Is NEW HONGSHENG LIMITED safe?

Business

License

Is New Hongsheng Limited Safe or Scam?

Introduction

New Hongsheng Limited, often referred to as New Hongsheng FX, positions itself as a forex broker operating out of the United Kingdom. With claims of providing various financial products and services across global markets, it attracts traders seeking diverse investment opportunities. However, the forex market is notorious for its risks, and traders must exercise caution when evaluating brokers. The potential for fraud is significant, making it essential for investors to thoroughly assess the legitimacy and reliability of any brokerage firm before committing their funds. This article investigates whether New Hongsheng Limited is safe or a scam by analyzing its regulatory status, company background, trading conditions, and customer feedback.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its legitimacy. A regulated broker is typically held to higher standards of transparency and accountability, providing a layer of security for traders' funds. In the case of New Hongsheng Limited, it claims to operate under UK regulations, yet it lacks any valid regulatory licenses. This absence raises significant red flags for potential investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Not Found |

The Financial Conduct Authority (FCA) is the primary regulatory body overseeing forex brokers in the UK. Upon investigation, New Hongsheng Limited does not appear in the FCA's registry, indicating that it is unlicensed and unregulated. This lack of oversight suggests that the broker operates outside the legal framework designed to protect investors. Additionally, the absence of a regulatory license can lead to a higher risk of fraudulent activities, making it imperative for traders to be cautious. The quality of regulation is crucial; brokers regulated by reputable authorities are often required to maintain segregated accounts for client funds and provide compensation schemes in case of insolvency. New Hongsheng Limited's failure to meet these standards raises concerns about its safety and reliability.

Company Background Investigation

New Hongsheng Limited presents itself as an established entity with a presence in various global financial hubs, including Zurich, Hong Kong, Dubai, and Tokyo. However, upon closer examination, the company's history and ownership structure remain ambiguous. The lack of transparency regarding its operational history and the identities of its management team further complicates the assessment of its legitimacy.

The absence of detailed information about the company's founders or executive team raises questions about their qualifications and experience in the forex industry. Reliable brokers typically provide information about their management team, including their backgrounds and relevant expertise. New Hongsheng Limited's failure to disclose this information hinders potential investors' ability to evaluate the broker's credibility. Furthermore, without a clear understanding of the company's operational history, it is challenging to ascertain its commitment to ethical practices and compliance with industry standards. This lack of transparency contributes to the skepticism surrounding New Hongsheng Limited's safety.

Trading Conditions Analysis

The trading conditions offered by a broker play a crucial role in determining its overall attractiveness to traders. New Hongsheng Limited claims to provide competitive trading conditions, including high leverage and tight spreads. However, a closer examination reveals potential issues with its fee structure and trading policies.

| Fee Type | New Hongsheng Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 - 0.3 pips | 1.0 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The broker advertises a spread of 0.2 - 0.3 pips for major currency pairs, which is significantly lower than the industry average. While low spreads can be enticing, traders should be wary of any hidden fees or unfavorable trading conditions that may not be immediately apparent. Additionally, New Hongsheng Limited's commission-free model may seem attractive, but it is essential to investigate whether the broker compensates for this through other means, such as higher spreads or withdrawal fees.

Moreover, the broker's leverage offerings, reportedly up to 1:1000, are alarmingly high. In regulated environments, leverage is typically capped at lower ratios to protect inexperienced traders from excessive risk. Such high leverage can lead to devastating losses, especially for novice traders. The combination of low spreads and high leverage could indicate a potentially risky trading environment, further questioning whether New Hongsheng Limited is safe for investors.

Client Funds Safety

The safety of client funds is a critical concern for any forex trader. New Hongsheng Limited's website lacks comprehensive information regarding its policies on fund security, which is a significant concern. A reputable broker typically implements measures such as segregated accounts, which keep client funds separate from the broker's operational funds, ensuring that traders' money is protected in case of financial difficulties.

Additionally, the absence of information about investor protection schemes raises further doubts about the safety of funds held with New Hongsheng Limited. In regulated environments, brokers are often required to participate in compensation schemes that protect clients in the event of insolvency. New Hongsheng Limited's lack of such measures suggests that traders may be at risk of losing their investments without any recourse.

