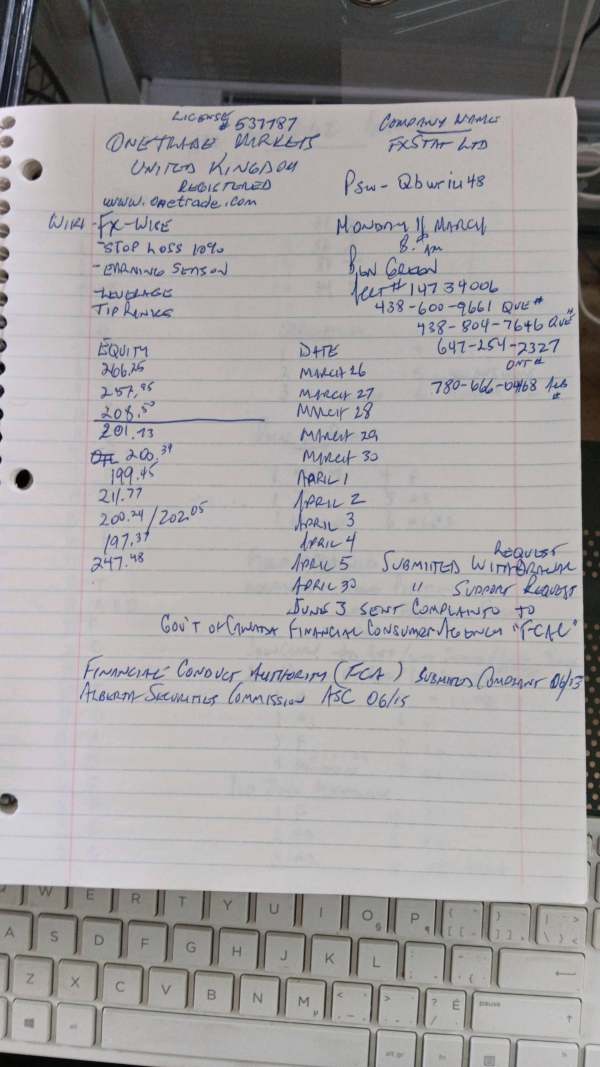

The broker operates under multiple regulatory frameworks across different jurisdictions. These include oversight from BaFin in Germany, CNMV in Spain, FCA in the UK, and ESMA regulations. OneTrade's business model focuses on providing direct market access with an emphasis on transparency, which appeals to traders seeking clear pricing structures without hidden fees.

The platform caters to a diverse user base. This ranges from retail traders seeking their first forex trading experience to sophisticated investors requiring advanced trading tools and institutional-grade execution. With its multi-jurisdictional presence and regulatory compliance, OneTrade positions itself as a trustworthy option in the competitive forex brokerage landscape.

Important Notice

OneTrade operates through different entities across various countries, including Germany, Spain, the United Kingdom, and France. Each jurisdiction is subject to its respective regulatory authority. Trading conditions, available services, and regulatory protections may vary between these different regional entities.

Traders should verify which specific OneTrade entity serves their region. They should also understand the applicable regulatory framework. This review is based on publicly available information and user feedback from various sources.

The analysis does not include specific user ratings or detailed customer testimonials. Comprehensive user evaluation data was not available in the source materials. Potential clients are encouraged to conduct their own due diligence before making trading decisions.

Rating Framework

Broker Overview

OneTrade launched its operations in 2011. The company established itself as an online trading broker with headquarters spanning multiple European jurisdictions, including Germany, Spain, the United Kingdom, and France. The company has built its reputation on providing direct market access to retail and institutional clients, with a particular focus on delivering transparent trading experiences without the complications often associated with traditional market maker models.

The broker's business philosophy centers around eliminating conflicts of interest between the company and its clients. This happens by providing direct access to liquidity providers. This approach allows OneTrade to offer institutional-grade pricing to retail traders while maintaining transparency in its operations.

The company's multi-jurisdictional structure enables it to serve clients across different European markets. It adheres to local regulatory requirements while doing so. OneTrade supports the MetaTrader 4 platform along with its web-based version, providing traders with access to comprehensive charting tools, technical indicators, and automated trading capabilities.

