Is ECFX safe?

Pros

Cons

Is Ecfx Safe or a Scam?

Introduction

Ecfx is a forex broker that has garnered attention in the trading community, primarily due to its claims of offering a wide range of financial products and services. Positioned as a player in the competitive forex market, it aims to provide traders with access to various instruments, including foreign exchange, commodities, and cryptocurrencies. However, with the proliferation of online trading platforms, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy of their chosen brokers. The potential for scams and fraudulent activities in the forex market necessitates a careful assessment of any broker's regulatory status, company background, trading conditions, and customer experiences. This article will investigate whether Ecfx is a safe broker or a potential scam by analyzing its regulatory compliance, company history, trading conditions, customer feedback, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. Brokers operating under strict regulatory frameworks are generally considered safer, as they are subject to oversight that protects traders' interests. In the case of Ecfx, it claims to be regulated by the Financial Conduct Authority (FCA) in the United Kingdom. However, various sources have raised concerns regarding its regulatory legitimacy, citing it as a "suspicious clone" of another entity.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 626879 | United Kingdom | Suspicious Clone |

The FCA is known for its stringent regulatory standards, requiring brokers to maintain a minimum capital requirement and adhere to strict guidelines regarding client funds. However, the designation of Ecfx as a "suspicious clone" raises significant red flags. This implies that while Ecfx may claim to be regulated, it may not have the necessary authorization to operate legally, putting traders at risk. The lack of a solid regulatory foundation can lead to issues such as difficulty in withdrawing funds and a lack of recourse in the event of disputes. Therefore, it is essential to question Is Ecfx safe? The answer becomes increasingly complex when faced with the inconsistencies in its regulatory claims.

Company Background Investigation

Ecfx's company background is another crucial aspect to consider when determining its legitimacy. The broker is associated with Eustachio Coretti, who is reportedly based in the United Kingdom but has connections to Italy. While the broker has been operational for several years, its history is marred by inconsistencies and a lack of transparency.

The management team behind Ecfx has not been thoroughly vetted, and there is limited information available regarding their professional backgrounds and experience in the financial industry. This lack of transparency raises concerns about the broker's credibility and operational integrity. Furthermore, the company's website appears to be poorly maintained, with outdated information and a lack of essential details about its services and trading conditions.

In terms of information disclosure, Ecfx does not provide adequate insights into its ownership structure or the qualifications of its management team. This opacity can be alarming for potential traders, as it creates an environment where accountability is diminished. Therefore, when asking Is Ecfx safe?, the answer leans towards skepticism due to the broker's unclear background and management history.

Trading Conditions Analysis

Understanding a broker's trading conditions is vital for traders looking to maximize their investment potential. Ecfx claims to offer competitive spreads and a variety of trading instruments, but an in-depth examination reveals potential issues. The overall fee structure and trading costs associated with Ecfx raise concerns about transparency and fairness.

| Fee Type | Ecfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1.0 - 1.5 pips |

| Commission Model | Not Specified | $3 - $6 per lot |

| Overnight Interest Range | Not Specified | Varies |

The lack of clearly defined trading costs and the absence of standard commission structures can be problematic for traders. Many brokers provide transparent information about their fees, allowing traders to accurately gauge their potential expenses. However, Ecfx's ambiguous fee policies may lead to unexpected charges, further complicating the trading experience.

Additionally, traders should be wary of any unusual fee structures that could indicate potential scams. The absence of specific details regarding spreads, commissions, and overnight interest rates suggests that Ecfx may not be operating with the same level of transparency as reputable brokers. Thus, traders must carefully consider these factors when evaluating Is Ecfx safe? The answer is increasingly uncertain given the lack of clarity surrounding its trading conditions.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. Ecfx claims to implement various measures to safeguard client deposits, including segregated accounts and investor protection policies. However, the effectiveness of these measures is questionable given the broker's regulatory status.