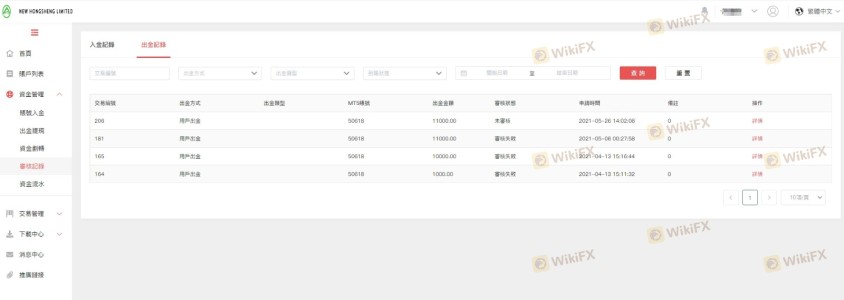

Furthermore, historical complaints from clients indicate issues with fund withdrawals, which is a common warning sign of potential scams. Reports of clients being unable to access their funds after making deposits raise red flags about the broker's operational integrity. The absence of robust safeguards for client funds poses a significant risk for traders considering New Hongsheng Limited.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews and testimonials from existing clients can provide insights into the overall client experience with New Hongsheng Limited. However, the feedback surrounding this broker is predominantly negative, with numerous complaints highlighting issues related to fund withdrawals and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Misleading Information | High | Unresponsive |

Common complaints include difficulties in withdrawing funds, with many users reporting that their requests are met with delays or outright denials. Additionally, clients have expressed frustration over the lack of responsive customer support, which can exacerbate issues when traders encounter problems with their accounts. The severity of these complaints suggests a pattern of operational mismanagement, further questioning whether New Hongsheng Limited is safe for potential investors.

A few notable cases highlight the broker's questionable practices. For instance, one client reported being unable to withdraw their funds after multiple attempts, leading them to suspect that the broker may have absconded with their money. Such experiences are alarming and warrant caution for anyone considering trading with New Hongsheng Limited.

Platform and Trade Execution

The trading platform offered by a broker is a vital aspect of the trading experience, influencing order execution quality and overall user satisfaction. New Hongsheng Limited claims to provide access to the popular MetaTrader 5 platform, known for its robust features and user-friendly interface. However, the performance and reliability of the platform are critical factors to consider.

Users have reported issues with order execution, including instances of slippage and rejected orders. Such problems can significantly impact trading outcomes, particularly in a fast-moving market. Additionally, any indications of platform manipulation, where the broker may artificially influence prices or execution, raise serious concerns about the broker's integrity.

Overall, while New Hongsheng Limited may offer a familiar trading platform, the stability and reliability of its execution remain questionable. Traders should be cautious and consider the potential risks associated with using a broker that lacks a proven track record of reliable trade execution.

Risk Assessment

Engaging with New Hongsheng Limited presents several risks that potential investors should carefully consider. The absence of regulatory oversight, coupled with a lack of transparency regarding fund safety and operational practices, creates a precarious environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Safety Risk | High | Lack of client fund protection |

| Withdrawal Risk | High | Historical complaints regarding withdrawals |

| Execution Risk | Medium | Issues with order execution |

To mitigate these risks, traders are advised to conduct thorough research before engaging with New Hongsheng Limited. Seeking alternative brokers with established reputations and regulatory compliance can provide a safer trading environment. Additionally, utilizing demo accounts and starting with smaller investments can help traders gauge the broker's reliability without exposing themselves to significant losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that New Hongsheng Limited poses significant risks for potential investors. The lack of regulatory oversight, coupled with numerous complaints regarding fund withdrawals and customer support, raises serious concerns about the broker's legitimacy. Traders should approach this broker with caution and consider the potential for fraud.

For those seeking to engage in forex trading, it is advisable to consider alternative brokers that are regulated and have a proven track record of client satisfaction. Brokers with established reputations and transparent practices can provide a safer trading experience. Overall, the question of "Is New Hongsheng Limited safe?" leans heavily towards skepticism, and traders should prioritize their financial security by choosing reputable and trustworthy brokers.

Is NEW HONGSHENG LIMITED a scam, or is it legit?

The latest exposure and evaluation content of NEW HONGSHENG LIMITED brokers.

NEW HONGSHENG LIMITED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NEW HONGSHENG LIMITED latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.