Is eex safe?

Pros

Cons

Is Eex Safe or a Scam?

Introduction

Eex, short for the European Energy Exchange, is a prominent entity in the forex market, primarily focusing on energy trading and commodity markets. Established in Leipzig, Germany, Eex has positioned itself as a key player in providing secure and sustainable trading platforms for various commodities, including power, natural gas, and emission allowances. However, as the forex market continues to evolve, traders are increasingly aware of the potential risks associated with unregulated brokers. This awareness necessitates a cautious approach when evaluating brokers like Eex, especially given the numerous reports of scams and fraudulent activities in the trading industry.

In this article, we will investigate whether Eex is a safe platform for trading or if it poses risks to investors. Our evaluation will be based on a thorough analysis of Eex's regulatory status, company background, trading conditions, customer experience, and overall risk assessment. We will utilize a combination of qualitative insights and quantitative data to provide a comprehensive overview of Eex's operations and its implications for potential traders.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect investors' interests. Unfortunately, Eex currently operates without any valid regulatory oversight, which raises significant concerns regarding its legitimacy and trustworthiness.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Eex does not fall under the scrutiny of any governmental or financial authority. This lack of oversight can lead to increased risks for traders, including potential issues with fund security, withdrawal difficulties, and lack of recourse in case of disputes. The importance of regulation cannot be overstated, as it provides a layer of protection for investors and ensures that brokers maintain ethical and transparent practices.

Given Eex's unregulated status, it is imperative for potential traders to conduct thorough research and consider the possible risks associated with trading on this platform. The absence of a regulatory framework raises red flags, and it is generally advisable to invest with brokers that are well-regulated to safeguard one's funds. In summary, the current lack of regulation makes it challenging to conclude that Eex is a safe trading environment.

Company Background Investigation

Eex has a relatively short history in the trading landscape, having been established within the last decade. The company is owned by the European Energy Exchange AG and operates from its headquarters in Leipzig, Germany. While the exchange has made strides in the energy market, its rapid growth and lack of regulatory oversight warrant a closer examination of its management team and operational transparency.

The management team at Eex comprises professionals with extensive backgrounds in finance, energy trading, and market operations. However, the specific qualifications and experiences of these individuals are not always publicly disclosed, which can hinder transparency. A transparent organization should provide detailed information about its leadership and operational practices to instill confidence among its clients.

Furthermore, Eex's commitment to information disclosure is questionable, as it does not provide comprehensive reports or updates regarding its operations, financial health, or compliance with industry standards. This lack of transparency can lead to skepticism among potential investors, as they may be left in the dark about the company's practices and performance.

In conclusion, while Eex has established itself as a player in the energy trading market, its lack of regulatory oversight and transparency raises concerns about its legitimacy. For traders considering this platform, it is crucial to weigh these factors carefully before proceeding.

Trading Conditions Analysis

When assessing a forex broker, understanding the trading conditions they offer is paramount. Eex provides a range of trading instruments, particularly in the energy sector, which can be appealing to traders looking to diversify their portfolios. However, the overall fee structure and trading costs associated with Eex are essential factors to consider.

Eex's fee structure includes various costs related to trading, including spreads, commissions, and overnight interest rates. It is important to analyze these fees in comparison to industry averages to determine whether Eex offers competitive trading conditions.

| Fee Type | Eex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 3.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2% |

While specific data on Eex's trading fees is limited, reports indicate that some users have experienced difficulties when attempting to withdraw funds or have faced unexpected charges. These issues could signal a lack of clarity in the broker's fee policies, which can lead to frustration and distrust among traders.

Moreover, the absence of a demo account option further complicates the evaluation process, as it prevents potential clients from testing the platform before committing real funds. A reputable broker typically offers a demo account to allow traders to familiarize themselves with the trading environment without financial risk.

In summary, while Eex offers access to various trading instruments, the lack of transparency regarding its fee structure and withdrawal issues raises concerns about the overall trading conditions. Traders should carefully consider these factors when evaluating whether to engage with Eex.

Customer Funds Security

The security of customer funds is a critical aspect of any trading platform. Eex's lack of regulation raises significant concerns regarding the safety of client funds. Without regulatory oversight, there are no guarantees that Eex implements adequate measures to protect investors' capital.