Segregated accounts are essential for ensuring that client funds are kept separate from the broker's operational funds. This practice protects traders in the event of bankruptcy or insolvency. However, without robust regulatory oversight, the effectiveness of these protections may be compromised. Furthermore, the absence of information regarding negative balance protection policies raises additional concerns about the safety of traders' investments.

Historically, there have been instances where brokers operating without proper regulation have encountered significant financial issues, resulting in traders losing their funds. Therefore, when assessing Is Ecfx safe?, it is crucial to consider the potential risks associated with inadequate fund protection measures. The lack of transparency regarding these policies only adds to the uncertainty surrounding this broker's safety.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. In the case of Ecfx, reviews and testimonials from users reveal a mixed bag of experiences, with some traders expressing dissatisfaction with the broker's services. Common complaints include issues with fund withdrawals, lack of responsive customer support, and unclear communication regarding trading conditions.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support Availability | Medium | Limited Resources |

| Transparency of Fees | High | Unclear Responses |

One notable case involved a trader who reported difficulties withdrawing their funds after several attempts to contact customer support. The lack of timely responses and resolution left the trader feeling frustrated and concerned about the safety of their investment. Another trader highlighted the ambiguity surrounding the broker's fee structure, leading to unexpected charges that impacted their trading experience.

These complaints indicate that while some users may have had positive experiences, there are significant issues that warrant caution. As such, the question of Is Ecfx safe? becomes more pressing when considering the negative experiences reported by customers.

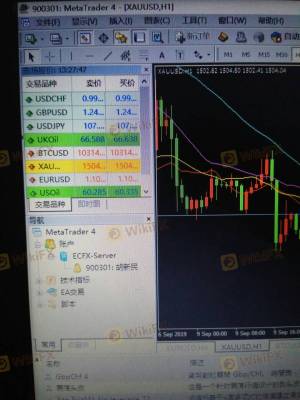

Platform and Execution

The performance and reliability of a trading platform are critical for successful trading. Ecfx claims to offer a user-friendly platform with access to various trading instruments. However, the overall performance, stability, and execution quality of the platform have come under scrutiny.

Traders have reported issues with order execution, including slippage and rejected orders, which can be detrimental to trading strategies. A reliable broker should provide seamless order execution and minimal disruptions. However, the reported instances of execution problems raise concerns about the integrity of Ecfx's trading platform.

Furthermore, any signs of potential platform manipulation can severely undermine traders' confidence. Given the importance of a stable trading environment, the question of Is Ecfx safe? is increasingly relevant when considering the platform's performance and execution quality.

Risk Assessment

Engaging with a broker like Ecfx involves inherent risks that traders must carefully evaluate. The following risk assessment summarizes key areas of concern associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of clear regulatory status |

| Fund Safety | High | Concerns regarding fund protection |

| Customer Support | Medium | Reports of slow response times |

| Trading Conditions | High | Ambiguous fee structure |

| Platform Reliability | Medium | Issues with order execution |

To mitigate these risks, traders should consider conducting thorough research before engaging with Ecfx. Seeking alternative brokers with robust regulatory oversight and transparent trading conditions may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the investigation into Ecfx raises several concerns regarding its legitimacy and safety as a forex broker. The lack of clear regulatory compliance, ambiguous trading conditions, and mixed customer feedback contribute to an overall perception of risk. Therefore, when asking Is Ecfx safe?, the evidence suggests that caution is warranted.

For traders seeking a reliable and trustworthy broker, it is advisable to consider alternatives that are well-regulated and have a proven track record of transparency and customer satisfaction. Brokers such as those regulated by the FCA or ASIC may offer a more secure trading environment. Ultimately, conducting thorough research and understanding the risks involved is crucial for any trader looking to navigate the forex market successfully.

Is ECFX a scam, or is it legit?

The latest exposure and evaluation content of ECFX brokers.

ECFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ECFX latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.