Is Shinmarkets safe?

Business

License

Is Shinmarkets Safe or a Scam?

Introduction

Shinmarkets is a relatively new player in the forex trading industry, positioning itself as a broker offering a wide range of trading instruments, including forex, CFDs, and commodities. As the forex market continues to grow, traders must exercise caution when selecting brokers, as the presence of unregulated and potentially fraudulent entities can pose significant risks. Evaluating a broker's credibility involves scrutinizing its regulatory status, company background, trading conditions, and customer feedback. This article aims to provide an objective assessment of Shinmarkets, utilizing information gathered from various reputable sources, including regulatory databases and user reviews.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its legitimacy and the safety of client funds. A broker regulated by a reputable authority is more likely to adhere to strict operational standards and provide a layer of protection for traders. Unfortunately, Shinmarkets has been flagged for its lack of regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

Shinmarkets operates without a valid regulatory license, which raises significant concerns about its operational practices. The absence of oversight means that traders have no recourse if the broker engages in unethical practices or fails to honor withdrawal requests. Moreover, the lack of regulatory compliance can expose traders to high risks, as there is no assurance of fund segregation or investor protection mechanisms in place. Historical compliance issues are also a red flag, as they indicate a pattern of disregard for regulatory norms.

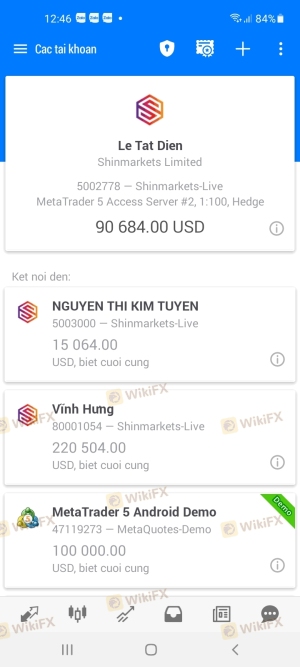

Company Background Investigation

Shinmarkets Limited was established in 2020, making it a relatively new entity in the forex market. The company claims to operate from London, UK; however, its registration status has been questioned, with reports indicating that it may not be properly registered with the UK's Financial Conduct Authority (FCA).

The management team of Shinmarkets has not been extensively detailed in the available resources, which raises concerns about transparency. A lack of information about the leadership's qualifications and experience can be detrimental to a broker's credibility. Transparency is vital in the financial industry, and the inability to access information regarding the company's ownership and management casts doubt on its legitimacy.

Trading Conditions Analysis

The trading conditions provided by a broker can significantly impact a trader's experience. Shinmarkets claims to offer competitive spreads and various account types, but the absence of regulatory oversight raises questions about the overall integrity of these claims.

| Fee Type | Shinmarkets | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | From 0.8 pips | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies widely |

| Overnight Interest Range | N/A | Varies widely |

While the spreads offered by Shinmarkets may appear attractive at first glance, the lack of transparency regarding commissions and overnight interest rates is concerning. Traders should be wary of hidden fees that could erode potential profits. Additionally, the absence of a clear commission structure can lead to misunderstandings and dissatisfaction among clients.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Shinmarkets has not provided clear information about its policies regarding fund security. The absence of information on fund segregation, investor protection, and negative balance protection raises significant red flags.

Without proper fund segregation, client deposits may be at risk if the broker faces financial difficulties. Furthermore, the lack of insurance for client funds means that traders could potentially lose their entire investment without any recourse. Historical issues related to client fund security have not been publicly documented for Shinmarkets, but the absence of protective measures is a cause for concern.

