imsecurities 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

The brokerage firm known as imsecurities positions itself as a cost-effective trading platform, catering primarily to novice traders seeking low-fee options to dip their toes into financial markets. For inexperienced investors, the allure of minimal trading costs can often overshadow the critical need for secure and reputable trading environments. However, prospective users must tread cautiously. The dubious regulatory status and glaring transparency issues surrounding imsecurities raise significant red flags concerning fund safety and overall trustworthiness. For those willing to navigate these murky waters, the potential for high returns exists, but it is accompanied by considerable risks; thus, the opportunity comes at the cost of potential peril. In navigating these dichotomous landscapes, novice traders must balance their pursuit of low costs against the prudent foresight of safeguarding their investments.

⚠️ Important Risk Advisory & Verification Steps

Investing in imsecurities carries inherent risks:

- A trust score of 1/100 indicates a high likelihood of the brokerage being a scam.

- Lack of regulatory transparency raises concerns about the safety of funds.

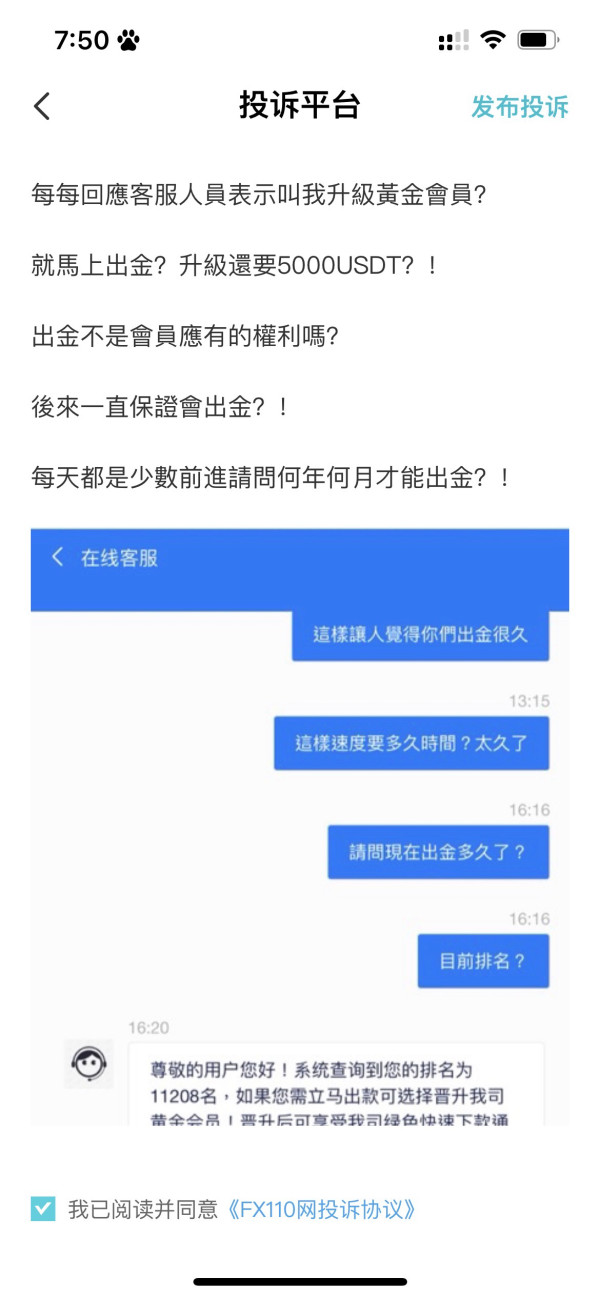

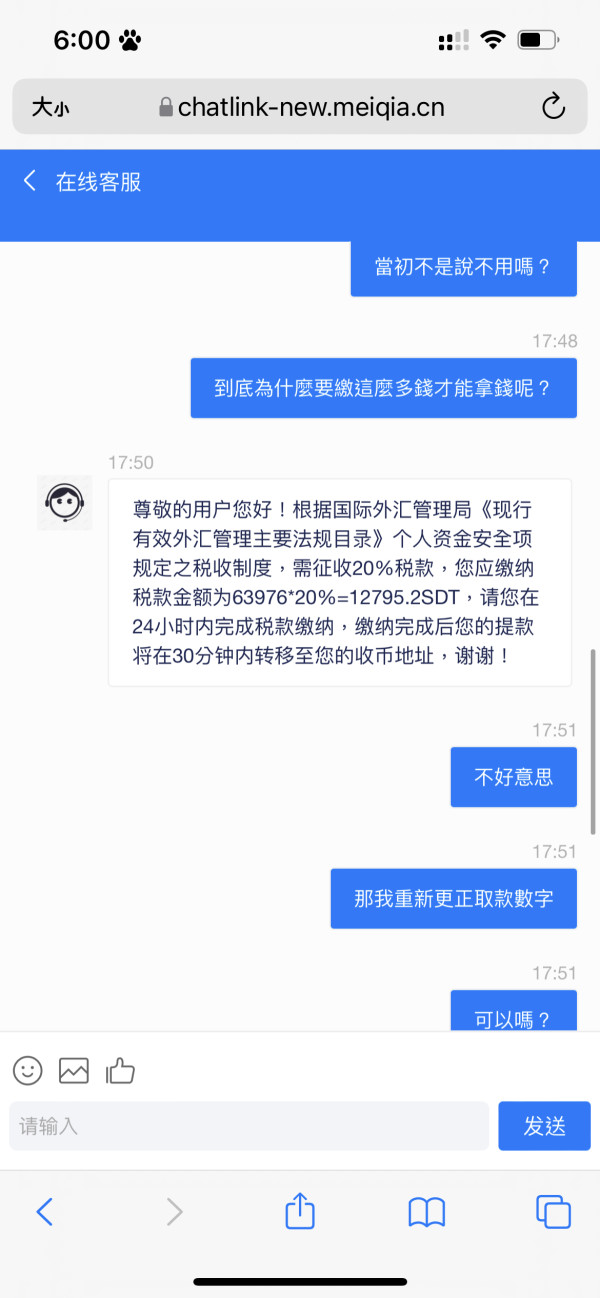

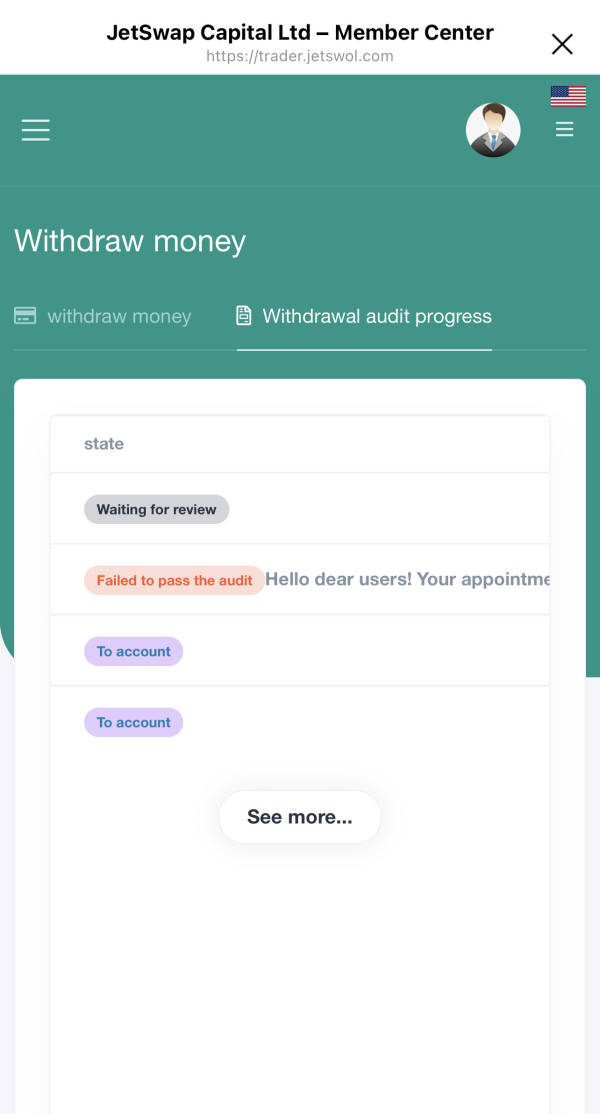

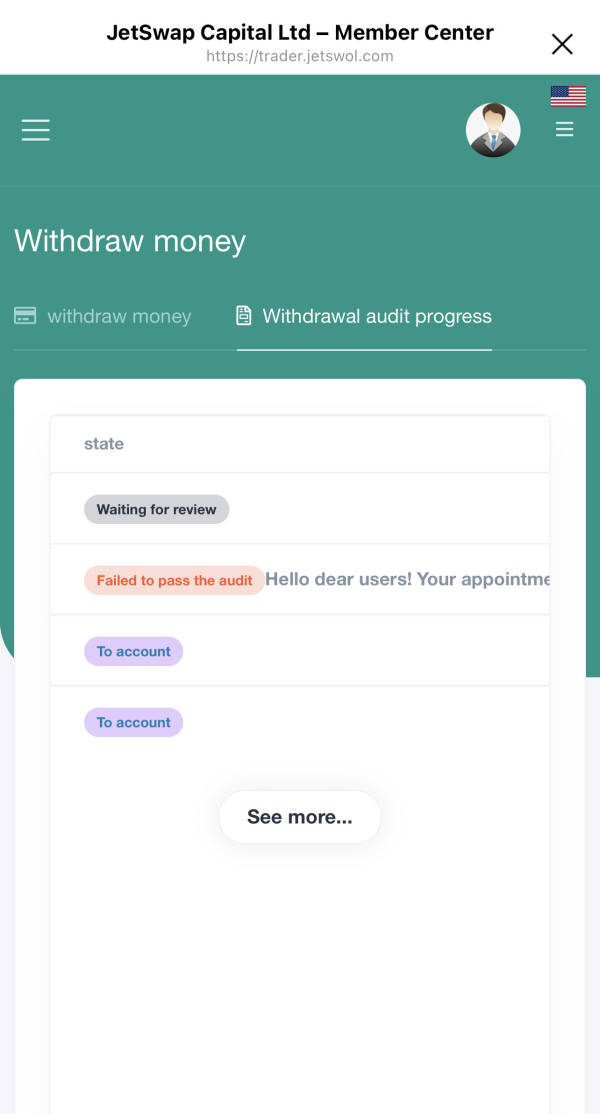

- Multiple reports highlight withdrawal issues and negative experiences from users.

How to self-verify before investing:

- Visit the NFA's BASIC website to check registration status.

- Use FINRAs BrokerCheck tool to investigate any complaints against the broker.

