Is ITOFX safe?

Business

License

Is ITOFX A Scam?

Introduction

ITOFX is a forex broker that has positioned itself in the global trading market, aiming to provide a platform for traders looking to engage in various financial instruments. Established in 2017, ITOFX claims to offer competitive trading conditions and access to a wide range of assets, including forex, commodities, and indices. However, as with any trading platform, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. The forex market is rife with both legitimate opportunities and potential scams, making it essential for traders to assess the credibility and safety of their chosen brokers. In this article, we will investigate whether ITOFX is safe or if it presents risks to potential investors. Our analysis is based on a review of regulatory information, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy and safety. Regulatory bodies oversee financial institutions to ensure they adhere to specific standards that protect traders' interests. In the case of ITOFX, it is essential to evaluate its regulatory framework and licensing.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 476086 | New Zealand | Unverified |

ITOFX operates under the Financial Service Providers Register (FSPR) in New Zealand, but it has been flagged for having an unverified regulatory status. This raises significant concerns about its legitimacy. While the FSPR does provide a framework for financial institutions, the lack of a verified license from a more reputable regulatory body, such as the FCA or ASIC, poses a risk for traders. The absence of strict regulatory oversight can lead to potential issues regarding fund safety, transparency, and ethical trading practices. Furthermore, past evaluations indicate that ITOFX has a low score on platforms like WikiFX, which suggests a concerning level of risk associated with trading through this broker. Therefore, when considering the question, "Is ITOFX safe?" it is vital to acknowledge the implications of its regulatory status.

Company Background Investigation

To further understand whether ITOFX is safe for trading, it is crucial to delve into the company's history and ownership structure. ITOFX was founded in 2017, and while it has been operational for several years, the details of its ownership and management team remain somewhat opaque. The limited information available raises questions about transparency and accountability.

The management teams background and experience in the financial industry are essential indicators of a broker's reliability. However, specific details about ITOFX's management have not been extensively disclosed, which is a red flag for potential investors. A transparent company typically shares information about its leadership and their qualifications, which can instill confidence in traders. Furthermore, the lack of detailed disclosures about the company's operational practices and financial health can lead to skepticism regarding its legitimacy.

In terms of transparency, ITOFX does not provide comprehensive information about its operational practices, which is critical for building trust with clients. Without clear information on its ownership and management, it becomes challenging for traders to assess the broker's credibility. As such, the question of "Is ITOFX safe?" remains uncertain, and potential clients should proceed with caution.

Trading Conditions Analysis

The trading conditions offered by a broker significantly influence a trader's experience and profitability. ITOFX claims to provide competitive spreads and a variety of trading instruments. However, it is essential to scrutinize the fee structure and any potential hidden costs that may affect traders.

| Fee Type | ITOFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 1.0 pips |

| Commission Model | 0% | 0.1% - 0.5% |

| Overnight Interest Range | Varies | Varies |

ITOFX advertises a spread of 0.2 pips for major currency pairs, which appears attractive compared to the industry average of 1.0 pips. Additionally, the broker claims to have a 0% commission model, which can be appealing to traders looking to minimize costs. However, it is crucial to understand the implications of such claims. Often, brokers with low spreads may compensate by increasing other fees or offering poor execution quality.

Moreover, the overnight interest rates at ITOFX are not clearly defined, which can lead to unexpected costs for traders holding positions overnight. The lack of transparency regarding these fees can signal potential risks. Therefore, while the initial trading conditions may seem favorable, traders should remain vigilant and inquire about any additional charges that may apply.

Client Fund Safety

Ensuring the safety of client funds is paramount when evaluating a broker's reliability. ITOFX must implement robust measures to protect traders' investments, including fund segregation and investor protection policies.

ITOFX claims to follow standard practices for fund safety, such as maintaining segregated accounts for client funds. This means that traders' money is kept separate from the broker's operating funds, which is a positive sign. However, the effectiveness of these measures largely depends on the broker's regulatory oversight and compliance with local laws.

Additionally, it is essential to assess whether ITOFX offers negative balance protection, which prevents traders from losing more money than they have deposited. This feature is critical for protecting clients from unexpected market volatility. Unfortunately, there is limited information available regarding ITOFX's policies on fund safety and investor protection, which raises concerns.

Historically, unregulated or poorly regulated brokers have faced issues related to fund misappropriation and withdrawal difficulties. If ITOFX does not have a strong track record of protecting client funds, it could pose a significant risk to traders. Thus, when considering "Is ITOFX safe?" the lack of detailed information on fund security measures warrants caution.

