Is HUIZHON safe?

Business

License

Is Huizhon Safe or Scam?

Introduction

Huizhon is a forex broker that has positioned itself primarily within the Chinese market, offering various trading services to retail clients. As the forex market continues to grow, traders are increasingly seeking reliable platforms to facilitate their trading activities. However, the rise of unregulated brokers has made it essential for traders to conduct thorough assessments before committing their funds. This article aims to evaluate the safety and legitimacy of Huizhon by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. Our investigation is based on a comprehensive review of available data from reputable sources, including regulatory filings and user feedback.

Regulation and Legitimacy

Understanding a broker's regulatory status is crucial for assessing its legitimacy. Regulated brokers must adhere to strict guidelines that protect traders' interests, while unregulated brokers may operate with minimal oversight, increasing the risk of fraud. Unfortunately, Huizhon appears to lack any valid regulatory licenses, which raises significant concerns about its operational legitimacy. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation suggests that Huizhon is not subject to the same level of scrutiny as its regulated counterparts. This lack of oversight can result in inadequate protection for traders, making it crucial to approach this broker with caution. Moreover, the absence of any historical compliance records further complicates the assessment of Huizhon's trustworthiness.

Company Background Investigation

A detailed examination of Huizhon's company history reveals a lack of transparency regarding its ownership structure and operational history. Established within the last few years, the company has not made significant information available about its founding team or management. This opacity raises concerns about the broker's long-term viability and commitment to ethical trading practices.

The absence of a clear ownership structure can lead to potential conflicts of interest, making it difficult for traders to trust the broker with their funds. Furthermore, the lack of publicly available information about the management teams qualifications and experience in the financial sector adds to the uncertainty surrounding Huizhon. Traders are advised to consider these factors carefully when evaluating whether Huizhon is safe for their trading activities.

Trading Conditions Analysis

When evaluating a forex broker, it is essential to understand its trading conditions, including fees and spreads. Huizhon's fee structure appears to be less competitive than industry standards, which may affect traders' profitability. Below is a comparison of core trading costs:

| Fee Type | Huizhon | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | High | Low |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | High | Moderate |

The high spreads and unclear commission structure can be red flags for potential traders. Typically, reputable brokers offer competitive spreads and transparent fee structures, allowing traders to make informed decisions. The lack of clarity around overnight interest rates may also indicate that traders could face unexpected costs, further questioning whether Huizhon is safe for trading.

Client Funds Security

One of the most critical aspects of any forex broker is the safety of client funds. Huizhon's policies regarding fund security are concerning. The broker does not appear to implement adequate measures for fund segregation, which is crucial for protecting traders' assets in the event of insolvency. Additionally, the absence of investor protection schemes raises alarms about the broker's commitment to safeguarding client funds.

Moreover, Huizhon lacks a negative balance protection policy, meaning traders could potentially lose more than their initial deposits. This absence of essential safety nets is particularly concerning for those new to trading. Historically, unregulated brokers can face serious financial issues, leading to disputes over fund withdrawals. Therefore, potential clients should exercise extreme caution and consider whether Huizhon is safe for their trading needs.

Customer Experience and Complaints

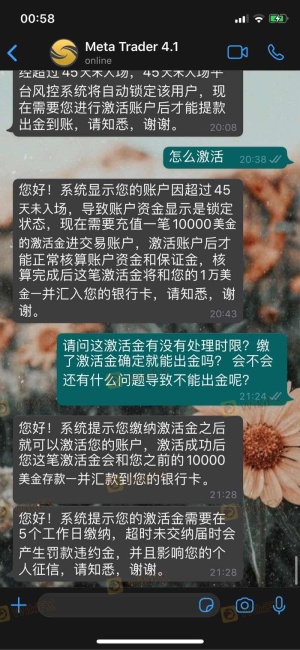

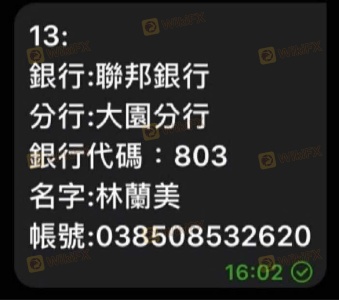

Analyzing customer feedback is vital in understanding a broker's reliability. Reviews concerning Huizhon indicate a pattern of complaints related to withdrawal issues and unresponsive customer support. Below is a summary of the main complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Information | High | Inconsistent |

The severity of withdrawal delays and the quality of customer support have led many traders to question whether Huizhon is safe. In some cases, clients have reported difficulties in retrieving their funds, which is a significant red flag for any broker. Furthermore, the lack of prompt and effective responses from customer service representatives exacerbates these concerns, as traders rely on timely assistance when issues arise.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for successful trading. Huizhons platform has received mixed reviews, with users reporting issues related to stability and execution quality. Traders have experienced slippage during high volatility periods, which can significantly impact trading outcomes. Additionally, there are concerns about the potential for order rejections, raising questions about the broker's integrity.

The platform's user interface and functionality also play a significant role in the overall trading experience. If a broker's platform is unreliable or difficult to navigate, it can hinder traders' ability to execute their strategies effectively. Given these factors, it is essential for potential clients to carefully consider whether Huizhon is safe for their trading activities.

Risk Assessment

Engaging with an unregulated broker such as Huizhon carries inherent risks. A comprehensive risk assessment reveals several critical areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of fund protection measures |

| Operational Risk | Medium | Platform stability issues |

| Customer Support Risk | High | Poor response times and support |

The high-risk ratings across multiple categories highlight the significant concerns associated with trading through Huizhon. Traders should be aware of these risks and consider implementing risk mitigation strategies, such as only allocating funds they can afford to lose and diversifying their trading portfolios.

Conclusion and Recommendations

In conclusion, the analysis of Huizhon raises numerous red flags regarding its safety and legitimacy. The absence of regulatory oversight, coupled with a lack of transparency and numerous customer complaints, suggests that potential traders should approach this broker with extreme caution. There is insufficient evidence to support the notion that Huizhon is safe, and the potential for fraud or mismanagement cannot be overlooked.

For traders seeking alternatives, it is advisable to consider regulated brokers with a proven track record of reliability and customer satisfaction. Options such as ZFX, XM, or other well-established platforms may provide a safer trading environment and better overall experience. Always prioritize safety and conduct thorough research before engaging with any forex broker.

Is HUIZHON a scam, or is it legit?

The latest exposure and evaluation content of HUIZHON brokers.

HUIZHON Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HUIZHON latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.