- Cross-check user reviews on platforms like Trustpilot or Scamadviser.

- Look into visit tracking on SimilarWeb or related tools to confirm site activity.

- Always contact the brokerage via official channels before making any financial commitments to test responsiveness.

Rating Framework

Broker Overview

Company Background and Positioning

Founded recently, imsecurities operates without a clear public identity and scant information regarding ownership. Based in Gujarat, India, the firm claims to provide a platform that enhances investment opportunities for everyday traders. While promoting exponential growth as its operational mantra, the reality of its market positioning is steeped in skepticism. The lack of transparency and importantly, regulatory oversight, places it in a questionable categorization that potential clients should critically evaluate.

Core Business Overview

imsecurities offers a selection of trading options across various asset classes including forex, commodities, and CFDs. Operating on platforms such as MetaTrader 5 and some proprietary tools, the ease of access to trading across diverse markets is met with concerns over execution quality and platform reliability. No significant regulatory bodies openly supervise its operations, adding to an already concerning reputation in the trading community.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The most pressing concern regarding imsecurities pertains to its regulatory standing, or rather, the lack thereof. A trust score of 1/100 from Scamadviser clearly indicates high potential for malpractice, marking it as a potential scam. Users should be wary, as multiple reviews corroborate the perception of imsecurities as lacking formal oversight.

