Is GOKEX safe?

Business

License

Is Gokex Safe or a Scam?

Introduction

Gokex is a relatively new player in the forex trading market, seeking to carve a niche for itself among a plethora of established brokers. As the forex market continues to expand, traders are presented with a multitude of options, making it crucial to thoroughly evaluate each broker before committing funds. This is especially true for Gokex, given the increasing reports of scams and fraudulent activities in the online trading space. This article aims to provide a comprehensive analysis of Gokex, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The evaluation is based on a review of multiple online sources, user feedback, and industry standards to determine whether Gokex is safe or potentially a scam.

Regulation and Legitimacy

A broker's regulatory status is one of the most critical factors in assessing its legitimacy. Gokex has not been able to establish a solid regulatory framework, which raises significant concerns regarding its operations. The absence of regulation means that there is little to no oversight, making it easier for brokers to engage in unethical practices without fear of repercussions.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulation is alarming, especially in an industry where regulatory bodies play a vital role in protecting traders' interests. A regulated broker is typically subject to stringent compliance requirements, which can help mitigate risks such as fraud and mismanagement. Gokex's lack of oversight suggests a high potential risk for traders, as there are no guarantees regarding the safety of their funds or the fairness of the trading environment. Furthermore, historical compliance issues or scandals involving the broker could further tarnish its reputation, although specific past incidents have not been documented in this case.

Company Background Investigation

Gokex's company history and ownership structure remain somewhat obscure, which is another red flag for potential investors. Established only a few years ago, the broker lacks a long-standing track record in the industry. The management team behind Gokex has not been widely publicized, and there is little information available regarding their professional backgrounds or expertise in forex trading. This lack of transparency can lead to skepticism among potential clients, as a reputable broker typically provides detailed information about its executives and their qualifications.

Moreover, the company's operational transparency is questionable. A trustworthy broker should offer clear information about its business practices, including how it handles client funds, its fee structure, and its trading policies. Without this level of transparency, it is difficult for traders to ascertain whether Gokex operates ethically and responsibly. Overall, the company's background raises concerns about its credibility and reliability in the forex market.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. Gokex's fee structure and overall trading conditions have been described as ambiguous, which can lead to unexpected costs for traders. For instance, the absence of clear information regarding spreads, commissions, and overnight interest rates can complicate the trading experience.

| Fee Type | Gokex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency in these areas may indicate that Gokex does not adhere to industry standards, which could result in traders facing higher costs than anticipated. Additionally, any unusual or hidden fees can significantly impact a trader's profitability. Therefore, potential clients should approach Gokex with caution, as the trading conditions may not be competitive or fair.

Customer Fund Safety

The safety of customer funds is paramount in the forex trading industry. Gokex's measures for ensuring fund safety are not well-documented, making it difficult to assess the effectiveness of its security protocols. A reputable broker typically employs stringent measures such as segregated accounts and investor protection schemes to safeguard client funds.

Unfortunately, Gokex's lack of regulatory oversight raises questions about whether it implements these critical safety measures. Without a clear commitment to safeguarding client funds, traders may be at risk of losing their investments. Furthermore, any historical issues related to fund security or customer complaints regarding the handling of funds could further diminish confidence in the broker's reliability.

Customer Experience and Complaints

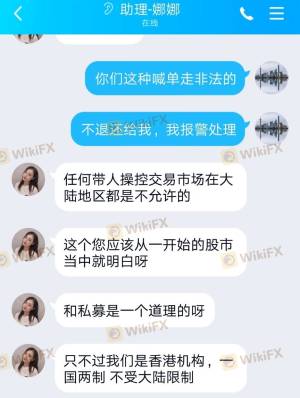

Customer feedback is a vital component of assessing a broker's reputation. Reviews of Gokex reveal a mixed bag of experiences, with several users reporting issues related to withdrawals and customer service. Common complaints include difficulty withdrawing funds, unresponsive customer support, and unclear communication regarding account management.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Slow |

| Account Management | High | Unresponsive |

These complaints indicate a concerning trend that potential clients should be aware of. Issues with fund withdrawals are particularly alarming, as they can signify deeper operational problems within the broker. Furthermore, a lack of timely and effective responses from customer support can exacerbate traders' frustrations, making it challenging to resolve issues when they arise.

Platform and Execution

The trading platform's performance and execution quality are crucial for a positive trading experience. Gokex's platform has received mixed reviews, with some users reporting stability issues and concerns about order execution quality. Instances of slippage and rejected orders can significantly impact a trader's ability to execute strategies effectively.

Moreover, any signs of platform manipulation or unfair practices can further erode trust in the broker. Traders should be cautious when using Gokex's platform, as the quality of execution can directly affect their trading outcomes.

Risk Assessment

Using Gokex comes with a variety of risks that potential traders should carefully consider. The absence of regulation, unclear trading conditions, and negative customer feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Unclear fees and withdrawal issues |

| Operational Risk | Medium | Mixed reviews on platform stability |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Gokex. It may also be prudent to start with a small investment or to explore alternative brokers with better regulatory standing and customer feedback.

Conclusion and Recommendations

In summary, the evidence suggests that Gokex is not a safe option for forex trading. The lack of regulation, transparency issues, and negative customer experiences raise significant concerns about the broker's legitimacy. While some traders may still consider using Gokex, it is essential to approach with caution and be prepared for potential challenges.

For those seeking reliable alternatives, consider brokers that are well-regulated, have a proven track record, and offer transparent trading conditions. Always prioritize safety and due diligence when selecting a forex broker to ensure a secure trading experience.

Is GOKEX a scam, or is it legit?

The latest exposure and evaluation content of GOKEX brokers.

GOKEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GOKEX latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.