Infinox 2025 Review: Everything You Need to Know

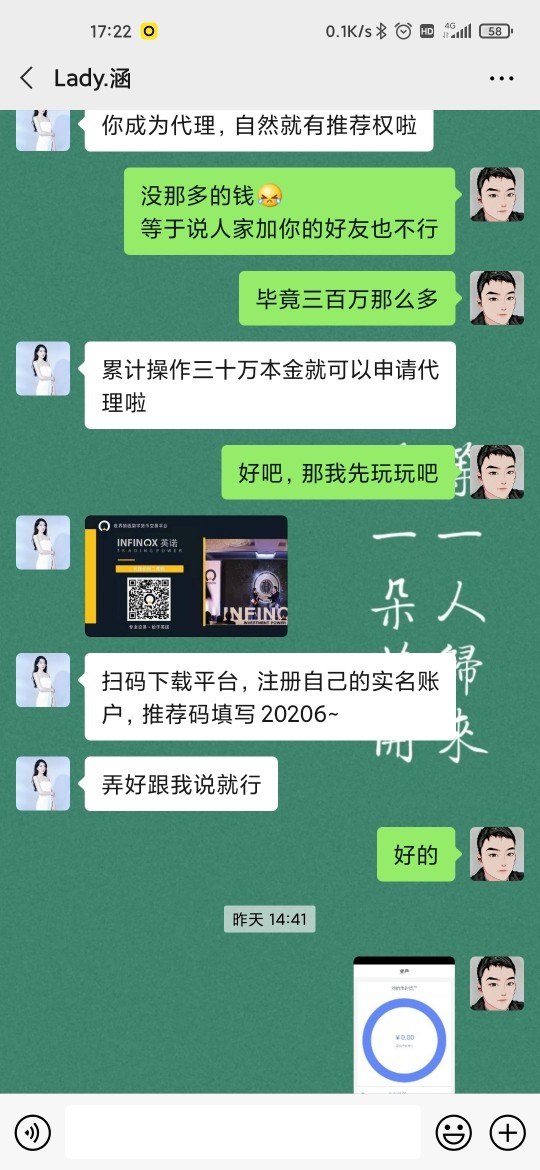

Infinox, established in 2009, has emerged as a notable player in the forex and CFD trading landscape, offering a range of trading instruments and robust platforms. While many users report positive experiences, a significant number of complaints regarding withdrawal issues and customer service cannot be overlooked. This review aims to provide a comprehensive overview of Infinox, highlighting both user experiences and expert opinions.

Note: It is crucial to recognize that Infinox operates through different entities across various regions, which may lead to discrepancies in services and regulatory protections. This aspect is vital for traders to consider when evaluating their options.

Ratings Overview

How We Rate Brokers: Based on user reviews, expert assessments, and an analysis of the broker's offerings.

Broker Overview

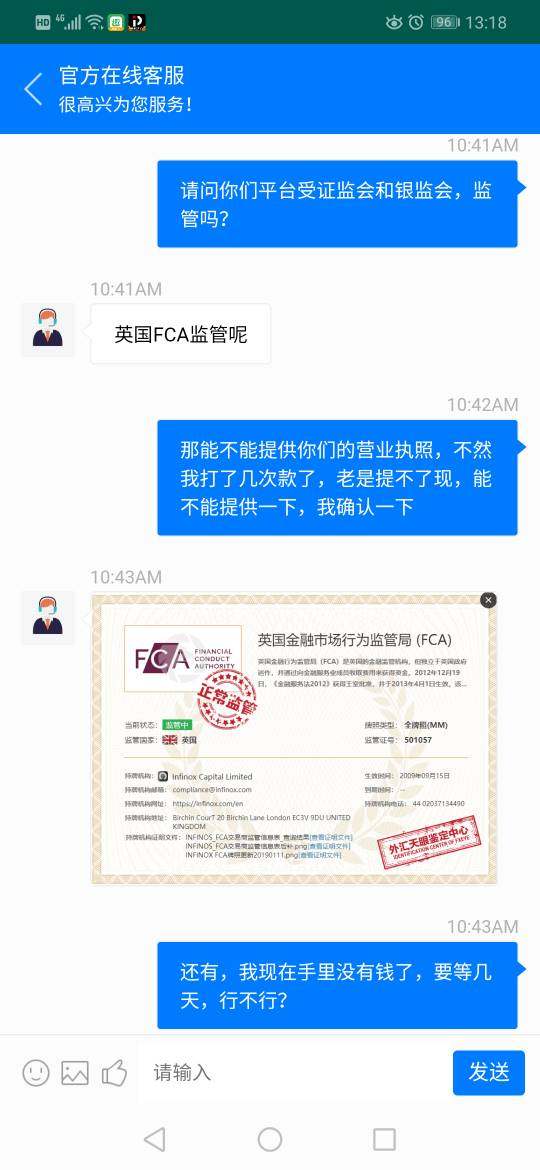

Infinox is a UK-based forex and CFD broker that has been operational since 2009. The broker offers trading on popular platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), catering to both novice and experienced traders. With a diverse array of assets available for trading—including forex, commodities, indices, and cryptocurrencies—Infinox aims to provide a comprehensive trading experience. The broker is regulated by the Financial Conduct Authority (FCA) in the UK, as well as by the Securities Commission of the Bahamas (SCB), the Financial Services Commission (FSC) in Mauritius, and the Financial Sector Conduct Authority (FSCA) in South Africa.

Detailed Analysis

Regulatory Regions

Infinox operates under multiple regulatory jurisdictions, including the UK (FCA), Bahamas (SCB), Mauritius (FSC), and South Africa (FSCA). The FCA regulation is particularly significant, as it ensures a higher level of oversight and protection for traders. However, the varying regulatory standards across different regions may impact the level of security and service quality experienced by traders.