User Self-Verification Guide

- Navigate to NFA's BASIC database at nfa.futures.org and enter the broker's name to check registration.

- Access FINRAs BrokerCheck at brokercheck.finra.org to uncover any complaints or sanctions.

- Review recommendations from user experiences prevalent on Trustpilot and Scamadviser.

- Employ website analytical tools like SimilarWeb to assess traffic and activity levels on imsecurities' site.

- Reach out via contact options provided on the website to gauge their business legitimacy.

Industry Reputation and Summary

Feedback from existing and former users emphasizes significant concerns regarding fund safety and operational transparency. Several have reported issues primarily centered around withdrawal failures. As one user expressed succinctly:

"I was unable to withdraw my funds, despite multiple inquiries. It feels like a trap."

This highlights the importance of conducting due diligence before engaging with the platform.

Trading Costs Analysis

Advantages in Commissions

One of the primary attractions of imsecurities is its low-cost trading structure. Users can open positions with minimal commissions, often appealing to novice traders eager to maximize their investment potential without incurring hefty upfront costs. This structure creates a seemingly attractive trading environment.

The "Traps" of Non-Trading Fees

However, while trading costs may appear low, imsecurities imposes high withdrawal charges. Various complaints indicate that users faced fees upwards of $30 for withdrawals, alongside other hidden costs that aren't prominently disclosed on their website.

