Regarding the legitimacy of huanqiuhui forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is huanqiuhui safe?

Business

License

Is huanqiuhui markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Roemer Capital (Europe) Limited

Effective Date: Change Record

2016-08-05Email Address of Licensed Institution:

info@roemercapital.comSharing Status:

No SharingWebsite of Licensed Institution:

www.roemercapital.comExpiration Time:

--Address of Licensed Institution:

Georgiou Karaiskaki 17 Limassol Business Centre, 4th Floor Office 4, 3032, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 059300Licensed Institution Certified Documents:

Is Huanqiuhui Safe or Scam?

Introduction

Huanqiuhui is a foreign exchange broker that positions itself within the competitive landscape of the forex trading market. As traders increasingly seek opportunities in this volatile environment, it becomes crucial to assess the trustworthiness and reliability of brokers like Huanqiuhui. Given the prevalence of scams and fraudulent activities in the forex industry, traders must exercise caution and conduct thorough evaluations before committing their resources. This article investigates the safety of Huanqiuhui, employing a comprehensive framework that includes regulatory status, company background, trading conditions, fund security, customer experience, platform performance, and risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is a fundamental aspect of its credibility. Regulation ensures that brokers adhere to strict standards and provides a level of protection for traders. Huanqiuhui's regulatory framework is critical in determining whether it is safe for trading. Below is a summary of Huanqiuhui's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Unknown | N/A | N/A | Not Verified |

Unfortunately, Huanqiuhui lacks clear regulatory oversight, which raises significant concerns about its legitimacy. Without proper regulation, traders may be exposed to higher risks, including potential fraud and mismanagement of funds. It is essential to understand that reputable brokers are typically regulated by recognized authorities, which provide a safety net for investors. The absence of such oversight for Huanqiuhui indicates that traders should proceed with caution and consider the potential implications of trading with an unregulated entity.

Company Background Investigation

Huanqiuhui's history and ownership structure provide insight into its operational integrity. Established recently, the company claims to offer a range of trading services. However, the lack of detailed information about its founding and management team raises questions about transparency and accountability. A thorough background check on the management team reveals limited professional experience in the financial sector, which further compounds concerns regarding the broker's reliability.

Moreover, the company's transparency in disclosing its operational framework and financial health is minimal. Traders should be wary of brokers that do not provide comprehensive information about their business practices, as this can be indicative of underlying issues. The absence of transparent communication can lead to mistrust and may suggest that the broker is not entirely forthcoming about its operations. Therefore, it is crucial for traders to remain vigilant and consider these factors when evaluating whether Huanqiuhui is safe for their trading activities.

Trading Conditions Analysis

Understanding the trading conditions offered by Huanqiuhui is vital for potential investors. The broker's fee structure and trading costs can significantly impact profitability. Huanqiuhui's overall fees appear to be competitive; however, there are concerns regarding hidden charges that may not be immediately apparent to traders. Below is a comparative analysis of Huanqiuhui's core trading costs:

| Fee Type | Huanqiuhui | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Variable | 1.0 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | 2% | 1.5% |

While Huanqiuhui offers variable spreads, the potential for higher overnight interest rates may deter some traders. It is essential to scrutinize the fee structure closely and ensure that there are no unexpected costs that could erode profits. Traders should also be aware of any additional fees for withdrawals or inactivity, as these can further impact the overall trading experience. Evaluating the transparency of the fee structure is crucial for determining whether Huanqiuhui is a safe choice for trading.

Client Fund Safety

The safety of client funds is a paramount consideration for any forex broker. Huanqiuhui's measures for ensuring the security of client funds warrant careful examination. The broker claims to implement various safety protocols, including segregated accounts and investor protection policies. However, without third-party verification or regulatory oversight, the effectiveness of these measures remains uncertain.

