Is Ingoinvest safe?

Business

License

Is IngoInvest A Scam?

Introduction

IngoInvest has emerged as a player in the forex trading market, positioning itself as an online broker that offers a variety of trading instruments, including forex pairs, commodities, and indices. However, the rise of unregulated brokers in the financial industry has led to an increased need for traders to exercise caution when selecting a trading platform. The importance of assessing the legitimacy and reliability of brokers cannot be overstated, as many traders have fallen victim to scams that result in significant financial losses. This article aims to provide a comprehensive evaluation of IngoInvest, analyzing its regulatory status, company background, trading conditions, client fund safety, customer experiences, and overall risk profile. The findings are based on extensive research and reviews from multiple credible sources.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy. IngoInvest is owned by Rapid Develop Group Ltd, which is based in the Marshall Islands. Notably, it operates without any formal regulation, which raises serious concerns regarding its trustworthiness. The absence of oversight from recognized regulatory bodies means that clients may have little recourse in the event of disputes or financial discrepancies.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Marshall Islands | Unverified |

The lack of regulatory oversight is a significant red flag. Regulated brokers are subject to strict guidelines and must adhere to ethical standards, which helps protect traders' interests. IngoInvest's operations in the unregulated environment of the Marshall Islands expose clients to increased risks, including potential fraud and the mismanagement of funds. Moreover, the absence of a history of compliance with regulatory standards further solidifies the notion that IngoInvest may not be a safe choice for traders.

Company Background Investigation

IngoInvests history and ownership structure reveal a lack of transparency that is often characteristic of fraudulent brokers. The company claims to provide innovative trading solutions, but there is little verifiable information about its establishment or operational history. Rapid Develop Group Ltd, the parent company, does not appear to have a credible track record or a well-defined corporate structure, which raises concerns about its legitimacy.

The management team behind IngoInvest is also shrouded in mystery, with limited information available regarding their professional qualifications or industry experience. This lack of transparency is troubling, as reputable brokers typically provide detailed information about their leadership and operational practices. The overall opacity surrounding IngoInvest contributes to the perception that it may not be a safe broker for traders.

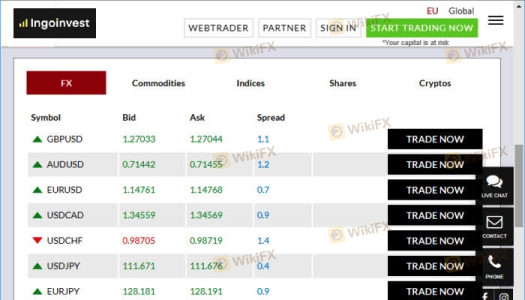

Trading Conditions Analysis

An examination of IngoInvest's trading conditions reveals a complex fee structure that could potentially be detrimental to traders. The broker advertises high leverage ratios of up to 1:300, which can amplify both gains and losses. However, these enticing offers often come with hidden costs that are not disclosed upfront.

| Fee Type | IngoInvest | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 1.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads, commissions, and overnight fees raises concerns about the broker's transparency. Traders may find themselves facing unexpected charges that could significantly impact their profitability. Moreover, the lack of a demo account restricts potential clients from testing the platform before committing funds, which is a common practice among reputable brokers.

Client Fund Safety

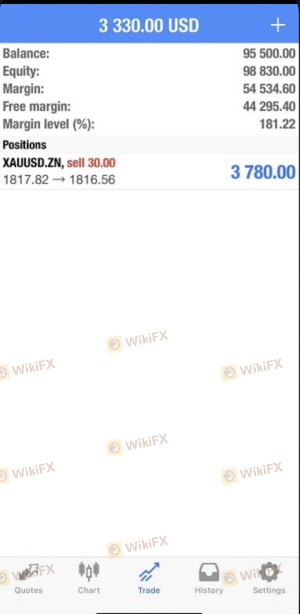

The safety of client funds is paramount when considering a trading platform. IngoInvest does not provide adequate information regarding its fund safety measures, such as segregated accounts or investor protection policies. The absence of these critical safeguards means that clients' deposits may not be secure, leaving them vulnerable to potential losses in the event of the broker's insolvency.

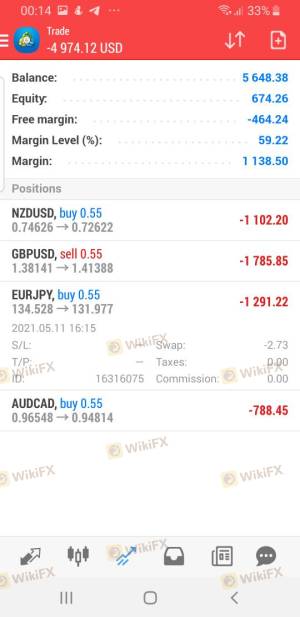

Furthermore, the lack of negative balance protection means that traders could potentially lose more than their initial investment, which is a significant risk. Historical accounts of fund mismanagement and withdrawal issues associated with IngoInvest further exacerbate concerns about the safety of client funds.

Customer Experience and Complaints

Analyzing customer feedback reveals a mixed bag of experiences with IngoInvest. While some users report positive interactions and satisfactory trading experiences, a significant number of complaints highlight serious issues, particularly regarding withdrawal requests and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Fair |

| Account Closure Issues | High | Poor |

Common complaints from clients include difficulties in withdrawing funds and unresponsive customer support. For instance, one user reported a frustrating experience where their withdrawal request was delayed for several months, leading to significant distress. Such patterns of complaints raise alarms about the reliability of IngoInvest as a trading platform.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for traders. IngoInvest claims to offer a user-friendly interface with access to the popular MetaTrader 4 platform. However, users have reported issues related to order execution, including slippage and rejected orders, which can severely impact trading outcomes.

The platforms stability is also a concern, with some users experiencing frequent downtime and technical glitches. These issues are indicative of potential manipulation or operational inefficiencies that can hinder a trader's ability to execute strategies effectively.

Risk Assessment

Engaging with IngoInvest presents several risks that potential clients should consider. The lack of regulation, combined with a history of client complaints and operational opacity, raises the risk level significantly.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of fund protection measures |

| Operational Risk | Medium | Technical issues and execution delays |

To mitigate risks, traders should conduct thorough research and consider using regulated brokers with established reputations. It is also advisable to start with minimal investments until they can verify the broker's reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that IngoInvest poses significant risks to traders, primarily due to its unregulated status and concerning customer feedback. The absence of regulatory oversight, combined with a lack of transparency regarding fees and fund safety, indicates that IngoInvest is not a safe option for traders looking to invest their funds.

For those seeking to engage in forex trading, it is advisable to consider regulated alternatives that offer robust protections and transparent operations. Brokers such as IG Group, OANDA, or Forex.com provide a safer trading environment with comprehensive regulatory oversight. Ultimately, traders must prioritize safety and due diligence to protect their investments in the volatile forex market.

Is Ingoinvest a scam, or is it legit?

The latest exposure and evaluation content of Ingoinvest brokers.

Ingoinvest Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ingoinvest latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.