Is FxCapital360 safe?

Business

License

Is FxCapital360 A Scam?

Introduction

FxCapital360 is an online trading broker that positions itself within the forex market, claiming to offer a variety of trading instruments and account types to cater to different investor needs. However, the increasing prevalence of scams in the trading industry necessitates that traders conduct thorough due diligence before committing their funds. This article aims to provide a comprehensive analysis of FxCapital360, focusing on its legitimacy, regulatory status, trading conditions, and overall reputation. The assessment is based on a review of multiple sources, including user feedback, regulatory databases, and expert opinions.

Regulation and Legitimacy

Regulation is a crucial factor in evaluating the safety and reliability of a trading broker. A regulated broker is typically subject to oversight by a financial authority that ensures compliance with industry standards, thereby protecting clients' funds. In the case of FxCapital360, it is important to note that the broker operates without any recognized regulatory license.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Applicable | N/A | N/A | Unregulated |

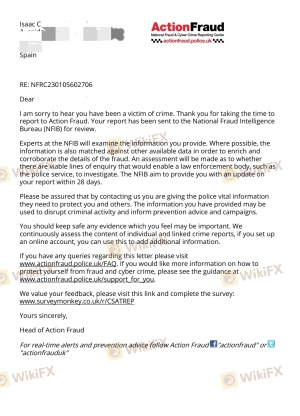

The lack of regulation raises significant concerns about the safety of client funds. Without a governing body to oversee its operations, FxCapital360 poses a risk to traders, as there are no guaranteed measures to protect their investments. Furthermore, historical compliance issues have been noted, with reports indicating that the broker has faced scrutiny from financial regulators, including warnings from the Spanish Comisión Nacional del Mercado de Valores (CNMV) regarding its unauthorized operations. This lack of regulatory oversight is a critical factor in determining whether FxCapital360 is safe for traders.

Company Background Investigation

FxCapital360 claims to have a history in the trading industry, but there is a lack of verifiable information regarding its establishment and ownership structure. The company's website does not provide clear details about its founders or management team, which is a red flag for potential investors. Transparency is essential in building trust, and the absence of such information raises questions about the broker's legitimacy.

Additionally, the company's claims of operating from the UK have been challenged, as no valid registration details have been found in the UK Financial Conduct Authority (FCA) database. This discrepancy further complicates the broker's credibility. The lack of transparency regarding its history and ownership, combined with its unregulated status, suggests that traders should approach FxCapital360 with caution.

Trading Conditions Analysis

When assessing a broker, understanding the trading conditions they offer is vital. FxCapital360 presents a tiered account system with varying minimum deposit requirements and trading conditions. However, the overall fee structure appears to be less competitive compared to industry standards.

| Fee Type | FxCapital360 | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 1.0 pips |

| Commission Structure | Unclear | Varies |

| Overnight Interest Range | N/A | Varies |

One concerning aspect of FxCapital360's trading conditions is the lack of clarity regarding commissions and potential hidden fees. Many users have reported unexpected charges that were not disclosed upfront, which can significantly impact overall profitability. Such practices are often associated with unregulated brokers and indicate that FxCapital360 may not be safe for traders looking for transparency in their trading costs.

Client Funds Security

The security of client funds is paramount when selecting a trading broker. FxCapital360 has not demonstrated adequate measures to ensure the safety of its clients' investments. There is no indication that the broker employs segregated accounts to separate client funds from its operational capital. This lack of segregation poses a risk, as clients' funds could be misused or lost in the event of the broker's insolvency.

Moreover, there are no investor protection schemes in place, which means that clients have no recourse in case of financial loss. The absence of negative balance protection further exacerbates this risk, as traders could potentially lose more than their initial investment. Historical issues concerning fund security have also been reported, with clients experiencing difficulties in withdrawing their funds. This history raises serious concerns about the broker's reliability and whether FxCapital360 is safe for trading.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding a broker's reputation. Reviews of FxCapital360 reveal a pattern of complaints primarily related to withdrawal issues. Many users have reported being unable to access their funds, with some claiming that their withdrawal requests were delayed indefinitely.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Fair |

| Customer Support Inaccessibility | High | Poor |

One notable case involved a client who attempted to withdraw their funds after several months of trading. The request was met with delays and vague responses from the support team, leading to frustration and a sense of being scammed. Such experiences suggest that FxCapital360 may not be a reliable broker, as the company appears to struggle with addressing customer concerns effectively.

Platform and Execution

The trading platform offered by FxCapital360 is web-based, which may appeal to some users due to its accessibility. However, the platform's performance has been criticized for its instability and lack of advanced features commonly found in reputable trading software. Users have reported issues with order execution, including slippage and rejections, raising concerns about the broker's operational integrity.

Additionally, there are indications that the platform may be manipulated, as some users have noticed discrepancies between their account balances and reported trading activity. This manipulation could further erode trust in the broker and suggests that FxCapital360 is not safe for serious traders.

Risk Assessment

Engaging with FxCapital360 presents several risks that potential investors should consider. The unregulated status of the broker, combined with its poor customer service reputation and questionable trading conditions, creates an environment fraught with uncertainty.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight or protection |

| Fund Security Risk | High | No segregation or insurance |

| Customer Service Risk | Medium | Poor response to complaints |

To mitigate these risks, traders should exercise extreme caution when considering investments with FxCapital360. It is advisable to conduct thorough research and consider alternative brokers that are regulated and have a proven track record of reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that FxCapital360 is not safe for trading. The broker operates without regulation, lacks transparency in its operations, and has a history of customer complaints, particularly concerning fund withdrawals. Given these significant red flags, traders are strongly advised to avoid investing with FxCapital360.

For those seeking reliable trading options, it is recommended to consider alternative brokers that are well-regulated and have demonstrated a commitment to customer service and transparency. Such brokers are more likely to provide a secure trading environment and safeguard clients' investments.

Is FxCapital360 a scam, or is it legit?

The latest exposure and evaluation content of FxCapital360 brokers.

FxCapital360 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FxCapital360 latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.