Is Idealkind safe?

Business

License

Is Idealkind Safe or Scam?

Introduction

Idealkind, officially known as Idealkind Market Ltd, has emerged as a player in the forex trading landscape. However, with the proliferation of online trading platforms, traders must exercise caution when selecting a broker. The potential for fraud and mismanagement looms large in an industry that is not uniformly regulated. This article aims to provide a comprehensive analysis of whether Idealkind is a safe option for traders or if it raises red flags that suggest it might be a scam. Our investigation is based on a review of multiple sources, including regulatory filings, customer feedback, and expert opinions, to create a balanced assessment of Idealkind's credibility.

Regulation and Legitimacy

The regulatory environment is crucial for any trading platform, as it serves as a safeguard for investors. A well-regulated broker is typically held to higher standards of conduct and transparency. Unfortunately, Idealkind operates without any significant regulatory oversight. Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

Idealkind claims to be registered in the USA and supervised by a non-existent entity called the "Supervisory Commission." This misleading information raises serious concerns about its legitimacy. Furthermore, multiple financial regulators, including Italy's CONSOB and Austria's FMA, have issued warnings against Idealkind for providing unauthorized trading services. The absence of credible regulation is a significant factor to consider when evaluating whether "Is Idealkind safe?"

Company Background Investigation

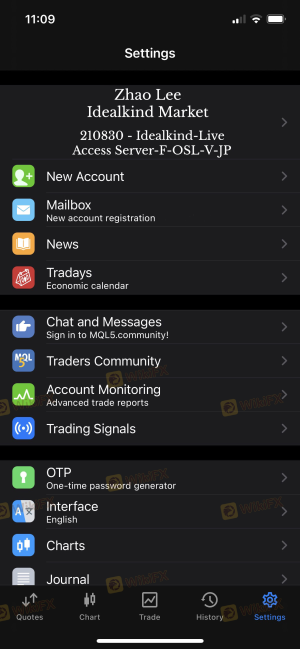

Founded in 2015, Idealkind Market Ltd claims to offer various trading services, including forex and CFDs. However, the lack of transparency regarding its ownership structure and management team is troubling. The company's website does not provide any information about its team members, which makes it difficult for potential clients to assess their qualifications and experience. Transparency in a broker's operations is essential for building trust, and Idealkind's failure to disclose this information raises questions about its integrity.

The company's history is relatively short, and without a proven track record, it becomes challenging to evaluate its reliability. The absence of detailed information about its operations and the team behind it is a red flag for traders. This lack of transparency contributes to the ongoing question: "Is Idealkind safe?"

Trading Conditions Analysis

When assessing a broker, it is essential to understand its fee structure and trading conditions. Idealkind claims to offer competitive trading costs; however, many users have reported hidden fees that complicate the overall cost of trading. Below is a comparison of core trading costs:

| Fee Type | Idealkind | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

The spread on major currency pairs can vary significantly, and many traders have reported experiencing unfavorable trading conditions, such as high overnight interest rates. These factors can lead to increased trading costs, making it essential for traders to be aware of the potential pitfalls when considering whether "Is Idealkind safe?"

Client Funds Security

The security of client funds is paramount in the forex trading industry. Idealkind has not provided sufficient information regarding its fund protection measures. The lack of segregated accounts and investor protection schemes raises concerns about the safety of client deposits. Furthermore, there have been no concrete assurances regarding negative balance protection, which could leave traders vulnerable to significant losses. The absence of a solid framework for fund security is another factor that contributes to the ongoing skepticism about whether "Is Idealkind safe?"

Customer Experience and Complaints

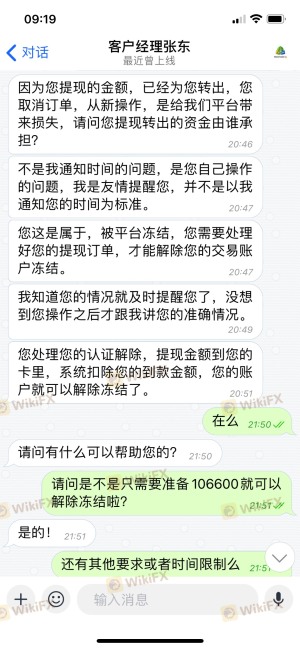

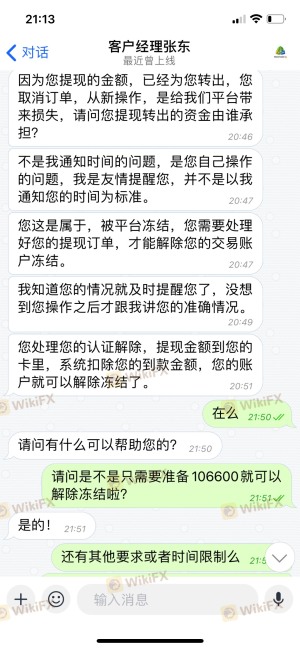

Customer feedback is a vital indicator of a broker's reliability. Unfortunately, Idealkind has received numerous complaints regarding withdrawal issues and poor customer service. Many traders have reported difficulties in accessing their funds, which is a significant concern that questions the broker's integrity. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Poor Customer Service | Medium | Unresolved |

| Inconsistent Trading Signals | High | Unresponsive |

Two notable cases involve traders who experienced significant delays in fund withdrawals, leading to frustration and loss of trust in the platform. The company's slow response to these complaints further exacerbates the situation, making it imperative for potential clients to consider their options carefully. This raises the question again: "Is Idealkind safe?"

Platform and Trade Execution

The performance and reliability of a trading platform are critical for a seamless trading experience. Idealkind claims to offer a user-friendly trading interface; however, reports of technical glitches and poor execution quality have surfaced. Traders have noted issues with slippage and rejected orders, which can severely impact trading outcomes. The potential for platform manipulation is a serious concern that traders must consider when evaluating whether "Is Idealkind safe?"

Risk Assessment

Using Idealkind comes with several risks that potential clients should be aware of. Below is a summary of key risk areas:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns |

| Financial Risk | High | Lack of fund protection measures |

| Customer Service Risk | Medium | Poor response to complaints |

To mitigate these risks, traders should consider using smaller amounts for initial investments and thoroughly research alternative brokers with better regulatory oversight and customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that Idealkind raises several red flags that warrant caution. The lack of regulation, transparency issues, and numerous customer complaints indicate that traders should be wary of engaging with this broker. Based on the findings, it is reasonable to conclude that "Is Idealkind safe?" is a question that leans toward a negative response.

For traders seeking reliable options, it is advisable to consider established brokers that are well-regulated and have a proven track record. Traders should prioritize their investments by choosing platforms that offer transparency, robust customer support, and a solid regulatory framework to ensure their trading experience is both safe and rewarding.

Is Idealkind a scam, or is it legit?

The latest exposure and evaluation content of Idealkind brokers.

Idealkind Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Idealkind latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.