Is FXTrade safe?

Business

License

Is Fxtrade Safe or Scam?

Introduction

Fxtrade positions itself as an online brokerage firm offering forex and CFD trading services. Established in 2015 and claiming to operate from London, the broker aims to attract a wide range of traders with its competitive leverage and diverse trading options. However, the online trading landscape is fraught with risks, making it essential for traders to conduct thorough evaluations of brokers before committing their funds. This assessment is particularly important given the increasing prevalence of scams in the financial sector. In this article, we will delve into the regulatory status, company background, trading conditions, customer experiences, and overall risks associated with Fxtrade to determine whether it is indeed a safe trading platform or a potential scam.

Regulation and Legitimacy

The regulatory status of a brokerage is a critical factor in determining its safety and legitimacy. Fxtrade has been flagged as an unregulated broker, which raises significant concerns about the protection of client funds and the integrity of its operations. Without oversight from recognized financial authorities, traders may find themselves vulnerable to unethical practices and potential fraud.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation from reputable authorities, such as the FCA in the UK or ASIC in Australia, means that Fxtrade does not adhere to the stringent compliance and transparency standards typically expected from licensed brokers. This lack of oversight can lead to serious risks for traders, including the potential for fund mismanagement and fraudulent activities. Historical compliance issues further exacerbate these concerns, as unregulated brokers often lack accountability, making it difficult for traders to seek recourse in case of disputes or malpractices.

Company Background Investigation

Fxtrade's history and ownership structure are crucial to understanding its trustworthiness. Founded in 2015, the broker claims to be based in London; however, there are no verifiable records to confirm this assertion. The lack of transparency regarding its ownership and management team raises red flags.

The management team's background and professional experience are often indicative of a broker's reliability. Unfortunately, Fxtrade does not provide sufficient information about its management, which makes it difficult to assess their qualifications and expertise in the financial industry. The overall transparency level of the company is low, with minimal information disclosed about its operations, which is a common characteristic of potentially fraudulent entities.

Trading Conditions Analysis

Fxtrade offers a variety of trading conditions, including high leverage of up to 1:500, which can be enticing for traders looking to maximize their returns. However, such high leverage also magnifies potential losses, posing significant risks to inexperienced traders.

The fee structure is another critical aspect to consider when evaluating a broker. Fxtrade does not appear to have a clear and transparent fee model, which can lead to unexpected costs for traders.

| Fee Type | Fxtrade | Industry Average |

|---|---|---|

| Spread on Major Pairs | 0.4 - 1.2 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The lack of commissions and competitive spreads may initially seem appealing, but the absence of clear information on overnight interest and other potential fees can lead to confusion and mistrust. Traders should be cautious of brokers that do not provide comprehensive details about their fee structure, as this can often indicate hidden costs or unfavorable trading terms.

Client Fund Safety

The safety of client funds is paramount in the trading industry. Fxtrade's unregulated status raises serious concerns about its fund protection measures. Without regulatory oversight, there are no guarantees regarding the segregation of client funds or the existence of investor protection schemes.

The broker's policies on negative balance protection are also unclear, which is a crucial feature that prevents traders from losing more money than they have deposited. The absence of such protections can lead to significant financial risks, especially in volatile market conditions.

Historically, unregulated brokers like Fxtrade have faced allegations of mishandling client funds, which further underscores the importance of conducting thorough research before engaging with such platforms.

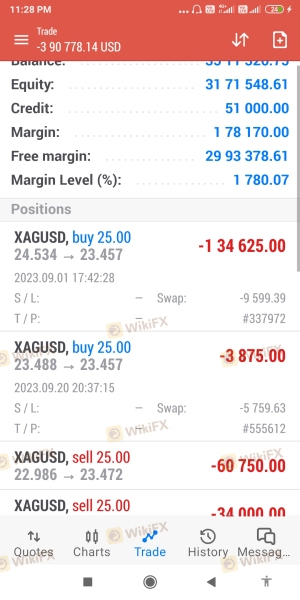

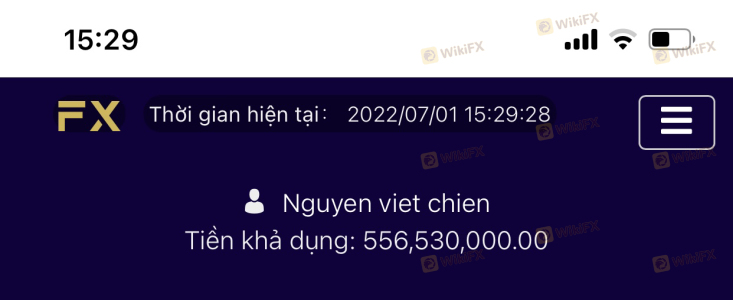

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. Many reviews and testimonials regarding Fxtrade highlight a range of negative experiences, particularly concerning withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delay | Medium | Average |

| Misleading Information | High | Poor |

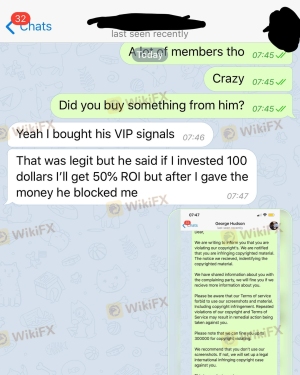

Common complaints include difficulties in withdrawing funds, lack of communication from customer support, and concerns about misleading promotional offers. These issues can significantly impact a trader's experience and raise further doubts about the broker's integrity.

For instance, one user reported being unable to withdraw their funds for several weeks, leading to frustration and a loss of trust in the platform. Such experiences are indicative of systemic issues within the brokerage, which traders should consider when evaluating whether Fxtrade is safe.

Platform and Trade Execution

The performance and reliability of a trading platform are critical factors for traders. Fxtrade claims to offer a proprietary trading platform along with popular options like MetaTrader 4. However, user reviews suggest that the platform may not meet industry standards in terms of stability and functionality.

Concerns about order execution quality, slippage, and potential rejections have been raised by users, indicating that the platform may not be as reliable as advertised. Any signs of platform manipulation or poor execution can severely impact trading outcomes and should be carefully scrutinized by potential users.

Risk Assessment

Using Fxtrade presents several risks that traders need to be aware of. The combination of unregulated status, unclear fee structures, and negative customer feedback contributes to a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities. |

| Financial Risk | High | Potential for fund mismanagement. |

| Operational Risk | Medium | Issues with platform reliability. |

To mitigate these risks, traders should conduct extensive research, consider diversifying their investments, and only invest funds they can afford to lose. Additionally, seeking out regulated alternatives can provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fxtrade raises multiple red flags regarding its safety and reliability. The lack of regulation, negative customer feedback, and unclear trading conditions indicate that traders should exercise extreme caution when considering this broker.

If you are a trader seeking a reliable platform, it is advisable to look for brokers that are regulated by reputable authorities and have a transparent operational history. Alternatives such as regulated brokers with proven track records can provide the necessary safeguards to protect your investments.

In summary, is Fxtrade safe? The overwhelming evidence points towards a conclusion that traders should be wary of engaging with this broker. It is crucial to prioritize safety and due diligence in the ever-evolving landscape of online trading.

Is FXTrade a scam, or is it legit?

The latest exposure and evaluation content of FXTrade brokers.

FXTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXTrade latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.