Is IFAFX safe?

Pros

Cons

Is Ifafx Safe or Scam?

Introduction

Ifafx is a forex broker that has garnered attention in the trading community for its offerings in the foreign exchange and CFD markets. As a trader, it is crucial to conduct thorough research before committing funds to any brokerage. The forex market is rife with opportunities, but it also harbors risks, particularly from unregulated or poorly regulated brokers. Therefore, assessing the credibility and safety of a broker like Ifafx is essential for safeguarding your investments. This article employs a structured approach, utilizing various sources and reviews, to evaluate Ifafx's regulatory status, company background, trading conditions, and overall safety for potential investors.

Regulation and Legitimacy

The regulatory status of a broker is a significant factor in determining its safety. Ifafx is registered in Belize but currently operates without any active regulation, raising concerns about its legitimacy. Regulatory oversight is vital as it ensures that brokers adhere to specific standards and practices, protecting traders from fraud and malpractice. Below is a summary of Ifafxs regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Belize | Not Verified |

The absence of a regulatory body overseeing Ifafx indicates a higher risk for traders. Regulatory authorities, such as the FCA in the UK or ASIC in Australia, impose strict rules on brokers, including the segregation of client funds and regular audits. Ifafx's lack of regulation means that it does not have to comply with these standards, making it potentially unsafe for traders. Additionally, the historical compliance of Ifafx remains questionable, as there are no records available to confirm its adherence to any regulatory requirements.

Company Background Investigation

Ifafx, officially known as Integrated Financials Advisors, has a limited public presence, which raises concerns about its transparency. The company appears to have been operational for several years, but specific details about its ownership structure and management team remain elusive. A lack of information about the individuals running the brokerage can be a red flag for potential investors.

Transparency in a company's operations is critical for building trust. Ifafx's website does not provide adequate information regarding its history, ownership, or management qualifications. This lack of clarity can lead to skepticism among traders, as reputable brokers typically showcase their leadership team's backgrounds and qualifications to instill confidence in their operations. Overall, the opacity surrounding Ifafx's corporate structure further complicates the assessment of whether Ifafx is safe.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its overall value. Ifafx presents a relatively low barrier to entry, with a minimum deposit requirement of just $1. However, the overall fee structure appears to be somewhat ambiguous, which can lead to unexpected costs for traders. Below is a comparative analysis of Ifafxs trading costs:

| Fee Type | Ifafx | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 0.8 pips | 0.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | Not Disclosed | Varies |

The spreads offered by Ifafx for major currency pairs are higher than the industry average, which could impact profitability for traders. Moreover, the lack of clarity regarding commissions and overnight interest raises concerns. Traders should be wary of hidden fees that may not be disclosed upfront, as this can significantly affect trading costs and overall returns. Therefore, it is essential to approach trading with Ifafx with caution, as the potential for unexpected expenses exists.

Client Funds Safety

The safety of client funds is paramount when choosing a broker. Ifafx's lack of regulation raises questions about its fund safety measures. Regulators typically mandate that brokers maintain segregated accounts to protect client funds from being used for operational expenses. However, Ifafx does not provide any information regarding its fund segregation policies or investor protection measures.

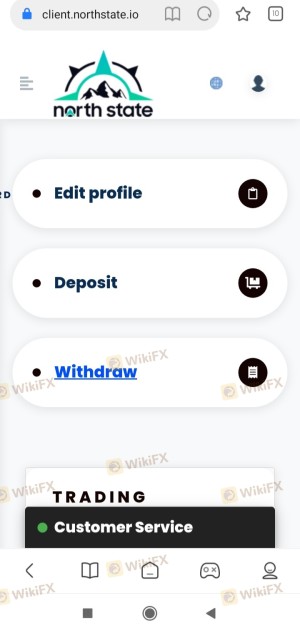

In addition to fund segregation, negative balance protection is another critical component of fund safety. This feature ensures that traders cannot lose more than their deposited amount, providing an added layer of security. Unfortunately, Ifafx does not appear to offer such protection, which heightens the risk for traders. Historical issues surrounding fund safety and withdrawals have also been reported, with numerous complaints from users unable to access their funds. This lack of transparency and potential for fund mismanagement raises significant concerns about whether Ifafx is safe.

Customer Experience and Complaints

User feedback plays a crucial role in assessing the reliability of a broker. Reviews of Ifafx reveal a troubling pattern of complaints, particularly concerning fund withdrawals and customer service responsiveness. Many traders have reported difficulties in accessing their funds, which is a significant red flag. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Average |

| Misleading Information | High | Poor |

Two notable cases include a trader who deposited funds but faced repeated delays in processing their withdrawal requests, leading to frustration and a sense of distrust. Another user reported that their account was locked without explanation, further complicating their ability to trade. These complaints highlight a concerning trend regarding Ifafx's operational integrity and customer service, raising doubts about whether Ifafx is safe for potential investors.

Platform and Trade Execution

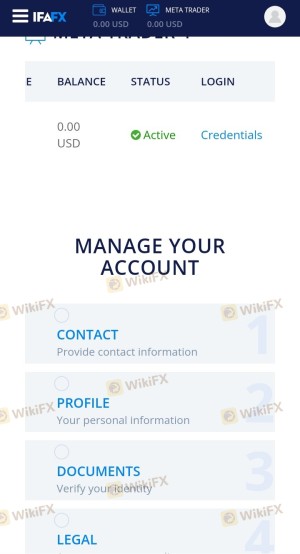

The trading platform's performance is another critical aspect of a broker's reliability. Ifafx utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. However, there have been reports of execution issues, including slippage and order rejections, which can severely impact trading outcomes.

Traders have expressed dissatisfaction with the platform's stability, citing instances of downtime during critical trading hours. Such issues can lead to significant financial losses and further erode trust in the brokerage. Moreover, any signs of potential platform manipulation, such as artificially widening spreads during high volatility, should be closely monitored. This raises the question: Is Ifafx safe for traders who rely on consistent execution and platform reliability?

Risk Assessment

Engaging with Ifafx presents several risks that potential traders should consider. Below is a risk assessment summarizing key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight from regulatory bodies. |

| Fund Safety | High | No clear policies on fund segregation or protection. |

| Withdrawal Issues | Medium | History of complaints regarding fund access. |

| Execution Reliability | High | Reports of slippage and order rejections. |

To mitigate these risks, it is advisable for traders to diversify their investments and avoid placing significant funds with Ifafx until more transparency and regulatory oversight are established. Traders should also consider using risk management strategies, such as setting stop-loss orders, to protect their investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Ifafx may pose significant risks to potential traders. The lack of regulation, unclear trading conditions, and troubling customer feedback all point to a brokerage that may not prioritize investor safety. Therefore, it is imperative for traders to exercise caution when considering Ifafx as a trading option.

For those seeking a more reliable trading experience, it is recommended to explore brokers that are well-regulated and transparent in their operations, such as those regulated by the FCA or ASIC. These brokers typically offer better protections for client funds and a more robust trading environment. In light of the findings, it is prudent to ask: Is Ifafx safe? The answer leans towards caution, and traders should thoroughly evaluate their options before proceeding.

Is IFAFX a scam, or is it legit?

The latest exposure and evaluation content of IFAFX brokers.

IFAFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IFAFX latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.