Regarding the legitimacy of minzhong forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is minzhong safe?

Business

License

Is minzhong markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Arta Global Futures Limited

Effective Date: Change Record

2004-11-19Email Address of Licensed Institution:

cs@artatechfin.comSharing Status:

No SharingWebsite of Licensed Institution:

www.artagm.comExpiration Time:

--Address of Licensed Institution:

香港鰂魚涌英皇道728 號K11 ATELIER King's Road 9樓901-02室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Minzhong Safe or a Scam?

Introduction

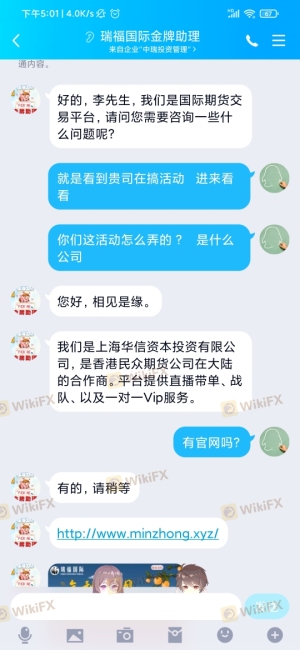

Minzhong is a relatively new player in the forex trading market, having launched its platform in June 2023. As a forex broker, it positions itself as a gateway for traders looking to engage in currency trading. However, the rapid expansion of online trading platforms has raised concerns among traders regarding the safety and legitimacy of these brokers. With numerous reports of scams and fraudulent activities in the industry, it is crucial for traders to carefully assess any broker before committing their funds. This article aims to evaluate whether Minzhong is a safe trading option or a potential scam. Our investigation will be based on a comprehensive analysis of its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

One of the primary factors to consider when determining if a broker is safe is its regulatory status. Regulation by a recognized financial authority provides a level of security for traders, ensuring that the broker adheres to strict operational standards and practices. Minzhong's regulatory framework is currently unclear, as there is no information suggesting that it is regulated by a reputable body.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulatory oversight raises significant concerns about Minzhong's legitimacy. Without a license from a recognized authority, traders may face increased risks, including potential loss of funds and lack of recourse in the event of disputes. Historically, unregulated brokers have been associated with various fraudulent schemes, making it vital for traders to exercise caution when dealing with such entities. Thus, the question remains: Is Minzhong safe? The lack of regulation is a red flag that traders should not overlook.

Company Background Investigation

Minzhong's company background is another essential aspect to evaluate. The broker is relatively new, having registered its domain on June 19, 2023. While the company claims to provide forex trading services, there is limited information available about its ownership structure and management team. A transparent company profile typically includes details about its founders, their professional backgrounds, and the company's operational history.

The absence of publicly available information about Minzhong's management team raises concerns about its credibility. A robust management team with a proven track record in the financial industry is essential for building trust with potential clients. Furthermore, the lack of transparency regarding its operations and ownership structure makes it difficult to assess the broker's reliability. In light of these factors, traders must ask themselves: Is Minzhong safe? The limited information available about the company suggests that it may not be a trustworthy option for forex trading.

Trading Conditions Analysis

The trading conditions offered by a broker significantly impact the overall trading experience. Minzhong's fee structure and trading conditions are crucial to understanding whether it operates fairly and transparently. A thorough analysis of its fees reveals that there may be hidden costs that could affect traders' profitability.

| Fee Type | Minzhong | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

Without clear information on its fees, traders may find themselves facing unexpected costs that could erode their profits. Moreover, any unusual or excessive fees should raise concerns about the broker's intentions. Traders must remain vigilant and conduct thorough research before choosing to trade with Minzhong. As the analysis continues, the question persists: Is Minzhong safe? The lack of clarity surrounding its trading conditions is a significant factor to consider.

Client Fund Security

The security of client funds is paramount when evaluating a forex broker. Minzhong's measures for safeguarding client funds are not well-documented, which raises concerns about the safety of traders' investments. Effective fund protection typically includes segregated accounts, investor compensation schemes, and negative balance protection policies.

Unfortunately, there is no information available regarding Minzhong's approach to client fund security. This lack of transparency is alarming, as it leaves traders vulnerable to potential financial loss. Moreover, if a broker does not have a history of addressing fund security issues, it could indicate a lack of commitment to protecting clients' interests. Therefore, traders must carefully consider whether Minzhong is safe for their investments, given the apparent absence of robust security measures.

Customer Experience and Complaints

Customer feedback provides valuable insight into a broker's reliability and service quality. An analysis of user experiences with Minzhong reveals a mixed bag of reviews, with some users expressing satisfaction with their trading experience, while others report issues with withdrawals and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Fair |

| Account Verification Problems | High | Poor |

Common complaints include difficulties in withdrawing funds, which is a significant concern for traders. If a broker cannot facilitate timely withdrawals, it raises questions about its legitimacy and operational practices. The company's response to these complaints has been criticized as inadequate, further eroding trust among users. As such, potential traders must ponder: Is Minzhong safe? The reports of withdrawal issues and poor customer support suggest that caution is warranted.

Platform and Trade Execution

The performance and reliability of a trading platform are critical to a trader's success. Minzhong's platform needs to be assessed for its stability, user experience, and order execution quality. While some users report a satisfactory experience, others have encountered issues such as slippage and order rejections.

A reliable platform should provide seamless execution and minimal slippage. However, any signs of manipulation or consistent issues with trade execution can indicate deeper problems within the broker's operations. Thus, traders must carefully evaluate whether Minzhong is safe to trade with based on the platform's performance and reliability.

Risk Assessment

Every trading platform carries inherent risks, and Minzhong is no exception. A comprehensive risk assessment reveals several potential areas of concern that traders should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Security Risk | High | Lack of transparency regarding fund protection measures. |

| Customer Service Risk | Medium | Reports of poor support and withdrawal issues. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Minzhong. This includes understanding the potential for loss, assessing the broker's operational practices, and considering alternative options. As the risk assessment unfolds, the question remains: Is Minzhong safe? The identified risks suggest that traders should proceed with caution.

Conclusion and Recommendations

In conclusion, the investigation into Minzhong raises several red flags that traders should consider. The lack of regulatory oversight, limited company information, unclear trading conditions, and reports of customer complaints all contribute to a perception of risk surrounding this broker. Therefore, it is essential for traders to exercise caution and conduct thorough research before deciding to trade with Minzhong.

While some traders may still choose to engage with this broker, it is crucial to remain vigilant and aware of the potential risks involved. For those seeking safer alternatives, it may be wise to consider brokers with established regulatory frameworks and positive customer feedback. Ultimately, the question of whether Minzhong is safe remains uncertain, and traders should prioritize their financial security above all else.

Is minzhong a scam, or is it legit?

The latest exposure and evaluation content of minzhong brokers.

minzhong Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

minzhong latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.