Is GFT safe?

Business

License

Is GFT Safe or a Scam?

Introduction

GFT, or Global Futures Forex, has been a player in the forex market since its inception in 1997. The broker claims to provide a user-friendly trading environment with various platforms catering to both retail and institutional clients. However, as the forex market is rife with potential scams and fraudulent schemes, traders must approach any broker with caution. Evaluating the legitimacy and safety of a broker like GFT is crucial for safeguarding one's investments. This article employs a comprehensive assessment framework, analyzing regulatory status, company background, trading conditions, and customer experiences to determine if GFT is indeed safe or a scam.

Regulation and Legitimacy

The regulatory status of a broker is a key indicator of its legitimacy and safety. GFT claims to be regulated by several authorities, including the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) in the United States. However, there are concerns regarding the authenticity of these claims, as many sources indicate that GFT may not be operating under the scrutiny necessary to ensure safe trading conditions.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0279553 | United States | Verified |

| CFTC | N/A | United States | Verified |

| ASIC | N/A | Australia | Suspicious |

| FSA | N/A | United Kingdom | Suspicious |

The lack of transparency regarding regulatory compliance raises serious questions about GFT's operations. While the NFA and CFTC are reputable regulatory bodies, the presence of suspicious licenses in other jurisdictions suggests that GFT may not adhere to the same stringent standards expected of legitimate brokers. Past compliance issues further compound the concerns surrounding the broker's regulatory quality.

Company Background Investigation

GFT was established in 1997 and has since claimed to serve clients in over 140 countries. The company's headquarters is located in Ada, Michigan, USA. Despite its long history, there is a notable lack of transparency regarding the ownership structure and management team. The absence of publicly available information about the executives raises red flags about the company's accountability.

The management team is said to consist of professionals with extensive backgrounds in finance and trading, but without concrete details, it is challenging to assess their expertise accurately. This lack of information contributes to a perception of opacity, which is often associated with less reputable firms. Furthermore, the company has faced allegations of misleading practices and poor customer service, which undermine its credibility.

Trading Conditions Analysis

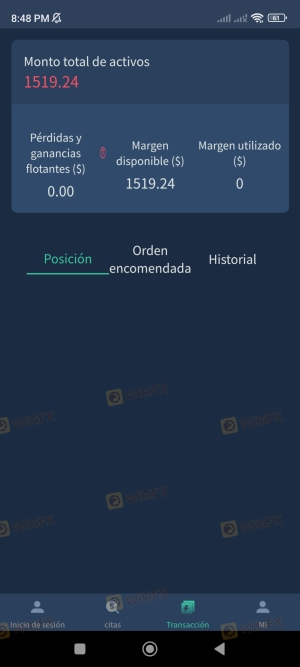

GFT offers various trading accounts, including standard and premium options, with minimum deposit requirements ranging from $200 to $2,500. The broker provides leverage up to 1:400, which is significantly higher than the limits imposed by many regulatory bodies. This high leverage can be a double-edged sword, amplifying both potential gains and losses.

| Fee Type | GFT | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1 pip | 1.0 - 2.0 pips |

| Commission Model | Variable | 0.1% - 0.5% |

| Overnight Interest Range | Not disclosed | 0.3% - 1.5% |

The overall fee structure of GFT lacks clarity, with many traders reporting hidden costs that can significantly impact profitability. The absence of clear information regarding spreads and commissions raises concerns, as traders need to understand the total cost of trading to make informed decisions. This opacity in pricing may indicate potential issues, suggesting that GFT might not be as safe as it claims to be.

Customer Fund Security

The safety of client funds is paramount in the forex trading environment. GFT claims to implement measures such as fund segregation, which is a standard practice among regulated brokers. However, the effectiveness of these measures is questionable given the broker's history of compliance issues.

Investors should inquire about the specifics of GFT's investor protection policies, including whether they participate in any compensation schemes. The absence of clear information regarding fund security is concerning, especially considering that effective protection measures are crucial for safeguarding client assets. Historical issues related to fund security can significantly impact a trader's decision to engage with GFT.

Customer Experience and Complaints

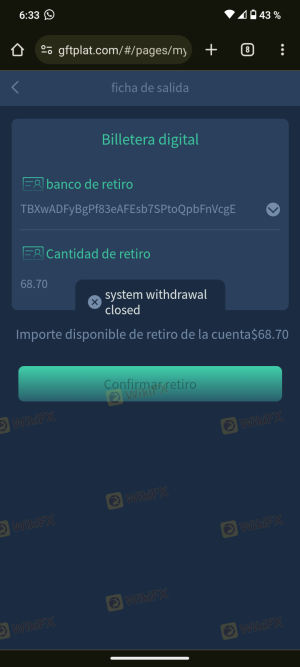

Customer feedback serves as a vital component in assessing whether GFT is safe for trading. Numerous negative reviews highlight issues such as withdrawal delays, poor customer service, and account freezes. These complaints often point to operational inefficiencies and a lack of responsiveness from the company's support team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow, often unresponsive |

| Poor Customer Service | Medium | Limited availability |

| Account Freezes | High | Rare resolutions |

For instance, some users have reported significant delays in withdrawing funds, with accounts being frozen without explanation. Such experiences are indicative of deeper operational problems and raise serious concerns about GFT's legitimacy and safety as a trading platform.

Platform and Trade Execution

The trading platform offered by GFT, including its proprietary Dealbook and MetaTrader 4, has received mixed reviews regarding performance and stability. While some users appreciate the platform's features, others have reported issues related to order execution quality, including slippage and high rejection rates.

Key performance indicators include:

- Order Execution Quality: Traders have experienced varying levels of slippage, which can erode profits.

- Rejection Rates: High rejection rates on orders could indicate potential issues with liquidity or platform reliability.

- Signs of Manipulation: No substantial evidence of platform manipulation has been reported, but the lack of transparency raises questions.

A reliable platform is essential for successful trading, and any signs of instability can deter potential clients. GFT's mixed reviews regarding platform performance further contribute to the uncertainty surrounding its safety.

Risk Assessment

Engaging with GFT involves inherent risks that traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unverified licenses in major markets |

| Financial Stability | Medium | Past fines and regulatory scrutiny |

| Customer Service Issues | High | Frequent complaints about service |

To mitigate risks, potential clients should conduct thorough research and consider starting with a demo account or minimal investment until they are confident in the broker's reliability. Understanding the risks associated with high leverage and unclear fee structures is crucial for protecting investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that GFT may not be the safest choice for forex trading. The presence of suspicious licenses, a lack of transparency regarding fees, and numerous customer complaints raise significant concerns. While GFT claims to be regulated by reputable authorities, the overall regulatory landscape and historical issues indicate that traders should exercise caution.

For those considering trading with GFT, it is advisable to remain vigilant and perhaps seek alternatives. Potential clients should prioritize brokers with strong regulatory backing, transparent fee structures, and positive customer feedback. Recommended alternatives include well-established firms that are regulated in major jurisdictions, ensuring a safer trading environment. Always prioritize safety and due diligence when selecting a forex broker to protect your investments.

Is GFT a scam, or is it legit?

The latest exposure and evaluation content of GFT brokers.

GFT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GFT latest industry rating score is 1.33, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.33 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.