Deposit/Withdrawal Currencies/Cryptocurrencies

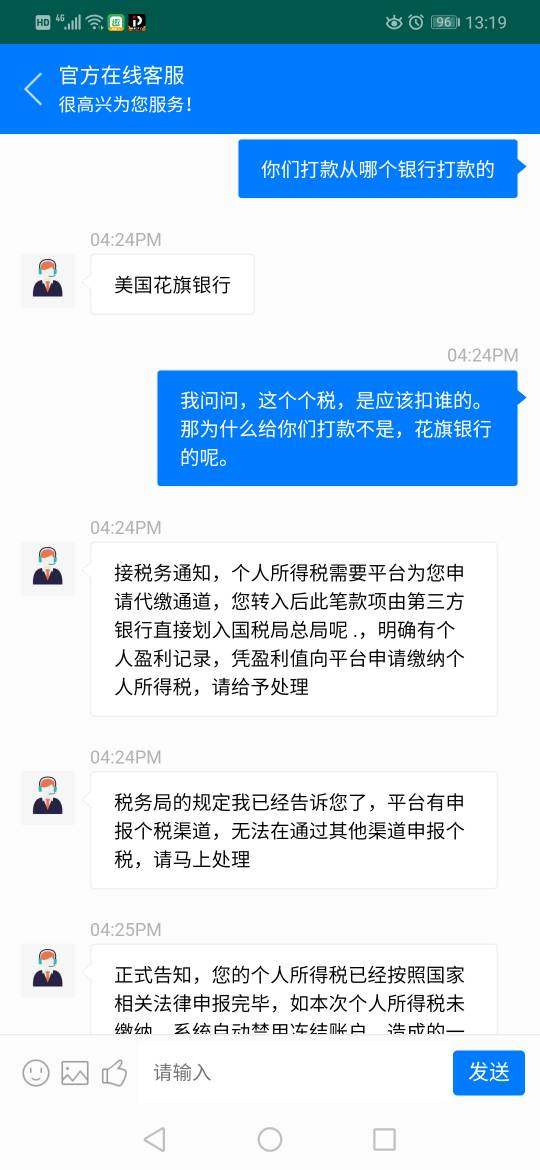

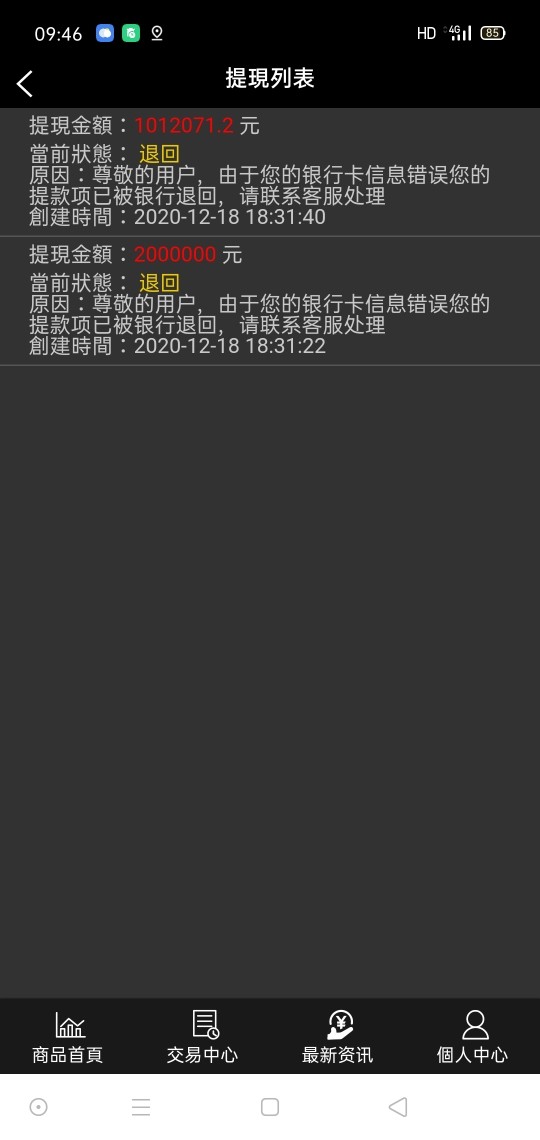

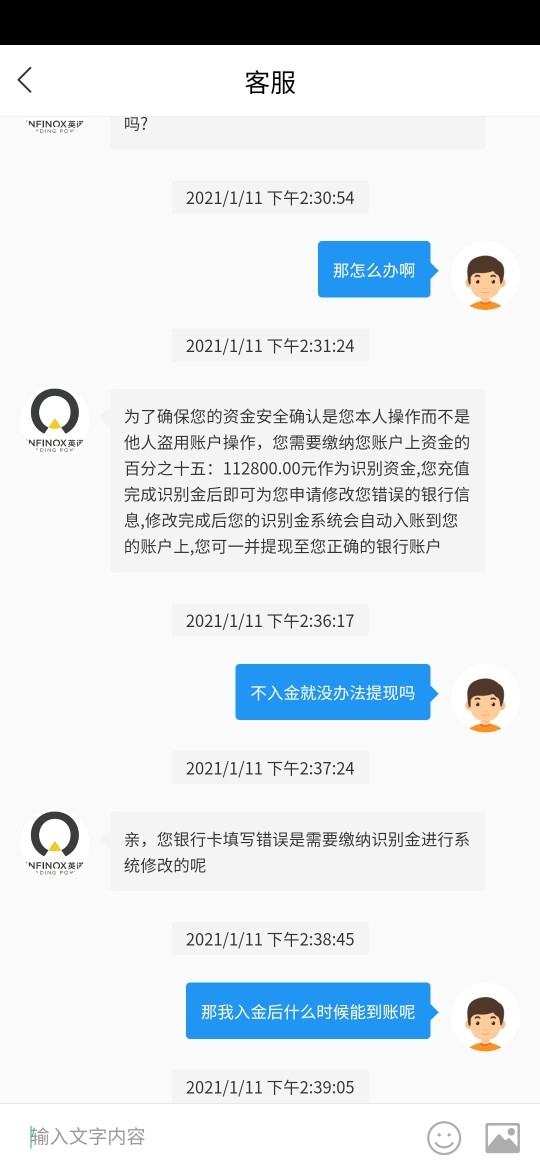

Infinox supports a range of deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller. The minimum deposit requirement is notably low, starting at just $1, which is appealing for new traders. Notably, Infinox does not charge fees for deposits or the first withdrawal each month, although subsequent withdrawals incur a fee of approximately $15 or €7, depending on the currency.

Minimum Deposit

The minimum deposit to open an account with Infinox is $1, making it accessible for traders at various levels. This low barrier to entry allows new traders to start without a significant financial commitment.

Currently, Infinox does not offer any promotional bonuses, which may be a disadvantage compared to other brokers that provide incentives for new traders. However, the absence of bonuses may also indicate a focus on maintaining transparency and compliance with regulatory standards.

Tradable Asset Categories

Infinox offers a diverse selection of trading instruments, including over 45 forex pairs, commodities (such as gold and silver), indices, and cryptocurrencies. This variety allows traders to diversify their portfolios and explore different market opportunities.

Costs (Spreads, Fees, Commissions)

Infinox's spreads are competitive, with average spreads reported at around 1.2 pips for major currency pairs. The broker's ECN accounts feature lower spreads starting at 0.2 pips, but they also charge a commission of $7.50 per lot. Overall, the cost structure is favorable compared to industry averages, although some users have reported higher fees on specific instruments.

Leverage

Infinox offers leverage up to 1:30 for retail clients under the FCA regulation, while international clients may access higher leverage ratios, up to 1:500, depending on the regulatory framework applicable to their accounts. This flexibility allows experienced traders to optimize their trading strategies but also increases the risk of significant losses.

Traders at Infinox can choose between MT4 and MT5 platforms, both of which are well-regarded in the trading community for their user-friendly interfaces and extensive features. Additionally, Infinox has integrated its proprietary platform, IX Social, which facilitates copy trading and community engagement among traders.

Restricted Areas

Infinox does not accept clients from the United States, which may limit access for traders in that region. Additionally, there may be restrictions based on local regulations in various countries.

Available Customer Service Languages

Infinox provides customer support in multiple languages, including English, Arabic, Spanish, and Portuguese. However, the support is available only 24/5, which may be a limitation for traders seeking assistance outside of these hours.

Repeat Ratings Overview

Detailed Breakdown

Account Conditions

Infinox offers both STP and ECN account types, allowing traders to choose based on their preferences for spreads and commissions. The flexibility in account types is appreciated, especially for those who prefer lower spreads or commission-free trading.

While Infinox provides essential trading tools, some users have noted that the educational resources could be more comprehensive. The availability of research tools, such as IX Intel, is a positive feature, but there is room for improvement in educational content for novice traders.

