Mona 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive mona review reveals significant challenges in evaluating this entity as a forex broker. Based on available information, Mona appears to be primarily a Philadelphia-based restaurant offering modern Greek cuisine rather than a traditional forex brokerage. The establishment was created by Teddy Sourias and features 'néos-Mediterranean' cooking, floor-to-ceiling olive trees, and a selfie area, positioning itself as a contemporary dining destination in Center City.

However, our research uncovered references to "Mona-Groupe.com" as a potential broker entity, though detailed trading information remains scarce. This mona review must therefore address the apparent disconnect between the restaurant business and any forex trading services that may exist under the Mona brand. The target audience appears to be consumers interested in modern Greek cuisine and upscale dining experiences, rather than forex traders seeking brokerage services.

Given the limited availability of concrete trading-related information, potential clients should exercise extreme caution and conduct thorough due diligence before considering any investment activities with entities operating under the Mona name.

Important Notice

This mona review is based on publicly available information and user feedback collected from various sources. Due to the apparent discrepancy between restaurant operations and potential forex services, readers should be aware that different regional entities may operate under similar names with varying regulatory statuses.

Our evaluation methodology relies on publicly accessible data, regulatory filings, and user testimonials. However, the lack of comprehensive trading-related information in our research sources significantly limits the scope of this assessment. Potential investors should independently verify all regulatory credentials and trading conditions before engaging with any financial services provider.

Rating Framework

Broker Overview

Based on available information, the Mona entity presents a complex picture that requires careful examination. The primary documented presence is Mona Restaurant in Philadelphia, established by founder Teddy Sourias. This establishment operates as a bar-restaurant in Center City, featuring contemporary Greek cuisine across two levels. The restaurant specializes in 'néos-Mediterranean' cooking and has created what's described as a "sultry, over-the-top" dining environment.

The business model centers around upscale dining experiences. It incorporates modern design elements such as floor-to-ceiling olive trees and dedicated selfie areas to attract contemporary diners. Located at 1308 Chestnut Street, the establishment includes both a downstairs lounge and additional dining areas, suggesting a substantial investment in hospitality infrastructure.

However, research also revealed references to potential forex broker operations under similar naming conventions. This includes mentions of "Mona-Groupe.com" in broker safety discussions. This creates significant confusion regarding the actual nature of services offered. The lack of clear trading platform information, regulatory details, or asset class specifications in available sources raises substantial questions about any legitimate forex broker operations under the Mona brand.

Regulatory Jurisdictions: Available research sources do not specify any regulatory oversight for forex trading activities under the Mona brand.

Deposit and Withdrawal Methods: Specific payment processing methods for trading accounts are not detailed in accessible documentation.

Minimum Deposit Requirements: No minimum deposit information is available in current research sources.

Bonus and Promotions: Trading-related promotional offers are not documented in available materials.

Tradeable Assets: The range of available financial instruments remains unspecified in research findings.

Cost Structure: Comprehensive fee schedules, including spreads, commissions, and overnight charges, are not detailed in accessible sources. This represents a significant transparency concern for potential traders.

Leverage Ratios: Maximum leverage offerings are not specified in available documentation.

Platform Options: No specific trading platform information is provided in research sources.

Geographic Restrictions: Service availability by region is not clearly documented.

Customer Support Languages: Multi-language support capabilities are not specified beyond general business operations.

This mona review must emphasize that the absence of detailed trading information represents a major red flag for potential forex traders.

Account Conditions Analysis

The evaluation of account conditions proves challenging due to insufficient information in available research sources. Traditional forex broker account types, such as standard, premium, or professional accounts, are not documented in connection with Mona operations. This absence of basic account structure information raises immediate concerns about the legitimacy of any trading services.

Minimum deposit requirements, which typically serve as a primary consideration for trader selection, remain completely unspecified. Similarly, account opening procedures, verification requirements, and documentation standards are not outlined in accessible sources. The lack of information regarding Islamic or swap-free accounts, which are standard offerings among legitimate brokers, further compounds transparency concerns.

Account funding methods and withdrawal procedures, critical components of any trading relationship, are not detailed in available documentation. This creates significant uncertainty about fund security and accessibility. Additionally, account maintenance fees, inactivity charges, and other cost considerations that directly impact trader profitability remain unaddressed.