Eex has not provided clear information regarding its fund segregation practices, investor protection mechanisms, or negative balance protection policies. These are essential features that reputable brokers typically offer to ensure the safety of their clients' funds. The absence of such information can lead to skepticism about the platform's reliability and commitment to safeguarding customer assets.

Furthermore, historical reports of withdrawal difficulties and complaints from users about accessing their funds further highlight potential issues with Eex's financial practices. When traders encounter problems withdrawing their funds, it raises alarms about the broker's credibility and may indicate deeper systemic issues within the organization.

In conclusion, the lack of transparency regarding customer funds security and the absence of regulatory oversight make Eex a concerning choice for traders. Potential investors should exercise extreme caution and thoroughly assess the risks associated with trading on this platform.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Eex has received mixed reviews from users, with some praising its range of products while others express dissatisfaction with customer support and withdrawal processes.

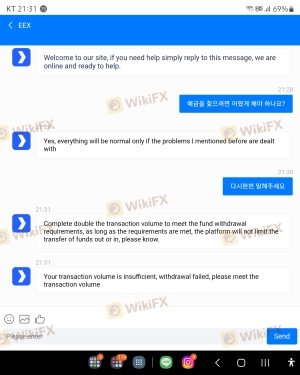

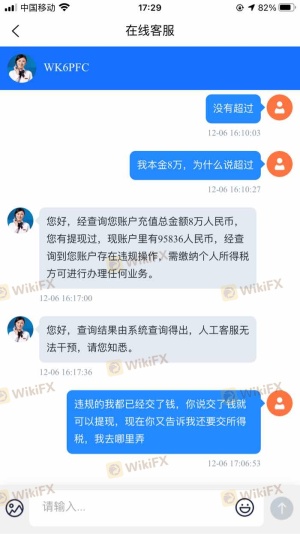

Common complaints include difficulties in withdrawing funds, unresponsive customer service, and unclear fee structures. These issues can significantly impact the overall trading experience and raise concerns about the broker's commitment to customer satisfaction.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Customer Service Issues | Medium | Average |

| Fee Transparency Concerns | High | Limited |

A few notable cases highlight the challenges faced by Eex users. For instance, one trader reported being unable to withdraw their principal investment after multiple requests, which resulted in frustration and a loss of trust in the platform. Another user expressed dissatisfaction with the quality of customer support, noting long wait times and unhelpful responses.

In summary, while Eex offers various trading options, the overall customer experience appears to be marred by significant complaints regarding fund withdrawals and customer service. These issues warrant careful consideration for anyone contemplating trading with Eex.

Platform and Execution

A broker's trading platform is crucial for a seamless trading experience. Eex provides a trading platform designed for energy and commodity markets, but the performance and user experience are vital factors to assess.

Users have reported varying experiences with the platform's stability and execution quality. Some traders have experienced slippage during volatile market conditions, leading to concerns about the broker's order execution practices. Additionally, reports of order rejections and delays can further exacerbate trader frustrations.

In conclusion, while Eex provides access to essential trading tools, the platform's performance and execution quality require further scrutiny. Traders should be aware of potential issues that could impact their trading experience.

Risk Assessment

Using Eex as a trading platform comes with inherent risks, primarily due to its unregulated status and reported customer complaints.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Withdrawal Risk | High | Reports of difficulties accessing funds |

| Service Quality Risk | Medium | Mixed customer feedback on support |

To mitigate these risks, traders should consider implementing strict risk management practices, such as limiting the amount of capital allocated to Eex and diversifying their trading activities across multiple platforms. Additionally, conducting thorough due diligence and staying informed about the broker's operations can help traders make more informed decisions.

Conclusion and Recommendations

In conclusion, while Eex has established itself in the energy trading market, its lack of regulatory oversight, transparency issues, and mixed customer feedback raise significant concerns about its safety and reliability. The absence of regulation makes it challenging to deem Eex a safe trading platform, and potential investors should exercise caution.

For traders seeking safer alternatives, it is advisable to explore well-regulated brokers with a proven track record of customer satisfaction and transparent practices. Brokers regulated by top-tier authorities, such as the FCA or ASIC, provide a greater level of security and investor protection, making them more suitable options for trading.

Ultimately, while Eex may offer appealing trading opportunities, the associated risks and concerns warrant careful consideration before engaging with this broker.

Is eex a scam, or is it legit?

The latest exposure and evaluation content of eex brokers.

eex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

eex latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.