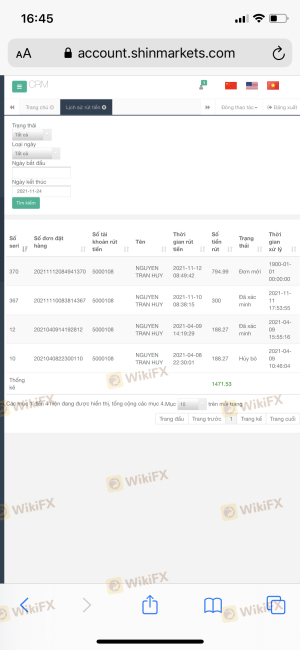

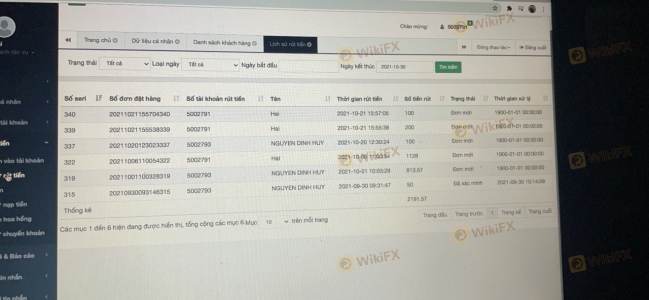

Customer Experience and Complaints

Customer feedback is an essential component of assessing a broker's credibility. Reviews and testimonials from current and former clients of Shinmarkets reveal a mixed bag of experiences.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Fair |

| Misleading Information | High | Poor |

Common complaints include difficulties with fund withdrawals and inadequate customer support. Traders have reported long wait times for responses and a lack of resolution for their issues. These patterns indicate a troubling trend that could signal deeper operational problems within the company.

Case Studies

-

Withdrawal Issues: A trader reported that after several attempts to withdraw funds, they were met with delays and unresponsive customer service. This raised concerns about the broker's reliability and trustworthiness.

Customer Support Complaints: Another user expressed frustration over the slow response times from customer service, highlighting a lack of support during critical trading periods.

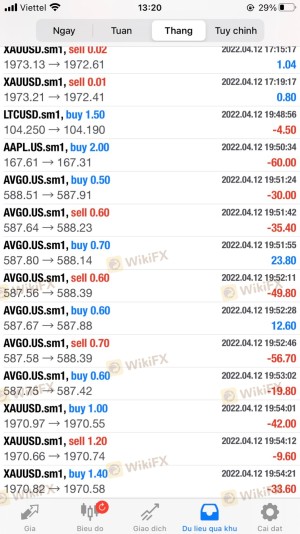

Platform and Execution

The trading platform offered by Shinmarkets is another critical area for evaluation. The broker claims to provide a user-friendly experience with access to advanced trading tools. However, the absence of detailed information about platform performance, stability, and execution quality raises concerns.

Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. Such issues may indicate potential manipulation or inefficiencies within the trading system. Without transparent performance metrics, it is challenging to assess the reliability of the trading platform.

Risk Assessment

Using Shinmarkets carries inherent risks that traders must consider before engaging with the broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases potential for fraud. |

| Fund Security Risk | High | Absence of fund protection measures is alarming. |

| Customer Service Risk | Medium | Poor response times can lead to unresolved issues. |

To mitigate these risks, traders should conduct thorough research and consider using a demo account to test the platform before committing substantial capital. Additionally, maintaining a cautious approach and being aware of the potential pitfalls can help protect against losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Shinmarkets is not a safe broker. The lack of regulatory oversight, transparency issues, and negative customer experiences raise significant concerns about its legitimacy. Traders should be wary of the potential risks involved in trading with Shinmarkets, as the absence of protective measures for client funds and inadequate customer support can lead to substantial losses.

For traders seeking reliable alternatives, it is advisable to consider brokers that are regulated by reputable authorities, such as the FCA or ASIC. These brokers typically offer better security for funds, transparent fee structures, and responsive customer service.

In summary, is Shinmarkets safe? The answer appears to be no, and traders should exercise caution when considering this broker for their forex trading needs.

Is Shinmarkets a scam, or is it legit?

The latest exposure and evaluation content of Shinmarkets brokers.

Shinmarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Shinmarkets latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.