Is Obsbit safe?

Business

License

Is Obsbit A Scam?

Introduction

Obsbit is a forex and cryptocurrency broker that has been operating since 2018, positioning itself as a platform for both novice and experienced traders. While it claims to offer a range of trading options, including forex, commodities, stocks, indices, and cryptocurrencies, the legitimacy of Obsbit has come under scrutiny. In the volatile world of forex trading, it is crucial for traders to thoroughly evaluate brokers before committing their hard-earned money. This article aims to assess whether Obsbit is a safe platform or a potential scam by examining its regulatory status, company background, trading conditions, and customer experiences. The investigation draws upon various online reviews, regulatory alerts, and user testimonials to provide a comprehensive analysis.

Regulation and Legitimacy

Regulatory oversight is one of the most critical factors in determining the safety of a trading platform. A regulated broker is typically subject to strict standards that ensure transparency, security, and fair trading practices. In the case of Obsbit, it is operated by Setonix Holding Ltd., a company registered in the Marshall Islands. Unfortunately, the regulatory framework in the Marshall Islands is known for being lax, which raises questions about the legitimacy of Obsbit's operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| International Financial Services Commission (IFSC) | Not provided | Marshall Islands | Unverified |

The absence of a robust regulatory framework is a significant red flag. While Obsbit claims to be regulated, the lack of verification from credible regulatory bodies like the FCA or ASIC raises concerns about its operational integrity. Moreover, the Spanish regulator, CNMV, has issued warnings against Obsbit, labeling it as an unregulated broker. This lack of oversight makes it imperative for traders to exercise caution when considering this platform, as the absence of a regulatory safety net can expose them to potential fraud or financial loss.

Company Background Investigation

Obsbit's ownership structure and history provide further insight into its reliability. The broker operates under Setonix Holding Ltd., which is registered in the Marshall Islands. The company's registration in a known offshore zone often indicates a desire to evade stringent regulatory requirements, which can be a tactic employed by less scrupulous brokers.

The management team behind Obsbit has not been extensively documented, raising concerns about their qualifications and experience in the financial sector. Transparency is crucial when it comes to trust in a trading platform, and the lack of available information about the management team does not inspire confidence. Furthermore, many reviews point to a troubling history of customer complaints, particularly regarding withdrawal issues and unresponsive customer service.

Overall, the opaque nature of Obsbit's corporate structure and the absence of detailed information about its management team contribute to the skepticism surrounding its legitimacy. In the context of the question, "Is Obsbit safe?" the evidence points to a lack of transparency that could be detrimental to potential investors.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential for assessing overall cost-effectiveness and transparency. Obsbit offers a minimum deposit of $200, which is relatively standard in the industry. However, the fee structure appears to be somewhat opaque, with potential hidden costs that could affect traders' profitability.

| Fee Type | Obsbit | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 1.0 pips |

| Commission Structure | Not specified | Varies |

| Overnight Interest Range | Not disclosed | Varies |

While Obsbit advertises competitive spreads, the lack of clarity regarding commissions and overnight interest raises concerns. Traders may find themselves facing unexpected fees that could erode their profits. The absence of a transparent fee structure is a warning sign, as reputable brokers typically provide clear and detailed information about their pricing models.

In summary, while Obsbit may appear attractive at first glance, the lack of transparency in its fee structure raises questions about its overall trading conditions. This uncertainty adds to the skepticism surrounding the question, "Is Obsbit safe?"

Customer Funds Safety

The safety of customer funds is paramount when choosing a trading broker. Obsbit claims to employ various safety measures to protect client funds, but the lack of regulatory oversight significantly undermines these assurances. A critical aspect of fund safety is the segregation of client funds from the broker's operational funds, which is a standard practice among regulated brokers.

However, given Obsbit's unregulated status, it is unclear whether such protections are in place. Additionally, the absence of investor compensation schemes raises further concerns. Without these safeguards, traders could find themselves at risk of losing their investments without recourse.