Traders should inquire about how Huanqiuhui manages client funds and whether there are guarantees in place to protect against potential losses. Additionally, the absence of negative balance protection raises concerns, as this could leave traders vulnerable to significant financial losses. Historical incidents of fund mismanagement or disputes can also provide valuable insight into the broker's track record. It is essential for traders to conduct due diligence and assess the overall safety of their funds when considering whether Huanqiuhui is safe for trading.

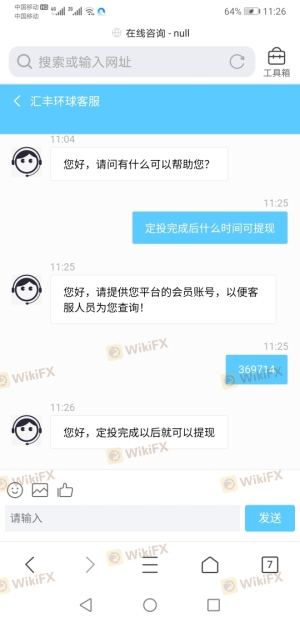

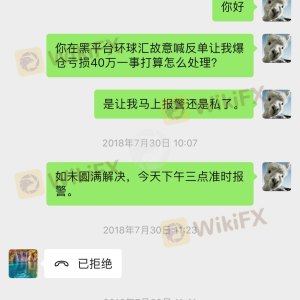

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. Analyzing user experiences with Huanqiuhui reveals a mix of positive and negative reviews. While some traders report satisfactory experiences, others express concerns about withdrawal delays and unresponsive customer service. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Account Closure Issues | High | No resolution |

The prevalence of withdrawal-related complaints is particularly alarming, as it raises questions about Huanqiuhui's operational integrity. Traders should be cautious about engaging with brokers that have a history of unresolved complaints, as this may indicate deeper issues within the organization. A broker's ability to address customer concerns effectively is a critical aspect of its overall trustworthiness.

Platform and Trade Execution

The performance of the trading platform is a significant factor in determining the overall trading experience. Huanqiuhui utilizes a standard trading platform, but its stability and user experience are essential considerations. Traders have reported mixed experiences, with some noting issues related to order execution quality, including slippage and rejected orders. Evaluating the platform's performance and reliability is crucial for assessing whether Huanqiuhui is safe for trading.

Moreover, any signs of platform manipulation, such as unusual price spikes or discrepancies in order execution, should be taken seriously. Traders should be vigilant and consider the implications of using a platform that may not provide a fair trading environment. Conducting thorough research and seeking feedback from other users can help traders make informed decisions about whether to engage with Huanqiuhui.

Risk Assessment

Engaging with Huanqiuhui presents various risks that traders should be aware of. Below is a concise risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation |

| Fund Safety Risk | High | Unclear fund protection measures |

| Customer Service Risk | Medium | Inconsistent support and response times |

| Trading Conditions | Medium | Potential hidden fees and costs |

To mitigate these risks, traders should consider diversifying their investments and employing risk management strategies. It is advisable to start with a demo account to familiarize oneself with the platform and its features before committing real funds. Additionally, seeking out brokers with established regulatory oversight and a proven track record can help enhance safety and security in trading.

Conclusion and Recommendations

In conclusion, the investigation into Huanqiuhui raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, combined with customer complaints and potential fund security issues, suggests that traders should exercise caution. While some aspects of Huanqiuhui's trading conditions may appear attractive, the overall risk profile indicates that it may not be a safe choice for trading.

For traders seeking reliable alternatives, it is recommended to consider brokers with established regulatory credentials, transparent fee structures, and positive customer feedback. Engaging with reputable brokers can significantly enhance the trading experience and provide peace of mind. Ultimately, conducting thorough research and due diligence is essential in navigating the forex market safely.

In summary, is Huanqiuhui safe? The evidence suggests that potential traders should proceed with caution and consider alternative options.

Is huanqiuhui a scam, or is it legit?

The latest exposure and evaluation content of huanqiuhui brokers.

huanqiuhui Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

huanqiuhui latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.