DACFX Review 1

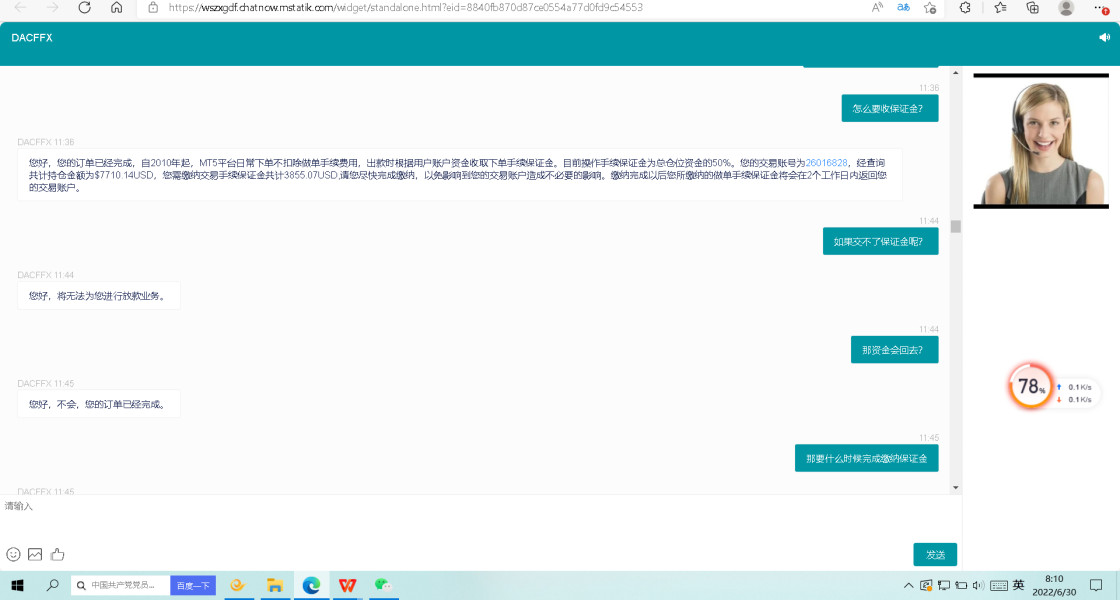

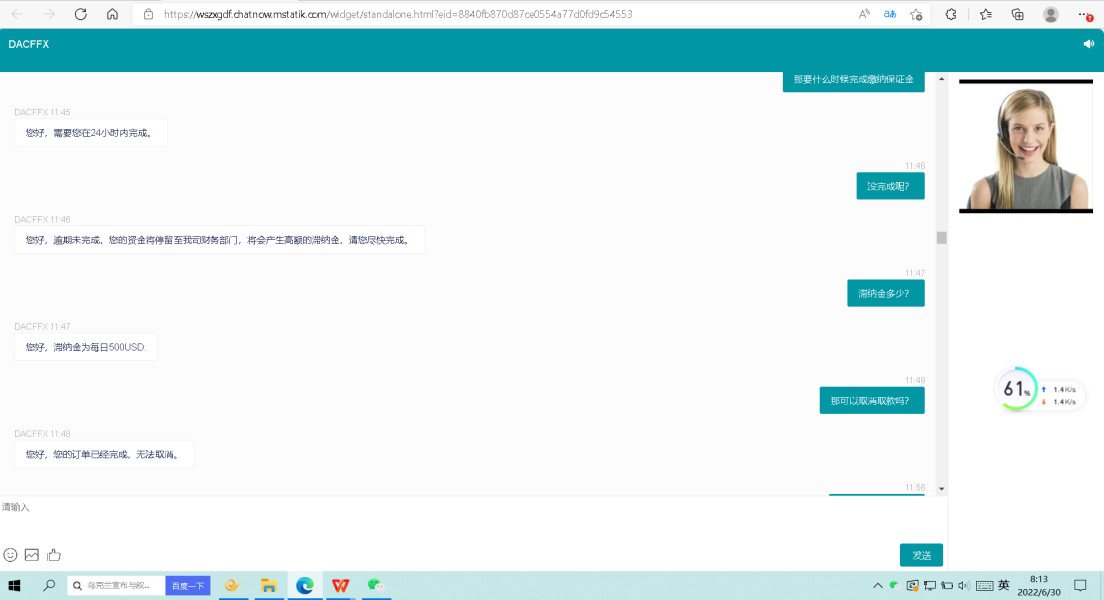

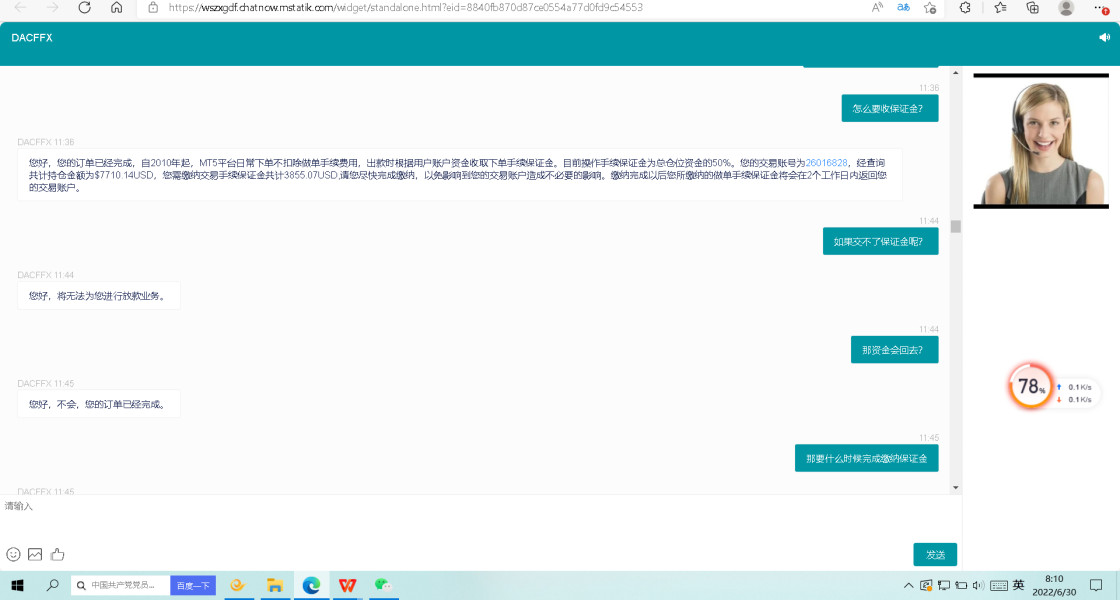

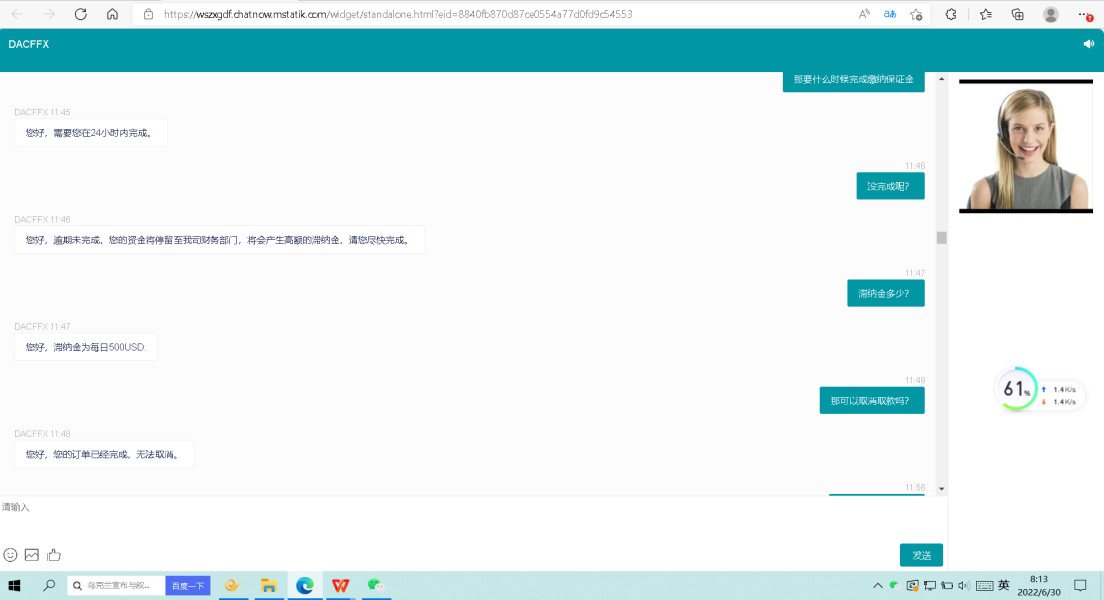

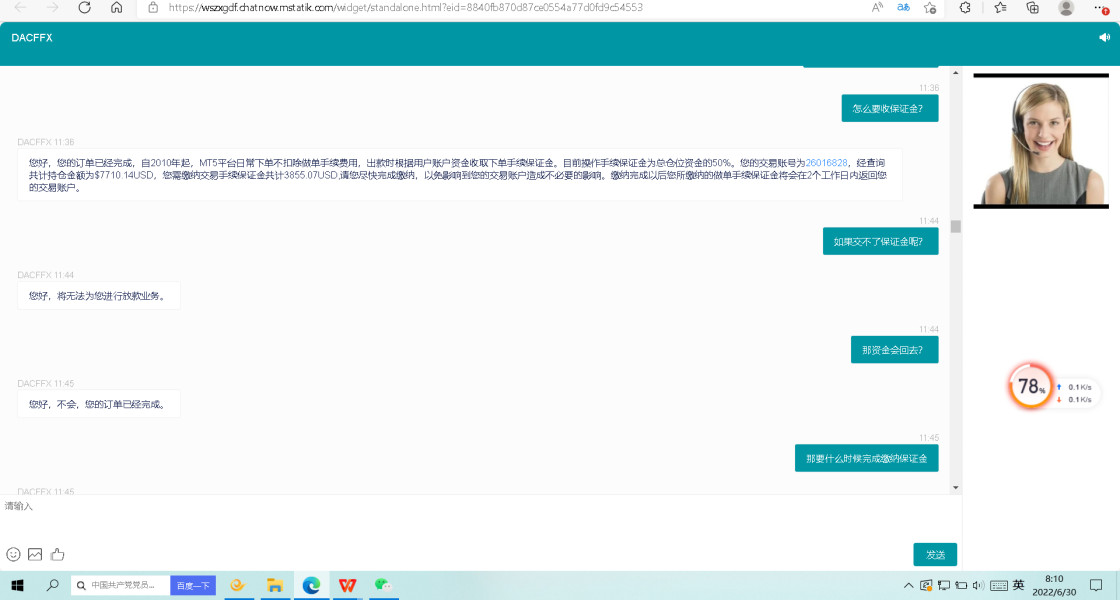

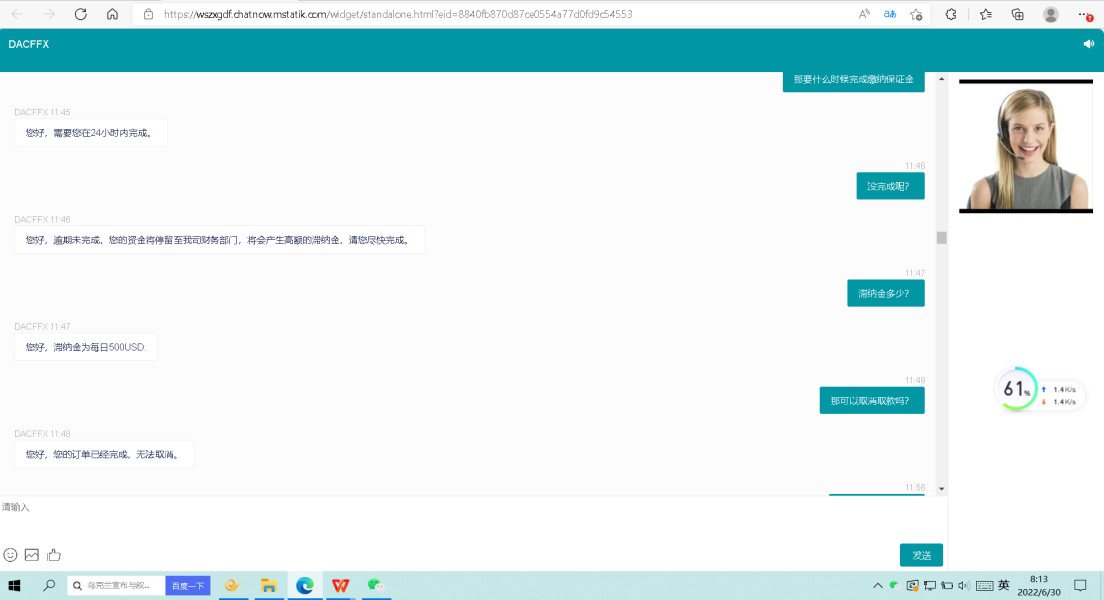

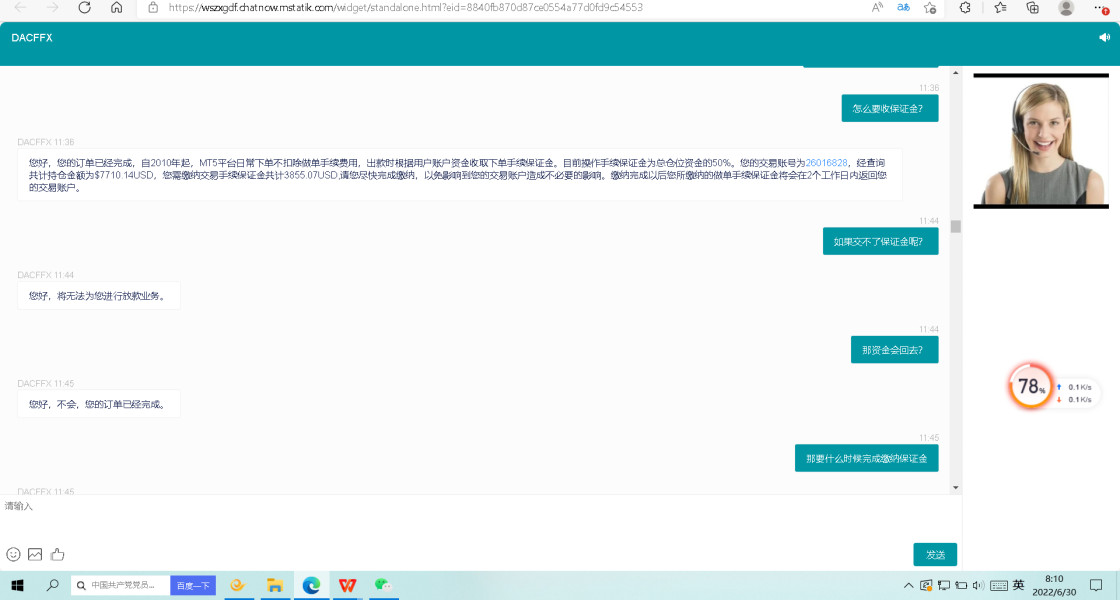

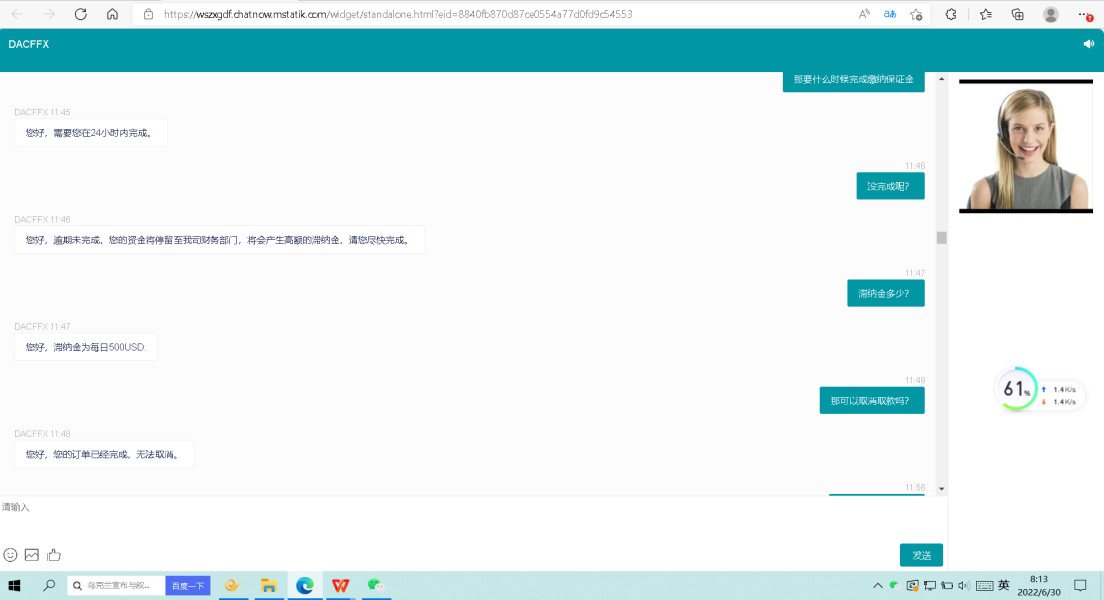

Unable to withdraw. Withdrawal requires 50% margin. Who will believe it?

