Is Mona safe?

Pros

Cons

Is Mona Safe or Scam?

Introduction

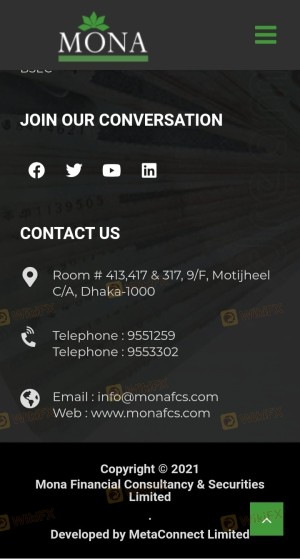

Mona, also known as Mona Financial Consultancy & Securities Limited, is a brokerage firm based in Bangladesh that offers various financial services, including forex trading. As the forex market continues to grow, it attracts a wide range of traders, from beginners to seasoned professionals. However, the increasing number of unregulated and potentially fraudulent brokers makes it essential for traders to carefully evaluate the legitimacy and safety of any brokerage they consider. In this article, we will investigate whether Mona is a safe trading option or a potential scam. Our analysis is based on a comprehensive review of regulatory information, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

One of the most critical factors in determining whether a broker is safe is its regulatory status. A regulated broker must adhere to specific standards and practices that protect traders' interests. Unfortunately, Mona is an unregulated broker, which raises significant concerns regarding its legitimacy.

Here is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Bangladesh | Not Verified |

The absence of regulation means that there is no oversight to ensure that Mona operates transparently and fairly. This lack of regulatory compliance can expose traders to various risks, including potential fraud and the inability to recover funds in case of disputes. Furthermore, the fact that Mona is based in Bangladesh, a region known for limited financial oversight, adds to the apprehension surrounding its operations.

Company Background Investigation

Mona Financial Consultancy & Securities Limited has been in operation since 1995, primarily serving the Bangladeshi stock market. However, its expansion into forex trading raises questions about its expertise and focus. The ownership structure of Mona remains opaque, with limited information available about its management team and their qualifications. This lack of transparency is concerning, as effective management is crucial for maintaining a trustworthy brokerage.

The company's website offers minimal details about its operational history, and there is little to no third-party verification of its claims. Moreover, the absence of clear communication regarding its ownership and management raises red flags about its commitment to transparency. Reliable brokers usually provide detailed information about their teams, including professional backgrounds and industry experience, which is notably lacking in Mona's case.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for evaluating its reliability. Mona presents a variety of trading options, but its fee structure appears to be inconsistent and potentially misleading.

Here‘s a comparison of Mona’s core trading costs against industry averages:

| Cost Type | Mona | Industry Average |

|---|---|---|

| Major Currency Spread | 1.8 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

Mona's spreads for major currency pairs are slightly higher than the industry average, which could indicate a less favorable trading environment for clients. Additionally, the absence of a clear commission structure raises concerns about hidden fees that may arise during trading. Traders should be cautious about such discrepancies, as they can significantly impact profitability.

Client Funds Safety

The safety of client funds is paramount when assessing a broker's reliability. Unfortunately, Mona does not provide any information regarding the segregation of client funds or investor protection measures.

Without regulatory oversight, there are no guarantees that traders' funds are held securely. The lack of negative balance protection further exacerbates the risks associated with trading with Mona. In the event of significant losses, traders could find themselves liable for debts exceeding their account balance. There have been historical complaints about fund withdrawal issues, which raises concerns about the broker's financial stability and trustworthiness.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience with a brokerage. Unfortunately, reviews of Mona indicate a pattern of negative experiences, particularly regarding fund withdrawals and customer service responsiveness.

Here are some common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Service | Medium | Poor |

| Misleading Information | High | Poor |

Typical cases include reports of clients facing difficulties in withdrawing their funds, often with claims of arbitrary account closures. One user reported that their account was disabled without warning, leaving them unable to access their funds. These issues highlight the potential risks associated with trading with an unregulated broker like Mona.

Platform and Execution

Mona utilizes its proprietary trading platform, which has received mixed reviews from users. While some traders appreciate the user-friendly interface, there are concerns about execution quality, including slippage and order rejections.

Traders have reported instances of significant slippage during high volatility periods, which can lead to unexpected losses. Additionally, there are allegations of potential manipulation, where trades are executed at unfavorable prices. Such practices are highly concerning and further emphasize the need for caution when trading with Mona.

Risk Assessment

Using Mona as a trading platform comes with inherent risks that potential traders should consider.

Heres a risk assessment summary:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | No fund protection measures in place. |

| Operational Risk | Medium | Poor customer service and execution issues. |

To mitigate these risks, traders should consider using regulated brokers with established reputations and robust customer protection policies. It is advisable to conduct thorough research and seek out alternatives that offer a higher level of security and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that Mona is not a safe trading option. The lack of regulation, poor customer feedback, and questionable trading practices indicate that traders should exercise extreme caution. The absence of transparency regarding company operations and management further exacerbates the concerns surrounding this brokerage.

For traders seeking a reliable trading experience, it is advisable to consider regulated alternatives that provide better protections for client funds and a more transparent trading environment. Some reputable brokers include those regulated by the FCA, ASIC, or CySEC, which have stringent oversight mechanisms in place to safeguard traders' interests.

In summary, if you are considering trading with Mona, it is crucial to weigh the risks carefully and explore safer options.

Is Mona a scam, or is it legit?

The latest exposure and evaluation content of Mona brokers.

Mona Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Mona latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.