The absence of clear terms and conditions regarding account usage, trading restrictions, and compliance requirements suggests either inadequate documentation or questionable operational standards. This mona review must highlight these deficiencies as major concerns for potential clients.

Assessment of trading tools and resources reveals a complete absence of information regarding platform capabilities, analytical instruments, or educational materials. Standard forex broker offerings such as technical analysis tools, economic calendars, market research, and trading signals are not documented in available sources.

Educational resources, which legitimate brokers typically provide to support trader development, are entirely absent from accessible documentation. This includes the lack of webinars, tutorials, market analysis, or trading guides that would be expected from a professional forex service provider.

Research capabilities, including fundamental analysis, technical studies, and market commentary, are not mentioned in available sources. The absence of third-party research partnerships or proprietary analysis teams further questions the depth of services offered.

Automated trading support, including Expert Advisor compatibility, algorithmic trading tools, or copy trading services, remains undocumented. Mobile trading applications and desktop platform features are similarly absent from available information.

Risk management tools, position sizing calculators, and portfolio analysis features are not described in accessible sources. This comprehensive absence of trading-related tools and resources represents a fundamental deficiency that would be unacceptable for legitimate forex broker operations.

Customer Service and Support Analysis

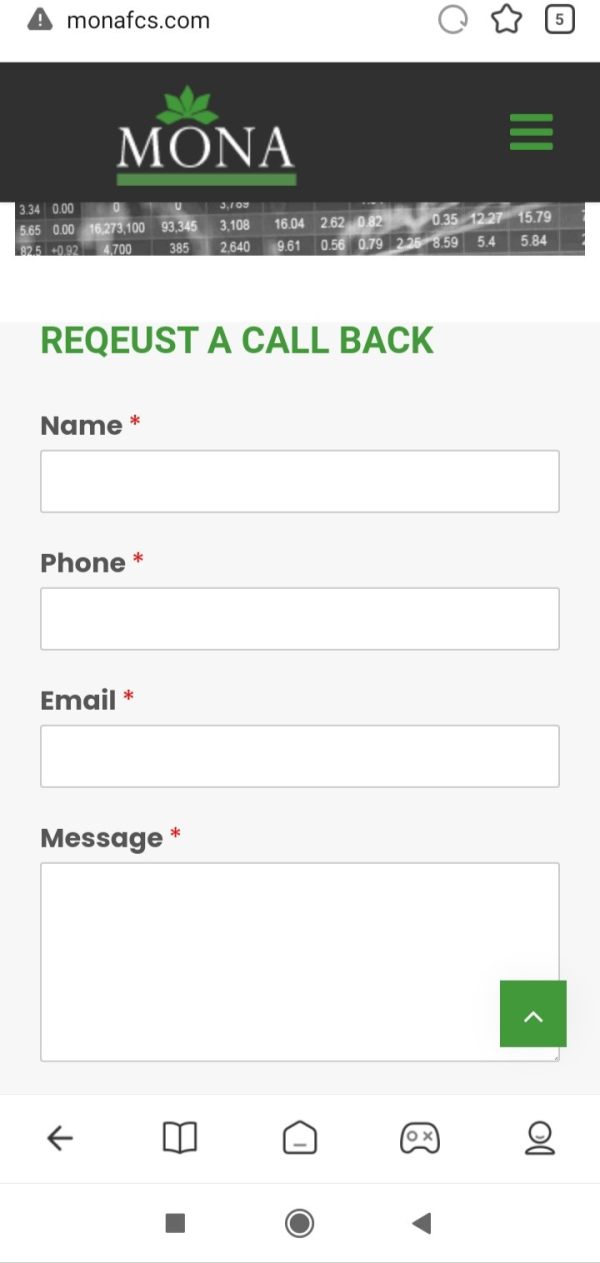

Customer service evaluation faces significant limitations due to the lack of specific support information in available research sources. Traditional broker support channels such as live chat, dedicated phone lines, email ticketing systems, and comprehensive FAQ sections are not documented for trading-related services.

