Is Eagle Trades safe?

Pros

Cons

Is Eagle Trades A Scam?

Introduction

Eagle Trades positions itself as a dynamic player in the forex market, aiming to cater to a diverse range of traders with various account types and trading options. However, as the forex trading landscape is fraught with risks—including scams and unregulated brokers—it's crucial for traders to exercise caution and conduct thorough evaluations before engaging with any trading platform. This article aims to provide an objective assessment of Eagle Trades by investigating its regulatory status, company background, trading conditions, customer experiences, and overall safety. The evaluation is based on a comprehensive analysis of available data, user feedback, and industry standards.

Regulation and Legitimacy

The regulatory environment surrounding a broker is vital for ensuring the safety of traders' funds and maintaining market integrity. Eagle Trades operates without any recognized regulatory oversight, which raises significant concerns about its legitimacy. The absence of regulation implies a lack of accountability and investor protection, making it a risky choice for traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Applicable | N/A | N/A | Not Verified |

The lack of a regulatory framework means that Eagle Trades does not adhere to the stringent compliance standards set by established financial authorities. This absence of oversight can lead to potential issues, such as fund mismanagement and inadequate dispute resolution mechanisms. Traders must be particularly wary of platforms that operate without regulatory backing, as these are often associated with higher risks of fraud and malpractice.

Company Background Investigation

Eagle Trades is registered in Australia but lacks transparency regarding its ownership and management structure. The company has been operational for approximately 2 to 5 years, yet specific details about its founding date, ownership, and the expertise of its management team remain elusive. This lack of transparency raises red flags, as legitimate brokers typically provide comprehensive information about their corporate structure and team qualifications.

The management teams background and professional experience are critical in assessing the credibility of a broker. However, Eagle Trades does not disclose such information, leaving potential clients with little insight into who is managing their investments. This opacity further complicates the evaluation of Eagle Trades, as traders often rely on the experience and qualifications of a broker's management to feel secure in their investments.

Trading Conditions Analysis

Eagle Trades offers a variety of trading accounts and conditions, but the overall fee structure raises concerns. The platform's minimum deposit requirement starts at $600, which is relatively modest compared to some industry standards. However, the potential for high costs associated with spreads and commissions can significantly impact traders' profitability.

| Fee Type | Eagle Trades | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unclear | 1-2 pips |

| Commission Model | Unclear | Varies |

| Overnight Interest Range | Unclear | Varies |

The ambiguity surrounding the fee structure, particularly regarding spreads and commissions, can lead to unexpected costs for traders. Without clear information, traders may find themselves facing higher expenses than anticipated, which can erode profits. Moreover, the lack of a demo account option means that potential clients cannot test the trading conditions before committing funds, which is a standard practice among reputable brokers.

Customer Funds Security

The security of customer funds is paramount in the forex trading industry. Eagle Trades claims to implement various security measures, but the absence of regulatory oversight raises questions about the effectiveness of these measures. There is no clear information regarding fund segregation, investor compensation schemes, or negative balance protection policies.

Traders should be particularly cautious when dealing with unregulated platforms, as they may not have robust systems in place to protect client funds. Historical issues or controversies related to fund security can further highlight the risks associated with trading on such platforms. Unfortunately, Eagle Trades does not provide sufficient information to instill confidence in its fund security practices.

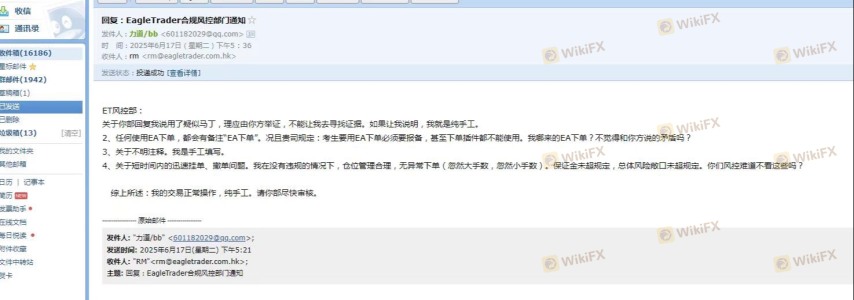

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating the reliability of a trading platform. Reviews of Eagle Trades are mixed, with some users praising its user-friendly interface while others express concerns about slow withdrawal processes and unclear fee structures.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Fee Transparency | Medium | Unclear |

| Customer Support | Medium | Email Only |

Common complaints include difficulties in withdrawing funds and a lack of responsiveness from customer support. These issues are significant, as they can lead to frustration and financial losses for traders. The reliance on email communication for support may result in delayed responses, further exacerbating customer dissatisfaction.

Platform and Trade Execution

The trading platform provided by Eagle Trades is designed to facilitate a range of trading activities, but the overall performance and reliability of the platform remain uncertain. Traders need a platform that ensures smooth execution, minimal slippage, and high uptime to succeed in the competitive forex market.

The quality of order execution, including slippage and rejection rates, is crucial for traders, especially in fast-moving markets. However, there are no clear indicators regarding Eagle Trades' execution quality, which raises concerns about potential platform manipulation or inefficiencies.

Risk Assessment

Using Eagle Trades comes with inherent risks that traders should carefully consider. The lack of regulation, transparency, and customer feedback suggests that the platform may not be a safe choice for most traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from financial authorities. |

| Fund Security Risk | High | Lack of clear security measures. |

| Customer Service Risk | Medium | Slow response times to inquiries. |

To mitigate these risks, potential traders are advised to conduct thorough due diligence, seek out regulated alternatives, and ensure they are comfortable with the risks associated with trading on unregulated platforms.

Conclusion and Recommendations

In conclusion, while Eagle Trades offers a range of trading options, the evidence suggests that it may not be a safe or reliable broker. The absence of regulatory oversight, coupled with a lack of transparency regarding company operations and customer feedback, raises significant concerns.

Traders should be cautious and consider alternative brokers that are well-regulated and transparent in their operations. For those seeking to engage in forex trading, it is advisable to choose platforms that provide robust security measures, clear fee structures, and reliable customer support. Potential traders should prioritize their safety and the security of their funds by opting for brokers with established reputations and regulatory compliance.

Is Eagle Trades a scam, or is it legit?

The latest exposure and evaluation content of Eagle Trades brokers.

Eagle Trades Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Eagle Trades latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.