Is OlympusFx safe?

Pros

Cons

Is OlympusFX A Scam?

Introduction

OlympusFX is an online forex broker that positions itself as a provider of various trading services, including forex, commodities, and cryptocurrencies. Based in Saint Vincent and the Grenadines, it claims to offer competitive trading conditions and access to the popular MetaTrader trading platforms. However, the rise of unregulated brokers in the forex market has made it crucial for traders to carefully assess the legitimacy and safety of their chosen trading platforms. Given the potential risks involved, this article aims to investigate whether OlympusFX is a scam or a reliable trading option by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To conduct this investigation, we have utilized multiple online sources, including user reviews, regulatory information, and expert analyses. Our evaluation framework focuses on key aspects such as regulatory compliance, company transparency, trading costs, customer fund safety, and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that determines its legitimacy and trustworthiness. OlympusFX operates without any valid regulatory oversight, as it is registered in an offshore jurisdiction, specifically Saint Vincent and the Grenadines. This lack of regulation raises significant concerns about the safety of customer funds and the overall reliability of the broker.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a regulatory framework means that OlympusFX is not required to adhere to the stringent compliance standards set by reputable financial authorities such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), or the Australian Securities and Investments Commission (ASIC). Unregulated brokers like OlympusFX can operate with minimal oversight, making them susceptible to fraudulent activities and poor business practices.

Historically, unregulated brokers have been linked to various issues, including withdrawal problems, account manipulation, and lack of transparency. Therefore, the regulatory quality of OlympusFX is alarmingly low, making it imperative for potential traders to exercise extreme caution when considering this broker.

Company Background Investigation

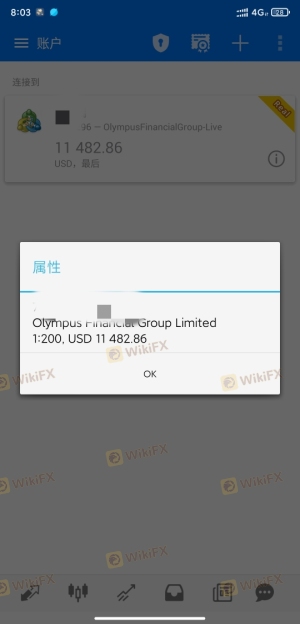

OlympusFX is owned by Olympus Financial Group Limited, which operates from Saint Vincent and the Grenadines. The company claims to have been established in 2014, yet there are significant gaps in the available information regarding its history and ownership structure. A thorough investigation reveals that the management team behind OlympusFX lacks a solid track record in the financial services industry, raising further concerns about their expertise and ability to manage client funds responsibly.

Moreover, the level of transparency exhibited by OlympusFX is disappointing. The broker does not provide comprehensive details about its operational history, management team, or financial standing, which are critical factors for establishing trust. The lack of transparency can be a red flag for potential investors, as it indicates a possible unwillingness to disclose essential information that could affect clients' trading decisions.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is vital. OlympusFX presents a range of trading options, including forex pairs, commodities, and cryptocurrencies. However, the broker's fee structure and trading costs are somewhat opaque, making it challenging for traders to assess the overall cost of trading.

| Fee Type | OlympusFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (not specified) | 0.1 - 1.0 pips |

| Commission Model | N/A | Typically 0 - 10 USD per lot |

| Overnight Interest Range | N/A | Varies by broker |

While OlympusFX claims to offer competitive spreads, the absence of specific details obscures the actual trading costs. Traders should be wary of potential hidden fees, which can significantly impact profitability. Furthermore, the lack of clarity regarding commissions and overnight interest rates raises concerns about the broker's transparency and fairness in trading practices.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. OlympusFX does not appear to have robust measures in place to protect client funds. The broker's website lacks information about fund segregation, which is a standard practice among regulated brokers to ensure that client funds are kept separate from the company's operational funds. Additionally, there is no mention of investor protection schemes that would offer compensation in the event of insolvency.

Given the lack of transparency regarding fund safety measures, potential clients should be cautious. Historical complaints and reports of withdrawal issues further exacerbate concerns about the safety of funds deposited with OlympusFX. Traders need to be aware that engaging with an unregulated broker increases the risk of losing their investments without any recourse.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. Research indicates that OlympusFX has received a significant amount of negative reviews from users. Common complaints include difficulties with fund withdrawals, lack of responsive customer support, and issues with trade execution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Trade Execution | High | Poor |

One typical case involves users reporting that they were unable to withdraw their funds after making multiple requests. In some instances, traders claimed that their accounts were manipulated, leading to forced liquidations. These experiences highlight the serious risks associated with trading through OlympusFX.

Platform and Trade Execution

The performance of a trading platform is critical for a trader's success. OlympusFX offers the MetaTrader 5 platform, which is known for its advanced features and user-friendly interface. However, there have been reports of execution issues, including slippage and rejected orders, which can severely impact trading outcomes.

Users have expressed concerns about the stability of the platform, with some alleging that it exhibits signs of manipulation. Such issues can deter traders from executing their strategies effectively and raise doubts about the broker's integrity.

Risk Assessment

Engaging with OlympusFX presents several risks that potential traders should consider. The lack of regulation, transparency issues, and negative customer feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Financial Risk | High | Potential loss of funds without recourse |

| Operational Risk | Medium | Complaints about execution and withdrawal issues |

To mitigate these risks, traders should conduct thorough research and consider opting for regulated brokers with a proven track record. Implementing strict risk management strategies and only investing what one can afford to lose are also prudent measures.

Conclusion and Recommendations

Based on the evidence gathered, it is evident that OlympusFX raises several red flags that warrant caution. The broker's lack of regulation, transparency issues, and negative user experiences suggest that it may not be a safe trading environment. Therefore, traders should be wary of potential scams and consider alternative brokers that are regulated and have positive reputations.

For those looking for reliable trading options, we recommend considering brokers such as eToro, Plus500, or XM, which are regulated and offer competitive trading conditions. Ultimately, it is essential to prioritize safety and transparency when choosing a broker to ensure a secure trading experience.

In conclusion, is OlympusFX safe? The overwhelming evidence suggests that it is not, and potential traders should exercise extreme caution before engaging with this broker.

Is OlympusFx a scam, or is it legit?

The latest exposure and evaluation content of OlympusFx brokers.

OlympusFx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OlympusFx latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.