DACFX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Unable to withdraw. Withdrawal requires 50% margin. Who will believe it?

DACFX positions itself as a forex trading platform appealing primarily to traders seeking high-leverage options, yet it bears significant concerns regarding its unregulated status and concerning user feedback surrounding fund safety and withdrawal difficulties. The platform is suitable for experienced traders who are willing to navigate substantial risks in pursuit of potentially high rewards. However, it must be avoided by those new to trading, those seeking a secure environment, and individuals wary of the safety and reliability of their funds.

When considering DACFX, potential traders must be aware of the high risks involved:

| Dimension | Rating (out of 5) | Justification |

|---|---|---|

| Trustworthiness | 1 | DACFX lacks any valid regulatory oversight, raising red flags about its legitimacy. |

| Trading Costs | 2 | While the commission structure is low, it comes with numerous hidden fees that customers report. |

| Platforms & Tools | 3 | Utilizes MT5 but lacks essential features, which hinders usability for traders. |

| User Experience | 1 | Consistent reports of platform glitches and a poor withdrawal experience tarnish the user experience. |

| Customer Support | 1 | Reviews highlight unresponsiveness and inadequate problem resolution from customer support. |

| Account Conditions | 2 | High leverage may attract traders but presents significant risks usually not suitable for retails. |

DACFX claims to provide forex trading services and is reportedly registered in the United Kingdom. However, it operates as an unregulated broker, casting doubt on its operational history and credibility. The lack of available regulatory documents and transparency raises significant concerns about its legitimacy, further reinforcing the notion that it should be approached with caution.

