Is XS Plus safe?

Pros

Cons

Is XS Plus A Scam?

Introduction

XS Plus is a forex broker that has emerged in the competitive landscape of online trading. Operating under the umbrella of the Hong Kong Xin Sheng Jin Ye Group, XS Plus claims to offer a range of trading services, including forex and CFDs. However, the rapid growth of online trading has also seen an increase in scams, making it crucial for traders to carefully evaluate the legitimacy of brokers before investing their hard-earned money. This article aims to provide a comprehensive analysis of XS Plus, focusing on its regulatory status, company background, trading conditions, and overall safety. The evaluation is based on extensive research, including reviews from trusted financial websites and user feedback, to determine whether XS Plus is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its safety. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and protects traders' funds. In the case of XS Plus, the broker claims to be regulated by the Chinese Gold and Silver Exchange Society (CGSE) and the Cyprus Securities and Exchange Commission (CySEC). However, the legitimacy of this claim is questionable.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CGSE | 081 | China | Not a government authority |

| CySEC | 299/16 | Cyprus | License belongs to another entity |

The CGSE is merely an industry organization, lacking the authority to regulate forex trading. Furthermore, the license number 299/16 is associated with a different company, Magic Compass Ltd., raising concerns that XS Plus may be using cloned regulatory information. As a result, it is evident that XS Plus operates without proper regulatory oversight, which significantly increases the risk for traders. Therefore, XS Plus is not considered safe, and potential investors should exercise extreme caution.

Company Background Investigation

Understanding a broker's history and ownership structure is vital for assessing its credibility. XS Plus is marketed as a brand of the Hong Kong Xin Sheng Jin Ye Group Company Limited. However, there is limited information available regarding the company's history, management team, and operational track record. This lack of transparency raises red flags, as reputable brokers typically provide detailed information about their leadership and operational milestones.

The absence of a well-defined management team and clear ownership structure makes it difficult to evaluate the expertise and reliability of the individuals behind XS Plus. Transparency in business operations is essential for fostering trust among clients, and XS Plus appears to fall short in this regard. Without a solid foundation of corporate governance, the risk of potential fraud or mismanagement increases, further questioning whether XS Plus is safe for traders.

Trading Conditions Analysis

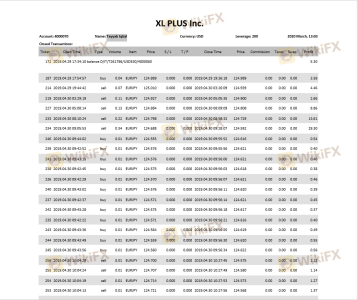

The trading conditions offered by a broker can significantly impact a trader's profitability. XS Plus claims to provide competitive spreads and various account types, but a closer examination reveals inconsistencies. The broker's fee structure is not clearly outlined, and there are indications of hidden costs that may catch traders off guard.

| Fee Type | XS Plus | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.1 pips | 1.0 pips |

| Commission Structure | Varies | $3 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by XS Plus appear to be slightly above the industry average, which could affect trading profitability. Additionally, the lack of clarity regarding commissions and overnight interest raises concerns about the broker's transparency. Traders may find themselves facing unexpected fees, leading to frustration and potential losses. Overall, the trading conditions at XS Plus do not instill confidence, suggesting that XS Plus may not be a safe choice for traders seeking a reliable trading environment.

Client Funds Security

The safety of client funds is paramount in the forex trading industry. XS Plus claims to implement various security measures, including fund segregation and negative balance protection. However, the absence of regulatory oversight raises significant concerns about the effectiveness of these measures.

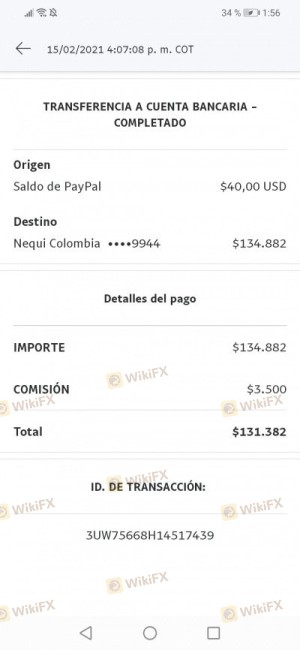

Traders' funds should be held in segregated accounts, separate from the broker's operational funds, to ensure safety in case of insolvency. The absence of a robust regulatory framework means that traders may not have access to investor protection schemes, leaving their funds vulnerable. Furthermore, there have been reports of withdrawal issues and difficulties in accessing funds, which further undermine the broker's credibility. Given these factors, it is evident that XS Plus does not provide a safe environment for traders' funds.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of XS Plus reveal a mixed bag of experiences, with several users reporting issues related to withdrawals and customer support. Common complaints include delays in processing withdrawals and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Average |

For instance, several users have reported that after making significant profits, their withdrawal requests were either delayed or denied without proper explanation. This pattern of complaints raises serious concerns about the broker's integrity and its commitment to customer satisfaction. The overall sentiment among users suggests that XS Plus may not be a safe trading option, as unresolved complaints can indicate deeper issues within the company.

Platform and Trade Execution

The performance of a trading platform is crucial for a trader's success. XS Plus offers access to popular trading platforms like MetaTrader 4 and MetaTrader 5. However, user experiences indicate that there may be issues with order execution, including slippage and rejected orders.

Traders rely on timely execution to capitalize on market opportunities, and any delays can lead to significant losses. Reports of frequent slippage and poor execution quality suggest that the trading environment at XS Plus may not be optimal. Furthermore, the lack of transparency regarding trading conditions raises concerns about potential manipulation. Given these issues, it is essential to question whether XS Plus is indeed a safe broker for traders seeking reliable execution.

Risk Assessment

Using XS Plus as a trading platform comes with inherent risks. The lack of regulation, questionable trading conditions, and negative user experiences contribute to an overall high-risk profile for the broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk. |

| Financial Risk | High | Potential hidden fees and costs. |

| Operational Risk | Medium | Reports of withdrawal issues. |

To mitigate these risks, traders should consider limiting their exposure to XS Plus by investing only what they can afford to lose. Additionally, it may be wise to explore alternative brokers with established regulatory frameworks and positive user feedback.

Conclusion and Recommendations

After a thorough investigation, it is clear that XS Plus exhibits several characteristics of a potentially unsafe broker. The lack of regulatory oversight, questionable trading conditions, and negative user experiences raise significant concerns about the broker's legitimacy. Traders should exercise extreme caution when considering XS Plus as their trading partner.

For those seeking reliable trading options, it is advisable to consider established brokers regulated by reputable authorities, such as ASIC or FCA. These brokers typically offer greater transparency, better customer support, and a safer trading environment. In conclusion, potential investors should avoid XS Plus and opt for more trustworthy alternatives to safeguard their investments.

Is XS Plus a scam, or is it legit?

The latest exposure and evaluation content of XS Plus brokers.

XS Plus Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XS Plus latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.