Is JOJOMARKETS safe?

Business

License

Is Jojo Markets A Scam?

Introduction

Jojo Markets is a forex broker that has positioned itself as a trading platform for both novice and experienced traders. Operating primarily in the foreign exchange market, it offers a variety of financial instruments, including CFDs, cryptocurrencies, and commodities. However, the rapid growth of online trading has also led to an increase in fraudulent schemes, making it essential for traders to carefully assess the legitimacy and safety of their chosen brokers. This article aims to investigate whether Jojo Markets is a safe trading platform or a potential scam. The evaluation draws from a variety of sources, including user reviews, regulatory information, and expert analyses, to provide a comprehensive overview of the broker's operations.

Regulation and Legitimacy

The regulation of a forex broker is crucial for ensuring the safety of traders' funds and maintaining fair trading practices. Regulatory bodies enforce strict guidelines that brokers must follow, which helps protect investors from fraud and malpractice. Jojo Markets claims to be registered in the United Kingdom and purports to be regulated by the Financial Service Providers Register (FSPR) of New Zealand. However, this claim is suspect, as multiple sources have flagged it as a potential clone firm, meaning it may not be operating under legitimate regulatory oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | N/A | New Zealand | Suspicious Clone |

The quality of regulation is paramount; a broker that lacks proper oversight can pose significant risks to investors. Jojo Markets has been reported to operate without valid licenses, and its claims of regulation have been challenged. The absence of a credible regulatory framework raises serious concerns about the broker's legitimacy and the safety of client funds.

Company Background Investigation

Jojo Markets was founded approximately 5 to 10 years ago, with claims of being based in the United Kingdom. However, the company's ownership structure and the backgrounds of its management team remain unclear. Transparency is critical for any financial institution, and the lack of available information about Jojo Markets raises red flags. A broker should ideally provide detailed information about its founders, management team, and operational history to build trust with potential clients. Unfortunately, Jojo Markets fails to meet these standards, resulting in a lack of confidence among traders.

The absence of a clear company history and ownership structure is concerning, as it complicates any efforts to hold the broker accountable for its actions. Without transparent information, it becomes challenging for traders to assess the broker's credibility and reliability.

Trading Conditions Analysis

Jojo Markets presents a range of trading conditions, including various account types and trading platforms. However, the overall fee structure and commission policies warrant scrutiny. Traders often seek brokers with competitive spreads and transparent pricing, but Jojo Markets has been criticized for its lack of clarity regarding fees.

| Fee Type | Jojo Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.1 pips | 1.0 pips |

| Commission Model | Non-specified | Varies widely |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

While Jojo Markets advertises low spreads, the absence of detailed commission information can lead to unexpected costs for traders. The lack of transparency in these areas raises concerns about the broker's overall reliability and fairness in trading practices.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Jojo Markets claims to implement several measures to protect client funds, including fund segregation and investor protection policies. However, given the broker's questionable regulatory status, the effectiveness of these measures is uncertain.

Traders should always ensure that their broker has a solid plan for fund protection, including negative balance protection. Unfortunately, Jojo Markets has a history of complaints regarding fund access and withdrawal issues, which raises further doubts about its commitment to safeguarding client assets.

Customer Experience and Complaints

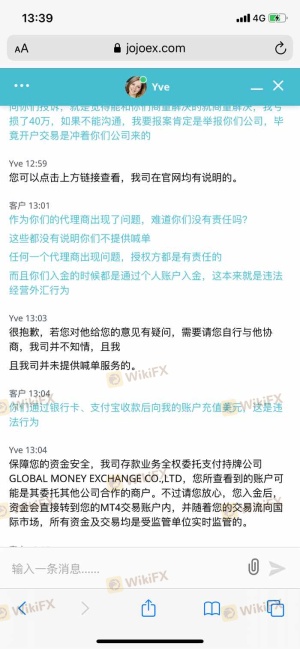

Customer feedback is an essential aspect of evaluating any broker. Jojo Markets has accumulated a significant number of complaints, with users reporting difficulties in withdrawing funds and accessing customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Accessibility | Medium | Poor |

Common complaints include users being unable to withdraw funds after making deposits, which is a significant red flag. The quality of customer service has also been criticized, with many users reporting slow response times or complete lack of communication from the broker.

Platform and Trade Execution

The performance of a trading platform can significantly impact a trader's experience. Jojo Markets utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust features. However, reports of execution issues, such as slippage and order rejections, have surfaced, causing frustration among traders.

The platform's stability is crucial for executing trades effectively, especially in volatile markets. Any signs of manipulation or technical issues can undermine trust in the broker and its trading environment. Traders should be cautious when evaluating Jojo Markets' execution quality, as negative reports can indicate deeper operational problems.

Risk Assessment

Using Jojo Markets carries inherent risks, primarily due to its lack of regulation and transparency. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operating without valid licenses |

| Fund Safety Risk | High | History of withdrawal issues |

| Customer Service Risk | Medium | Poor responsiveness to complaints |

| Execution Risk | Medium | Reports of slippage and rejections |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts where available, and only invest funds they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that Jojo Markets poses significant risks to potential investors. The broker's lack of regulation, transparency issues, and numerous customer complaints indicate that it may not be a safe trading platform. Traders are advised to exercise extreme caution when considering Jojo Markets for their trading activities.

For those seeking reliable alternatives, consider brokers that are regulated by reputable authorities, such as the FCA or ASIC, and have a proven track record of positive customer feedback. Always prioritize safety and due diligence to ensure a secure trading experience.

In summary, is Jojo Markets safe? The overwhelming indications suggest that it is not, and traders should be wary of engaging with this broker.

Is JOJOMARKETS a scam, or is it legit?

The latest exposure and evaluation content of JOJOMARKETS brokers.

JOJOMARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JOJOMARKETS latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.