Regarding the legitimacy of FXVGI forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is FXVGI safe?

Business

License

Is FXVGI markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Forex Execution (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

REGAL PARTNERS LIMITED

Effective Date: Change Record

2008-03-05Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2023-01-18Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is FXVGI Safe or a Scam?

Introduction

FXVGI is a forex brokerage that emerged onto the trading scene in 2018, positioning itself within the competitive landscape of online trading platforms. As with any financial service provider, particularly in the volatile forex market, it is crucial for traders to conduct thorough evaluations of brokers before committing their funds. The potential for scams and fraudulent activities in this sector necessitates a careful approach to ensure the safety of investments. This article aims to provide an objective analysis of FXVGI's legitimacy, examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The information presented is derived from various credible sources, including regulatory databases and user reviews, to provide a comprehensive overview of whether FXVGI is safe or a scam.

Regulation and Legitimacy

FXVGI's regulatory status is a critical factor in determining its credibility. Regulatory oversight is essential for ensuring that brokers adhere to industry standards and protect clients' interests. According to available data, FXVGI claims to be regulated by the Australian Securities and Investments Commission (ASIC). However, it has been flagged as a "suspicious clone," raising concerns about its legitimacy. This classification suggests that FXVGI may not be operating under the strict guidelines typically enforced by ASIC, which is known for its rigorous regulatory framework.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 321789 | Australia | Suspicious Clone |

The low score of 1.97 out of 10 on WikiFX indicates serious concerns regarding FXVGI's compliance and operational integrity. While it is essential for brokers to have a valid regulatory license, the quality and reputation of the regulatory body are equally important. ASIC is considered a top-tier regulator; however, the designation of FXVGI as a clone suggests that it may not be operating legitimately under this authority, thereby raising red flags for potential investors. In summary, the regulatory landscape surrounding FXVGI presents significant concerns, making it imperative for traders to exercise caution and conduct further due diligence.

Company Background Investigation

FXVGI's history and ownership structure provide additional context for evaluating its reliability. Established in 2018, FXVGI has had a relatively short presence in the forex market. However, the lack of transparency regarding its ownership and management team raises questions about its operational integrity. A reputable brokerage typically provides detailed information about its founders and executive team, including their professional backgrounds and experience in the financial sector.

The absence of such information can be a significant red flag, as it may indicate a lack of accountability and transparency. Additionally, the company's operational history has not been extensively documented, which further complicates efforts to assess its credibility. Without a clear understanding of the management team's qualifications and the company's operational practices, it becomes challenging to ascertain whether FXVGI is a trustworthy broker or if it poses potential risks to investors.

Trading Conditions Analysis

Understanding the trading conditions offered by FXVGI is crucial for assessing its overall value proposition. A thorough examination of its fee structure reveals a mixed bag of offerings that could either attract or deter potential clients. FXVGI utilizes the MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, the lack of support for mobile applications may limit accessibility for some traders.

In terms of costs, FXVGI's spreads and commission structures need careful consideration. The following table outlines the core trading costs associated with FXVGI compared to industry averages:

| Cost Type | FXVGI | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1.2 pips |

| Commission Model | Not disclosed | $5 per lot |

| Overnight Interest Range | Not disclosed | Varies widely |

The absence of clear information regarding spreads and commissions is concerning and may indicate potential hidden fees that could impact trading profitability. Furthermore, the lack of transparency in overnight interest rates and other fees raises questions about the overall cost-effectiveness of trading with FXVGI. Traders should be wary of brokers that do not provide comprehensive details regarding their fee structures, as this can lead to unexpected costs and diminished returns.

Client Fund Security

The safety of client funds is a paramount concern for any broker. FXVGI claims to implement measures to protect client deposits; however, the specifics of these measures are not readily available. A reputable broker typically offers segregated accounts to ensure that client funds are kept separate from the company's operating capital, thereby providing an additional layer of security in the event of financial difficulties.

Moreover, the presence of investor protection schemes, such as those provided by ASIC, is critical for safeguarding traders' investments. Unfortunately, the designation of FXVGI as a suspicious clone raises concerns about the effectiveness of its fund security measures. Traders should be particularly cautious if a broker has a history of operational issues or lacks a clear framework for protecting client assets.

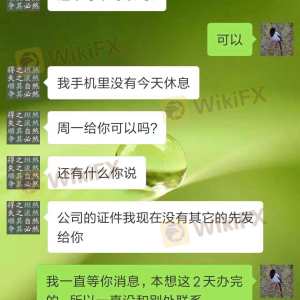

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews and testimonials from existing and former clients can provide insights into their experiences with FXVGI. However, the reviews for FXVGI are mixed, with some users expressing frustration over withdrawal processes and lack of response from customer support.

The following table summarizes the primary types of complaints associated with FXVGI, along with their severity and the company's response quality:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or unresponsive |

| Customer Support Availability | Medium | Limited hours |

| Platform Performance | Medium | Occasional issues |

Several users have reported difficulties in withdrawing funds, suggesting that FXVGI may not prioritize client satisfaction or operational transparency. The slow response times from customer support further exacerbate these issues, indicating a potential lack of commitment to addressing client concerns. Traders should be wary of brokers with a high volume of complaints, particularly regarding withdrawal processes, as this can be a significant indicator of underlying operational issues.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a seamless trading experience. FXVGI utilizes the MT5 platform, which is generally well-regarded for its functionality and user interface. However, users have reported occasional issues with platform stability, which can hinder trading activities and lead to missed opportunities.

The quality of order execution is another essential aspect to consider. Traders expect timely execution of their orders, with minimal slippage and rejections. Reports of slippage and rejected orders can indicate potential manipulation or inefficiencies within the trading platform. If FXVGI exhibits patterns of poor execution quality, it could be a significant red flag for potential investors.

Risk Assessment

Engaging with FXVGI entails various risks that traders must consider before committing their funds. The following risk assessment summarizes key risk areas associated with FXVGI:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Suspicious clone designation |

| Fund Security | High | Lack of transparency in measures |

| Customer Support | Medium | Slow response times |

| Platform Stability | Medium | Occasional performance issues |

Given the substantial risks associated with FXVGI, traders should approach this broker with caution. It is advisable to conduct thorough due diligence and consider alternative options that offer more robust regulatory oversight and client protection measures.

Conclusion and Recommendations

In conclusion, the evidence suggests that FXVGI may not be a safe option for traders. The lack of transparency regarding its regulatory status, combined with a history of customer complaints and questionable fund security measures, raises significant concerns. While FXVGI may offer certain features that appeal to traders, the overall risk profile indicates that potential investors should proceed with caution.

For traders seeking reliable and trustworthy forex brokers, it is recommended to consider alternatives that are well-regulated and have a proven track record of client satisfaction. Brokers regulated by top-tier authorities, such as ASIC or the FCA, provide a higher level of security and transparency, ensuring that traders' interests are protected. Always prioritize safety and conduct thorough research before engaging with any forex broker.

Is FXVGI a scam, or is it legit?

The latest exposure and evaluation content of FXVGI brokers.

FXVGI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXVGI latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.