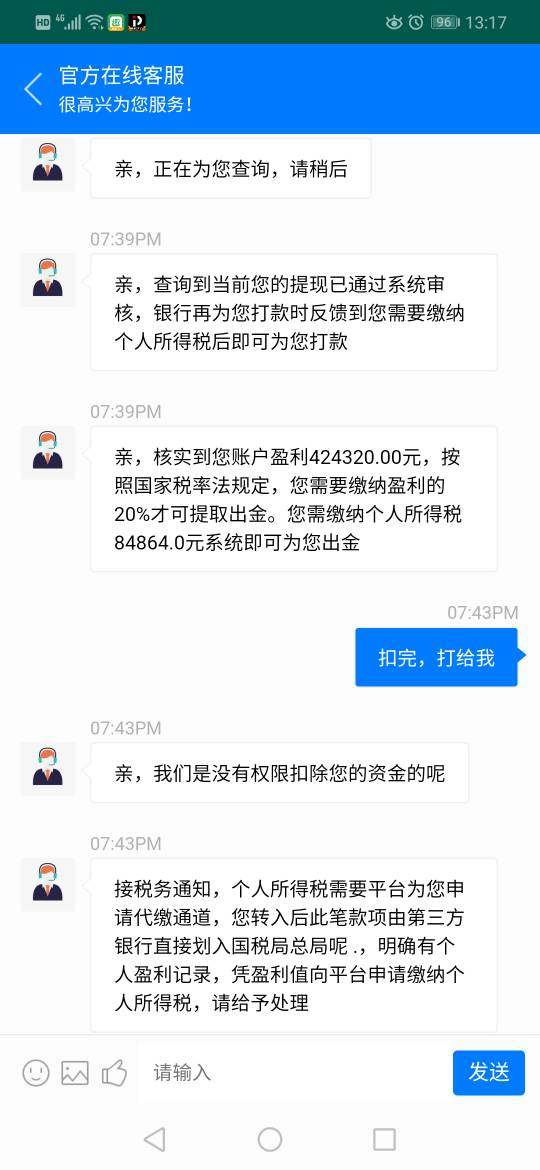

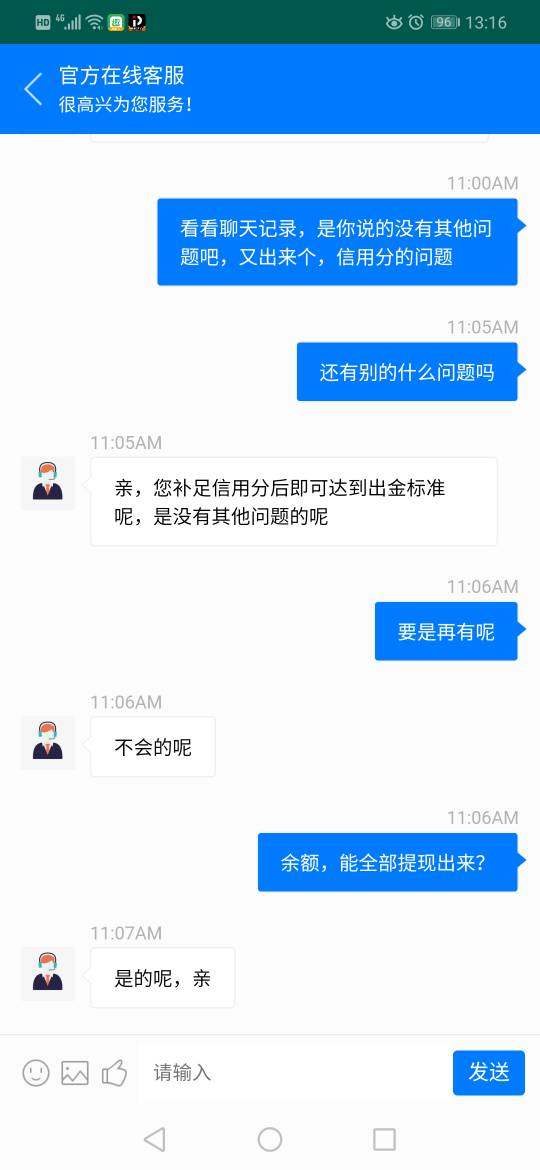

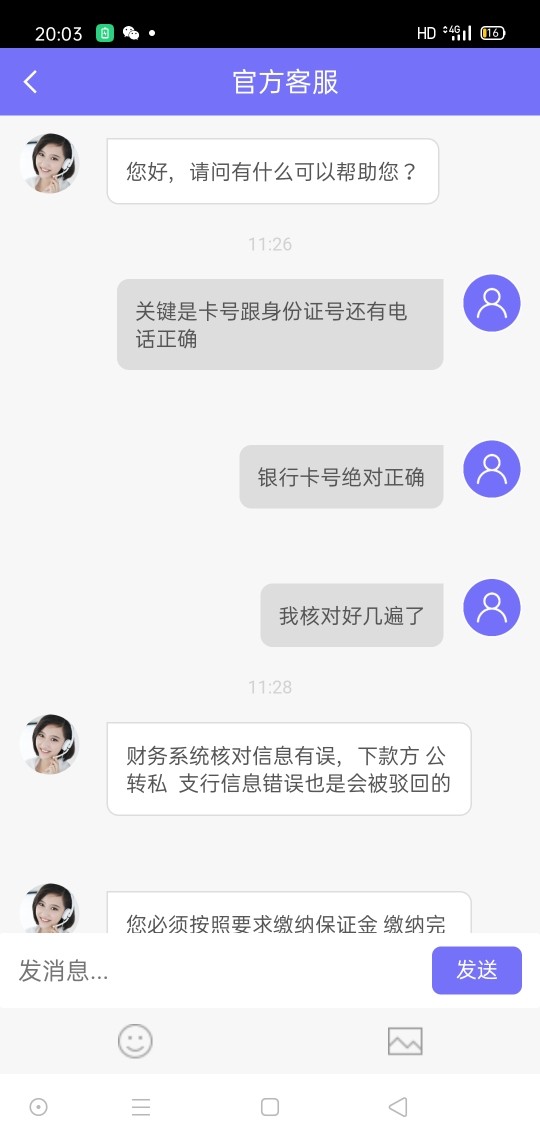

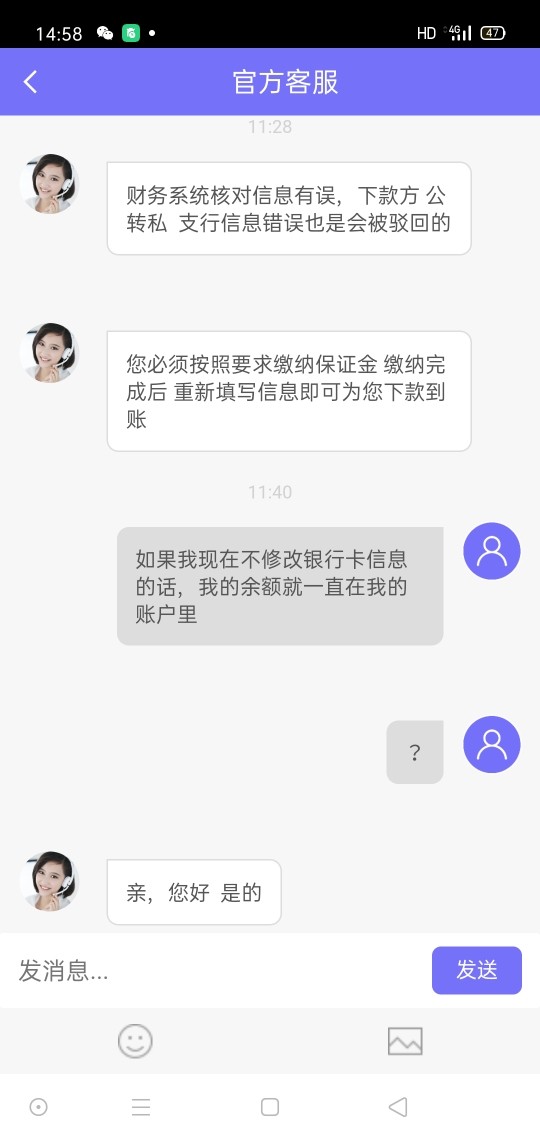

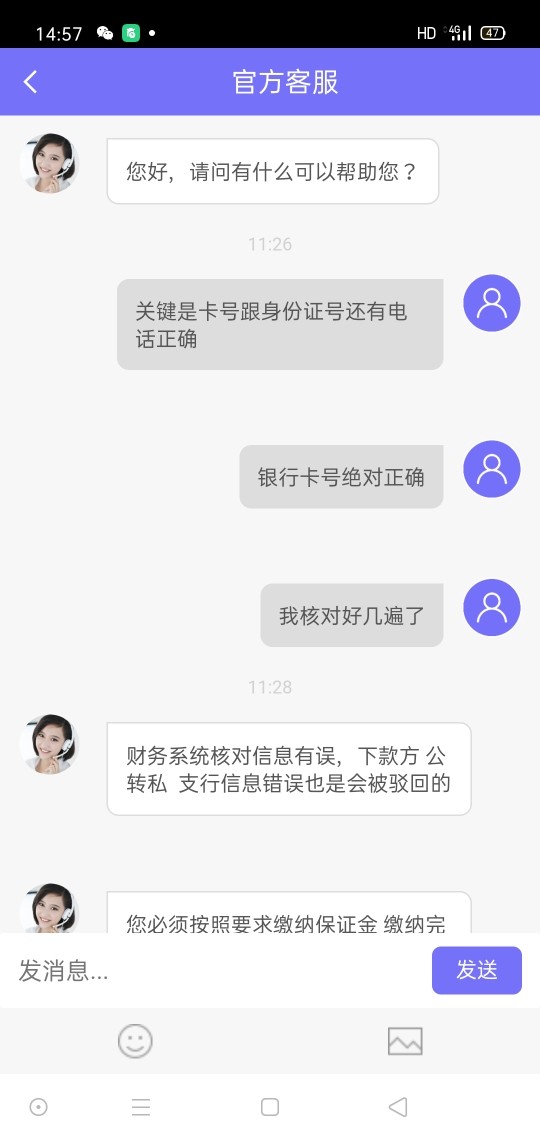

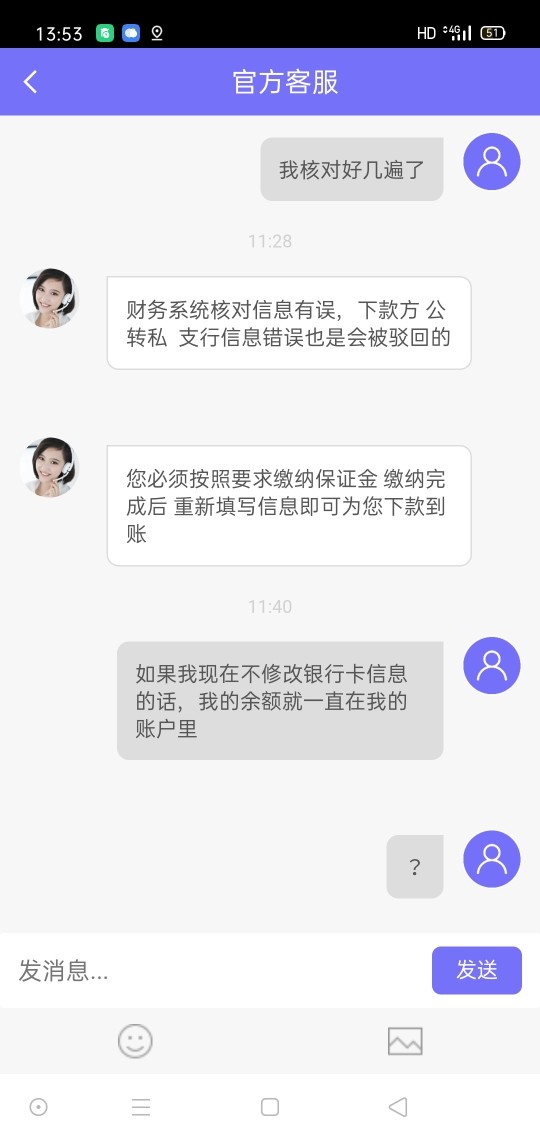

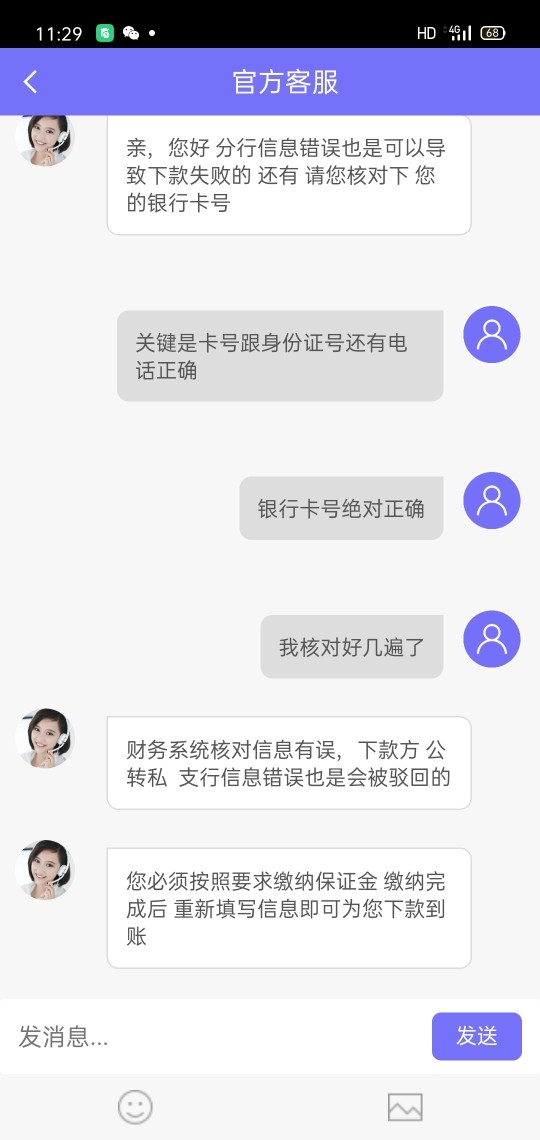

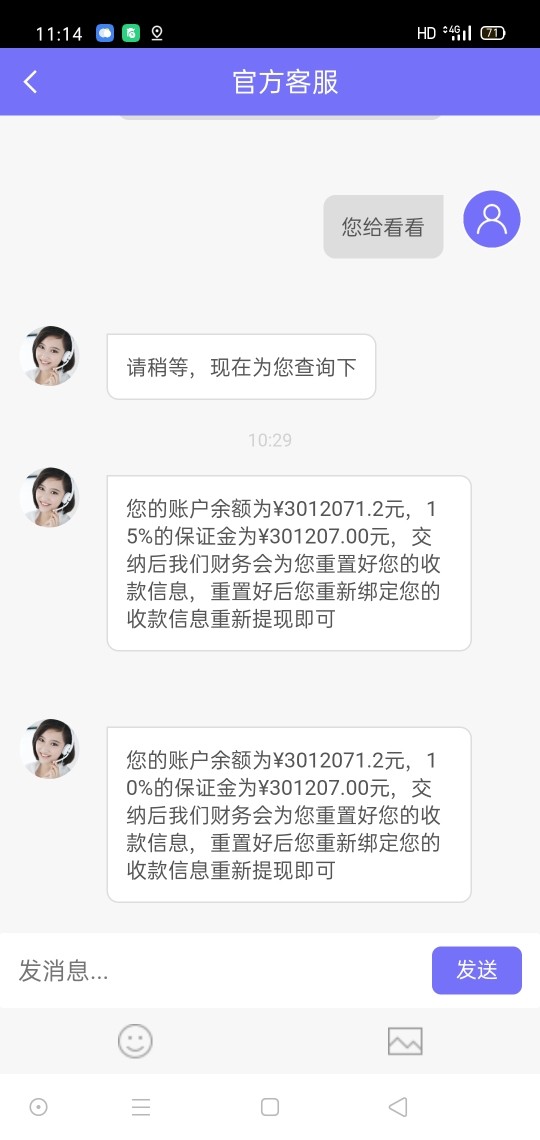

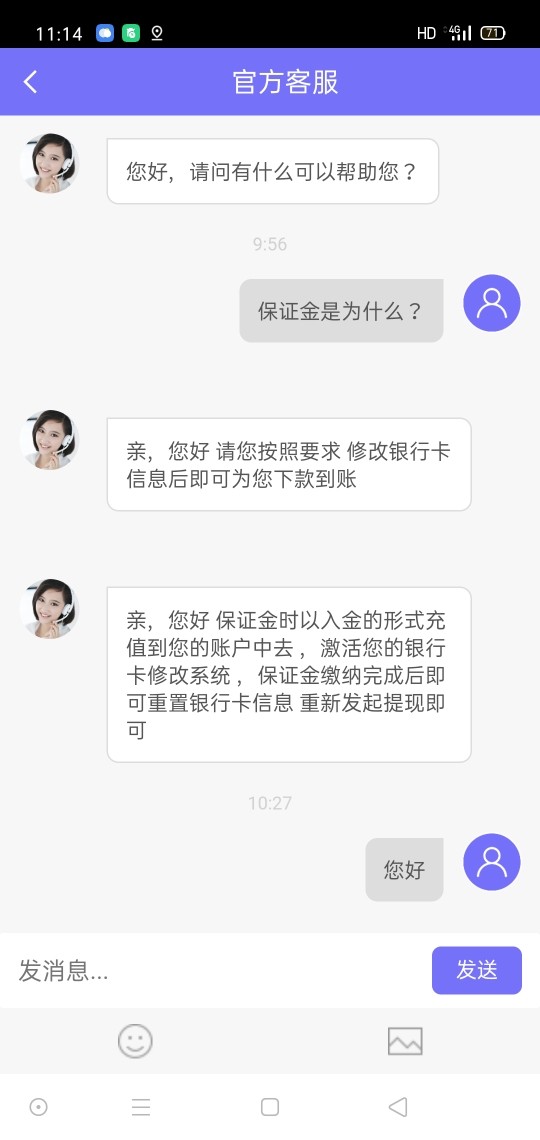

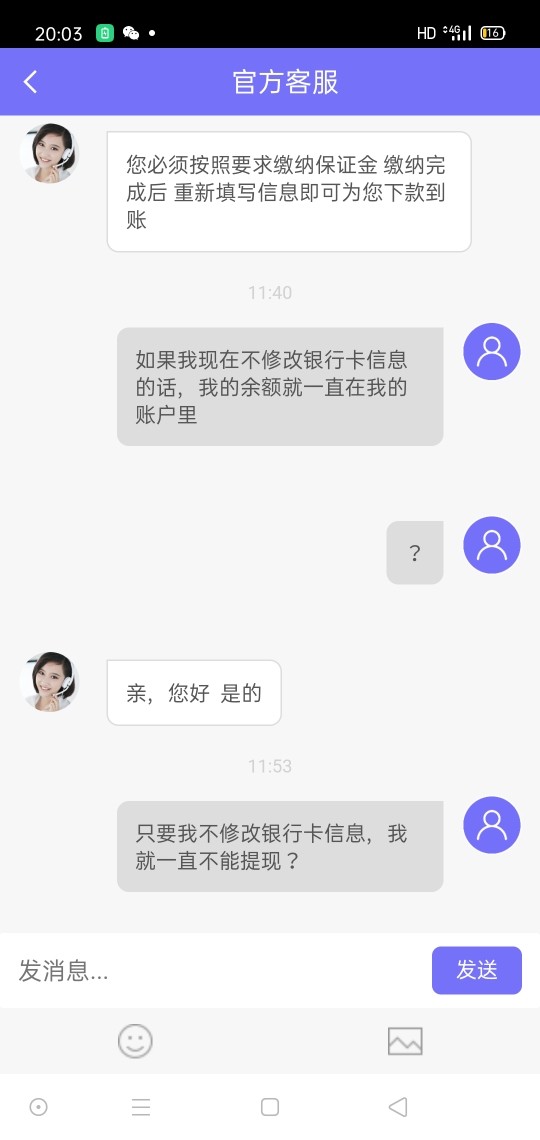

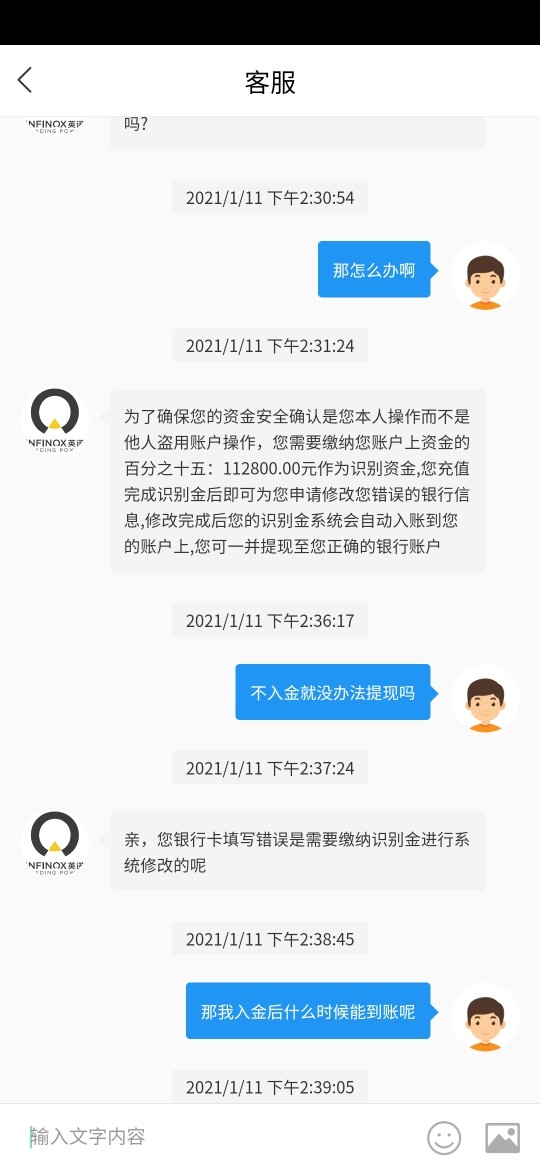

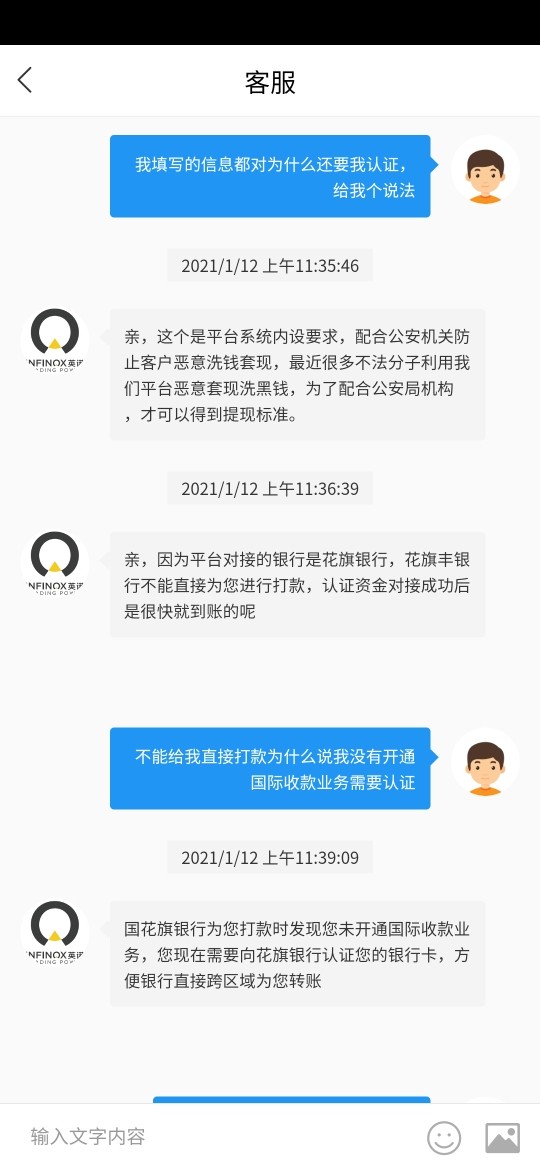

