Is Exen Trade safe?

Business

License

Is Exen Trade A Scam?

Introduction

Exen Trade is a forex broker that has emerged in recent years, positioning itself to cater to a diverse clientele interested in foreign exchange trading. As with any financial service provider, especially in the forex market, traders must exercise caution and conduct thorough evaluations before committing their funds. The forex market is rife with opportunities, but it also harbors risks, including potential scams and fraudulent practices. This article aims to assess the safety and legitimacy of Exen Trade by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation draws upon multiple sources, including reviews, user feedback, and regulatory databases, to provide a comprehensive overview of whether Exen Trade is a safe broker or a potential scam.

Regulation and Legitimacy

Understanding the regulatory framework within which a broker operates is crucial for assessing its legitimacy. Regulation serves as a protective measure for traders, ensuring that brokers adhere to strict operational standards and safeguarding client funds. Exen Trade claims to be regulated in the United States; however, the details surrounding its regulatory status are murky. Below is a summary of the core regulatory information for Exen Trade:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 20248265202 | United States | Exceeded Scope |

The broker's license indicates that it is registered with the National Futures Association (NFA) in the United States. However, several reviews highlight that Exen Trade exceeds its business scope regulated by the NFA, which raises significant concerns regarding its compliance with regulatory standards. The lack of a robust regulatory framework can result in increased risks for traders, as unregulated brokers often have fewer obligations to protect client funds. Thus, the regulatory quality and historical compliance of Exen Trade suggest potential vulnerabilities, making it essential for traders to weigh these factors carefully.

Company Background Investigation

A thorough understanding of a company's history, ownership structure, and management team is vital for evaluating its reliability. Exen Trade, officially registered as Exen Trade International Ltd., is headquartered in Seychelles. The company is relatively new, having been established within the last year. Unfortunately, there is limited information available regarding its ownership structure and the backgrounds of its management team. This lack of transparency can be a red flag for potential investors.

The absence of clear information about the company's leadership raises questions about its operational integrity. A reputable broker typically provides detailed information about its management team, including their professional experience and qualifications in the financial sector. In the case of Exen Trade, the lack of such disclosures may lead to skepticism regarding the broker's commitment to transparency and ethical practices.

Trading Conditions Analysis

When assessing whether Exen Trade is safe, it is essential to analyze its trading conditions, including fees, spreads, and commissions. Understanding the cost structure can help traders gauge the overall value proposition of the broker. Exen Trade's fee structure appears competitive on the surface; however, there are reports of unusual fees that may not be immediately apparent to new traders. Below is a comparison of core trading costs:

| Fee Type | Exen Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | 2.0% - 3.0% |

While Exen Trade offers a commission-free trading model, the spreads on major currency pairs can be variable, leading to potential costs that may exceed industry averages during periods of high volatility. Additionally, the reports of excessive overnight interest rates suggest that traders could face unexpected charges that could erode their profits. Traders should carefully review the fee structure and consider how these costs align with their trading strategies before engaging with Exen Trade.

Customer Funds Safety

The safety of customer funds is a paramount concern when evaluating any broker. Exen Trade claims to implement measures to protect client funds, yet the specifics of these measures remain vague. It is crucial to assess whether the broker employs segregated accounts for client deposits, which would ensure that client funds are kept separate from the broker's operational funds. A summary of Exen Trade's fund safety measures is provided below:

| Safety Measure | Status |

|---|---|

| Segregated Accounts | Unknown |

| Investor Protection | None |

| Negative Balance Protection | None |

The absence of clear information regarding fund segregation and investor protection schemes is concerning. Without these safeguards, traders face heightened risks, particularly in the event of the broker's insolvency or operational issues. Furthermore, any historical incidents related to fund safety or disputes involving client funds should be taken into account when determining the overall safety of Exen Trade.

Customer Experience and Complaints

Customer feedback and real user experiences provide valuable insights into a broker's operational integrity. Analyzing customer reviews reveals a mixed bag of experiences with Exen Trade, with several users reporting difficulties in withdrawing their funds. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| High Fees | Medium | Average |

| Customer Support Issues | High | Poor |

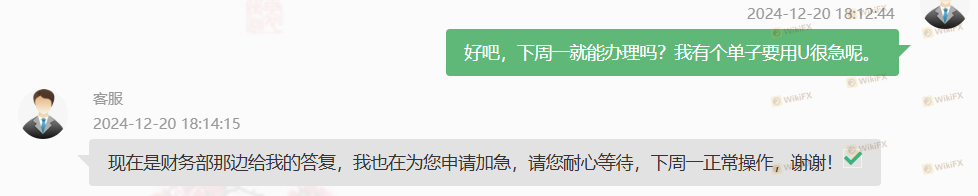

Many users have expressed frustration over withdrawal delays, often citing excuses from the broker as reasons for the inability to access their funds. Additionally, customer support appears to be lacking, with reports of slow response times and unhelpful interactions. These patterns of complaints raise significant concerns about the broker's reliability and responsiveness to client needs.

Platform and Trade Execution

Evaluating the trading platform's performance is crucial for determining whether Exen Trade is safe for traders. A reliable trading platform should offer stability, fast execution, and user-friendly features. However, there have been reports of platform instability and issues with order execution quality. Traders have expressed concerns about slippage and rejected orders, which can significantly impact trading outcomes.

The presence of any signs of platform manipulation is also a critical aspect to consider. If traders suspect that their orders are being manipulated or that the platform is designed to benefit the broker at their expense, it can severely undermine trust in the broker's operations.

Risk Assessment

Overall, the risks associated with using Exen Trade are notable. The following risk scorecard summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated and questionable oversight |

| Financial Risk | High | Lack of fund protection measures |

| Operational Risk | Medium | Reports of withdrawal issues and platform instability |

Given these risk factors, potential traders should exercise caution when considering Exen Trade as their broker. It is advisable to conduct thorough due diligence and consider alternative options that offer stronger regulatory oversight and better customer experiences.

Conclusion and Recommendations

In conclusion, the evidence suggests that Exen Trade raises several red flags that warrant caution. The lack of robust regulation, combined with reports of withdrawal difficulties and insufficient customer support, indicates a higher risk profile for traders. Therefore, it is imperative for potential clients to approach this broker with skepticism.

For traders seeking a reliable forex trading experience, it may be prudent to consider alternative brokers that are well-regulated and have a proven track record of positive customer experiences. Brokers with strong regulatory oversight, transparent fee structures, and responsive customer support should be prioritized to ensure a safer trading environment. In summary, while Exen Trade may present itself as a viable option, the potential risks involved necessitate careful consideration and alternative choices for prudent traders.

Is Exen Trade a scam, or is it legit?

The latest exposure and evaluation content of Exen Trade brokers.

Exen Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Exen Trade latest industry rating score is 1.25, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.25 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.