Is OINVEST safe?

Pros

Cons

Is Oinvest Safe or a Scam?

Introduction

Oinvest is a relatively new player in the forex market, having been established in 2018. Positioned primarily as a CFD and forex broker, it aims to cater to a diverse clientele, particularly in South Africa and the MENA region. As trading becomes increasingly accessible, it is crucial for traders to carefully evaluate the brokers they choose to work with. A broker's reputation, regulatory compliance, and overall trading conditions can significantly impact a trader's success and safety. This article employs a comprehensive investigative approach, examining Oinvest through the lenses of regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and risk assessment.

Regulation and Legitimacy

Regulatory oversight is a cornerstone of any reputable trading platform. Oinvest operates under the auspices of the Seychelles Financial Services Authority (FSA) and the Financial Sector Conduct Authority (FSCA) in South Africa. While the broker claims to adhere to strict regulatory standards, the effectiveness of these regulations has been questioned, especially given the Seychelles' reputation as an offshore haven with less stringent oversight compared to other jurisdictions.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 014 | Seychelles | Active |

| FSCA | 4 2020 | South Africa | Revoked |

The FSCA previously regulated Oinvest but withdrew its license in 2020 due to several compliance issues, including unauthorized financial advice and failure to process withdrawals in a timely manner. This history raises red flags regarding Oinvest's overall regulatory integrity and the safety of trading with them. The lack of a robust regulatory framework can expose traders to higher risks, making it essential to question the broker's legitimacy and operational practices.

Company Background Investigation

Oinvest is operated by Aronex Corporation Ltd, a company registered in Seychelles. Despite its relatively short history, it has made strides to position itself as a competitive broker in the forex trading arena. However, the company's ownership structure lacks transparency, as it is unclear how the management teams expertise aligns with the operational needs of a forex broker.

The management team‘s qualifications and experience play a crucial role in a broker’s reliability. While Oinvest claims to offer robust educational resources and support, the absence of detailed information about the management's professional background raises concerns about the broker's operational transparency. A clear understanding of a broker's ownership and management can help traders assess the potential risks involved in trading with them.

Trading Conditions Analysis

Oinvest offers a variety of trading conditions, including a minimum deposit requirement of $250 and leverage of up to 1:500, which can be attractive for aggressive traders. However, the fee structure can be convoluted, with potential hidden costs that may catch unsuspecting traders off guard.

| Fee Type | Oinvest | Industry Average |

|---|---|---|

| Spread for Major Pairs | 2.2 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not Disclosed | Varies |

The spreads offered by Oinvest are notably higher than the industry average, particularly for their basic account types. Furthermore, the broker imposes significant inactivity fees, which escalate to €500 after prolonged inactivity. Such policies may deter traders from maintaining accounts long-term, raising questions about the broker's commitment to client interests.

Client Fund Safety

The safety of client funds is paramount in the trading industry. Oinvest claims to prioritize fund security by maintaining segregated accounts, ensuring that client funds are kept separate from the broker's operational capital. This practice is essential for protecting traders' investments in the event of the broker facing financial difficulties.

However, the broker's lack of an investor compensation scheme raises concerns about the level of protection available to traders. The absence of such a safety net can leave clients vulnerable to losses in case of broker insolvency. Additionally, the lack of negative balance protection policies further increases the risk for traders, as they could potentially lose more than their initial investment.

Customer Experience and Complaints

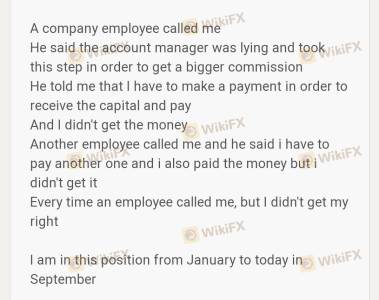

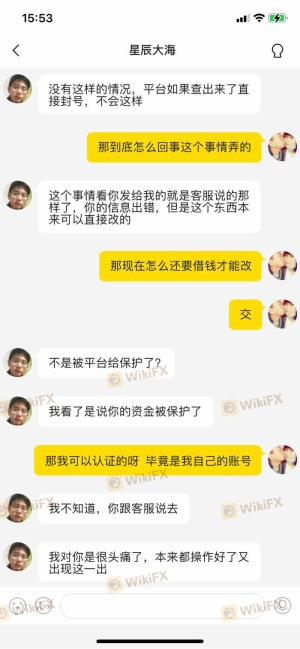

Customer feedback is a vital indicator of a broker's reliability. Reviews of Oinvest reveal a mixed bag of experiences, with some clients praising the broker's educational resources and customer support, while others report issues with withdrawal processing and aggressive sales tactics.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Aggressive Sales Tactics | Medium | Addressed |

| Inactivity Fees | High | Not Addressed |

Common complaints include long withdrawal times, with some clients waiting up to seven business days for their funds. Additionally, the aggressive nature of the broker's sales representatives has been highlighted, raising concerns about the pressure tactics used to encourage further trading and deposits. Such practices can be indicative of a broker prioritizing profits over client welfare.

Platform and Trade Execution

Oinvest utilizes the popular MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust analytical tools. However, the platform's performance and stability are crucial for ensuring a seamless trading experience. While MT4 is widely regarded as a reliable platform, users have reported instances of slippage and execution delays, which can be detrimental during volatile market conditions.

The broker's mobile application also provides access to trading features but lacks some of the advanced functionalities available on the desktop version. Traders should be cautious of any signs of platform manipulation, as this could indicate deeper issues within the broker's operational framework.

Risk Assessment

Using Oinvest comes with inherent risks that traders must be aware of. The combination of high leverage, potential withdrawal issues, and the broker's dubious regulatory history culminates in a high-risk trading environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Limited oversight and compliance issues. |

| Fund Safety | Medium | Lack of investor compensation schemes. |

| Withdrawal Risk | High | Complaints about delays and fees. |

To mitigate these risks, traders should consider implementing strict risk management strategies, including setting stop-loss orders and avoiding excessive leverage. Additionally, conducting thorough research before engaging with any broker can help minimize exposure to potential scams.

Conclusion and Recommendations

In conclusion, while Oinvest presents itself as a legitimate broker with various trading options and educational resources, significant concerns regarding its regulatory status, fund safety, and customer experiences cannot be overlooked. The withdrawal of its FSCA license and the questionable practices reported by clients raise red flags that warrant caution.

Traders looking for a reliable forex broker should consider alternatives with stronger regulatory oversight and a proven track record of client satisfaction. Brokers such as IG, Saxo Bank, or OANDA may provide more robust protections and transparent trading conditions for those seeking a safer trading environment.

In summary, is Oinvest safe? The answer is not straightforward; while it is regulated, the quality of that regulation and client experiences suggest that traders should proceed with caution.

Is OINVEST a scam, or is it legit?

The latest exposure and evaluation content of OINVEST brokers.

OINVEST Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OINVEST latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.