Is NewSolid safe?

Business

License

Is Newsolid A Scam?

Introduction

Newsolid is a forex and CFD broker that claims to provide trading services across various financial instruments, including currencies, commodities, and cryptocurrencies. Established with the aim of catering to both novice and experienced traders, Newsolid has positioned itself as a player in the competitive forex market. However, the rise of online trading has also led to an increase in fraudulent activities, making it crucial for traders to carefully evaluate the legitimacy of brokers like Newsolid. This article aims to provide an objective analysis of Newsolid's credibility, examining its regulatory status, company background, trading conditions, and customer experiences to determine whether Newsolid is safe or a potential scam.

To conduct this investigation, we utilized a comprehensive evaluation framework that includes a review of regulatory information, company history, trading conditions, customer feedback, and risk assessments. By analyzing a range of sources, including regulatory alerts, user reviews, and expert assessments, this article aims to present a balanced view of Newsolid's operations.

Regulation and Legitimacy

Regulation is a critical aspect of the forex trading landscape, as it ensures that brokers adhere to strict standards designed to protect traders. Unfortunately, Newsolid is not regulated by any major financial authority, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory license means that Newsolid is not subject to any regulatory oversight, which is a major red flag for potential traders. The Financial Markets Authority (FMA) of New Zealand has issued warnings against Newsolid, indicating that the broker operates without the necessary licenses to provide financial services. This lack of regulation not only compromises the safety of client funds but also raises questions about the overall trustworthiness of the broker.

Furthermore, Newsolid has undergone a change in its registration details, initially claiming to be based in New Zealand but later stating it is registered in Samoa. This inconsistency in information can lead to confusion and raises further doubts regarding the broker's credibility. Given these factors, it is essential for traders to approach Newsolid with caution and to consider whether it is indeed safe to invest with this broker.

Company Background Investigation

Newsolid's company background reveals a lack of transparency and a questionable ownership structure. Originally, it claimed to be operated by Solid Global Investment Limited, a company based in New Zealand. However, the current ownership details are murky, and there is little information available regarding the management team or their qualifications.

The absence of clear information about the company's history and the individuals behind it is concerning. A reputable broker typically provides comprehensive details about its founders and management team, including their professional experience and credentials. In the case of Newsolid, the lack of such information suggests a potential attempt to obscure its true operations and intentions.

Additionally, the companys website does not provide adequate disclosures about its financial health, operational practices, or any affiliations with recognized financial institutions. This lack of transparency can be a warning sign for potential investors, indicating that Newsolid may not be a trustworthy broker. As such, it is imperative that traders consider these factors when questioning, "Is Newsolid safe?"

Trading Conditions Analysis

An analysis of Newsolid's trading conditions reveals a concerning fee structure and trading model. The broker offers a minimum deposit of $100, which may seem attractive to new traders, but the overall trading costs are not competitive when compared to industry standards.

| Fee Type | Newsolid | Industry Average |

|---|---|---|

| Spread on Major Pairs | 2.5 pips | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread on major currency pairs offered by Newsolid is significantly higher than the industry average, which can erode potential profits for traders. Additionally, the lack of clarity regarding commission structures and overnight interest rates raises further concerns about the transparency of the brokers trading conditions.

Moreover, the absence of a demo account or a clear understanding of the trading platforms functionality adds to the challenges traders may face when attempting to navigate Newsolid's services. This lack of favorable trading conditions, combined with the absence of regulatory oversight, leads to the conclusion that Newsolid may not be a safe option for traders seeking a reliable forex broker.

Client Fund Security

The safety of client funds is a paramount concern for any trader, and Newsolid's approach to fund security raises several red flags. The broker does not provide clear information regarding the segregation of client funds, which is a standard practice among regulated brokers to ensure that client deposits are kept separate from the company's operational funds.

Without proper fund segregation, clients risk losing their investments in the event of the broker's insolvency. Additionally, Newsolid does not appear to offer any investor protection schemes that would safeguard client funds, further heightening the risk associated with trading through this broker.

Historically, there have been reports of clients experiencing difficulties when attempting to withdraw their funds, with many users claiming that their withdrawal requests were either delayed or denied. Such issues underscore the importance of assessing a broker's fund security measures before making any investments. Given the lack of transparency and the potential for fund mismanagement, traders should carefully consider whether Newsolid is safe for their investments.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability, and Newsolid has garnered a significant number of complaints from users. Many traders have reported issues related to withdrawal delays, poor customer support, and unclear trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Trading Conditions | High | Poor |

Common complaints include the inability to withdraw funds, with numerous users stating that their requests were met with delays or outright refusals. Additionally, many customers have expressed frustration with the quality of customer support, citing slow response times and unhelpful representatives. These patterns of complaints suggest a concerning trend that raises questions about the broker's commitment to customer service and support.

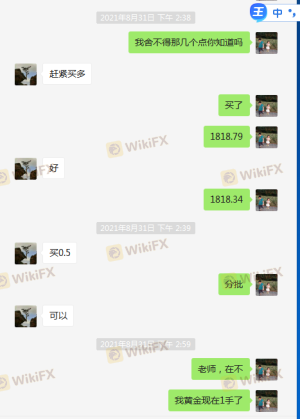

For instance, one user reported that after depositing a significant amount, they were unable to withdraw their funds despite multiple requests. This scenario highlights the potential risks associated with trading through Newsolid, prompting traders to ask, "Is Newsolid safe?"

Platform and Trade Execution

The trading platform offered by Newsolid is another critical area for evaluation. While the broker claims to utilize the popular MetaTrader 4 (MT4) platform, there have been reports of performance issues, including glitches and slow execution speeds. Such problems can severely impact a trader's ability to execute orders effectively, leading to potential financial losses.

Moreover, the lack of transparency regarding order execution quality raises concerns about possible manipulation or unfair practices. Traders have reported instances of slippage and rejected orders, which can further erode trust in the broker's operational integrity. These factors contribute to the overall risk associated with trading on Newsolid's platform, prompting further inquiry into whether this broker is indeed safe.

Risk Assessment

Using Newsolid as a trading platform comes with a range of risks that potential investors should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight. |

| Fund Security Risk | High | Lack of fund segregation and protection. |

| Customer Service Risk | Medium | Poor response to complaints and issues. |

| Trading Execution Risk | High | Reports of slippage and platform glitches. |

Given these risks, it is advisable for traders to exercise caution when considering Newsolid as a trading option. To mitigate these risks, traders should conduct thorough research, consider using regulated brokers, and ensure they have a clear understanding of the trading conditions before investing.

Conclusion and Recommendations

In conclusion, the evidence presented raises significant concerns about the legitimacy and safety of Newsolid as a forex broker. The lack of regulatory oversight, poor customer feedback, and questionable trading conditions suggest that Newsolid may not be a safe option for traders.

For those considering trading in the forex market, it is advisable to seek out reputable and regulated brokers that offer transparent trading conditions, robust customer support, and strong fund security measures. Brokers such as Blueberry Markets, Trade.com, and XM have established positive reputations within the industry and can provide a safer trading environment.

Ultimately, traders must prioritize their security and due diligence when selecting a broker, especially in light of the potential risks associated with unregulated entities like Newsolid. If you're still wondering, "Is Newsolid safe?" the overwhelming evidence suggests that it is prudent to proceed with caution.

Is NewSolid a scam, or is it legit?

The latest exposure and evaluation content of NewSolid brokers.

NewSolid Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NewSolid latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.