Regarding the legitimacy of OCTA forex brokers, it provides BAPPEBTI and WikiBit, (also has a graphic survey regarding security).

Is OCTA safe?

Business

License

Is OCTA markets regulated?

The regulatory license is the strongest proof.

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT. OCTA INVESTAMA BERJANGKA d/h PT. MULTI MULIA INVESTAMA BERJANGKA

Effective Date:

--Email Address of Licensed Institution:

support@octa.co.idSharing Status:

No SharingWebsite of Licensed Institution:

www.octa.co.idExpiration Time:

--Address of Licensed Institution:

Gedung Millennium Centennial Center Lt.37 C-H, Jl. Jenderal Sudirman Kav.25, Karet Kuningan, Setiabudi, Jakarta Selatan DKI Jakarta 12940Phone Number of Licensed Institution:

021 39708801Licensed Institution Certified Documents:

Is OCTA Safe or Scam?

Introduction

OCTA, formerly known as OctaFX, has established itself as a noteworthy player in the forex market since its inception in 2011. With a presence in over 180 countries and a claim of more than 42 million accounts opened, OCTA aims to provide a user-friendly trading experience with competitive conditions. However, the rise of online trading has also led to an increase in fraudulent schemes, making it imperative for traders to carefully evaluate the legitimacy and trustworthiness of brokers like OCTA.

In this article, we will delve into various aspects of OCTA to assess its safety and reliability. Our investigation will be based on a comprehensive analysis of its regulatory compliance, company background, trading conditions, customer feedback, and overall risk factors. By synthesizing data from multiple reputable sources, we aim to present a balanced view of whether OCTA is a safe trading option or a potential scam.

Regulation and Legitimacy

A broker's regulatory status is crucial in determining its legitimacy and the level of protection offered to traders. OCTA operates under several regulatory frameworks, which include the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) in South Africa, the Mwali International Services Authority (MISA) in Comoros, and the Financial Services Commission (FSC) in Mauritius. Below is a summary of OCTA's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 372/18 | Cyprus | Verified |

| FSCA | 51913 | South Africa | Verified |

| MISA | HY00623410 | Comoros | Verified |

| FSC | GB21027161 | Mauritius | Verified |

The regulatory oversight from CySEC is particularly noteworthy as it is considered a tier-1 regulator, which imposes stringent operational standards and offers a degree of investor protection. However, the presence of offshore regulations, such as those from MISA and FSC, raises questions about the level of protection afforded to traders in regions where these regulations apply. Overall, while OCTA is regulated, the lack of oversight from top-tier authorities in major financial markets may pose a risk to traders.

Company Background Investigation

OCTA has a relatively short history, having been founded in 2011. The company was established with the goal of making trading accessible to a broader audience, and it has since evolved to offer various trading services. The ownership structure of OCTA is privately held, and the company is headquartered in Comoros, with additional offices in Cyprus and South Africa.

The management team behind OCTA boasts significant experience in the financial services industry, contributing to the broker's growth and reputation. Transparency is a key aspect of OCTA's operations; the company provides clear information about its services, fees, and trading conditions. However, potential clients should be aware that while the company has received numerous industry awards for its services, the lack of a comprehensive disclosure regarding potential conflicts of interest or operational challenges could be a concern.

Trading Conditions Analysis

OCTA aims to provide competitive trading conditions, which include a low minimum deposit requirement of $25 and a commission-free trading model. The broker's fee structure is primarily based on spreads, which start from 0.6 pips for major currency pairs. Below is a comparison of OCTA's core trading costs with industry averages:

| Fee Type | OCTA | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | None (swap-free) | Varies |

OCTA's commission-free model is appealing to many traders, particularly those looking to minimize trading costs. However, the spreads can widen during times of high volatility, which could impact trading performance. Additionally, while the absence of overnight fees (swap-free trading) is beneficial for traders who hold positions long-term, it may limit the strategies available to some traders. Overall, while OCTA's trading conditions are competitive, traders should remain vigilant regarding the potential for hidden costs during volatile market conditions.

Client Fund Security

The safety of client funds is a paramount concern for any trader. OCTA has implemented several measures to ensure the security of its clients' funds. These include segregated accounts, which keep client funds separate from the company's operational funds, thereby reducing the risk of misuse. Additionally, OCTA provides negative balance protection, ensuring that traders cannot lose more than their deposited funds.