The broker covers multiple asset classes including forex currency pairs, contracts for difference, social trading features, and stock trading opportunities. Regulatory oversight comes from prominent European authorities including BaFin, CNMV, FCA, and ESMA, ensuring clients benefit from established investor protection frameworks.

Regulatory Coverage: OneTrade operates under supervision from multiple respected regulatory bodies across Europe. BaFin provides oversight for German operations, CNMV regulates Spanish activities, FCA governs UK services, and ESMA ensures compliance with broader European standards.

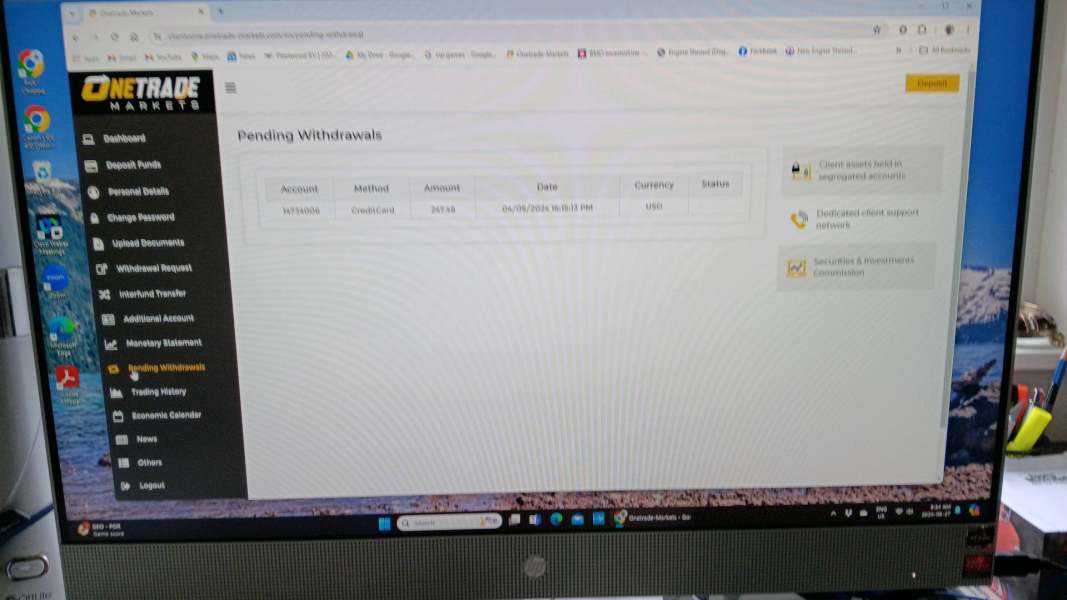

This multi-jurisdictional approach provides traders with regulatory protection appropriate to their location. It maintains consistent service standards across regions while doing so. Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods was not detailed in the source materials.

Prospective clients should contact OneTrade directly to understand available payment options. They should also ask about processing times and any associated fees for their specific region. Minimum Deposit Requirements: The minimum deposit requirements for opening accounts with OneTrade were not specified in the available information.

This detail typically varies by account type and regulatory jurisdiction. Bonus and Promotional Offers: Information regarding current bonus structures or promotional offers was not provided in the source materials. Traders should verify current promotional terms directly with OneTrade.

Available Trading Assets: OneTrade provides access to over 90 different trading instruments spanning multiple asset categories. The selection includes major and minor forex currency pairs, various CFD products, social trading opportunities, and stock trading options, offering sufficient diversity for most trading strategies.

Cost Structure: Specific details regarding spreads, commissions, and other trading costs were not available in the source materials. As OneTrade emphasizes transparent pricing, prospective clients should request detailed cost information directly from the broker. Leverage Ratios: Leverage options and maximum ratios were not specified in the available information and likely vary by asset class and regulatory jurisdiction.

Platform Options: The broker supports MetaTrader 4 and its web-based version. This provides users with familiar trading interfaces, comprehensive technical analysis tools, and automated trading capabilities through Expert Advisors. Geographic Restrictions: Specific information regarding geographic restrictions or prohibited countries was not detailed in the source materials.

Customer Service Languages: Available customer service languages were not specified in the provided information. This onetrade review continues with detailed analysis of each key dimension affecting trader experience and satisfaction.

Account Conditions Analysis

OneTrade's account structure and conditions represent a critical factor for traders evaluating the broker's suitability for their needs. However, specific information regarding account types, their distinctive features, and associated benefits was not detailed in the available source materials.