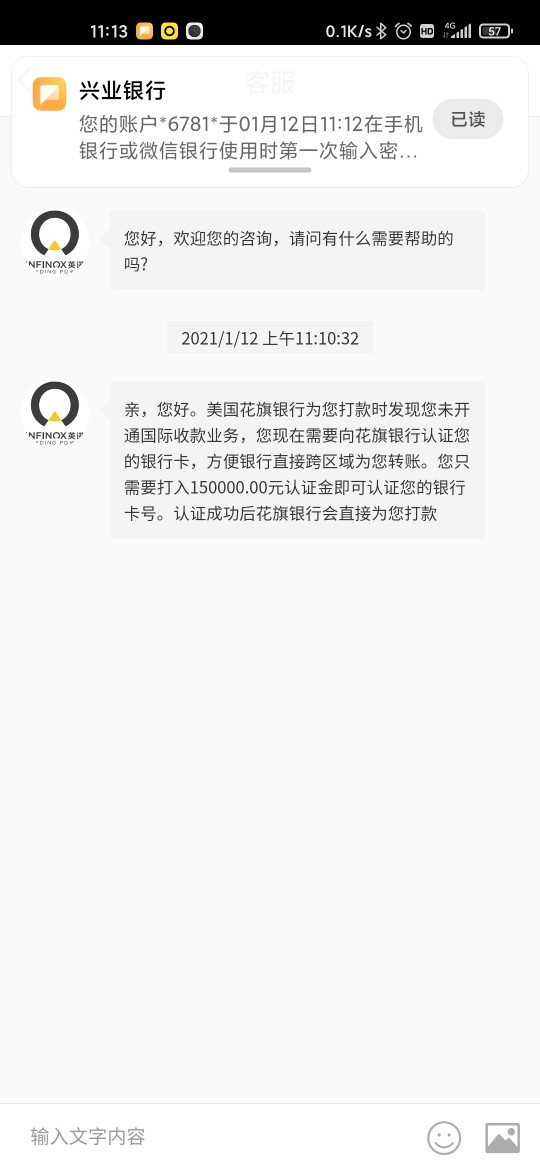

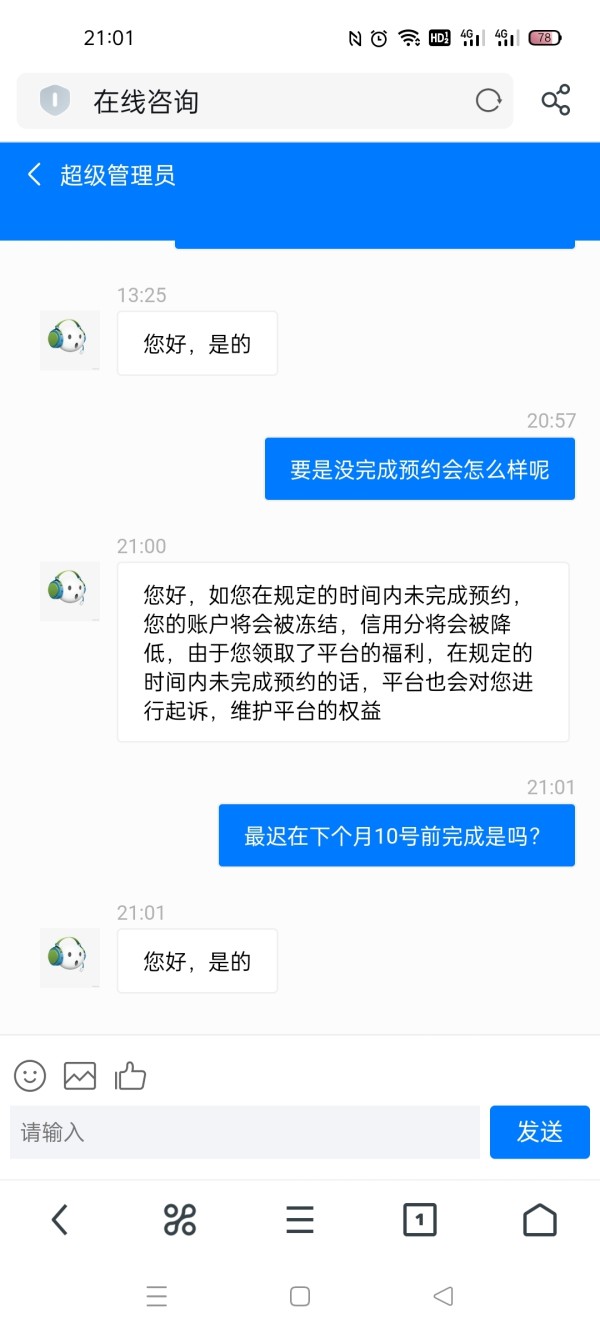

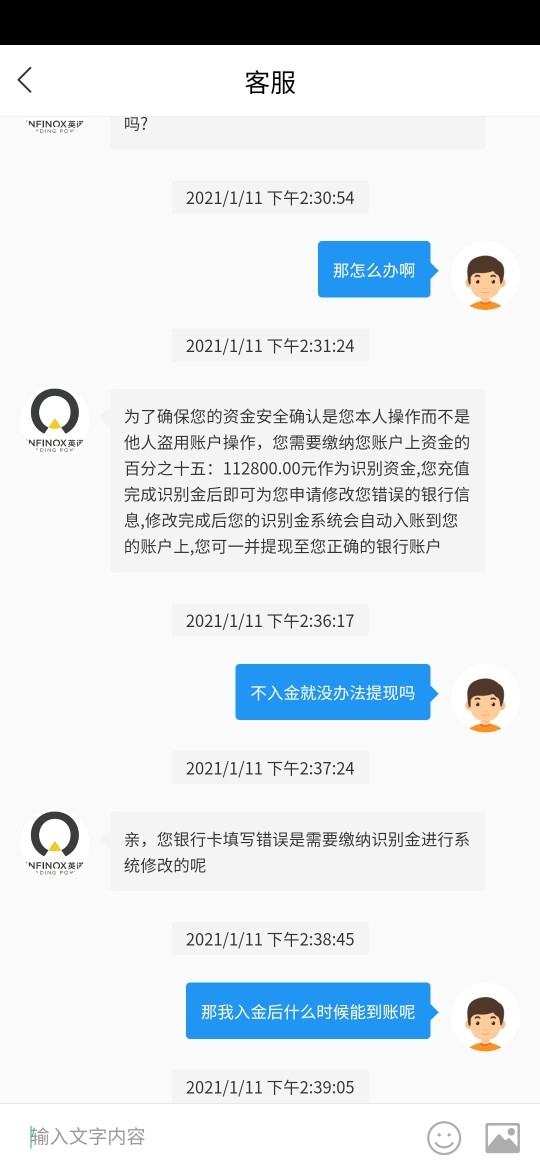

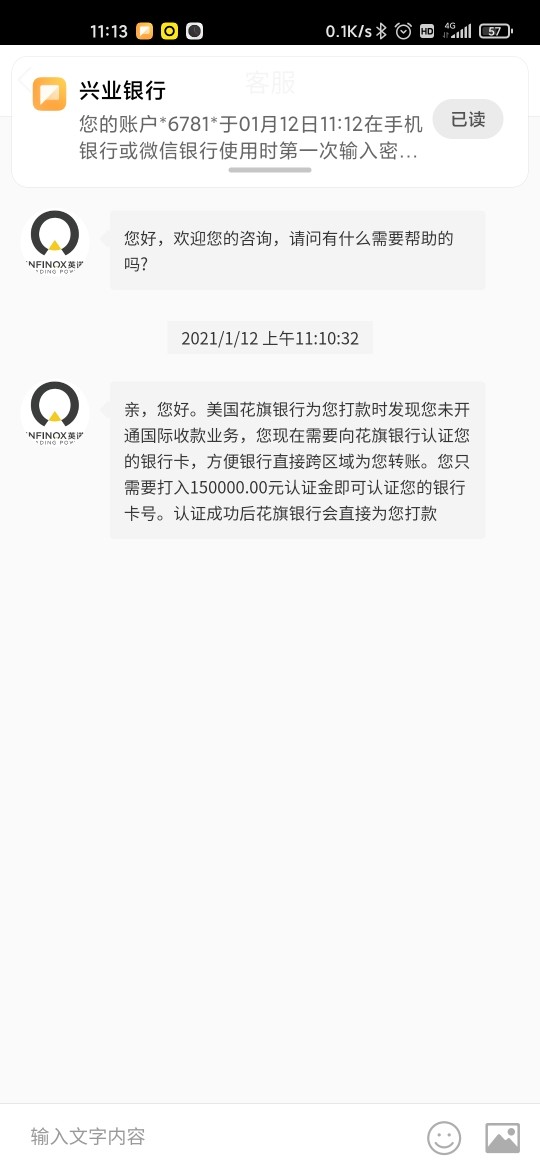

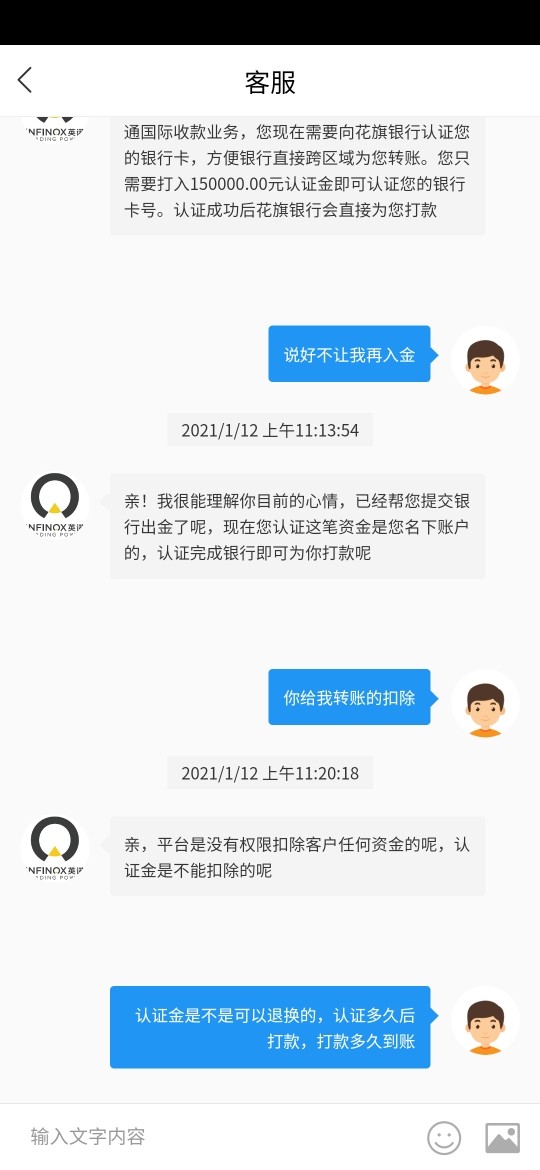

Customer Service and Support

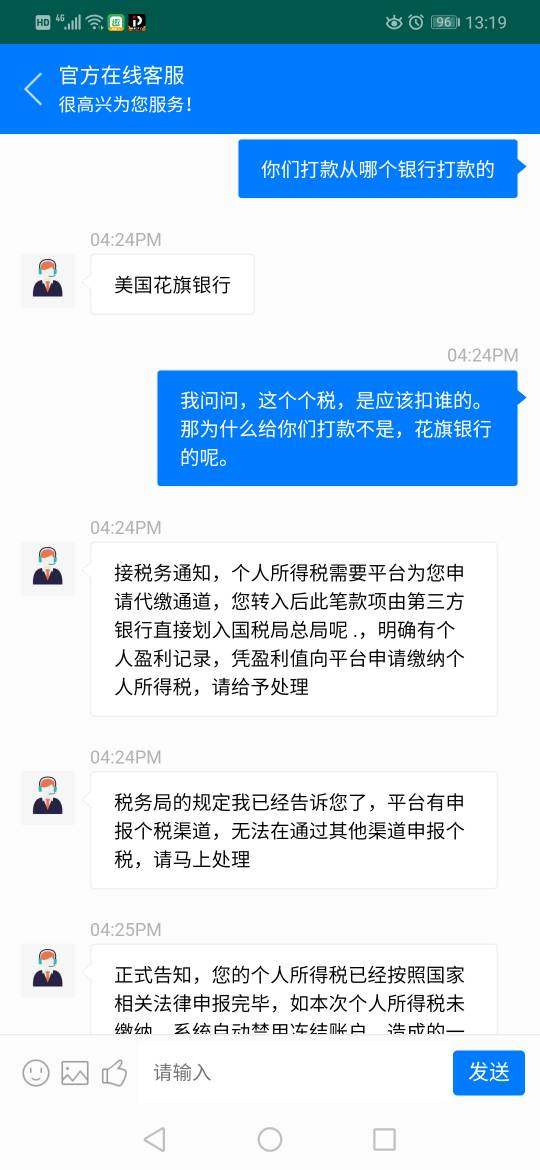

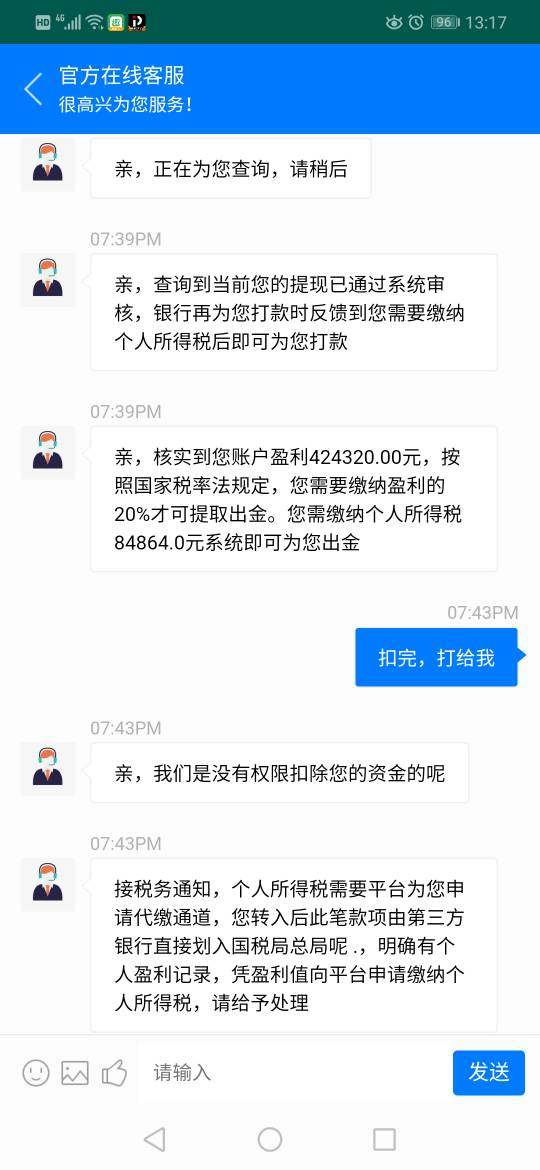

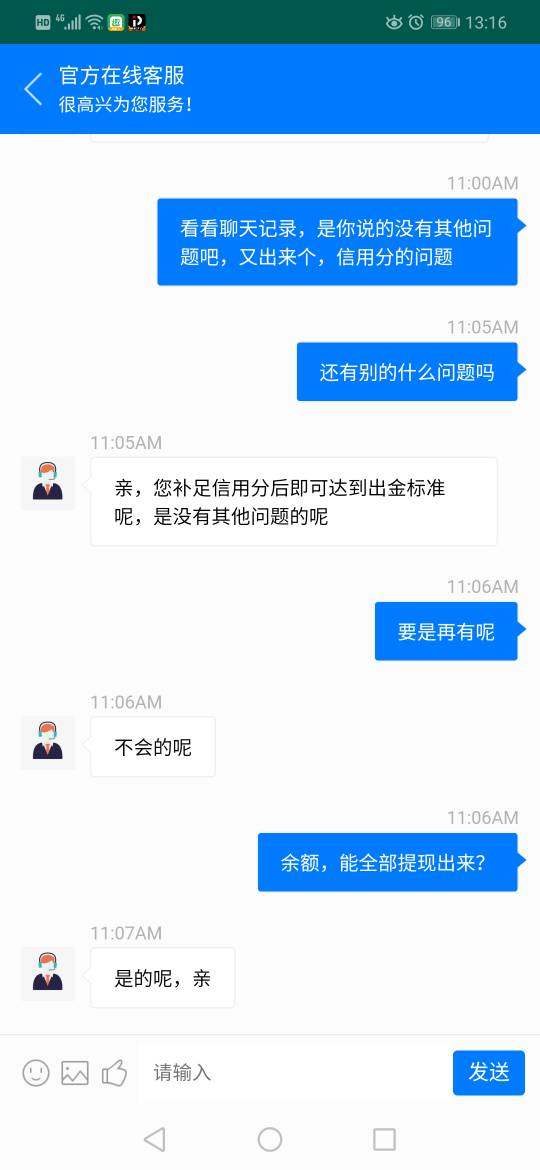

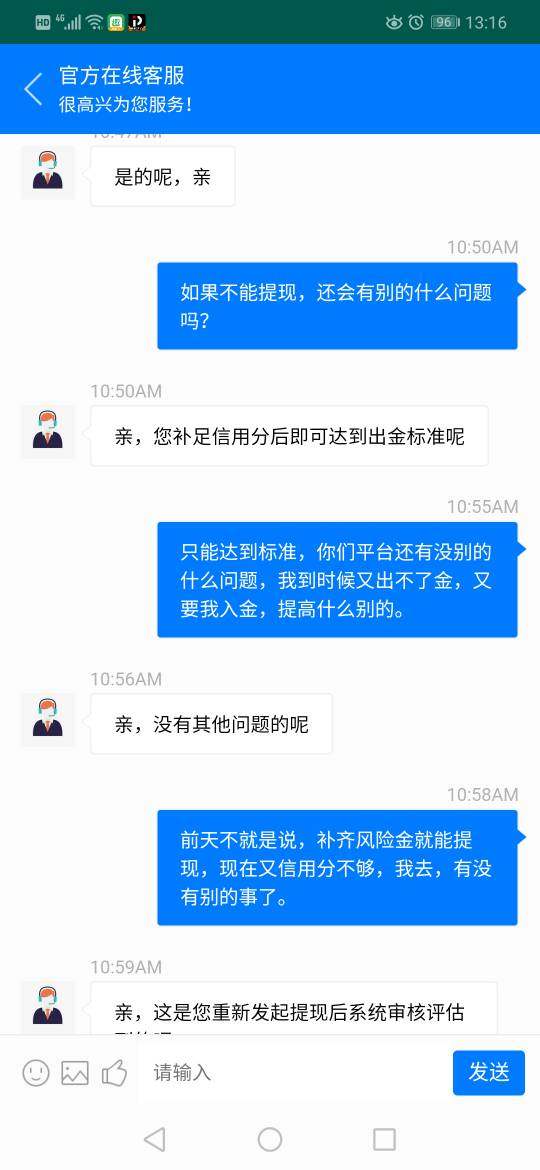

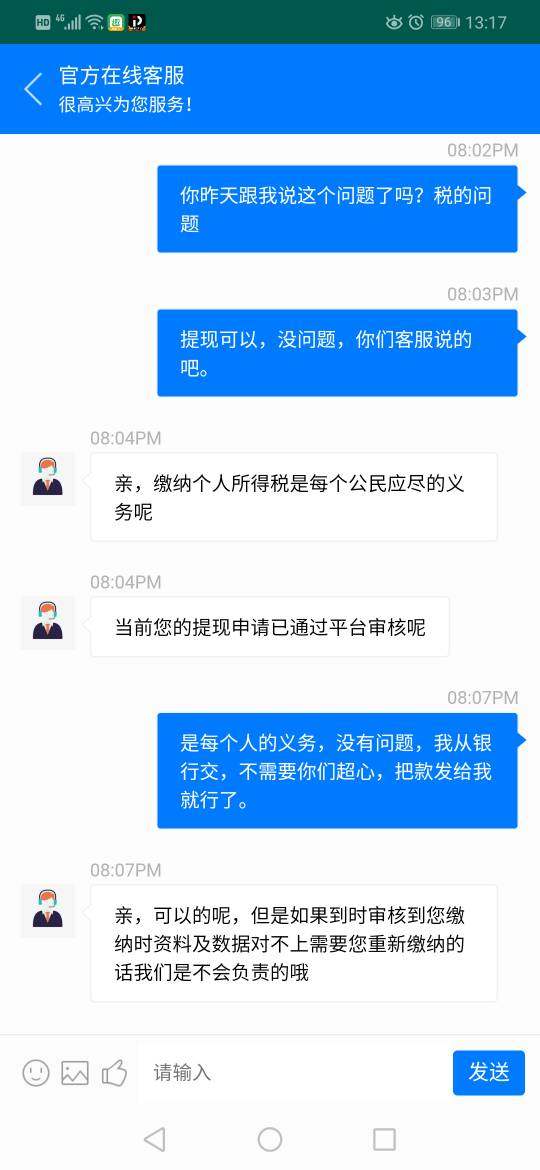

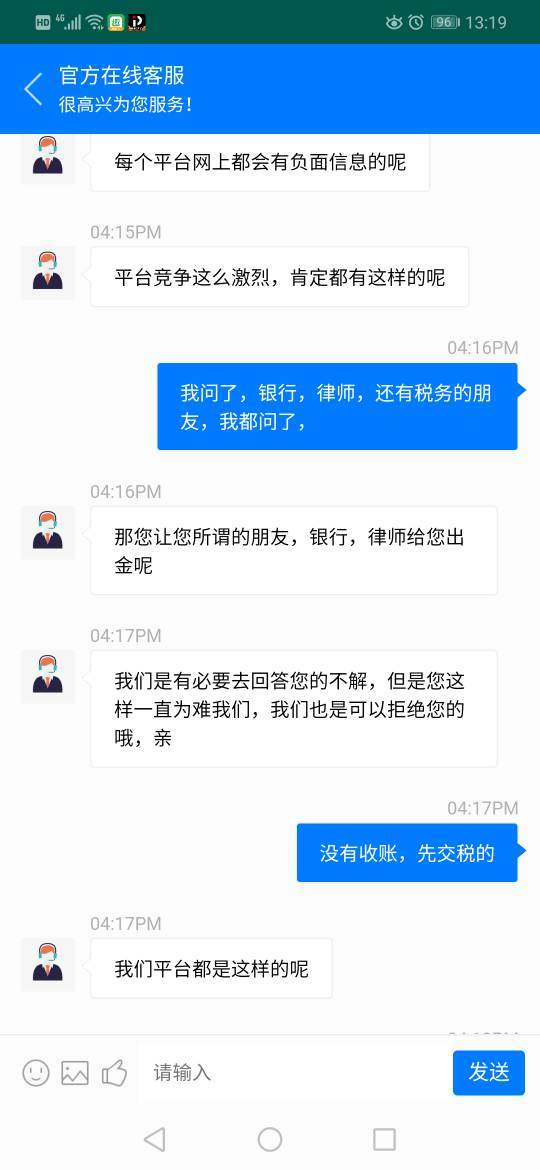