The primary business operations of DACFX involve offering access to forex trading, alongside alleged markets in stocks, commodities, indices, and cryptocurrencies. However, the details about trading conditions, including spreads and fees, are unclear. Moreover, the lack of any credible regulatory body overseeing DACFX exacerbates the risks associated with trading on this platform, limiting traders ability to make informed decisions.

| Feature | Details |

|---|---|

| Regulation | Unregulated |

| Min. Deposit | Not specified |

| Leverage | Up to 1:100 |

| Major Fees | High withdrawal fees reported |

| Trading Platform | MT5 (limited features) |

| Customer Support | Email contact only |

The absence of regulatory oversight for DACFX creates a significant risk for traders. Without any credible regulatory authority verifying its operations, potential users should proceed with extreme caution.

Analysis of Regulatory Information Conflicts: DACFX's regulatory status is alarming, with claims of operations in the UK without appropriate licensing. This suggests a high risk of fraudulent behavior as highlighted in various forums.

User Self-Verification Guide:

Visit reputable financial authority websites.

Search for DACFX in the advisory list of unregulated brokers.

Note any red flags or alerts concerning their activities.

Industry Reputation and Summary: User feedback consistently raises concerns regarding fund accessibility, showcasing that many traders have encountered withdrawal issues, highlighting a fundamental lack of trust in DACFX.

The trading costs associated with DACFX are a mixed bag that traders need to examine critically.

Advantages in Commissions: DACFX promotes a low-cost commission structure. However, specifics may be obscured, with comments suggesting unanticipated costs upon attempting withdrawals.

The "Traps" of Non-Trading Fees: User complaints indicate extreme withdrawal fees, claiming that DACFX deducts exorbitant charges. For example:

“... the fees came to $9,900 for a total of 15% of my account without informing me...”

DACFX utilizes the MT5 platform but lacks several features that would typically aid traders, particularly those new to the market.

Platform Diversity: The broker claims to employ a modified version of MT5, which almost certainly hampers trading potential compared to the full, technical capabilities available in standard MT5 setups.

Quality of Tools and Resources: Testimonies from users indicate the platform's performance is marred by significant issues, including:

“...the platform froze up when trying to adjust live orders or make withdrawals...”

User experiences on the DACFX platform seem primarily negative, suggesting extensive operational issues within their trading environment.

User Feedback Collection: Users report consistent challenges with withdrawing funds and lack of meaningful customer support when issues arise.

Platform Functionality Issues: Reviewers have described instances of delayed transactions and an unreliable platform that can prevent traders from operating effectively—a critical element in the fast-paced forex space.

User Experience Summary: Negative perceptions dominate the landscape of customer feedback, indicating a troubling operational structure within DACFX.

Customer support is consistently reported as one of the most significant pain points for traders using DACFX.

Response Efficiency: Many users echo sentiments about long hold times without satisfactory responses from customer service.

Help Accessibility: The lack of diverse communication options is concerning, with only an email address available for serious inquiries.

Customer Support Summary: The overall feedback indicates a lack of legitimate assistance when traders face withdrawal issues, contributing to an overall impression of unprofessionalism.

DACFXs account conditions provide a fascinating yet daunting landscape for potential traders, especially regarding the leverage offered.

High Leverage Risks: The firms offer of leverage up to 1:100 may attract ambitious traders, but this practice is typically discouraged among reputable brokers due to the associated high risks.

Spread and Fee Clarity: Details about spreads remain vague and hidden, typical of unregulated platforms—this lack of transparency should be a red flag for potential users.

Account Conditions Summary: The absence of clarity and the potential for escalating losses position DACFX as a risky venture, especially for inexperienced traders.

In summation, DACFX represents a high-risk trading platform characterized by its unregulated nature, user complaints about fund withdrawal issues, and operational inefficiencies. While it appears attractive to risk-tolerant, experienced traders due to its high leverage and potentially high returns, significant risks undermine its credibility. New traders or those prioritizing fund safety should unequivocally avoid DACFX in favor of regulated brokers providing safer trading environments.

For traders seeking reliable options, consider carefully reviewing regulated brokers that ensure security and dedicated customer service while promoting an atmosphere conducive to successful trading. Your financial assets deserve the protection that only reputable brokers can provide.

FX Broker Capital Trading Markets Review