Response time commitments, service level agreements, and support availability hours remain unspecified. Multi-language support capabilities, which are essential for international forex operations, are not detailed in accessible documentation. The absence of dedicated account management services or relationship management programs raises questions about client care standards.

Problem resolution procedures, escalation processes, and complaint handling mechanisms are not described in available sources. This creates uncertainty about how trading disputes, technical issues, or account problems would be addressed.

Educational support, including platform training, trading guidance, and market analysis assistance, is not documented. The lack of community forums, client portals, or interactive support features further limits the apparent service offering.

Without documented customer service standards, contact information for trading support, or evidence of professional client care infrastructure, this mona review cannot provide positive assessment of support capabilities.

Trading Experience Analysis

The evaluation of trading experience encounters fundamental obstacles due to the complete absence of platform information in available research sources. Essential elements such as order execution speed, platform stability, and trading interface quality cannot be assessed without access to actual trading infrastructure details.

Order types, execution models, and slippage characteristics remain undocumented. The lack of information regarding market access, liquidity providers, and execution transparency raises serious concerns about trading conditions. Price feed accuracy, spread consistency, and requote frequency are similarly absent from available documentation.

Mobile trading capabilities, which are essential for modern forex operations, are not described in accessible sources. Cross-platform synchronization, offline functionality, and mobile-specific features cannot be evaluated without proper documentation.

Advanced trading features such as one-click trading, partial position closing, trailing stops, and algorithmic trading support are not mentioned in available sources. The absence of backtesting capabilities, strategy development tools, and performance analytics further limits trading functionality assessment.

This mona review must emphasize that the complete lack of trading platform information makes it impossible to recommend this entity for forex trading activities.

Trust and Regulation Analysis

Trust assessment reveals critical deficiencies in regulatory transparency and compliance documentation. Available research sources do not identify any legitimate financial services regulation under recognized authorities such as the FCA, ASIC, CySEC, or other established forex regulators.

Fund security measures, including segregated account policies, client money protection, and deposit insurance schemes, are not documented in accessible sources. This represents a fundamental risk factor for potential traders considering fund safety.

Corporate transparency, including company registration details, ownership structure, and financial reporting, remains largely undocumented for any trading-related operations. The apparent confusion between restaurant operations and potential forex services further complicates trust assessment.

Industry reputation, professional associations, and third-party certifications are not evident in available documentation. The absence of audit reports, compliance statements, or regulatory communications raises substantial credibility concerns.

Negative incident history, regulatory actions, or industry warnings cannot be definitively assessed due to limited information availability. However, the lack of positive regulatory standing represents a significant risk factor that potential clients must carefully consider.

User Experience Analysis

User experience evaluation faces substantial limitations due to the absence of trading-specific feedback in available research sources. While restaurant reviews and dining experiences are documented, these do not provide relevant insights for forex trading assessment.

Interface design, platform usability, and navigation efficiency cannot be evaluated without access to actual trading platform information. Registration processes, account verification procedures, and onboarding experiences remain undocumented for trading services.

Fund management experiences, including deposit processing, withdrawal efficiency, and payment method satisfaction, are not detailed in available sources. This creates significant uncertainty about operational reliability and user satisfaction.

Common user complaints, recurring issues, and resolution effectiveness cannot be assessed due to the lack of trading-specific user feedback. The absence of user testimonials, case studies, or satisfaction surveys further limits experience evaluation.

Overall user satisfaction metrics, retention rates, and recommendation scores are not available in accessible documentation. This comprehensive absence of user experience data represents a major limitation in assessing service quality.

Conclusion

This comprehensive mona review reveals fundamental challenges in evaluating this entity as a legitimate forex broker. The apparent disconnect between documented restaurant operations and potential trading services creates significant uncertainty about actual business activities. The complete absence of essential trading information, including regulatory status, platform details, and service specifications, raises serious concerns about operational legitimacy.

Based on available research, this entity appears most suitable for individuals seeking upscale dining experiences featuring modern Greek cuisine rather than forex trading services. The lack of transparent trading conditions, regulatory oversight, and user feedback makes it impossible to recommend Mona for forex trading activities.

Potential traders should exercise extreme caution and seek clearly regulated, transparent forex brokers with documented track records and comprehensive service offerings.