Is DACFX safe?

Pros

Cons

Is DACFX Safe or Scam?

Introduction

DACFX, a relatively new player in the forex market, has garnered attention for its claims of offering diverse trading opportunities across various financial instruments. However, with the rise of unregulated brokers, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy and safety of any trading platform. This article aims to provide an objective analysis of DACFX's credibility by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The investigation is based on multiple sources, including user reviews, regulatory databases, and expert analyses, to form a comprehensive view of whether DACFX is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a key indicator of its reliability and safety for traders. DACFX currently operates without any recognized regulatory oversight, which raises significant concerns about its legitimacy. Below is a summary of the regulatory information related to DACFX:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unlicensed |

The absence of regulation means that DACFX does not adhere to any established financial standards or practices, which typically safeguard traders' interests. Regulated brokers are required to maintain transparency, segregate client funds, and provide a safety net for investors in the event of insolvency. The lack of oversight places DACFX in a high-risk category, making it imperative for potential clients to approach with caution. Historical compliance issues and a lack of transparency further exacerbate the risks associated with trading on unregulated platforms like DACFX.

Company Background Investigation

DACFX claims to be a forex broker registered in the United Kingdom, although its website has been reported as non-functional for some time. This lack of accessibility raises questions about its operational status and transparency. The ownership structure and management team behind DACFX remain largely undisclosed, which is a significant red flag for potential investors.

A reliable broker typically provides detailed information about its team, including the backgrounds and qualifications of its executives. In DACFX's case, the absence of such information not only diminishes its credibility but also leaves traders in the dark about who is managing their investments. Without a transparent operational history or a proven track record, the risk of encountering fraudulent practices increases dramatically.

Trading Conditions Analysis

Understanding the trading conditions offered by DACFX is essential for assessing its overall safety. DACFX advertises competitive trading conditions, including leverage of up to 1:100 and spreads starting at 0.7 pips on major currency pairs. However, the lack of regulation raises doubts about the reliability of these claims. Below is a comparison of DACFX's trading costs against industry averages:

| Fee Type | DACFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.7 pips | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While the spreads may appear attractive, traders should be wary of potential hidden fees and unfavorable trading practices that often accompany unregulated brokers. High leverage, while appealing, can lead to significant losses, especially for inexperienced traders. The combination of high leverage and low transparency raises concerns about the overall safety of trading with DACFX.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. DACFX's lack of regulatory oversight means that it is not obligated to implement robust security measures for client funds. The absence of segregated accounts, investor protection schemes, and negative balance protection policies further exacerbates the risk of trading with DACFX. Historical accounts from users indicate issues with fund withdrawals, suggesting that clients may struggle to access their money when needed.

In the forex trading environment, brokers that do not provide clear information on how they safeguard client funds should be approached with extreme caution. The risks associated with trading on an unregulated platform like DACFX cannot be overstated; traders could potentially lose their entire investment without any legal recourse.

Customer Experience and Complaints

Examining customer feedback is vital in assessing whether DACFX is safe or a scam. Reviews from users indicate a concerning trend of negative experiences, particularly regarding withdrawal issues. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Poor |

| Misleading Information | High | Poor |

Many users have reported being unable to withdraw their funds, with some alleging that DACFX imposes unexpected fees or conditions for withdrawal. The company's response to these complaints has been inadequate, further diminishing trust among its user base. For potential clients, these complaints serve as a warning that trading with DACFX could lead to significant financial distress.

Platform and Trade Execution

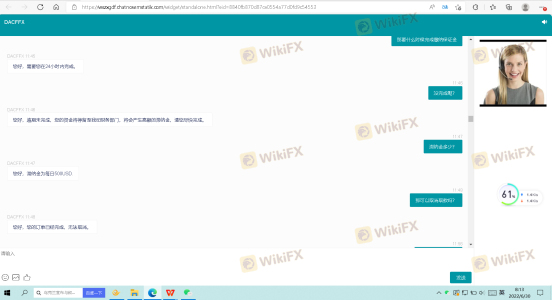

The performance and reliability of a broker's trading platform are crucial for a positive trading experience. DACFX claims to offer the MetaTrader 5 platform, yet reports suggest that the version provided may lack essential features and stability. Issues such as slippage, order rejections, and overall platform reliability have been noted in user reviews.

The potential for platform manipulation is another concern; if a broker is unregulated, there is little oversight to ensure that trades are executed fairly. Traders should be wary of any signs of platform issues that could indicate underlying problems with the broker's integrity.

Risk Assessment

Utilizing DACFX for trading presents various risks that potential clients should carefully consider. Below is a summary of the key risk areas associated with DACFX:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unlicensed broker operating without oversight. |

| Fund Security Risk | High | No protection or segregation of client funds. |

| Withdrawal Risk | High | Reports of significant withdrawal issues. |

| Platform Reliability Risk | Medium | Concerns over platform stability and execution. |

To mitigate these risks, it is advisable for traders to conduct thorough research, consider regulated alternatives, and avoid depositing large sums with DACFX until its legitimacy can be verified.

Conclusion and Recommendations

In conclusion, the evidence suggests that DACFX presents significant risks for potential traders. The lack of regulation, transparency, and negative customer feedback all point to a high likelihood of encountering issues related to fund safety and withdrawal difficulties. Therefore, it is prudent for traders to exercise extreme caution and consider alternative, regulated brokers that provide stronger investor protections and a more transparent trading environment.

For those seeking reliable trading options, brokers regulated by reputable authorities such as the FCA, ASIC, or NFA are recommended. These brokers typically offer better security for client funds and a more trustworthy trading experience. In light of the findings, it is clear that DACFX is not a safe choice for traders looking to protect their investments.

Is DACFX a scam, or is it legit?

The latest exposure and evaluation content of DACFX brokers.

DACFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DACFX latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.