Is MAX MARKET FX safe?

Business

License

Is Max Market FX Safe or a Scam?

Introduction

Max Market FX is a forex brokerage that positions itself as an international trading platform, offering a range of financial products including foreign exchange, commodities, and indices. In an industry rife with potential pitfalls, traders must exercise caution when selecting a broker. The significance of thorough evaluation cannot be overstated, as the wrong choice can lead to significant financial losses. This article aims to provide a comprehensive analysis of Max Market FX, focusing on its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment. Our investigation is based on a detailed review of various online resources, including regulatory databases, user reviews, and expert analyses.

Regulation and Legitimacy

The regulatory status of a trading platform is one of the most critical factors in determining its safety. Max Market FX claims to operate under the auspices of the National Futures Association (NFA) in the United States; however, reports indicate that its license is unauthorized, raising significant concerns about its legitimacy. Regulation serves to protect traders by enforcing standards that govern financial practices, ensuring that brokers operate transparently and ethically.

Here is a summary of the core regulatory information for Max Market FX:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0534271 | United States | Unauthorized |

The absence of valid regulatory oversight from recognized authorities is alarming. Without proper regulation, traders have little recourse in the event of disputes or financial mismanagement. Moreover, the history of compliance is crucial; brokers with a track record of regulatory infractions are often viewed with skepticism. In the case of Max Market FX, the lack of verifiable regulatory information raises alarming red flags, leading to the question: Is Max Market FX safe?

Company Background Investigation

Max Market FX was established in 2020, and its ownership and operational structure remain somewhat opaque. The company is registered in the UK, but its operational headquarters are reportedly located in Hong Kong, a jurisdiction often associated with higher risks in terms of financial regulation. The management team behind Max Market FX is not well-documented, which raises questions about their qualifications and industry experience. Transparency is a significant factor for traders; a broker that is open about its management and ownership instills more confidence than one that is not.

Moreover, the companys website provides limited information about its operational history, which is concerning for potential clients. A lack of clear and accessible information about the team behind the brokerage can contribute to distrust among prospective traders. Therefore, the overall transparency and information disclosure levels for Max Market FX are inadequate, leading to further skepticism about its safety.

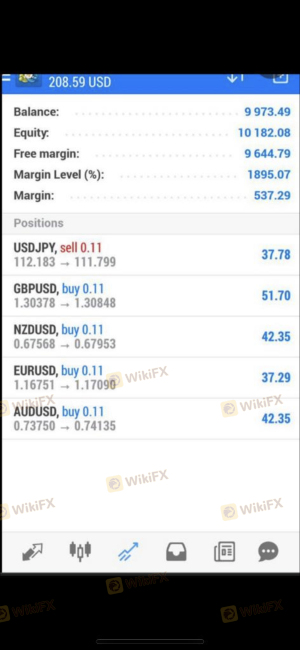

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. Max Market FX advertises competitive spreads and a variety of trading instruments; however, the lack of transparency surrounding its fees and commissions is troubling. Traders should be aware of all costs associated with trading to avoid unexpected financial burdens.

Heres a comparison of core trading costs:

| Fee Type | Max Market FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unspecified | 1-2 pips |

| Commission Structure | Unclear | Varies |

| Overnight Interest Range | Unspecified | 2-5% |

The absence of clear information regarding spreads and commissions can lead to confusion and dissatisfaction among traders. Furthermore, any unusual or hidden fees can be detrimental to a trader's bottom line. The overall fee structure at Max Market FX appears to lack clarity, which raises the question of whether the broker operates with full transparency. Thus, potential clients must consider: Is Max Market FX safe?

Client Fund Security

The safety of client funds is paramount in the trading industry. Max Market FX claims to employ measures such as segregated accounts to protect client funds, which is a standard practice among reputable brokers. However, the effectiveness of these measures is questionable given the broker's lack of regulation.

Traders should be aware of the following aspects of fund security:

- Segregated Accounts: Max Market FX claims to keep client funds separate from its operational funds, but the absence of regulatory oversight makes it difficult to verify this claim.

- Investor Protection: There are no clear indications that Max Market FX offers any investor protection schemes, which can safeguard traders in the event of broker insolvency.

- Negative Balance Protection: It is unclear whether Max Market FX has policies in place to prevent clients from losing more money than they have deposited.

Given the lack of transparency and regulatory oversight, historical security issues or disputes involving client funds are particularly concerning. This uncertainty leads to the question: Is Max Market FX safe?

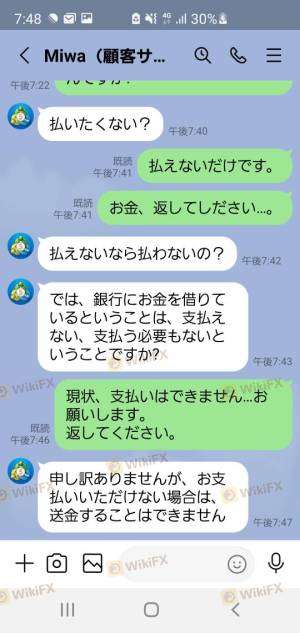

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews of Max Market FX reveal a mix of experiences, with several complaints regarding withdrawal issues and overall service quality. Common patterns in complaints often highlight difficulties in accessing funds, which is a significant red flag for any brokerage.

Heres a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Service | Medium | Inconsistent |

| Lack of Transparency | High | No Response |

Typical cases include users reporting that they were unable to withdraw their funds after multiple requests, raising serious concerns about the brokerage's credibility. Such issues are often indicative of deeper operational problems and can lead to significant financial losses for traders. This situation begs the question: Is Max Market FX safe?

Platform and Execution

The trading platform is a critical component of the trading experience. Max Market FX offers access to the popular MetaTrader 5 platform, which is known for its user-friendly interface and robust features. However, the performance of the platform, including order execution quality and any signs of manipulation, is crucial for traders.

Factors to consider include:

- Execution Quality: Reports of slippage and rejected orders can significantly affect trading outcomes. Traders need to understand how well the platform executes trades under various market conditions.

- Platform Stability: A stable platform is essential for effective trading. Any downtime can lead to missed opportunities and financial losses.

While the platform itself may be reputable, the overall execution quality and reliability of Max Market FX remain in question. The lingering doubts about the brokerage's operational integrity lead to the question: Is Max Market FX safe?

Risk Assessment

Engaging with any brokerage involves inherent risks, and Max Market FX is no exception. The lack of regulation, poor customer feedback, and unclear trading conditions contribute to a high-risk profile for this broker.

Heres a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Security Risk | High | Unclear protection measures |

| Customer Service Risk | Medium | Poor response to complaints |

| Platform Execution Risk | Medium | Reports of slippage |

To mitigate these risks, potential clients should conduct thorough research and consider trading with brokers that have solid regulatory frameworks and positive customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that Max Market FX raises several red flags regarding its safety and legitimacy. The lack of valid regulation, combined with numerous customer complaints and unclear trading conditions, indicates that traders should exercise extreme caution.

For those seeking a reliable trading experience, it is advisable to consider regulated brokers with a proven track record of customer satisfaction and transparent operations. Alternatives such as FBS or Swissquote may provide safer trading environments, ensuring that clients' funds are protected and that they have access to quality customer support.

Ultimately, the question remains: Is Max Market FX safe? Based on the current analysis, it is prudent for traders to approach this broker with skepticism and to prioritize their financial security by choosing more reputable alternatives.

Is MAX MARKET FX a scam, or is it legit?

The latest exposure and evaluation content of MAX MARKET FX brokers.

MAX MARKET FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MAX MARKET FX latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.