Despite these protective measures, there have been historical concerns regarding fund safety, particularly related to the broker's offshore regulatory status. Traders should be aware that while OCTA has taken steps to secure client funds, the lack of robust regulatory oversight in some jurisdictions may expose them to additional risks. As such, it is crucial for traders to conduct thorough due diligence before engaging with OCTA.

Customer Experience and Complaints

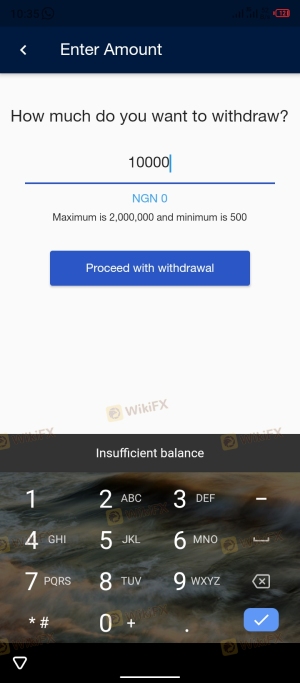

Customer feedback plays a significant role in evaluating a broker's reliability. Reviews of OCTA reveal a mixed bag of experiences. While many traders praise the platform for its user-friendly interface and quick withdrawal processes, others have reported issues with withdrawal delays and customer support responsiveness. Below is a summary of common complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times reported |

| Account Verification Issues | Medium | Generally resolved but can take time |

| Slippage and Execution Problems | Medium | Mixed reviews on responsiveness |

Typical case studies include instances where traders experienced significant delays in withdrawals, with some reporting waiting times of over a week. In contrast, others have commended the broker for processing withdrawals swiftly, often within hours. This inconsistency in customer service response times raises concerns about the overall reliability of OCTA's support.

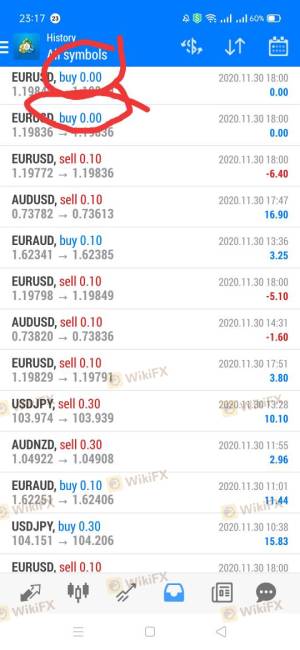

Platform and Execution

The performance of a trading platform is critical to a trader's experience. OCTA offers multiple trading platforms, including its proprietary OCTA Trader, as well as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms provide a range of features, including advanced charting tools and automated trading capabilities. However, some users have reported issues related to order execution quality, including slippage during volatile market conditions.

In terms of execution, OCTA claims to have a high success rate, with minimal slippage reported. Nevertheless, traders should remain cautious, as some reviews indicate instances of significant price deviations during high-impact news events. Overall, while OCTA's platforms are generally well-regarded, the potential for execution issues during volatile periods warrants careful consideration.

Risk Assessment

Trading with any broker carries inherent risks, and OCTA is no exception. A comprehensive risk assessment reveals several key areas of concern. Below is a summary of the risk factors associated with trading with OCTA:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Limited oversight from top-tier regulators |

| Fund Safety Risk | Medium | Offshore regulations may lack protections |

| Execution Risk | Medium | Potential for slippage during volatility |

| Customer Support Risk | High | Inconsistent response times reported |

To mitigate these risks, traders are advised to implement strict risk management practices, such as setting stop-loss orders and limiting leverage usage. Additionally, it is recommended to engage with the broker's support team proactively to address any issues before they escalate.

Conclusion and Recommendations

In conclusion, while OCTA presents itself as a viable option for forex trading, several factors warrant caution. The broker is regulated in multiple jurisdictions, but the absence of oversight from top-tier authorities raises questions about the level of protection afforded to traders. Additionally, while OCTA offers competitive trading conditions and a user-friendly platform, historical complaints regarding withdrawal delays and customer support responsiveness highlight potential areas of concern.

For traders considering OCTA, it is essential to weigh the benefits against the risks. Beginners may find value in the broker's educational resources and low entry costs, while experienced traders should remain vigilant regarding execution quality and support responsiveness. If you are hesitant about OCTA, consider exploring alternative brokers with robust regulatory frameworks and proven track records, such as IC Markets or Exness, which may provide additional peace of mind.

Overall, while OCTA is not a scam, potential clients should approach with due diligence and a clear understanding of the associated risks.

Is OCTA a scam, or is it legit?

The latest exposure and evaluation content of OCTA brokers.

OCTA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OCTA latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.