Is HCWH safe?

Business

License

Is Hcwh Safe or a Scam?

Introduction

Hcwh, operating under the name Hcwh Global Limited, has emerged as a player in the forex trading market, attracting the attention of both novice and experienced traders. However, the increasing number of complaints and reports questioning its legitimacy raises significant concerns. For traders, especially those new to the forex market, it is crucial to carefully assess the credibility of trading platforms. The potential for financial loss due to scams or unregulated brokers is high, making due diligence essential. This article aims to provide a thorough investigation into the safety and legitimacy of Hcwh by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors. The evaluation is based on a comprehensive review of multiple sources, including user feedback, expert analyses, and regulatory data.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety. A well-regulated broker typically adheres to strict financial standards, providing a safety net for traders' funds. Unfortunately, Hcwh has been identified as an unregulated broker with no oversight from any recognized financial authorities. This lack of regulation is a significant red flag for potential investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory framework means that traders using Hcwh have little to no legal protection. Reports indicate that Hcwh falsely claims to be supervised by authoritative financial institutions, but investigations reveal no supporting evidence on regulatory websites. This situation positions Hcwh as a high-risk broker, where investors funds are not safeguarded by any legal means. Without regulatory oversight, traders are vulnerable to potential fraud, making it essential for anyone considering this broker to thoroughly evaluate the risks involved.

Company Background Investigation

Hcwh Global Limited presents itself as a global trading platform, yet its company background raises concerns about its legitimacy. There is limited information available regarding its establishment, ownership structure, and operational history. This obscurity can be alarming for potential investors, as transparency is a hallmark of reputable brokers.

The management team behind Hcwh remains largely unknown, with no clear information regarding their qualifications or professional experience in the forex industry. This lack of transparency further complicates the assessment of Hcwh's credibility. Moreover, the companys website has faced issues, including periods of unavailability, which is often indicative of instability or potential fraudulent activity.

In summary, the insufficient information surrounding Hcwhs history and management, combined with its unregulated status, casts doubt on its reliability as a forex broker. Traders need to be cautious and consider these factors before deciding to engage with Hcwh.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a traders experience and potential profitability. In the case of Hcwh, the overall fee structure appears to be opaque, with many users reporting unexpected charges and difficulties in understanding the costs associated with trading.

| Fee Type | Hcwh | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | Unclear | $5 - $10 per lot |

| Overnight Interest Range | High | 1.5% - 3.0% |

The lack of transparency in Hcwh's fee structure raises concerns about potential hidden costs that could erode trading profits. Furthermore, users have reported issues with withdrawal fees, which can be excessive and were not disclosed upfront. Such practices are often indicative of a broker that may prioritize profit over the trader's interests, further questioning the safety of engaging with Hcwh.

Customer Funds Safety

When it comes to the safety of customer funds, Hcwh presents a concerning picture. The broker does not provide clear information on its policies regarding fund segregation, investor protection, or negative balance protection.

The absence of these fundamental safety measures means that traders may be at risk of losing their entire investment without any recourse. Historical reports indicate that many users have experienced difficulties withdrawing their funds, with claims of funds being frozen or excessive withdrawal fees being imposed. Such practices not only jeopardize traders' investments but also contribute to the perception that Hcwh operates in a manner that is not in the best interests of its clients.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a forex broker. In the case of Hcwh, numerous complaints have surfaced, highlighting various issues that users have faced.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Hidden Fees | Medium | Inconsistent |

| Customer Support Availability | High | Unresponsive |

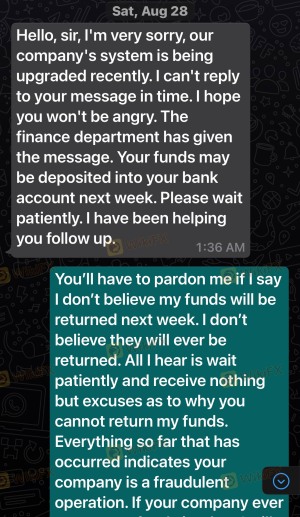

Common complaints revolve around difficulties in withdrawing funds, unexpected fees, and lack of customer support. Many users have reported that their requests for withdrawals were ignored or met with unreasonable delays. In some cases, traders claimed that they were pressured to deposit more funds before being allowed to withdraw their existing balances. Such patterns of behavior are concerning and suggest a lack of accountability on the part of Hcwh.

Several case studies reveal that users who sought to retrieve their funds often faced an uphill battle, leading to frustration and financial loss. These experiences underscore the importance of evaluating a broker's reputation and customer service quality before committing any capital.

Platform and Trade Execution

The performance of a trading platform is crucial for traders, as it directly affects their ability to execute trades effectively. Hcwh's platform has been criticized for its instability and poor execution quality. Users have reported frequent slippage and instances where orders were not executed as intended.

Moreover, the platform lacks advanced features that are typically expected from reputable brokers, such as comprehensive charting tools and risk management options. This deficiency can hinder traders' ability to make informed decisions and manage their risks effectively. The combination of a subpar trading platform and questionable trade execution practices raises further concerns about the overall safety of trading with Hcwh.

Risk Assessment

Using Hcwh as a forex broker presents several risks that potential traders should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight, leading to potential fraud. |

| Financial Risk | High | Difficulty in fund withdrawals and hidden fees. |

| Platform Stability Risk | Medium | Reports of slippage and execution issues. |

Given the high regulatory risk associated with Hcwh, traders are advised to approach this broker with caution. To mitigate these risks, it is recommended to seek alternative, well-regulated brokers that offer greater transparency and better customer protection.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Hcwh is not a safe option for forex trading. The combination of its unregulated status, lack of transparency, and numerous customer complaints paints a concerning picture for potential investors.

For traders seeking a reliable platform, it is advisable to consider well-regulated brokers that offer clear terms, robust customer support, and a proven track record of safety and security. By doing so, traders can significantly reduce their risk exposure and enhance their trading experience. In light of the findings, it is clear that Hcwh is not safe, and prospective users should exercise extreme caution before engaging with this broker.

Is HCWH a scam, or is it legit?

The latest exposure and evaluation content of HCWH brokers.

HCWH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HCWH latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.