Regarding the legitimacy of Fuji forex brokers, it provides SFC and WikiBit, .

Is Fuji safe?

Business

License

Is Fuji markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

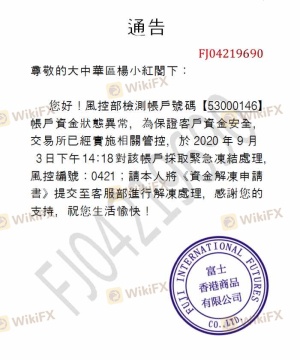

Clone FirmLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Fuji Hong Kong Commodities Company Limited

Effective Date:

2003-09-24Email Address of Licensed Institution:

admin@fujihk.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.fujihk01.com/Expiration Time:

--Address of Licensed Institution:

香港觀塘道368號波頓科創中心16EPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Fuji Safe or a Scam?

Introduction

Fuji is a forex broker that has carved a niche for itself in the competitive landscape of online trading. Primarily targeting Asian traders, it offers a variety of trading services, including forex and contracts for difference (CFDs). As the forex market continues to expand, the need for traders to exercise caution and thoroughly evaluate their brokers becomes increasingly critical. The potential for scams in the forex industry is significant, and many traders have fallen victim to fraudulent practices. This article aims to investigate whether Fuji is a safe trading platform or a potential scam. Our analysis will be based on a comprehensive review of regulatory compliance, company background, trading conditions, client fund security, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory status of a broker plays a vital role in ensuring the safety of traders' investments. Fuji claims to be regulated by the Chinese Gold and Silver Exchange Society (CGSE), which provides oversight for trading practices. However, the regulatory environment in Hong Kong, where Fuji is based, is often considered less stringent than that of other jurisdictions. Below is a summary of Fuji's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CGSE | Not disclosed | Hong Kong | Unverified |

The CGSE requires brokers to adhere to certain operational standards, but the lack of a detailed license number raises concerns about the broker's transparency. Furthermore, the absence of comprehensive regulatory oversight can lead to potential risks for traders using Fuji. Historically, brokers operating under similar jurisdictions have faced challenges related to compliance and customer protection. This raises significant questions about the overall safety of trading with Fuji, particularly for risk-averse investors.

Company Background Investigation

Fuji Bullion Limited, the entity behind the broker, has been operational for approximately 5 to 10 years. While its longevity in the market may lend it some credibility, the lack of transparency regarding its ownership structure and management team is concerning. The company operates under a limited liability framework in Hong Kong, which provides a degree of autonomy but does not guarantee investor protection.

The management team behind Fuji is composed of individuals with backgrounds in finance and trading; however, specific details about their expertise and professional history are not extensively disclosed. This lack of transparency can be a red flag for potential clients who seek to understand the qualifications of those managing their investments. Additionally, the company's information disclosure practices are insufficient, making it difficult for traders to conduct thorough research before investing. Overall, while Fuji may present itself as a reliable broker, the opacity surrounding its operations raises concerns about its trustworthiness.

Trading Conditions Analysis

When evaluating whether Fuji is safe, understanding its trading conditions is crucial. The broker offers various account types, including options for high leverage (up to 1:2000) and commission-free trading on most accounts. However, the spreads on these accounts can be above average, impacting overall trading costs. Below is a comparison of Fuji's trading costs with industry averages:

| Cost Type | Fuji | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 - 1.5 pips | 0.5 - 1.0 pips |

| Commission Model | None (most accounts) | Varies widely |

| Overnight Interest Range | Varies | Varies |

While Fuji's high leverage can be attractive, it also amplifies the risks associated with trading. Furthermore, the absence of a clear commission structure may lead to hidden fees, which could surprise clients. Reports of withdrawal fees and delayed processing times have surfaced, indicating that while the broker may offer competitive trading conditions, potential clients should carefully examine the fee structure before committing their capital.

Client Fund Security

Client fund security is paramount when determining whether Fuji is safe. The broker claims to implement various security measures, including segregating client funds from its operational capital. This practice is standard among reputable brokers and helps protect client funds in case of insolvency. However, the level of investor protection offered by the CGSE is not as robust as that provided by regulators in jurisdictions like the UK or Australia.

Additionally, Fuji does not appear to offer negative balance protection, meaning clients could potentially lose more than their initial investment. While there have been no widely reported incidents of fund mismanagement or security breaches at Fuji, the lack of stringent regulatory oversight raises concerns about the overall safety of client funds. Traders should prioritize brokers that provide comprehensive security measures and are regulated by reputable authorities to mitigate risks associated with fund safety.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reputation and reliability. Reviews of Fuji indicate a mixed bag of experiences. Some clients appreciate the high leverage and user-friendly trading platform, while others express concerns about slow withdrawal processes and unresponsive customer service. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Platform Issues | Medium | Addressed |

| Customer Service | High | Unresponsive |

Several traders have reported significant delays in withdrawing funds after profitable trading periods, leading to frustration and distrust. For instance, one user experienced an extended withdrawal request that took over a week to process, raising concerns about the broker's reliability. Such patterns indicate that while Fuji may offer attractive trading conditions, potential clients should be wary of the broker's customer service infrastructure.

Platform and Execution

The performance of the trading platform is another critical aspect to evaluate. Fuji primarily utilizes the MetaTrader 4 (MT4) platform, which is known for its reliability and extensive features. However, user experiences regarding platform stability and execution quality vary. Some traders have reported slippage and order rejections during high volatility, which can significantly impact trading performance. Any signs of manipulation or frequent technical issues should be closely monitored, as such activities can undermine the integrity of the trading environment.

Risk Assessment

Using Fuji as a forex broker involves several risks that traders should be aware of. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operating under a less stringent regulator |

| Fund Security Risk | Medium | Limited investor protection measures |

| Execution Risk | Medium | Potential for slippage and rejections |

| Customer Service Risk | High | Reports of unresponsive support |

To mitigate these risks, traders should conduct thorough research and consider starting with a small investment to gauge the platform's reliability. Additionally, maintaining awareness of market conditions and being prepared for potential execution issues can help manage trading risks effectively.

Conclusion and Recommendations

In conclusion, the question of whether Fuji is safe or a scam is nuanced. While the broker has been operational for several years and offers attractive trading conditions, significant concerns remain regarding its regulatory status, customer fund security, and overall transparency. Mixed customer feedback further complicates the picture, suggesting that potential clients should approach with caution.

For traders considering Fuji, it is advisable to start with a small investment and thoroughly test the platform and services before committing larger amounts. Additionally, traders may want to explore more reputable alternatives that offer stronger regulatory protections and better customer service. Brokers such as Plus500, XM, and eToro are often recommended for their robust regulatory frameworks and positive client feedback. Ultimately, conducting due diligence is vital to ensure a safe trading experience in the forex market.

In summary, while Fuji may present opportunities, traders must remain vigilant and consider the risks associated with trading through an unregulated broker.

Is Fuji a scam, or is it legit?

The latest exposure and evaluation content of Fuji brokers.

Fuji Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fuji latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.