"They say trading is commission-free, but when I tried to withdraw, I was hit with a $30 fee I never expected," states another frustrated user.

This dichotomy of marketing low-cost trades while piling on hidden fees presents a double-edged sword for users.

Cost Structure Summary

In summary, while prospects for minimal-cost trading options exist, they are often outweighed by the high costs linked with withdrawal processes, which could be detrimental for more cautious traders. Users are urged to weigh these circumstances carefully before diving into trading with imsecurities.

Clients of imsecurities have access to standard trading platforms, primarily including MetaTrader 5. While these platforms offer essential functionalities, they fall short of the expectations set by more reputable brokers. The functionality is limited compared to leading trader platforms in the industry, drawing complaints regarding both user experience and interface capability.

Facilitated tools for analysis and research appear scant, leading to concerns about the educational resources provided for new traders. With minimal analytical tools at hand, many novice users may find themselves ill-equipped to navigate market complexities intricately.

User feedback generally reflects dissatisfaction with the platform's design and operability. A user pointed out:

"The platform is clunky, and half the time, it doesnt even let me log in!"

This sentiment encapsulates broader concerns regarding both reliability and user-friendliness, leading to an overall unfavorable evaluation of imsecurities.

User Experience Analysis

Onboarding and Usability

The onboarding process, while relatively straightforward, presents barriers when users encounter operational issues. Many have expressed frustration regarding account creation challenges and the lack of clear guidance during the initial phases.

Interface Feedback

Once onboard, user experiences with the interface reveal additional shortcomings. As noted previously, complaints often revert to issues surrounding login failures and slow performance, detracting from the overall trading experience.

Customer Support Analysis

Availability and Responsiveness

Customer support at imsecurities has shown mixed reviews. Despite claims of continuous availability, many users have reported long wait times for query resolutions. Below is a users account:

"Trying to get help feels impossible; they dont respond promptly."

The lack of comprehensive support disproportionately affects novice traders who may typically depend on guidance while navigating their initial trades.

Account Conditions Analysis

Regulatory Composition

The absence of regulatory backing essentially means that users have no recourse should issues arise regarding fund safety or legitimacy. Transparency in account conditions also raises concerns; unclear fee structures leave users exposed to potentially unexpected charges.

