Is CH Markets safe?

Business

License

Is CH Markets Safe or a Scam?

Introduction

CH Markets is a relatively new player in the forex market, positioning itself as a broker that offers a wide range of trading instruments including forex, stocks, indices, and commodities. Established in 2023 and registered in Saint Vincent and the Grenadines, CH Markets aims to attract traders with its high leverage options and competitive spreads. However, with the proliferation of online trading platforms, it is crucial for traders to exercise caution and conduct thorough assessments before committing their funds to any broker. This article aims to provide an objective analysis of CH Markets, evaluating its safety, regulatory status, and overall credibility based on extensive research from various credible sources.

The evaluation framework will encompass several vital aspects, including regulatory compliance, company background, trading conditions, customer fund security, user experiences, platform performance, and risk assessment. By synthesizing these elements, traders can make informed decisions regarding whether to engage with CH Markets or consider alternative brokers.

Regulation and Legitimacy

Understanding the regulatory landscape is paramount when determining if a broker like CH Markets is safe. Regulation serves as a protective layer for investors, ensuring that brokers adhere to specific standards that promote fair trading practices and safeguard client funds. Unfortunately, CH Markets does not hold any significant regulatory licenses from reputable financial authorities, which raises serious concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Authority (FSA) | 1119 LLC 2021 | Saint Vincent and the Grenadines | Unverified |

The Financial Services Authority of Saint Vincent and the Grenadines is known for its lenient regulatory framework, which does not offer the same level of investor protection as more stringent regulators like the FCA (UK) or ASIC (Australia). Furthermore, there is no evidence that CH Markets is registered with the FCA, which is a significant red flag. Without proper regulation, traders may find themselves vulnerable to potential fraud, as there are no legal mechanisms in place to protect their interests.

Company Background Investigation

CH Markets is owned by a company registered in Saint Vincent and the Grenadines, which is often associated with offshore financial services. The lack of a robust corporate structure and transparency raises questions about the broker's operational integrity. The management team behind CH Markets is not well-documented, which contributes to the uncertainty surrounding its credibility.

While the company presents itself as a legitimate trading platform, the absence of clear information about its ownership and management can be unsettling for potential investors. Transparency is a critical factor in establishing trust, and CH Markets falls short in this regard. Investors should always seek brokers with established histories and transparent operations to mitigate risks.

Trading Conditions Analysis

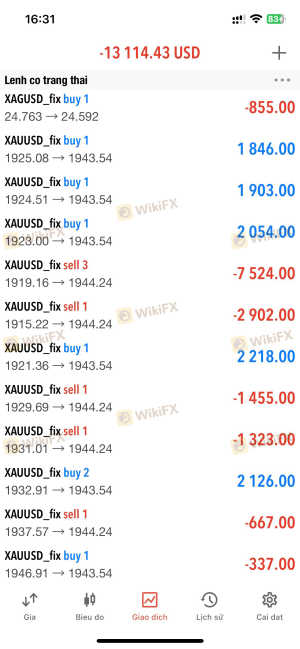

When evaluating whether CH Markets is safe, it is essential to analyze its trading conditions and fee structures. CH Markets offers various account types, which include the standard account, zero spread account, fixed spread account, and VIP account. However, the specifics of each account type, including minimum deposits and fee structures, are often vague and not clearly communicated.

| Fee Type | CH Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.1 pips (Standard) | 0.6 - 1.0 pips |

| Commission Structure | $0 (Standard, Fixed, VIP) | $0 - $10 per lot |

| Overnight Interest Range | High | Moderate |

The spreads offered by CH Markets are relatively higher than average, particularly for the standard account. Additionally, the commission structure is not competitive compared to industry standards, which may erode potential profits. Traders should be wary of any unusual fees or hidden costs that could impact their trading outcomes.

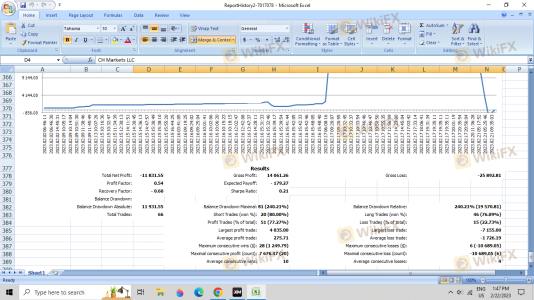

Customer Fund Security

Another critical aspect of assessing whether CH Markets is safe revolves around customer fund security. CH Markets does not provide adequate information regarding the segregation of client funds, investor protection schemes, or negative balance protection policies. These elements are crucial for safeguarding traders investments, especially in the event of broker insolvency or other financial issues.

Historically, unregulated brokers have faced numerous allegations of misappropriating client funds, and CH Markets, with its lack of regulatory oversight, may be no exception. Traders should always prioritize brokers that offer clear fund protection mechanisms and comply with established financial regulations.

Customer Experience and Complaints

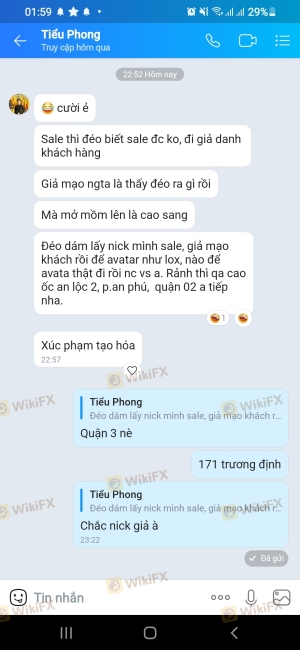

User feedback is a valuable resource for gauging the reliability of a broker. Unfortunately, CH Markets has received numerous negative reviews from users who report difficulties with withdrawals, lack of customer support, and overall dissatisfaction with the trading experience.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Account Management | High | Poor |

For instance, several users have reported being unable to withdraw their funds, with some claiming that their accounts were manipulated to generate high rollover fees, leading to significant losses. Such patterns of complaints are concerning and indicate potential operational issues within the broker.

Platform and Trade Execution

The trading platform offered by CH Markets is MetaTrader 5 (MT5), which is widely recognized for its user-friendly interface and extensive features. However, user experiences have varied, with some reporting issues related to order execution quality, slippage, and even instances of order rejections.

Traders should be cautious of any signs of platform manipulation, as these can severely impact trading outcomes. A reliable broker must ensure that its platform operates smoothly and that orders are executed fairly without undue interference.

Risk Assessment

When considering whether CH Markets is safe, it is essential to conduct a comprehensive risk assessment. Below is a summary of key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No credible regulation |

| Fund Security Risk | High | Lack of fund protection measures |

| Customer Service Risk | Medium | Poor response to complaints |

| Trading Risk | Medium | High spreads and commission structure |

To mitigate these risks, traders are advised to conduct thorough research, utilize demo accounts to test services, and consider regulated alternatives that offer better security and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that CH Markets raises several red flags that warrant caution. The lack of regulatory oversight, poor customer feedback, and potential difficulties in fund withdrawals indicate that this broker may not be a safe option for traders.

For those considering trading with CH Markets, it is essential to weigh these risks carefully. Traders may want to explore more reputable alternatives that provide robust regulatory protections, transparent fee structures, and positive user experiences. Brokers such as IG, Avatrade, and XM are examples of regulated platforms that can offer a more secure trading environment.

Ultimately, while CH Markets may present itself as a viable trading option, the associated risks and negative indicators strongly suggest that it is prudent to approach this broker with caution.

Is CH Markets a scam, or is it legit?

The latest exposure and evaluation content of CH Markets brokers.

CH Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CH Markets latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.