Regarding the legitimacy of INFINOX forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is INFINOX safe?

Business

License

Is INFINOX markets regulated?

The regulatory license is the strongest proof.

FCA Inst Market Making (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Inst Market Making (MM)

Licensed Entity:

Infinox Capital Limited

Effective Date:

2009-09-15Email Address of Licensed Institution:

compliance@infinox.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://infinox.co.uk/enExpiration Time:

--Address of Licensed Institution:

90 Bartholomew Close London EC1A 7BN UNITED KINGDOMPhone Number of Licensed Institution:

+4402045151797Licensed Institution Certified Documents:

Is Infinox A Scam?

Introduction

Infinox is a global forex and CFD broker that has been operating since 2009, headquartered in London, UK. It positions itself as a multi-regulated broker, providing access to a range of financial markets, including forex, commodities, and indices. As the trading landscape becomes increasingly crowded, it is essential for traders to exercise caution and thoroughly evaluate brokers before committing their funds. The potential for scams in the forex market necessitates a comprehensive understanding of a broker's regulatory status, trading conditions, and overall reputation. This article aims to provide a balanced assessment of Infinox's legitimacy and safety by analyzing its regulatory framework, company background, trading conditions, customer safety measures, and user experiences.

Regulation and Legitimacy

When assessing the trustworthiness of a forex broker like Infinox, regulatory oversight plays a crucial role. Infinox is regulated by several reputable authorities, which adds a layer of security for traders. Regulatory bodies enforce strict compliance measures to protect investors, ensuring that brokers operate transparently and ethically. Below is a summary of Infinox's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 501057 | United Kingdom | Verified |

| SCB | SIA-F-188 | Bahamas | Verified |

| FSCA | 50506 | South Africa | Verified |

| FSC | GB20025832 | Mauritius | Verified |

The FCA (Financial Conduct Authority) is considered a tier-1 regulator, known for its stringent rules and investor protection schemes, including the Financial Services Compensation Scheme (FSCS), which protects clients' funds up to £85,000. In contrast, the other regulatory bodies, such as the SCB and FSC, are classified as tier-2 and tier-3 regulators, respectively, often with less stringent oversight. While Infinox's FCA regulation is a positive sign, the varying quality of oversight in its other jurisdictions raises questions about the level of protection for international clients. Historical compliance records indicate that Infinox has maintained a clean regulatory history, which enhances its credibility.

Company Background Investigation

Infinox was founded in 2009 and has since established itself as a significant player in the forex and CFD markets. The company operates under the ownership of Infinox Capital Ltd, which is registered in the UK. The management team comprises experienced professionals with extensive backgrounds in finance and trading, contributing to the broker's growth and reputation. Infinox's transparency is evident in its corporate structure, with clear disclosures about its operations and regulatory affiliations.

The firm has also made efforts to build a reputable brand, participating in various industry events and receiving accolades for its customer service and trading conditions. However, the presence of multiple regulatory entities raises concerns about the consistency of service and protection across different regions. Traders should be aware that while the UK entity is heavily regulated, those trading under offshore entities may not enjoy the same level of protection.

Trading Conditions Analysis

Infinox offers competitive trading conditions, including a variety of account types and a transparent fee structure. The broker provides both STP (Straight Through Processing) and ECN (Electronic Communication Network) accounts, catering to different trading preferences. The overall fee structure is designed to be competitive; however, traders should be aware of specific fees that could impact their trading profitability. Below is a comparative summary of Infinox's trading costs:

| Fee Type | Infinox | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.5 pips |

| Commission Model | $7.50 per lot | $10 per lot |

| Overnight Interest Range | 0.5% - 2% | 1% - 3% |

While the spreads offered by Infinox are competitive, some traders have reported higher-than-expected overnight interest rates, particularly for positions held over longer periods. This could potentially deter swing traders or those looking to hold positions longer. Overall, the trading conditions at Infinox are favorable compared to many other brokers, but traders should remain vigilant about the potential for hidden costs.

Customer Funds Safety

The safety of customer funds is paramount in the forex trading industry. Infinox implements several measures to ensure the security of client deposits. Client funds are held in segregated accounts, which means that they are kept separate from the broker's operational funds. This practice is crucial in the event of insolvency, as it helps protect clients' investments. Additionally, Infinox offers negative balance protection, ensuring that traders cannot lose more than their deposited amount.