This information gap makes it challenging to provide a comprehensive assessment of how OneTrade's account conditions compare to industry standards. The absence of clear minimum deposit requirements in the source materials suggests that prospective clients need to contact OneTrade directly to understand entry-level investment requirements. Industry standards typically range from $100 to $500 for basic accounts, with premium accounts requiring significantly higher deposits.

Without specific data, traders cannot easily determine if OneTrade's requirements align with their available capital. Account opening procedures and verification processes also lack detailed description in the available materials. Modern brokers typically require identity verification, address confirmation, and financial suitability assessments as part of regulatory compliance.

The efficiency and user-friendliness of these processes significantly impact the initial client experience. Special account features such as Islamic accounts for Muslim traders, demo accounts for practice trading, or professional trader accounts with enhanced features were not mentioned in the source information. These specialized offerings often differentiate brokers in competitive markets, and their absence from available information represents a knowledge gap in this onetrade review.

OneTrade demonstrates strength in its trading instrument offerings. The broker provides access to over 90 different tradeable assets across multiple categories. This diverse selection includes forex currency pairs ranging from major pairs like EUR/USD and GBP/USD to more exotic combinations, offering traders opportunities to diversify their portfolios and capitalize on various market conditions.

The broker's CFD offerings expand trading opportunities beyond traditional forex markets. This allows clients to speculate on price movements in various underlying assets without direct ownership. This approach provides traders with flexibility to respond to different market opportunities while maintaining consistent platform experience across asset classes.

Social trading features represent an additional resource for traders seeking to learn from or copy successful trading strategies. While specific details about the social trading implementation were not provided in source materials, this functionality typically allows less experienced traders to benefit from the expertise of successful traders on the platform. The MetaTrader 4 platform serves as OneTrade's primary trading environment, providing traders with access to comprehensive technical analysis tools, customizable charts, and automated trading capabilities through Expert Advisors.

MT4's popularity stems from its robust functionality, extensive indicator library, and strong community support for custom trading tools. However, information regarding additional research resources, market analysis, educational materials, or trading tutorials was not detailed in the available sources. These supplementary resources often play crucial roles in trader development and decision-making processes, particularly for less experienced market participants.

Customer Service and Support Analysis

Customer service quality and availability represent essential factors in broker selection. Yet specific information regarding OneTrade's support structure was not provided in the available source materials. This absence of detail makes it impossible to evaluate response times, available communication channels, or service quality based on the current information set.

Modern forex brokers typically offer multiple contact methods including live chat, email support, and telephone assistance. The availability of these channels during different time zones becomes particularly important for brokers serving international client bases across multiple jurisdictions, as OneTrade does through its European operations. Response time expectations vary significantly across the industry, with leading brokers often providing live chat responses within minutes and email responses within several hours.

Without specific performance metrics or user feedback regarding OneTrade's customer service, traders cannot assess whether the broker meets contemporary service standards. Multilingual support capabilities would be particularly relevant for OneTrade given its operations across multiple European countries with different primary languages. However, information regarding available service languages or regional support specialization was not detailed in the source materials.

The quality of customer service often becomes most apparent during problem resolution scenarios. These include technical difficulties, account issues, or withdrawal complications. User testimonials and case studies regarding OneTrade's problem-solving capabilities were not available in the source information, limiting the ability to assess service effectiveness during challenging situations.

Trading Experience Analysis

The trading experience encompasses platform performance, execution quality, and overall user interface effectiveness. OneTrade's reliance on the MetaTrader 4 platform provides traders with a well-established and widely recognized trading environment.

MT4's reputation for stability, comprehensive charting capabilities, and extensive technical indicator library contributes positively to the overall trading experience. Platform functionality includes access to multiple chart types, timeframes, and analytical tools that support various trading strategies from scalping to long-term position trading. The availability of Expert Advisors enables automated trading strategies, appealing to traders seeking to implement systematic approaches or manage multiple positions simultaneously.

However, specific information regarding platform stability, server uptime, or execution speed was not provided in the source materials. These technical performance metrics significantly impact trading effectiveness, particularly for strategies requiring precise timing or during periods of high market volatility. Order execution quality represents another crucial component of trading experience, affecting the difference between intended and actual trade prices.