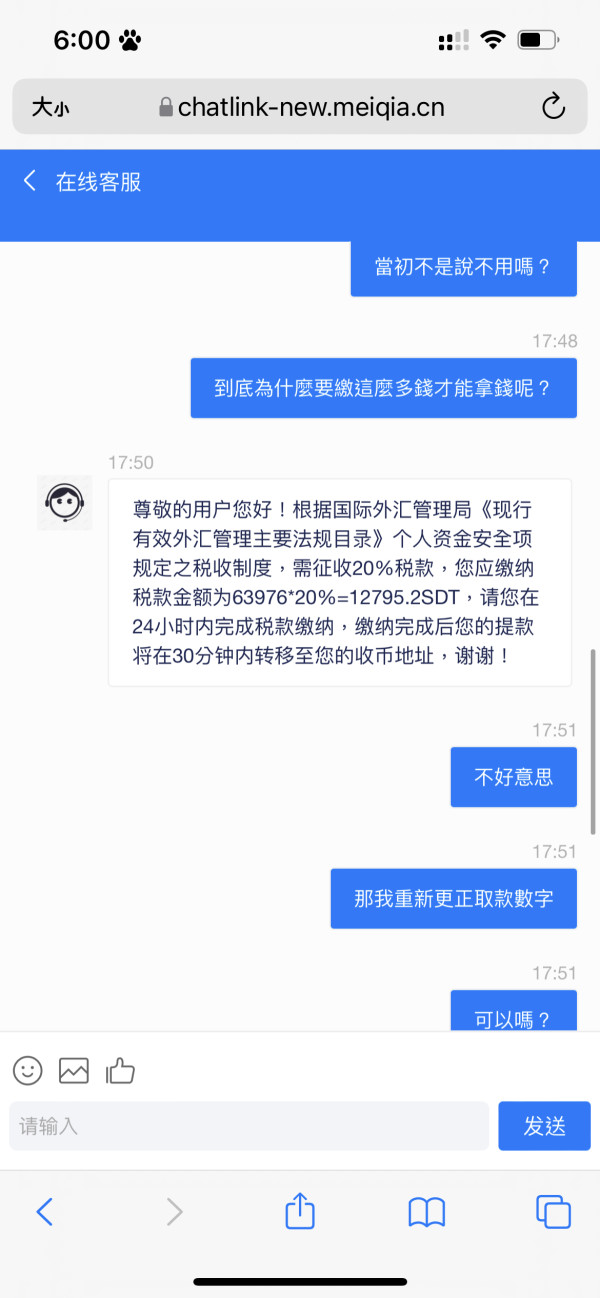

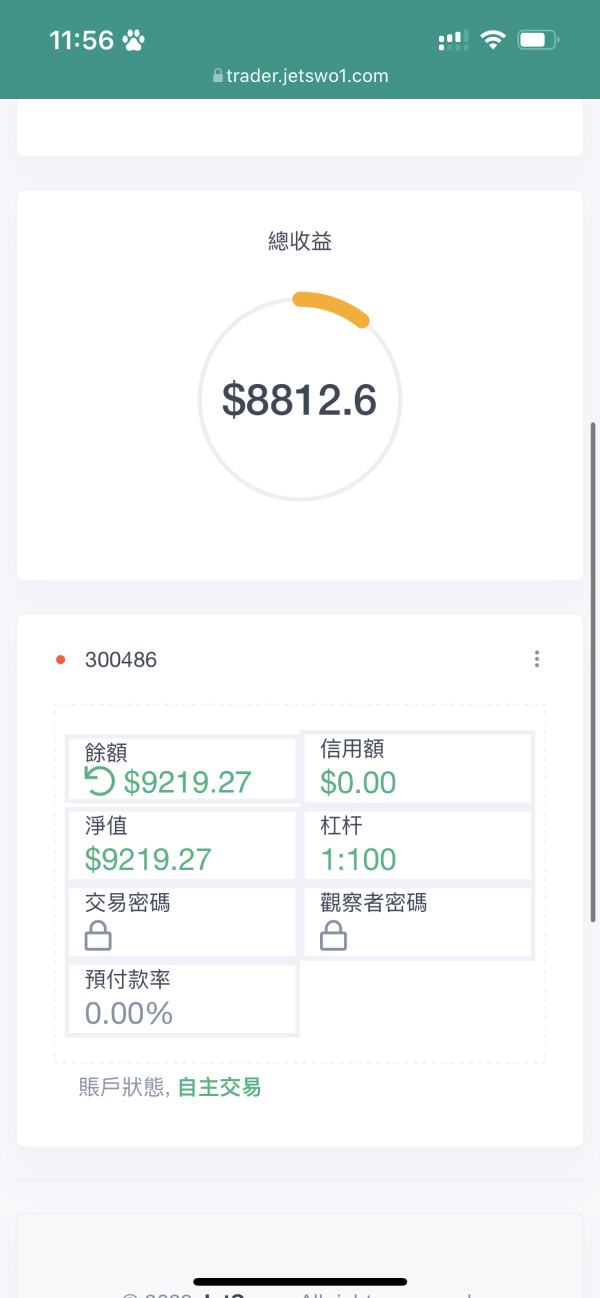

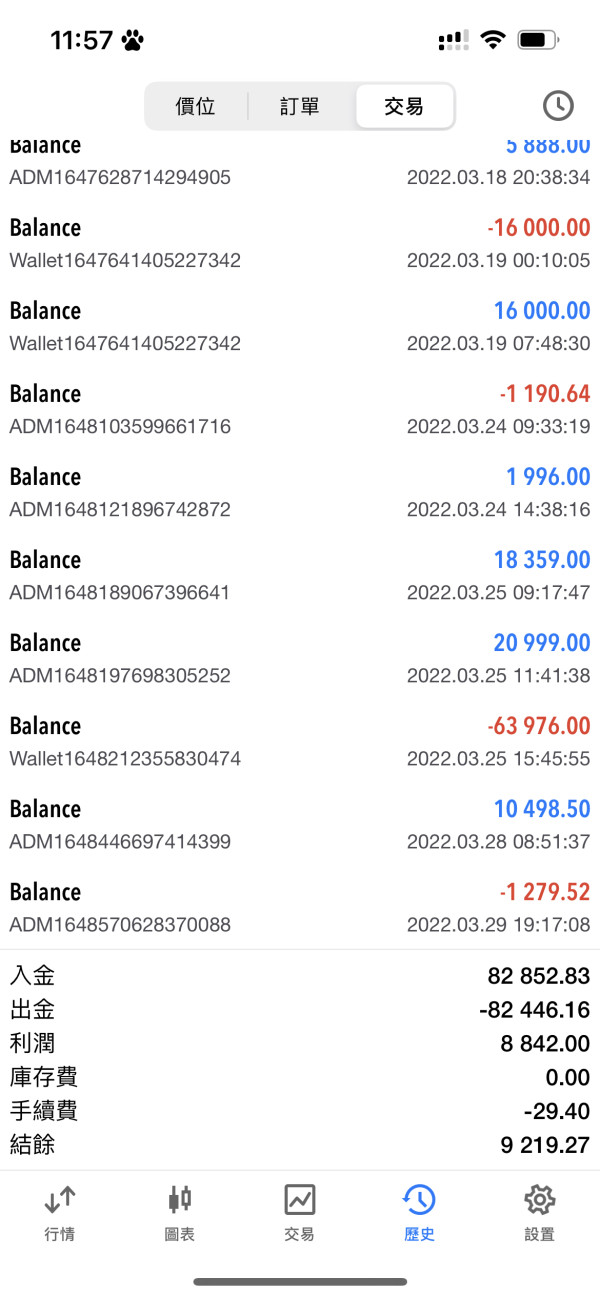

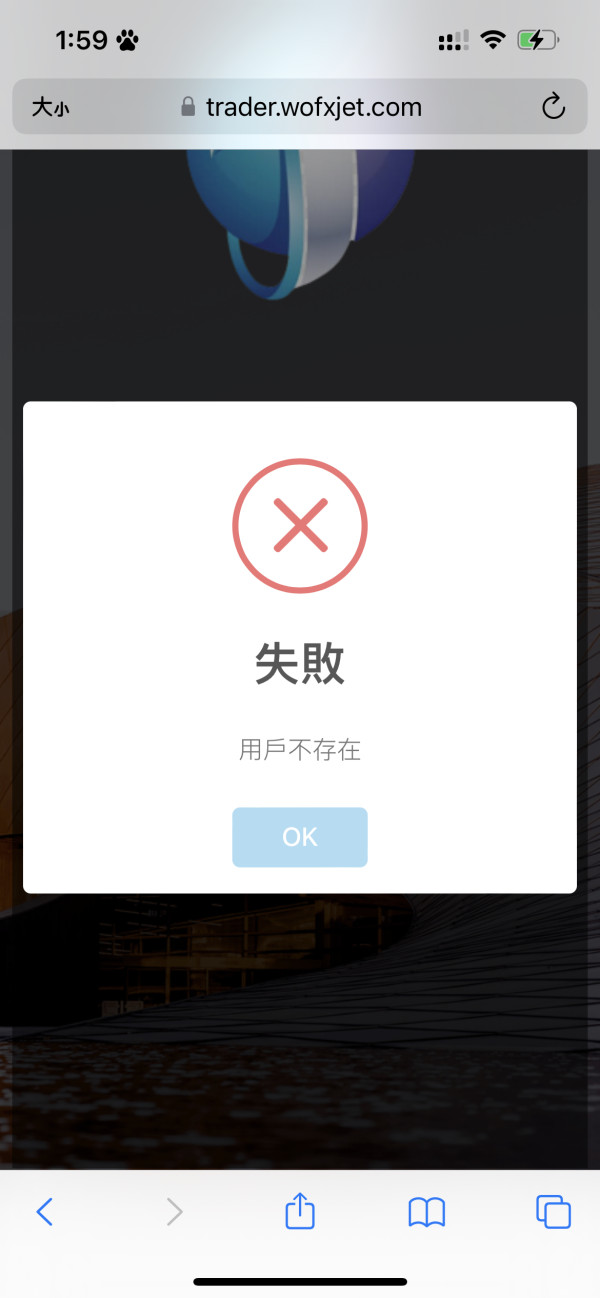

Withdrawal Processes and Feedback

While flexibility may exist in deposit options, the withdrawal processes seem mired in hidden fees and unexplained delays. Numerous reports articulate users' frustrations over their inability to access or withdraw funds freely.

Conclusion

In navigating the intricate landscape of imsecurities, the insights presented raise serious considerations about its viability as a trading platform. While marketed as a low-cost option for novice traders, the prevailing issues surrounding transparency, regulatory oversight, and user feedback significantly overshadow potential benefits. This brokerage may harbor lucrative opportunities, but its considerable risk factors indicate that imsecurities is more likely a trap than an ideal trading avenue. Potential traders are strongly advised to prioritize fund safety and undertake thorough diligence before committing their resources to imsecurities.