Customer Experience and Complaints

Understanding customer experiences and feedback is vital in assessing a broker's credibility. Reviews and complaints from current and former clients can provide insights into the operational practices and reliability of ITOFX.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Poor Customer Support | Medium | Fair |

| Misleading Advertising | High | Poor |

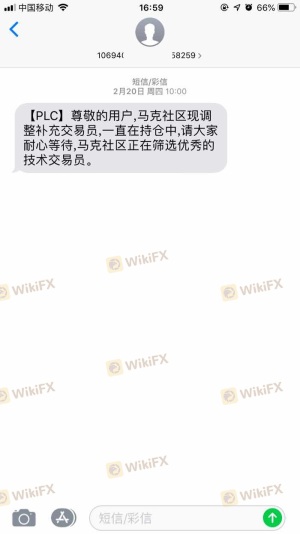

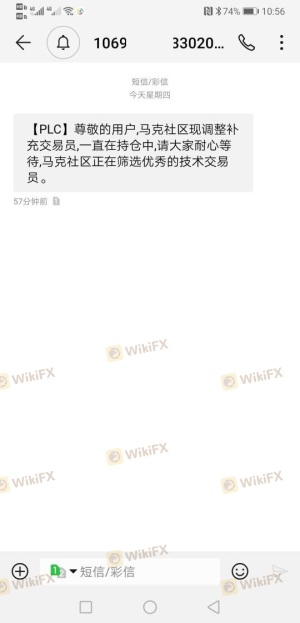

Common complaints regarding ITOFX include difficulties in withdrawing funds and inadequate customer support. Many users have reported challenges in accessing their capital after making requests for withdrawals, which raises significant red flags about the broker's trustworthiness. Additionally, the quality of customer service has been criticized, with reports of slow response times and unhelpful support representatives.

A few specific cases highlight these issues. For example, one trader reported that after initiating a withdrawal request, they faced numerous delays and received vague responses from the support team. Another user mentioned that their account was blocked without explanation, leaving them unable to access their funds. Such experiences contribute to the growing concern about whether ITOFX is safe for trading.

Platform and Execution

The trading platform's performance, stability, and user experience are crucial aspects of a trader's overall experience. ITOFX utilizes the MetaTrader 4 (MT4) platform, which is widely recognized for its reliability and user-friendly interface. However, the quality of order execution, slippage, and potential manipulation are critical factors to consider.

Traders have reported mixed experiences with ITOFX's execution quality. While some users praise the platform's ease of use, others have raised concerns about frequent slippage and occasional rejections of orders. In a volatile market, these issues can significantly impact a trader's profitability and lead to frustrating experiences. Additionally, any signs of platform manipulation—such as artificially widening spreads during high volatility—can indicate a lack of integrity on the broker's part.

Given these insights, traders should carefully evaluate their experiences with ITOFX's platform before committing significant funds. The question "Is ITOFX safe?" encompasses not only the regulatory aspects but also the reliability of its trading environment.

Risk Assessment

Engaging with any broker entails inherent risks. When considering ITOFX, it is essential to evaluate the comprehensive risk landscape associated with trading on this platform.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unverified regulatory status |

| Fund Safety Risk | Medium | Limited information on fund security |

| Execution Risk | Medium | Reports of slippage and order rejections |

| Customer Support Risk | High | Complaints about poor support |

The overall risk associated with trading on ITOFX appears elevated, primarily due to its unverified regulatory status and reported issues regarding fund safety and customer support. Traders should approach this broker with caution, especially if they are risk-averse or new to the trading environment.

To mitigate risks, traders should consider starting with a small investment and thoroughly researching the broker's practices. Additionally, it is advisable to look for alternative brokers with a solid regulatory framework and a proven track record of protecting client funds.

Conclusion and Recommendations

In conclusion, the investigation into ITOFX raises several concerns about its safety and legitimacy as a forex broker. The lack of verified regulation, combined with reports of withdrawal difficulties and poor customer support, suggests that traders should exercise caution when considering this platform. While ITOFX may offer attractive trading conditions, the potential risks associated with its operations cannot be overlooked.

For traders seeking a reliable and safe trading experience, it is advisable to consider alternative brokers that are well-regulated and have established a positive reputation in the industry. Brokers such as IG, OANDA, or Forex.com may present safer options for those looking to engage in forex trading. Ultimately, the question "Is ITOFX safe?" leans towards a cautious response, and potential investors should conduct thorough research before proceeding.

Is ITOFX a scam, or is it legit?

The latest exposure and evaluation content of ITOFX brokers.

ITOFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ITOFX latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.