OneTrade's emphasis on direct market access suggests a commitment to transparent execution. But specific performance data or user feedback regarding slippage, requotes, or execution delays was not available in the source information. Mobile trading capabilities through MT4's mobile applications would enable traders to manage positions and respond to market opportunities while away from desktop computers.

However, specific details regarding mobile platform performance or additional mobile features were not detailed in the available materials. This onetrade review recognizes that comprehensive trading experience evaluation requires more detailed performance data and user feedback than currently available in the source materials.

Trust and Reliability Analysis

OneTrade's regulatory framework provides a strong foundation for trust and reliability assessment. The broker operates under oversight from multiple respected European regulatory authorities, including BaFin in Germany, CNMV in Spain, FCA in the United Kingdom, and ESMA at the European Union level.

This multi-jurisdictional regulatory coverage ensures clients benefit from established investor protection frameworks regardless of their specific location within OneTrade's service area. BaFin represents one of Europe's most stringent financial regulators, requiring licensed brokers to maintain segregated client funds, adequate capital reserves, and transparent business practices. Similarly, the FCA's oversight provides UK clients with access to the Financial Services Compensation Scheme, offering additional protection for eligible deposits.

CNMV regulation ensures Spanish market compliance, while ESMA's broader European framework establishes consistent standards across member states. This includes leverage limits and negative balance protection for retail clients. This comprehensive regulatory coverage suggests OneTrade operates within established legal frameworks designed to protect client interests.

The broker's emphasis on transparent pricing and direct market access aligns with regulatory expectations for fair treatment of clients. By providing direct market access rather than acting as a market maker, OneTrade reduces potential conflicts of interest between the company and its clients, as the broker's revenue comes from commissions rather than client losses. However, specific information regarding additional trust measures such as segregated account details, insurance coverage beyond regulatory minimums, or third-party fund administration was not available in the source materials.

These additional protections often distinguish premium brokers from basic service providers.

User Experience Analysis

User experience assessment requires comprehensive feedback from actual clients. Yet specific user testimonials, satisfaction surveys, or detailed experience reports were not available in the source materials. This limitation prevents thorough evaluation of how OneTrade's services perform in real-world trading scenarios.

The MetaTrader 4 platform provides a familiar interface for traders with previous MT4 experience. This potentially reduces the learning curve for new OneTrade clients. MT4's standardized layout and functionality enable traders to transfer their existing platform knowledge directly to OneTrade's environment.

OneTrade's target audience includes both novice and experienced traders, suggesting the broker attempts to balance simplicity for beginners with advanced features for sophisticated users. However, specific information regarding educational resources, account management tools, or user onboarding processes was not detailed in the available sources. Registration and account verification procedures significantly impact initial user experience, but specific details regarding OneTrade's processes, required documentation, or typical approval timeframes were not provided in the source materials.

Streamlined verification processes often correlate with positive user experiences. Complex or lengthy procedures may frustrate new clients. The user interface design beyond the MT4 platform, including account management areas, customer portals, or mobile applications, lacks detailed description in the available information.

These elements contribute significantly to overall user satisfaction and operational efficiency. Without access to user feedback, satisfaction ratings, or common complaint patterns, this onetrade review cannot provide comprehensive user experience assessment based on actual client experiences.

Conclusion

OneTrade presents itself as a regulated forex broker with strong regulatory credentials across multiple European jurisdictions. The broker offers transparent pricing through direct market access and supports over 90 tradeable instruments via the established MetaTrader 4 platform. The broker appears well-suited for traders prioritizing regulatory protection and transparent execution over extensive educational resources or comprehensive customer feedback availability.

The most significant strength identified in this evaluation lies in OneTrade's regulatory framework. Oversight from respected authorities including BaFin, CNMV, FCA, and ESMA provides clients with established investor protections. The broker's commitment to transparent pricing and direct market access aligns with contemporary best practices for client-broker relationships.

However, this assessment reveals substantial information gaps regarding specific trading conditions, account requirements, customer service quality, and user experiences. Prospective clients should conduct direct inquiries with OneTrade to obtain detailed information about costs, account minimums, and service levels before making trading decisions. The absence of comprehensive user feedback in available sources suggests additional research through alternative channels would benefit potential clients seeking peer experiences and recommendations.