Historical complaints from users indicate issues with fund withdrawals, suggesting that even if funds are held securely, accessing them may be problematic. Reports of unresponsive customer service further exacerbate these concerns, leading to the conclusion that traders may face significant challenges if they attempt to retrieve their funds.

In light of these factors, the question "Is Obsbit safe?" becomes increasingly complex. The lack of regulatory oversight and the questionable safety measures in place make it a risky choice for traders.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a trading platform. Reviews of Obsbit reveal a pattern of negative experiences, particularly concerning withdrawal issues and unresponsive customer support. Many users have reported difficulties in accessing their funds, with some claiming that their accounts were frozen without explanation.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Account Freezing | High | Unresponsive |

| Customer Support | Medium | Slow Response |

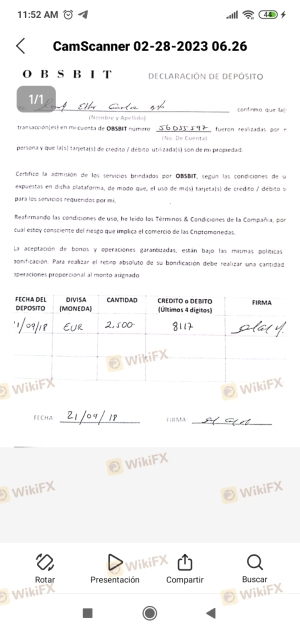

Two notable cases highlight these issues. One user reported that after depositing funds, they faced delays in withdrawing their profits, which led to frustration and a sense of betrayal. Another trader mentioned that their account was frozen without warning, leaving them unable to access their funds for weeks. These experiences contribute to the perception that Obsbit may not be a trustworthy platform.

The recurring themes of withdrawal difficulties and poor customer service strongly suggest that potential traders should approach Obsbit with caution. The evidence gathered raises significant concerns about the question "Is Obsbit safe?"

Platform and Trade Execution

The trading platform is another critical aspect of any broker's offering, as it directly impacts the user experience. Obsbit utilizes a web-based platform that includes various trading tools and features. However, user reviews indicate that the platform can be unstable, leading to issues with order execution and potential slippage.

Traders have reported instances of orders being rejected or executed at unfavorable prices, which can significantly impact trading outcomes. These issues raise concerns about the broker's ability to provide a reliable trading environment, which is essential for successful trading.

In conclusion, the performance and reliability of Obsbit's trading platform contribute to the overall skepticism surrounding its safety. The concerns about execution quality and potential slippage further complicate the question, "Is Obsbit safe?"

Risk Assessment

Using Obsbit as a trading platform presents several risks that potential traders should consider carefully. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases the risk of fraud. |

| Fund Safety | High | Lack of investor protection and withdrawal issues. |

| Customer Support | Medium | Reports of unresponsive service can lead to frustration. |

| Trading Environment | Medium | Platform instability may affect trade execution. |

To mitigate these risks, potential traders should consider using well-regulated brokers with transparent fee structures and robust customer support. Conducting thorough research and reading user reviews can also help in making an informed decision.

Conclusion and Recommendations

In summary, the evidence collected raises significant concerns about the legitimacy and safety of Obsbit as a trading platform. The lack of regulatory oversight, opaque fee structures, and troubling customer experiences suggest that traders should exercise extreme caution when considering this broker.

For traders looking for reliable alternatives, it is advisable to choose brokers that are regulated by reputable authorities, such as the FCA or ASIC. These brokers not only provide a safer trading environment but also offer better customer support and transparency in their operations.

In light of the findings, it is clear that the question "Is Obsbit safe?" leans heavily towards a negative response. As such, potential traders are encouraged to seek alternative options that prioritize security and reliability in their trading endeavors.

Is Obsbit a scam, or is it legit?

The latest exposure and evaluation content of Obsbit brokers.

Obsbit Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Obsbit latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.