Is MIEX safe?

Pros

Cons

Is MIEX Safe or Scam?

Introduction

MIEX is a forex broker that has positioned itself as a gateway for traders looking to access a diverse range of global markets, including forex, commodities, and cryptocurrencies. Established in 2011, the platform claims to offer various trading instruments and account types, but its lack of regulatory oversight raises significant concerns. Given the prevalence of scams in the forex market, it is crucial for traders to conduct thorough evaluations of brokers before committing their funds. This article investigates whether MIEX is a safe trading option or if it poses risks to potential investors. Our assessment draws on various online reviews, regulatory information, and user experiences to provide a comprehensive overview of MIEX's operations.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors to consider when evaluating its legitimacy. MIEX is currently unregulated, which means it operates without oversight from any recognized financial authority. This lack of regulation is a significant red flag, as it implies that the broker is not held accountable for its actions and does not adhere to industry standards designed to protect traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of a regulatory framework means that MIEX is not required to maintain a minimum level of capital, segregate client funds, or provide transparency regarding its operations. Such practices are standard among regulated brokers and are essential for ensuring client safety. The high-risk nature of unregulated trading platforms often leads to issues like withdrawal problems and fund mismanagement, further emphasizing the need for caution when considering MIEX as a trading partner.

Company Background Investigation

MIEX, officially registered as MIEX Limited, is headquartered in the Seychelles, a location often associated with lax regulatory practices. Since its inception in 2011, the company has aimed to cater to a global audience by offering access to various financial markets. However, its ownership structure and management team remain largely opaque, with little information available regarding the individuals behind the broker.

The lack of transparency raises questions about the brokers accountability and reliability. A credible broker should provide clear information about its management team and their qualifications. Without this transparency, potential clients may find it challenging to assess the broker's credibility. Furthermore, the company's choice to operate from a jurisdiction known for its lenient regulatory environment may be seen as an attempt to evade stricter oversight, which is another reason to approach MIEX with caution.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is essential. MIEX offers various account types and claims to provide competitive spreads and leverage options. However, as with many unregulated brokers, the actual trading costs and conditions may differ significantly from what is advertised.

| Cost Type | MIEX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.25 pips | From 0.1 pips |

| Commission Model | Not disclosed | Varies (usually low) |

| Overnight Interest Range | Not specified | Varies (typically 0.5% - 3%) |

The spread for major currency pairs starts at 0.25 pips, which may seem attractive, but without a clear commission structure, traders may face hidden costs that could significantly affect their profitability. Additionally, the lack of information regarding overnight interest rates raises concerns about potential hidden fees, which can be common in unregulated environments. Traders should be wary of any broker that does not provide full disclosure regarding its fee structures.

Client Fund Security

The security of client funds is paramount in the forex industry. MIEX's unregulated status raises concerns about the safety of investors' money. The broker does not provide clear information regarding its fund segregation practices, which are essential for protecting clients' capital in the event of insolvency.

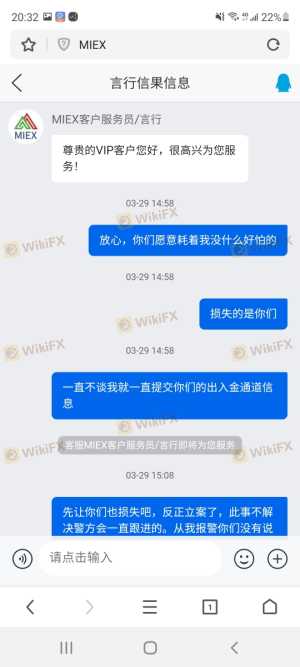

Moreover, MIEX has no investor protection mechanisms in place, which means that in the event of financial difficulties, clients may have no recourse to recover their funds. This lack of protection is particularly alarming given the numerous reports of clients being unable to withdraw their funds, a common issue with unregulated brokers.

Customer Experience and Complaints

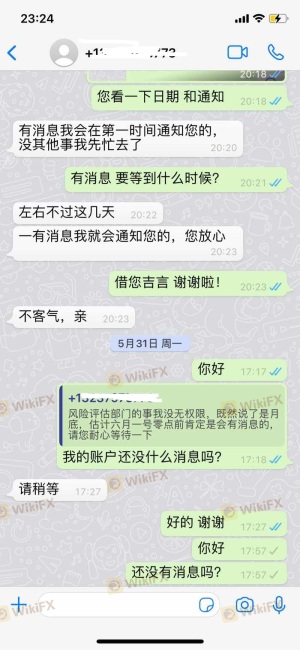

Customer feedback is a valuable resource for assessing a broker's reliability. Unfortunately, MIEX has garnered a significant number of complaints regarding its service quality and withdrawal processes. Many users have reported difficulties in accessing their funds, with some stating that their withdrawal requests were either denied or met with unreasonable delays.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Inconsistent |

| Misleading Information | High | Poor |

Typical complaints include users being pressured to make additional deposits before being allowed to withdraw their funds, which is a classic red flag for potential scams. In some cases, clients have reported that their accounts were blocked without clear justification, leaving them unable to access their investments. These patterns of behavior indicate a troubling trend that raises significant concerns about the overall safety of trading with MIEX.

Platform and Execution

The trading platform offered by MIEX is another critical aspect to consider. While the broker claims to provide access to popular trading platforms like MT4 and MT5, user experiences suggest that the platform's performance may not meet industry standards. Reports of slippage and order rejections are common, which can severely impact trading outcomes.

Moreover, the absence of clear communication regarding platform stability and execution quality further exacerbates concerns. Traders must be cautious when dealing with brokers that do not provide transparent information about their trading infrastructure, as this could indicate potential manipulation or operational issues.

Risk Assessment

Engaging with MIEX presents several risks that traders should be aware of. The combination of unregulated status, poor customer feedback, and questionable trading practices creates a high-risk environment for potential investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight or accountability. |

| Financial Risk | High | Potential loss of funds with no recourse. |

| Operational Risk | Medium | Issues with platform stability and execution. |

To mitigate these risks, traders are advised to conduct thorough due diligence and consider using regulated brokers with a proven track record. Engaging with a broker that adheres to strict regulatory standards can provide greater security and peace of mind.

Conclusion and Recommendations

In conclusion, the evidence suggests that MIEX poses significant risks to potential investors. The lack of regulation, coupled with numerous complaints regarding withdrawal issues and poor customer service, raises serious concerns about the broker's legitimacy. While MIEX may offer attractive trading conditions on the surface, the underlying risks make it a potentially dangerous choice for traders.

For those considering trading in the forex market, it is advisable to seek out regulated alternatives that offer greater transparency and security. Brokers with established reputations and robust regulatory oversight are more likely to provide a safe trading environment. Ultimately, exercising caution and conducting thorough research is essential to avoid falling victim to potential scams in the forex industry.

Is MIEX a scam, or is it legit?

The latest exposure and evaluation content of MIEX brokers.

MIEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MIEX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.