Is FXEDEAL safe?

Business

License

Is Fxedeal Safe or a Scam?

Introduction

Fxedeal is a forex and CFD broker that claims to offer a wide range of trading instruments, including forex, stocks, commodities, and cryptocurrencies. As the online trading market continues to grow, the number of brokers has also increased, making it crucial for traders to carefully evaluate the legitimacy and safety of these platforms. The potential risks associated with trading through unregulated or poorly regulated brokers can lead to significant financial losses. In this article, we will investigate whether Fxedeal is safe for traders or if it falls into the category of scams. Our investigation is based on various online reviews, regulatory information, and user feedback, providing a comprehensive assessment of the broker's credibility.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors to consider when evaluating its safety. Fxedeal claims to operate under the jurisdiction of the Saint Vincent and the Grenadines Financial Services Authority (SVG FSA). However, this authority is known for its lax regulations and does not provide adequate protection for traders.

Core Regulatory Information

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | Not applicable | Saint Vincent and Grenadines | Unverified |

The lack of a robust regulatory framework raises concerns about the safety of funds and the overall legitimacy of Fxedeal. Furthermore, the broker has been linked to misleading claims about its regulatory status, which could indicate a lack of transparency and accountability. Historically, many unregulated brokers have been involved in fraudulent activities, making it imperative for traders to exercise caution.

Company Background Investigation

Fxedeal's company history is somewhat opaque. While it claims to be part of a larger entity, the specific ownership structure and management team remain unclear. The absence of identifiable owners or a transparent corporate structure is a significant red flag.

The management teams qualifications and experience are also critical in assessing the broker's credibility. However, information regarding the team behind Fxedeal is scarce, leading to questions about their expertise and ability to manage the platform effectively. This lack of transparency in company information can be concerning for potential traders, as it may indicate that the broker is not fully committed to providing a secure trading environment.

Trading Conditions Analysis

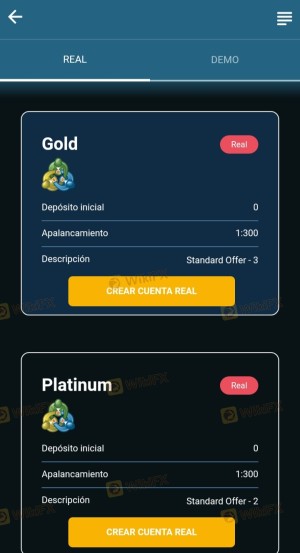

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. Fxedeal presents itself as a competitive option with a low minimum deposit requirement of $100 and high leverage of up to 1:500. However, its fee structure lacks transparency, which can lead to unexpected costs for traders.

Core Trading Costs Comparison

| Fee Type | Fxedeal | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Variable | Low to Medium |

| Commission Model | Varies by Account Type | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The absence of clear information regarding spreads and commissions raises concerns about the broker's pricing model. Traders may find themselves facing higher costs than anticipated, which could significantly impact their profitability. Furthermore, the lack of detailed information about overnight interest rates and other potential fees is another warning sign that traders should be aware of.

Client Fund Security

When considering whether Fxedeal is safe, the security of client funds is paramount. The broker claims to implement various security measures; however, the specifics of these measures are not well-documented.

Key aspects of fund security include fund segregation, investor protection, and negative balance protection. Unfortunately, there is limited evidence that Fxedeal provides these essential safeguards. For instance, the lack of information about segregated accounts means that traders cannot be confident that their funds are protected in the event of the broker's insolvency. Furthermore, any historical issues related to fund security or customer complaints regarding withdrawals can further exacerbate concerns about the broker's trustworthiness.

Customer Experience and Complaints

Feedback from existing and former clients can provide valuable insights into the reliability of a broker. In the case of Fxedeal, numerous negative reviews have surfaced, highlighting a range of complaints regarding the broker's practices.

Major Complaint Types Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Inconsistent |

| Misleading Information | High | Unresponsive |

Common complaints include significant delays in processing withdrawals, unresponsive customer support, and misleading information about the broker's regulatory status. These issues raise serious concerns about the broker's reliability and customer service quality. For instance, several users have reported difficulties in withdrawing their funds, which is a significant warning sign when evaluating whether Fxedeal is safe.

Platform and Trade Execution

The trading platform is another critical aspect of a broker's service. Fxedeal claims to use the popular MetaTrader 4 (MT4) platform, which is known for its reliability and user-friendly interface. However, user experiences regarding platform performance and order execution have been mixed.

Traders have reported issues such as slippage and rejected orders, which can negatively impact trading outcomes. Additionally, any signs of platform manipulation or discrepancies between advertised and actual trading conditions should be taken seriously, as they can indicate unethical practices.

Risk Assessment

Overall, the risks associated with trading through Fxedeal are significant. The combination of poor regulatory oversight, lack of transparency, and negative user experiences contributes to a high-risk profile for potential traders.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with dubious claims |

| Financial Risk | High | Potential for loss of funds |

| Operational Risk | Medium | Issues with platform stability |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Fxedeal. Utilizing a regulated broker with a proven track record can significantly reduce exposure to these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fxedeal may not be a safe option for traders. The lack of robust regulatory oversight, coupled with numerous negative reviews and complaints, raises significant concerns about the broker's legitimacy.

Traders should approach Fxedeal with caution, as the potential for fraud and financial loss is considerable. For those seeking safe trading environments, it is advisable to consider reputable, regulated alternatives that provide transparent trading conditions and robust client protections. Overall, it is crucial to prioritize safety and security in the volatile world of forex trading.

Is FXEDEAL a scam, or is it legit?

The latest exposure and evaluation content of FXEDEAL brokers.

FXEDEAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXEDEAL latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.