Is HYCMFX safe?

Business

License

Is HYCMFX A Scam?

Introduction

HYCMFX is a forex broker that has garnered attention in the trading community, primarily due to its claims of offering competitive trading conditions and a variety of financial instruments. However, with the rise of fraudulent schemes in the financial sector, it is imperative for traders to carefully evaluate the legitimacy and reliability of brokers like HYCMFX. This article aims to provide an in-depth analysis of HYCMFX, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experiences, and overall risk assessment. Our investigation is based on a comprehensive review of various online sources, including regulatory alerts, user reviews, and expert analyses, to ascertain whether HYCMFX is safe or a potential scam.

Regulation and Legitimacy

The regulatory environment plays a crucial role in determining the safety and reliability of a forex broker. HYCMFX claims to be regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Cayman Islands Monetary Authority (CIMA). However, recent findings suggest that HYCMFX is not actually regulated by these bodies, leading to concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Verified |

| CySEC | N/A | Cyprus | Not Verified |

| CIMA | N/A | Cayman Islands | Not Verified |

The FCA has issued warnings about HYCMFX, categorizing it as a "clone firm" that uses the credentials of legitimate brokers to mislead potential investors. This lack of genuine regulatory oversight raises significant red flags regarding the safety of trading with HYCMFX. Without a proper license, traders' funds are not protected under any regulatory framework, making it essential to question, "Is HYCMFX safe?"

Company Background Investigation

HYCMFX claims to be part of a long-standing financial group with over 40 years of experience. However, upon closer inspection, there are inconsistencies in its ownership structure and operational history. The company does not provide transparent information about its management team or their qualifications, which is a critical aspect for assessing the broker's credibility.

The lack of clear ownership and management details can be concerning for potential investors. A reputable broker typically discloses its leadership team and their professional backgrounds, allowing traders to gauge the company's expertise and reliability. In the case of HYCMFX, the absence of such information contributes to the skepticism surrounding its operations.

Furthermore, the company's transparency in disclosing its operational practices and compliance with industry standards is minimal. This lack of transparency raises questions about the broker's commitment to ethical trading practices, further emphasizing the need for caution when considering whether "Is HYCMFX safe?"

Trading Conditions Analysis

When evaluating a broker, the trading conditions offered are a fundamental aspect that traders must consider. HYCMFX promotes itself as providing competitive spreads and a variety of account types. However, the actual cost structure and potential hidden fees warrant a thorough examination.

The broker claims to offer spreads starting from 1.5 pips for its fixed accounts and 0.1 pips for raw accounts. However, the lack of clarity on commissions and other trading costs can lead to unexpected expenses for traders.

| Fee Type | HYCMFX | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1.5 pips | 1.0 pips |

| Commission Model | $4 per lot | $3 per lot |

| Overnight Interest Range | Varies | Varies |

It is essential for traders to be aware of any unusual fee structures or commission practices that may not be explicitly stated. A broker that lacks transparency in its pricing model can pose significant risks to traders, making it crucial to ask, "Is HYCMFX safe?"

Client Fund Safety

The safety of client funds is paramount when considering a forex broker. HYCMFX claims to employ various measures to ensure the security of traders' investments. However, the absence of regulatory oversight raises concerns about the effectiveness of these measures.

The broker states that it segregates client funds from its operational capital, which is a standard practice in the industry. However, without regulatory verification, the actual implementation of these practices cannot be guaranteed. Additionally, the lack of investor protection schemes, such as those provided by the FCA, further complicates the safety of funds held with HYCMFX.

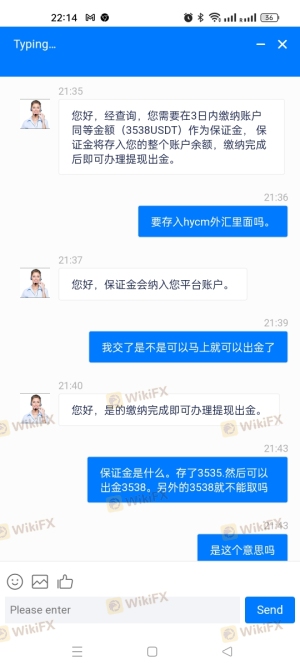

Traders should also be aware of the potential risks associated with withdrawal processes. Reports of delayed withdrawals and difficulties in accessing funds have surfaced, which can be indicative of underlying operational issues. This situation prompts the critical question of whether "Is HYCMFX safe?"

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. In the case of HYCMFX, numerous user reviews highlight a range of complaints, particularly regarding withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inadequate assistance |

Many traders have reported challenges in withdrawing their funds, with some claiming that their requests went unanswered for extended periods. The broker's customer service has also been criticized for being unresponsive and ineffective in addressing concerns. These patterns of complaints significantly impact the overall perception of HYCMFX's reliability.

For instance, one trader reported waiting several weeks for a withdrawal to be processed, only to receive vague responses from customer support. Such experiences raise alarms about the broker's operational integrity and lead to further skepticism about whether "Is HYCMFX safe?"

Platform and Execution

The trading platform is another critical aspect that can influence a trader's experience. HYCMFX claims to offer a robust trading environment with popular platforms like MetaTrader 4 and 5. However, the quality of order execution and platform stability is essential for successful trading.

Users have reported mixed experiences regarding order execution, with some noting instances of slippage and re-quotes during volatile market conditions. Such issues can hinder trading performance and lead to unexpected losses, raising concerns about the broker's execution quality. It is vital for traders to assess whether they can trust the platform to execute their trades reliably, which again brings us to the question: "Is HYCMFX safe?"

Risk Assessment

Considering the various factors discussed, it is necessary to evaluate the overall risk associated with trading with HYCMFX. The following risk assessment provides a summary of the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of genuine regulation |

| Fund Safety Risk | High | No investor protection |

| Customer Service Risk | Medium | Poor response to complaints |

| Execution Risk | Medium | Reports of slippage and delays |

To mitigate these risks, traders should consider diversifying their investments, using smaller position sizes, and thoroughly researching alternative brokers with a proven track record of reliability and regulatory compliance.

Conclusion and Recommendations

In conclusion, the evidence suggests that HYCMFX poses significant risks for traders. The lack of genuine regulatory oversight, coupled with numerous complaints regarding fund safety and customer service, raises serious concerns about the broker's legitimacy.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are well-regulated and have a strong reputation for customer service and fund security. Brokers such as HYCM, IG, and OANDA are examples of reputable firms that provide robust regulatory protections and positive user experiences.

Ultimately, potential traders must carefully weigh the risks and do their due diligence before deciding to engage with HYCMFX. The critical question remains: "Is HYCMFX safe?" The answer, based on the available evidence, leans towards caution.

Is HYCMFX a scam, or is it legit?

The latest exposure and evaluation content of HYCMFX brokers.

HYCMFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HYCMFX latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.