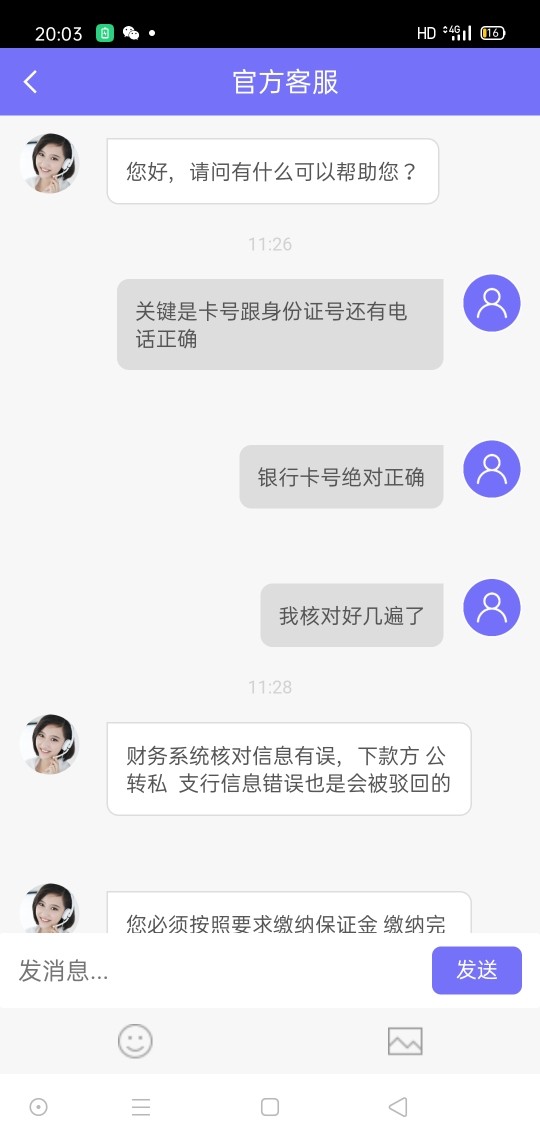

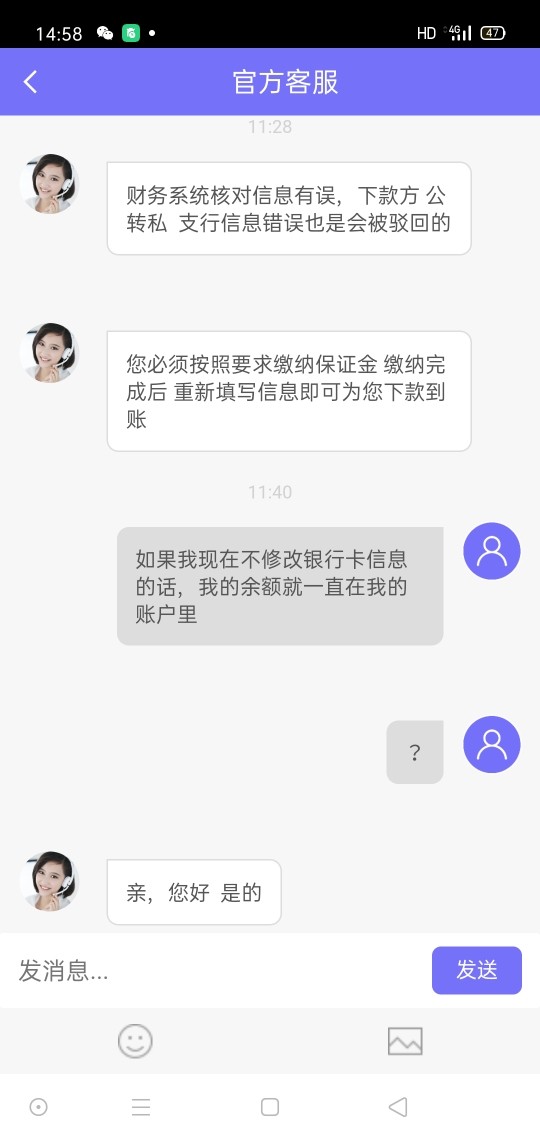

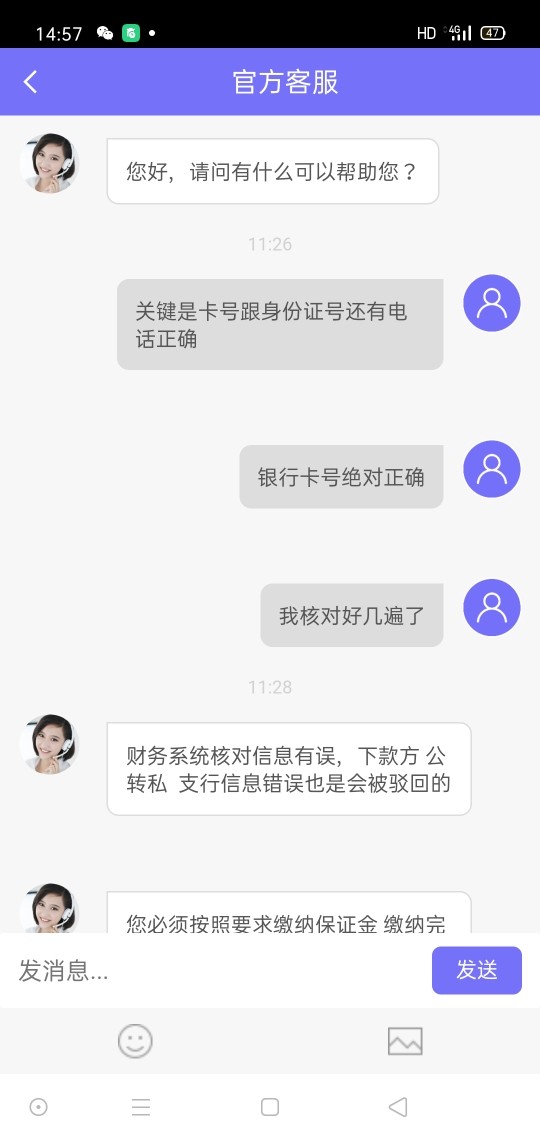

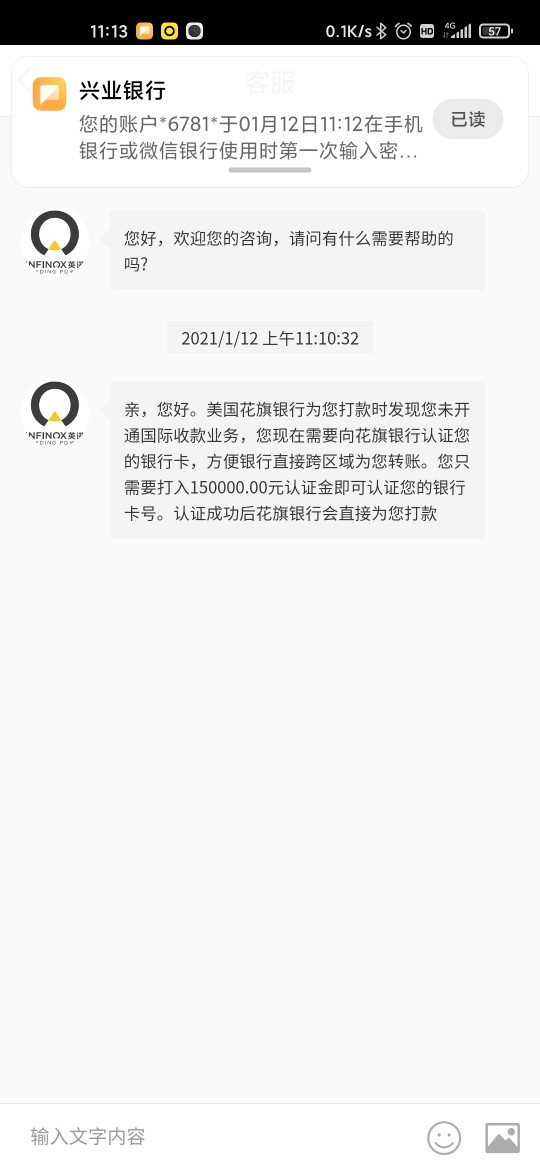

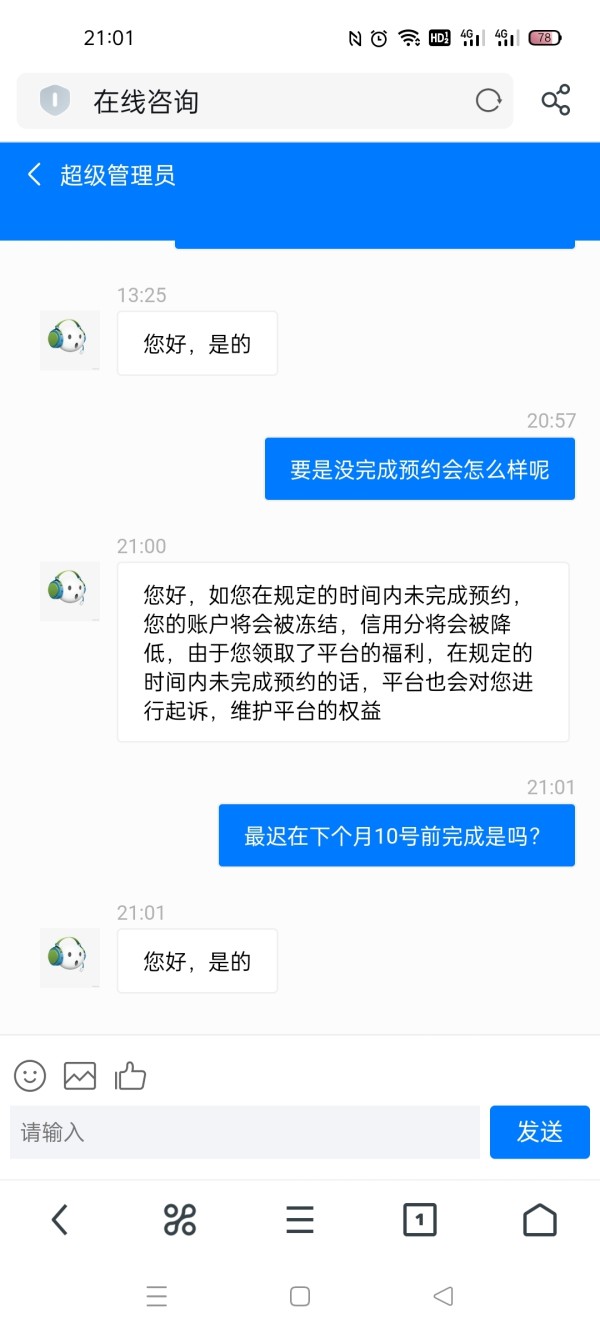

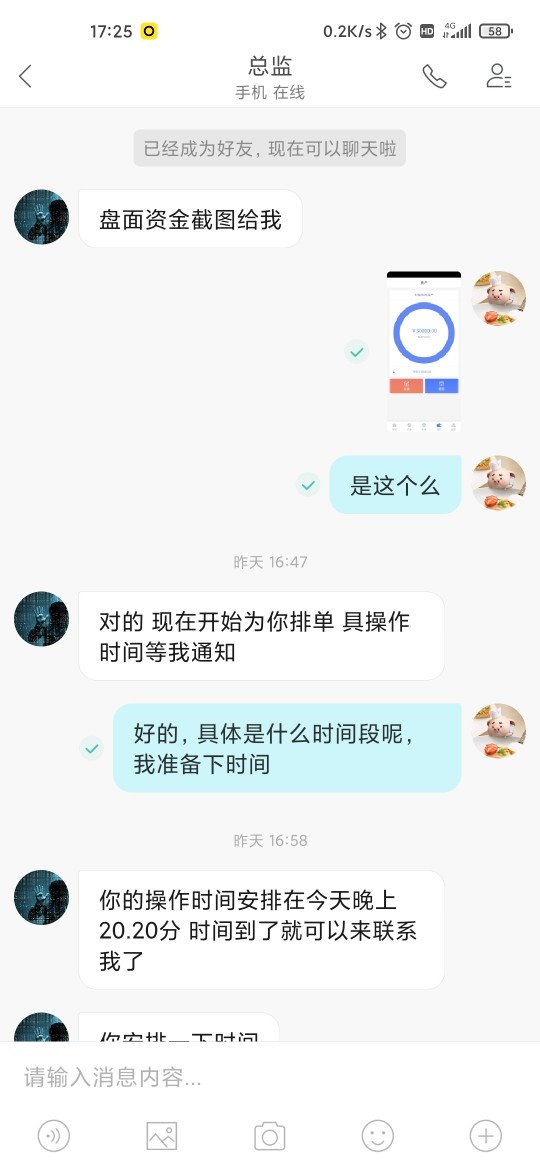

Customer service has received mixed reviews, with some users praising the responsiveness while others have reported delays in support responses. The lack of 24/7 support may also be a drawback for some traders.

Trading Setup (Experience)

