Is Grinta Invest safe?

Pros

Cons

Is Grinta Invest A Scam?

Introduction

Grinta Invest is an online forex broker that has positioned itself in the competitive landscape of foreign exchange trading since its inception in 2020. The platform offers various trading instruments, including forex, commodities, and cryptocurrencies, appealing to a diverse range of traders. However, the online trading environment is fraught with risks, and potential investors must exercise caution when selecting a broker. The importance of due diligence cannot be overstated, as the financial market is rife with unregulated and potentially fraudulent entities. This article aims to provide a comprehensive analysis of Grinta Invest, evaluating its regulatory status, company background, trading conditions, and customer experiences to determine whether it is a safe platform for trading or a potential scam.

To conduct this investigation, we have utilized multiple sources, including user reviews, regulatory information, and expert analyses. Our assessment framework encompasses key areas such as regulation and legality, company background, trading conditions, customer fund security, user experiences, platform performance, and risk factors associated with trading on this platform.

Regulation and Legality

The regulatory environment is a critical factor in assessing the safety and legitimacy of any trading platform. Grinta Invest operates without regulation from any recognized financial authority, which raises significant red flags about its operational legitimacy. The lack of oversight means that traders are not protected under any regulatory framework, making it challenging to seek recourse in the event of disputes or fund mismanagement.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight can lead to various risks, including the potential for withdrawal issues, lack of transparency in trading conditions, and inadequate protection for client funds. Historically, unregulated brokers have been associated with higher instances of fraud and financial malpractice, making it imperative for traders to be cautious. While Grinta Invest may claim to offer competitive trading conditions, the lack of a regulatory framework significantly diminishes its credibility.

Company Background Investigation

Grinta Invest is owned and operated by Grinta Invest Limited, a company registered in the Marshall Islands. The firm claims to have a robust operational framework and offers various trading accounts, including managed accounts. However, the company's offshore registration raises concerns about transparency and accountability. The management team is reportedly composed of professionals with experience in financial markets, yet specific details about their qualifications and backgrounds are scarce. This lack of transparency can be a red flag for potential investors.

Moreover, the company has not established a strong track record in the industry, having only been operational for a few years. The opacity surrounding its ownership structure and management team further complicates the assessment of its legitimacy. Investors are advised to exercise caution and conduct thorough research before engaging with Grinta Invest, as the absence of clear information can be indicative of larger issues.

Trading Conditions Analysis

When evaluating whether Grinta Invest is safe, it is essential to consider its trading conditions. The broker offers a range of trading instruments with varying spreads and leverage options. However, the overall fee structure appears to be less competitive compared to industry standards, which could impact profitability for traders.

| Fee Type | Grinta Invest | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.7 pips | 1.0 - 1.5 pips |

| Commission Structure | No commissions | Varies |

| Overnight Interest Range | Varies | Varies |

Grinta Invest's spreads are higher than the industry average, which may deter traders looking for cost-effective trading solutions. Additionally, there are reports of unexpected fees and commissions that could arise during trading, which is a common tactic used by less reputable brokers to erode profits. Such practices further contribute to the perception that Grinta Invest may not be entirely transparent about its fee structure.

Customer Fund Security

The security of customer funds is a paramount concern for any trader. Grinta Invest claims to implement various measures to protect client funds, including segregated accounts and negative balance protection. However, without regulatory oversight, the effectiveness of these measures is questionable.

The broker's policy of keeping client funds in segregated accounts is a positive aspect, as it can help ensure that client funds are not misused for operational expenses. However, the lack of a regulatory framework means that there is no guarantee of safety in the event of insolvency or mismanagement. Additionally, while negative balance protection is a valuable feature, it is essential to understand the circumstances under which it applies, as unregulated brokers may have more leeway in their operations.

Historically, there have been instances where unregulated brokers have faced allegations of fund mismanagement, leading to significant losses for traders. Therefore, it is crucial for potential clients to consider these risks when evaluating whether Grinta Invest is a safe trading platform.

Customer Experience and Complaints

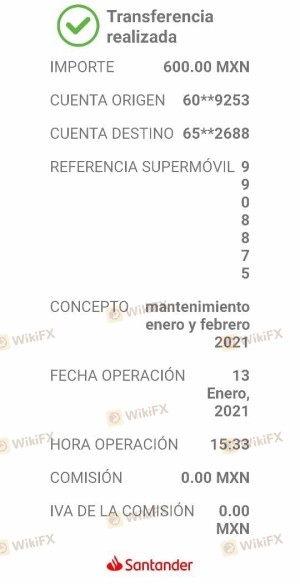

Customer feedback is a critical component in assessing the reliability of a broker. Reviews of Grinta Invest reveal a mixed bag of experiences. While some users report positive experiences with quick withdrawals and efficient customer support, others highlight serious issues, including difficulties in withdrawing funds and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Unclear Fee Structure | Medium | Inconsistent |

| Customer Support Quality | Medium | Varied response |

Common complaints include withdrawal delays, unexpected fees, and a lack of transparency regarding account management. These issues can significantly impact the overall trading experience and raise concerns about the broker's operational practices. For instance, one user reported significant delays in processing withdrawal requests, which is a common complaint among unregulated brokers.

Platform and Trade Execution

The trading platform offered by Grinta Invest is based on the widely used MetaTrader 4 (MT4) software, which is known for its user-friendly interface and comprehensive trading tools. However, the platform's performance, including order execution speed and slippage, has been a point of contention among users. Some traders have reported instances of slippage during volatile market conditions, which can lead to unexpected losses.

Moreover, the lack of regulatory oversight raises questions about the potential for platform manipulation. Traders should be vigilant and monitor their trades closely to ensure that they are not subjected to unfair practices.

Risk Assessment

Engaging with Grinta Invest comes with inherent risks, primarily due to its unregulated status and the potential for fund mismanagement.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Potential for fund mismanagement |

| Customer Service Risk | Medium | Varied response times and support quality |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative, regulated brokers with a proven track record. Implementing strict risk management strategies, such as setting stop-loss orders and only trading with funds that can be afforded to lose, is essential when trading with Grinta Invest.

Conclusion and Recommendations

Based on the comprehensive analysis presented, it is evident that Grinta Invest poses significant risks to potential traders. The absence of regulatory oversight, coupled with mixed customer feedback and questionable trading practices, raises serious concerns about the platform's legitimacy.

While some users report satisfactory experiences, the potential for fund mismanagement and withdrawal issues cannot be ignored. Therefore, it is advisable for traders to exercise caution and consider alternative, regulated brokers that offer a higher level of security and transparency.

In conclusion, while Grinta Invest may present itself as a viable trading platform, the associated risks and lack of regulatory protection suggest that it may not be a safe choice for all traders.

Is Grinta Invest a scam, or is it legit?

The latest exposure and evaluation content of Grinta Invest brokers.

Grinta Invest Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Grinta Invest latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.