Despite these safety measures, the broker's offshore entities, such as those regulated by the SCB and FSC, may not provide the same level of protection as the FCA. Historical incidents related to fund safety have not been reported prominently, indicating that Infinox has generally maintained a good track record in this area.

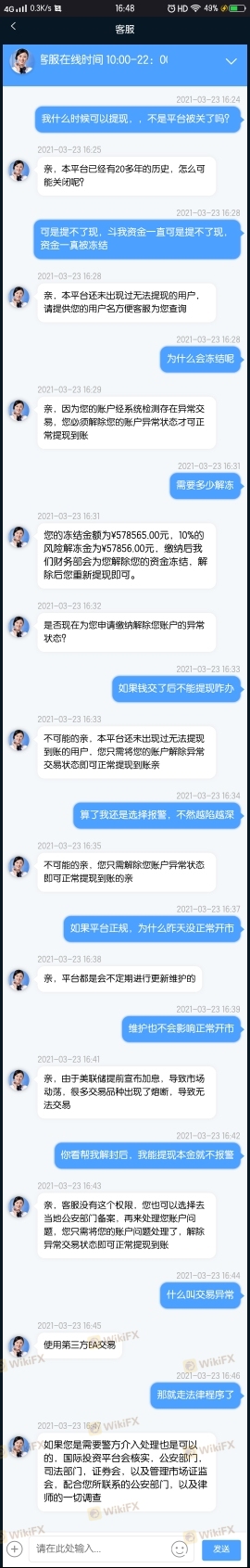

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Infinox has received mixed reviews from users, with some praising its trading conditions and customer support, while others have raised concerns about withdrawal issues and customer service responsiveness. Common complaints include delays in fund withdrawals and difficulties in accessing customer support. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Support Issues | Medium | Average response |

| Platform Stability Issues | Low | Generally responsive |

For instance, one user reported a significant delay in processing a withdrawal, stating that the broker's customer service was unresponsive. This highlights the importance of reliable customer support in maintaining trader trust. While many traders have reported positive experiences with Infinox, the recurring issues with withdrawals and support should be carefully considered by potential clients.

Platform and Trade Execution

Infinox offers its clients access to the widely-used MetaTrader 4 and MetaTrader 5 platforms, known for their robust functionality and user-friendly interfaces. The platforms provide a range of tools for technical analysis, automated trading, and seamless execution of trades. However, some users have reported instances of slippage and order rejections during high volatility periods, which can impact trading performance.

Overall, the execution quality is generally satisfactory, but traders should be aware of the potential for slippage, particularly in fast-moving markets. Any signs of platform manipulation or unfair practices have not been substantiated by substantial evidence, but traders should remain vigilant.

Risk Assessment

Using Infinox as a trading platform comes with inherent risks, as with any broker. Below is a risk assessment summary highlighting key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Varying regulatory standards across regions. |

| Withdrawal Risk | High | Reports of delays and issues with withdrawals. |

| Market Risk | High | Forex trading is inherently risky due to volatility. |

To mitigate these risks, traders should conduct thorough research, maintain a diversified portfolio, and use risk management tools such as stop-loss orders. Additionally, ensuring that funds are only deposited with the FCA-regulated entity can provide an extra layer of security.

Conclusion and Recommendations

Based on the analysis presented, Infinox is not a scam but operates as a legitimate broker, particularly under its FCA regulation. However, potential clients should remain cautious, especially those considering trading through offshore entities. While Infinox offers competitive trading conditions and robust safety measures, the mixed customer feedback regarding withdrawals and support raises concerns that should not be overlooked.

For traders who prioritize safety and regulatory oversight, it is advisable to engage with Infinox's FCA-regulated entity. However, those who may be more risk-tolerant and are looking for higher leverage options might consider other brokers that offer similar services with better reputations in customer support.

In summary, while Infinox presents itself as a credible broker, traders should conduct their due diligence and consider their individual trading needs and risk tolerance before proceeding.

Is INFINOX a scam, or is it legit?

The latest exposure and evaluation content of INFINOX brokers.

INFINOX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INFINOX latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.