Is IGFinvest safe?

Business

License

Is IGFinvest Safe or a Scam?

Introduction

IGFinvest is a forex broker that has emerged in the competitive landscape of online trading platforms. Positioned as a provider of various financial instruments, including forex, CFDs, and cryptocurrencies, it aims to attract traders with promises of advanced trading tools and high leverage. However, the rise of online trading has also seen an increase in fraudulent activities, making it essential for traders to carefully evaluate the legitimacy and safety of brokers. This article investigates IGFinvest's regulatory status, company background, trading conditions, and customer experiences to determine whether IGFinvest is safe or a potential scam. Our evaluation is based on a thorough review of available data, user feedback, and regulatory information.

Regulatory Status and Legitimacy

One of the most critical factors to consider when assessing the safety of a forex broker is its regulatory status. Regulatory bodies ensure that brokers adhere to strict guidelines, protecting clients from fraud and malpractice. Unfortunately, IGFinvest is not regulated by any recognized financial authority, which raises significant concerns about its legitimacy. The absence of regulation means that there are no legal protections in place for traders, increasing the risk of potential financial losses.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of oversight from financial authorities such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission) is alarming. Without regulation, IGFinvest operates in a legal gray area, leaving clients vulnerable to potential scams. Moreover, warnings have been issued by regulatory bodies in Europe, advising traders to avoid IGFinvest due to its unregulated status. The absence of regulatory compliance is a significant red flag, leading to the conclusion that IGFinvest is not a safe choice for traders.

Company Background Investigation

IGFinvest claims to be operated by IGF Investment Limited, a company allegedly registered in the Marshall Islands. However, conflicting information about the ownership structure raises questions about transparency. Some sources indicate that the broker is linked to Granit Oak Worldwide Limited, a company with a dubious reputation in the trading industry. This lack of clarity regarding the companys ownership and operational history contributes to concerns about its reliability.

The management team behind IGFinvest is not well-documented, and there is little information available regarding their professional backgrounds or expertise in the financial sector. This lack of transparency is concerning, as a reputable broker typically provides detailed information about its management team, including their qualifications and experience. Overall, the company's opacity and conflicting information about its ownership structure suggest that IGFinvest may not be a trustworthy broker.

Trading Conditions Analysis

When evaluating a broker's safety, it is essential to consider its trading conditions, including fees, spreads, and overall cost structure. IGFinvest offers several account types, each requiring a minimum deposit ranging from $500 to $20,000, which is significantly higher than the industry average. Additionally, the broker does not provide clear information regarding its trading conditions, such as spreads, leverage, or commissions, leaving traders in the dark about potential costs.

| Fee Type | IGFinvest | Industry Average |

|---|---|---|

| Spread for Major Pairs | 3.0 pips | 1.0-2.0 pips |

| Commission Model | None stated | Varies |

| Overnight Interest Rate | N/A | Varies |

The lack of transparency regarding fees is particularly concerning, as traders may face unexpected charges when trading with IGFinvest. Furthermore, the absence of a demo account prevents potential clients from testing the platform before committing funds, which is a standard practice among reputable brokers. These factors combined indicate that IGFinvest may not provide a safe trading environment for users.

Customer Fund Security

The safety of customer funds is paramount when assessing a broker's reliability. IGFinvest does not appear to have any measures in place to ensure the security of client funds. For instance, it is unclear whether client funds are held in segregated accounts, which are essential for protecting traders' money in the event of the broker's insolvency. Additionally, there is no mention of investor protection schemes, such as the Financial Services Compensation Scheme (FSCS) in the UK, which provides compensation to clients in the event that a broker fails.

The lack of negative balance protection further exacerbates the risk associated with trading on IGFinvest. Without this safeguard, clients could potentially lose more money than they initially invested, increasing the likelihood of significant financial loss. Historical issues regarding fund security or disputes with clients have not been disclosed, but the general lack of transparency raises concerns about the overall safety of funds held with IGFinvest.

Customer Experience and Complaints

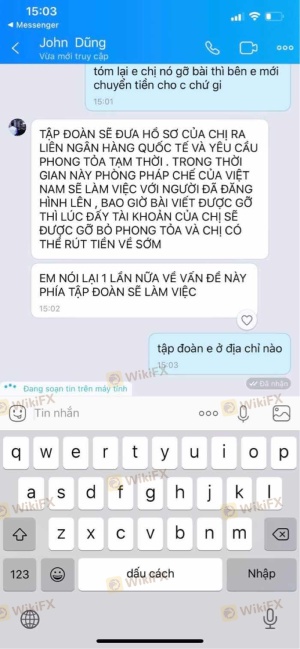

User feedback is a crucial aspect of evaluating a broker's trustworthiness. Numerous reviews and testimonials about IGFinvest indicate a pattern of dissatisfaction among clients. Common complaints include difficulties in withdrawing funds, lack of customer support, and issues with account management. Many users have reported significant delays in processing withdrawal requests, which is a common tactic employed by fraudulent brokers to retain client funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Poor |

One notable case involved a trader who attempted to withdraw funds after several months of trading. The withdrawal request was met with repeated delays, and the broker provided vague explanations, leading to frustration and distrust. Such experiences highlight the potential risks associated with trading with IGFinvest, reinforcing the notion that it may not be a safe option for traders.

Platform and Trade Execution

The trading platform offered by IGFinvest is another critical factor to consider. While the broker claims to provide access to popular trading platforms, user reviews suggest that the platform may suffer from performance issues, including slow execution times and frequent outages. Inconsistent order execution quality can lead to slippage and rejections, which can be detrimental to a trader's strategy.

Furthermore, there are no indications of platform manipulation, but the lack of transparency regarding execution policies raises concerns. Traders deserve a reliable and efficient platform, and the mixed reviews regarding IGFinvest's platform performance suggest that it may not meet those expectations.

Risk Assessment

Engaging with IGFinvest presents several risks that potential traders should be aware of. The absence of regulation, unclear trading conditions, and negative user experiences all contribute to a high-risk environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Risk | High | Lack of fund security measures. |

| Operational Risk | Medium | Performance issues with the trading platform. |

Traders should exercise caution when considering IGFinvest and may want to explore alternative brokers with established regulatory frameworks to mitigate these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that IGFinvest does not provide a safe trading environment for forex traders. The lack of regulation, unclear trading conditions, and negative customer feedback indicate potential fraud risks. Therefore, it is advisable for traders to approach IGFinvest with caution or avoid it altogether.

For those seeking reliable alternatives, consider brokers that are well-regulated and have demonstrated a commitment to transparency and customer service. Examples of such brokers include IG Group, OANDA, and Forex.com, which are known for their regulatory compliance and positive user experiences. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is IGFinvest a scam, or is it legit?

The latest exposure and evaluation content of IGFinvest brokers.

IGFinvest Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IGFinvest latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.