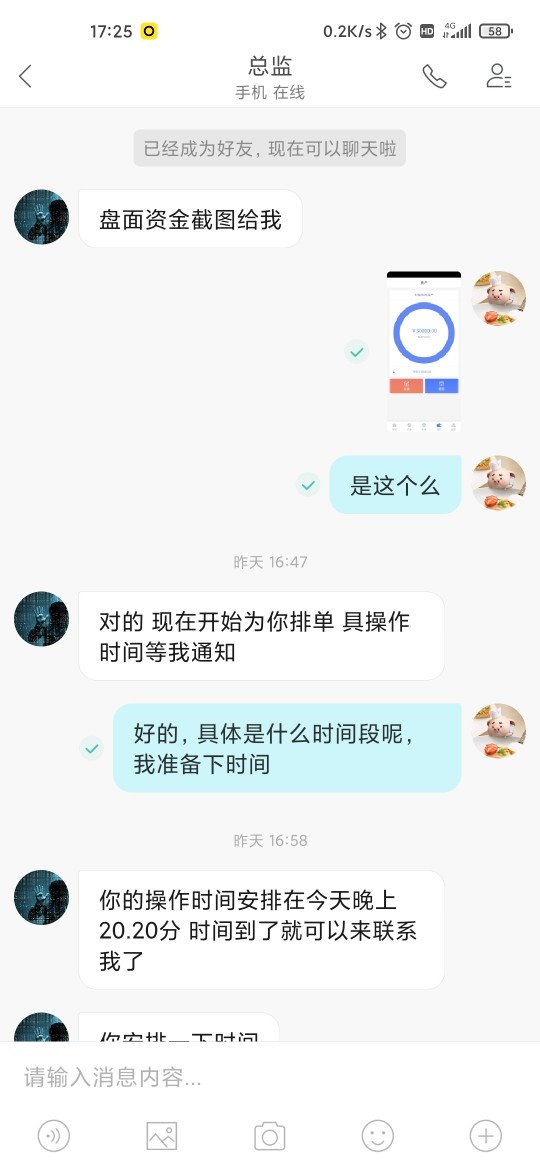

The overall trading experience with Infinox is generally positive, with fast execution speeds and reliable platforms. However, some users have reported issues with withdrawal processes, which could impact the overall satisfaction of the trading experience.

Trustworthiness

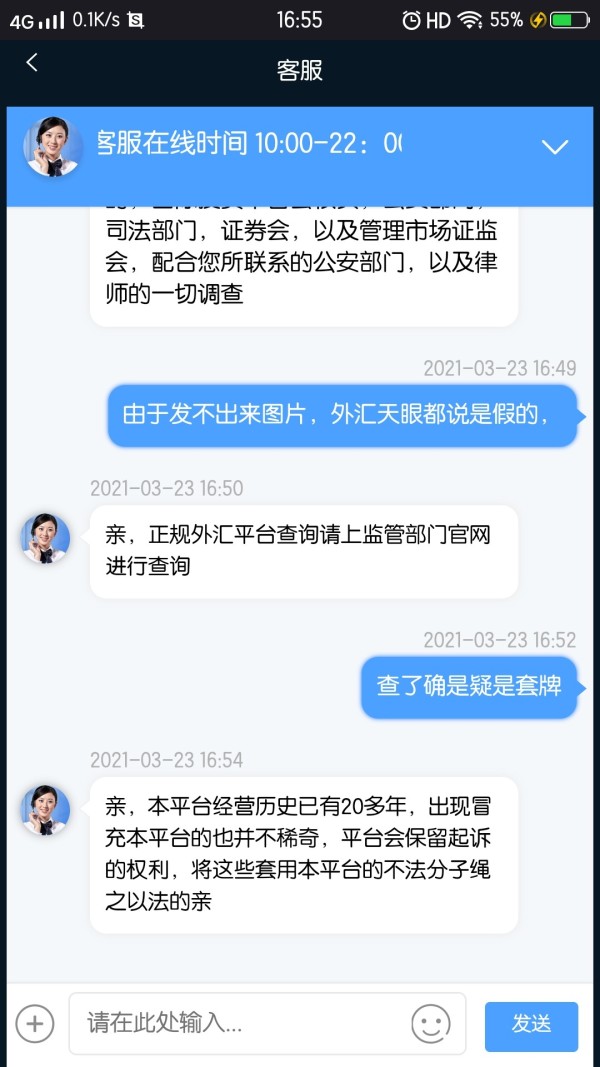

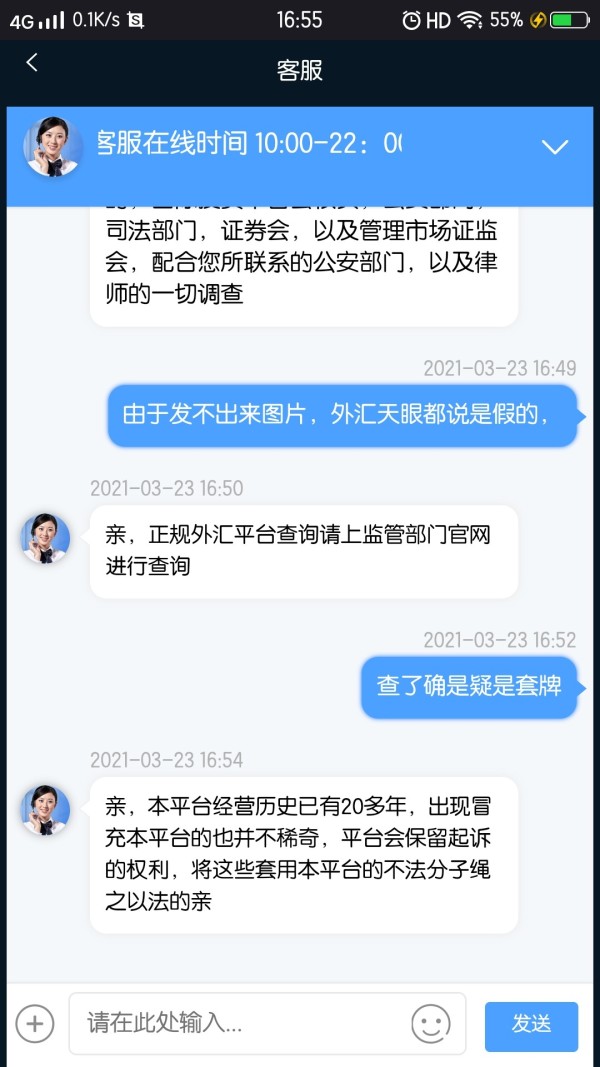

Infinox's regulatory status with the FCA significantly enhances its trustworthiness. However, the mixed reviews regarding customer service and withdrawal issues raise some concerns about the broker's reliability.

User Experience

User experiences vary, with many traders appreciating the low minimum deposit and diverse asset offerings. However, withdrawal complications and customer service issues have been highlighted as areas needing improvement.

Regulatory Compliance

Infinox is regulated by multiple authorities, including the FCA, which enhances its credibility. However, the varying regulatory standards across jurisdictions may lead to different levels of protection for traders.

In conclusion, Infinox presents itself as a robust trading platform with various offerings and regulatory backing. While many users enjoy positive trading experiences, potential clients should remain aware of the mixed reviews regarding customer service and withdrawal processes. As always, it is advisable to conduct thorough research and consider personal trading needs before choosing a broker.