Regarding the legitimacy of Eztradex forex brokers, it provides ASIC and WikiBit, .

Is Eztradex safe?

Business

License

Is Eztradex markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Forex Execution (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

PRIMETIME GLOBAL MARKETS PTY LTD

Effective Date: Change Record

2015-03-02Email Address of Licensed Institution:

compliance@katgroup.netSharing Status:

No SharingWebsite of Licensed Institution:

https://www.pgmfx.comExpiration Time:

--Address of Licensed Institution:

SE103 566 ST KILDA RD MELBOURNE VIC 3004Phone Number of Licensed Institution:

+84 982950549Licensed Institution Certified Documents:

Is Eztradex Safe or Scam?

Introduction

Eztradex is an online forex broker that has emerged in the competitive landscape of foreign exchange trading. Positioned as a platform for traders seeking access to various markets, Eztradex claims to offer a robust trading environment with competitive features. However, the proliferation of online scams in the financial sector necessitates that traders exercise caution and conduct thorough evaluations of brokerage firms before committing their funds. This article aims to investigate whether Eztradex is a trustworthy broker or if it falls into the category of scams that plague the industry. Our research methodology includes analyzing regulatory information, company background, trading conditions, customer experiences, and overall risk assessment, providing a comprehensive overview of Eztradex's credibility.

Regulation and Legitimacy

The regulatory environment is a crucial factor in determining the safety of a forex broker. A well-regulated broker is generally seen as more trustworthy, as they are held accountable by financial authorities. In the case of Eztradex, the broker's regulatory status raises significant concerns. According to multiple sources, Eztradex operates as a "suspicious clone" of a regulated entity, which implies it lacks legitimate oversight from a recognized regulatory body.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Suspicious Clone |

| FCA | N/A | United Kingdom | Not Registered |

The absence of a valid regulatory license is a major red flag. Regulatory bodies such as the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) enforce strict guidelines to protect traders. The designation of Eztradex as a "suspicious clone" suggests that it may be attempting to mimic the appearance of a legitimate broker without adhering to the necessary compliance measures. This lack of oversight can lead to potential risks for traders, making it imperative to question is Eztradex safe for investment.

Company Background Investigation

Understanding the history and ownership structure of Eztradex is essential in evaluating its reliability. Information regarding the company's formation, development, and management team is sparse, which contributes to concerns about its transparency. Eztradex appears to have been established within the last few years, but specific details about its founders or the management team are not readily available. This lack of information can be indicative of a company that may not prioritize transparency or accountability.

Moreover, the absence of a clear operational history and ownership structure raises questions about the broker's long-term viability. A reputable broker typically provides comprehensive information about its team and operational practices to instill confidence in potential clients. The limited disclosure from Eztradex further complicates the assessment of whether is Eztradex safe for traders.

Trading Conditions Analysis

The trading conditions offered by a broker significantly impact the overall trading experience. Eztradex claims to provide competitive spreads and various account types; however, the specifics of its fee structure remain ambiguous. A comprehensive review of the costs associated with trading on the platform is essential for potential clients to make informed decisions.

| Fee Type | Eztradex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

The spread of 1.5 pips for major currency pairs is higher than the industry average, which could indicate that traders may incur additional costs when trading with Eztradex. Furthermore, the lack of clarity regarding commissions and overnight interest rates raises concerns about potential hidden fees that could impact profitability. Traders must be vigilant and consider whether the trading conditions align with their expectations and financial goals, further questioning is Eztradex safe for their investments.

Customer Fund Security

The security of customer funds is paramount in establishing trust between a broker and its clients. Eztradex's website does not provide detailed information regarding its fund protection measures. In an industry where scams are prevalent, it is crucial for brokers to implement robust security protocols, including segregated accounts and investor protection schemes.

The absence of clear policies regarding fund segregation and negative balance protection is concerning. Traders should be cautious, as the lack of these security measures can expose them to significant financial risks. Historical issues related to fund safety can also indicate potential problems with a broker's reliability. Therefore, it is vital to assess whether is Eztradex safe in terms of protecting clients' investments.

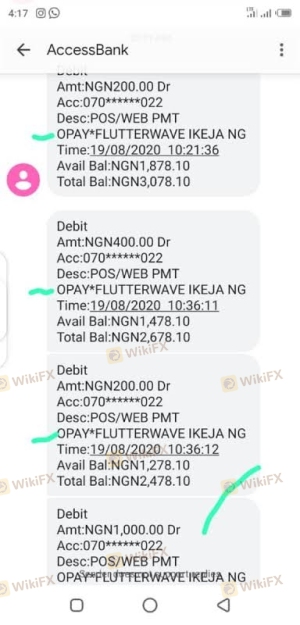

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's reputation. A review of user experiences with Eztradex reveals a pattern of complaints regarding withdrawal issues and slow customer service responses. Many users have reported difficulties in accessing their funds and delays in processing withdrawal requests, which can be a significant warning sign for prospective traders.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Issues | Medium | Slow |

Two notable cases involved clients who reported being unable to withdraw their funds after multiple attempts. In both instances, the clients faced unresponsive customer service, leading to frustration and dissatisfaction. Such complaints raise serious questions about the operational integrity of Eztradex and whether is Eztradex safe for traders seeking a reliable platform for their investments.

Platform and Trade Execution

The trading platform's performance and reliability play a crucial role in a trader's success. Eztradex offers a trading platform that is purportedly user-friendly and stable. However, reviews indicate that there may be issues with order execution quality, including instances of slippage and rejected orders. These factors can significantly impact trading outcomes and overall user satisfaction.

Moreover, any signs of potential platform manipulation or irregularities in trade execution must be thoroughly investigated. Traders should be wary of platforms that exhibit inconsistent performance, as this could lead to unfavorable trading conditions. Therefore, it is essential to consider whether is Eztradex safe when it comes to the reliability of its trading platform.

Risk Assessment

Using Eztradex comes with inherent risks that prospective traders must evaluate. The lack of regulation, unclear trading conditions, and reported customer complaints contribute to an overall risk profile that is concerning.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory oversight. |

| Fund Safety | High | Lack of clear fund protection measures. |

| Withdrawal Issues | Medium | Reports of delayed and denied withdrawals. |

To mitigate these risks, traders are advised to conduct thorough due diligence before engaging with Eztradex. Seeking alternative brokers with established regulatory frameworks and positive user feedback may be a prudent strategy for those looking to invest safely.

Conclusion and Recommendation

In conclusion, the evidence presented raises significant concerns about the legitimacy and safety of Eztradex. The lack of regulatory oversight, ambiguous trading conditions, and negative customer feedback suggest that traders should approach this broker with caution. The persistent question of is Eztradex safe remains unaddressed, as the broker's operational practices do not inspire confidence.

For traders seeking a reliable and secure trading environment, it may be advisable to explore alternative brokers that are well-regulated and have positive reputations in the industry. Options such as brokers regulated by top-tier authorities like the FCA or ASIC could provide a more secure trading experience. Ultimately, due diligence is crucial in safeguarding investments in the volatile forex market.

Is Eztradex a scam, or is it legit?

The latest exposure and evaluation content of Eztradex brokers.

Eztradex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Eztradex latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.